Table Of Contents

What is External Sources of Finance?

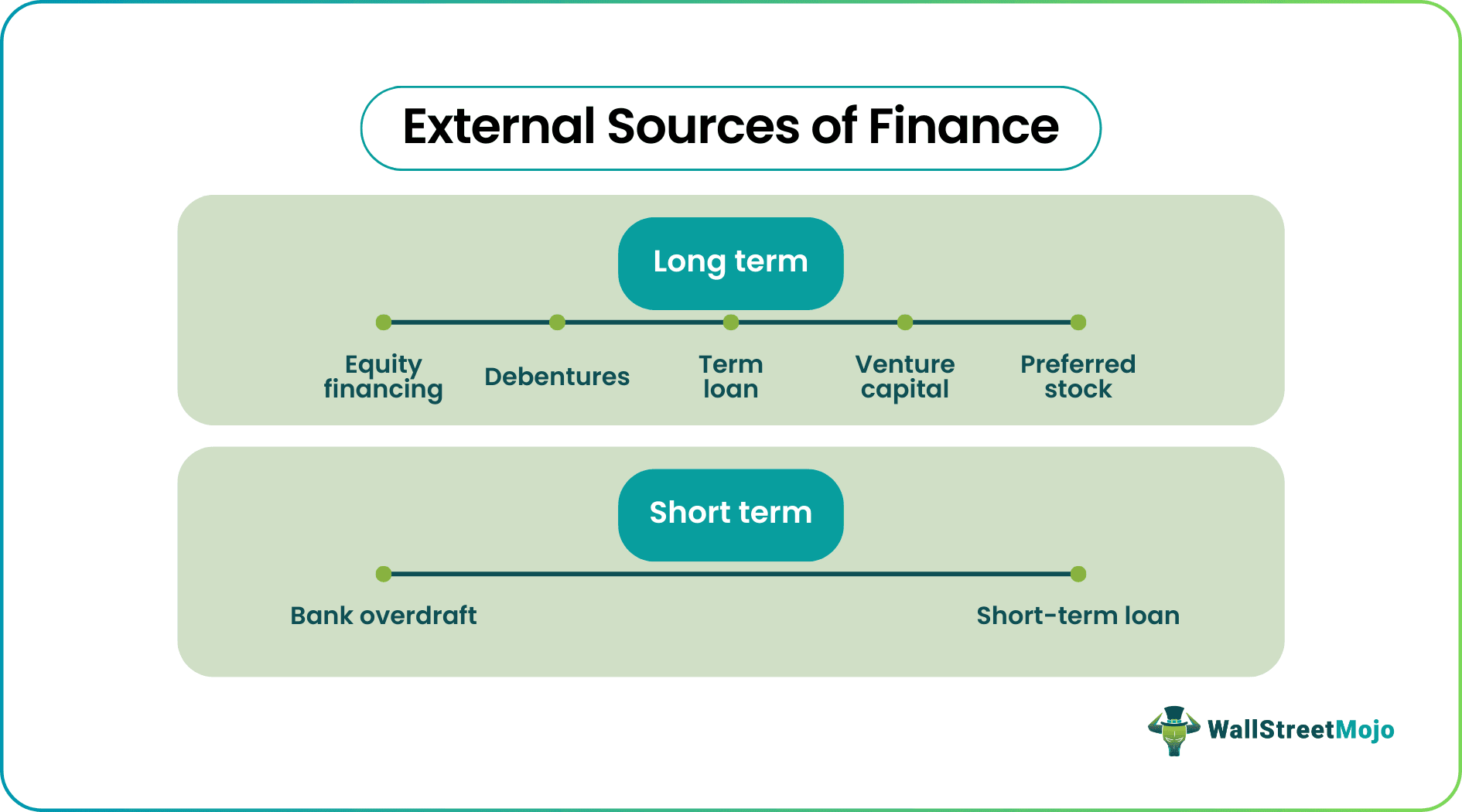

The external sources of finance are the ones where the head of finance comes from outside the organization and is generally bifurcated into different categories where first is long-term, being shares, debentures, grants, bank loans; second is short term, being leasing, hire purchase; and the other is short-term, including bank overdraft, debt factoring, etc.

When a company needs a lot of money and its internal sources of finance are exhausted, it tries out the external options. If we talk about external sources of finance, there are two types –

- Long term Financing

- Short term Financing

Key Takeaways

- The external sources of finance are those where the head of finance does not work for the organization.

- External sources are typically divided into three categories: long-term (shares, debentures, grants, and bank loans); short-term (leasing and hire-purchase); and long-term (bank overdrafts, debt factoring, etc.)

- Long terms finance options include equity financing, debentures, term loans, venture capital, and preferred stock. Short-term options contain bank overdrafts and short-term loans.

Long Term External Source of Finance

Under the long-term external source of finance, companies fund their requirements by looking into almost permanent options and can offer them a huge amount in a go.

Below are the long term external sources of finance examples

#1 - Equity Financing

- One of the most common external sources of finance is equity financing. Equity financing can’t be used by every company since there is a lot of legislation. Thus, equity financing can only be used by big companies.

- To finance the requirement through equity financing, the companies go for initial public offerings (IPOs), selling the rights to own shares instead of money. As a result, when the company makes profits, the shareholders of these equity shares receive dividends if the company decides to payout.

- These shareholders can also sell their shares in the market and earn a decent profit when the stock price of that particular company goes up. IPOs help companies amass huge amounts of money, and then they can use that money to expand their businesses or invest in a new project.

#2 - Debentures

source: jabholco.com

Many companies choose debentures financing over equity financing; because debenture financing allows them to save on taxes. Here’s how it works –

| Particulars | Amount (In US $) |

|---|---|

| Revenue | 1,500,000 |

| (-) Cost of Goods Sold | (500,000) |

| Gross Margin | 1,000,000 |

| Labour | (300,000) |

| General & Administrative Expenses | (200,000) |

| Operating Income (EBIT) | 500,000 |

| Interest expenses on debentures | (150,000) |

| Profit before taxes (PBT) | 350,000 |

| Tax Rate (25% of PBT) | (87,500) |

| Net Income (Profit after taxes) | 262,500 |

Look at the taxes here. It is $87,500 because there are interest expenses on debentures of $150,000.

Now, if we don’t take the interest expenses into account, look at what happens –

| Particulars | Amount (In US $) |

|---|---|

| Revenue | 1,500,000 |

| (-) Cost of Goods Sold | (500,000) |

| Gross Margin | 1,000,000 |

| Labour | (300,000) |

| General & Administrative Expenses | (200,000) |

| Operating Income (EBIT) or PBT* | 500,000 |

| Interest expenses on debentures | - |

| Profit before taxes (PBT) | 500,000 |

| Tax Rate (25% of PBT) | (125,000) |

| Net Income (Profit after taxes) | 375,000 |

As interest expenses are removed, the company needs to pay more taxes.

That's why debenture financing is considered a cheaper external financing source. Also, in debenture financing, the company doesn't need to let go of ownership of the company.

#3 - Term loan

- In the case of the term loan, the company doesn't need to issue debentures. But bank/financial institutions go through a thorough analysis of the company and then offer a loan.

- The assets of the company also secured term loans. If the company fails to pay off the money within a stipulated time, the bank/financial institution acquires the assets.

#4 - Venture Capital

- When they are at their starting stage, many companies take the help of venture capitalists.

- Venture capitalists also analyze the company's intense analysis and see the growth potential. If they feel satisfied, they invest in the company.

- Once the company does well, and the venture capitalists see that its valuation has drastically been increased, they choose the exit route.

#5 - Preferred Stock

source: Diana Shipping

- Preferred Stock is another long term external sources of finance. It has both the features of equity shares and the debt.

- Since these stocks are given preference over equity shareholders, they are called preference shareholders.

- They get the benefit of receiving the dividend even before the equity shareholders. If the company liquidates, preference shareholders are given preference over equity shareholders in dividends pay-out as well.

Short Term Financing

source: Colgate SEC Filings

Sometimes, companies don't need to borrow a lot of amounts. In that case, they can take a small amount for a year or less and then repay within the time. Let's see the short-term external sources of finance examples.

#1 - Bank Overdraft

- When the companies need money for day to day activities they can take the help of a bank overdraft.

- Bank overdraft is a sort of short term loan which can be paid off within a short time.

#2 - Short-Term Loan

- Companies may take a short-term loan for their immediate needs from the bank.

- Since the amount is small and the amount would be paid off within a short stint, the loan is unsecured in nature.