Table Of Contents

What Is Expense Tracking?

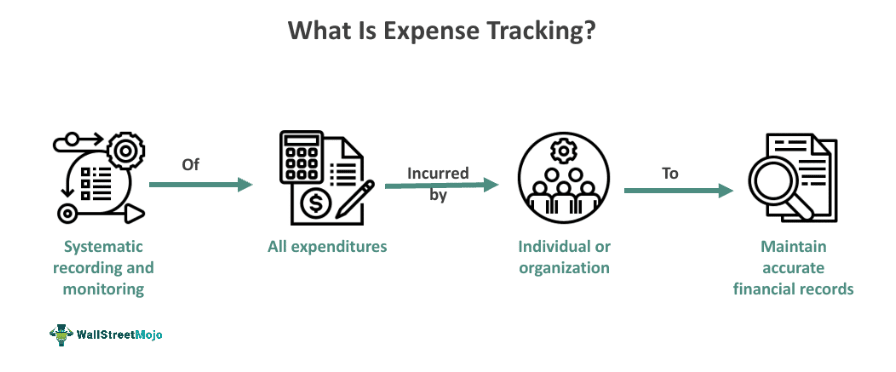

Expense Tracking refers to the systematic monitoring, recording, and categorization of expenditures to provide a comprehensive view of financial outflows. The primary goal is to achieve a clear understanding of spending patterns and allocate resources judiciously.

It is integral for budgeting, curbing spending habits, pinpointing savings opportunities, and aligning expenses with financial goals. This practice empowers individuals to make informed financial decisions, fostering control and stability in managing their finances effectively. It serves as a strategic tool for long-term financial well-being by ensuring that expenditures align with overarching financial objectives.

Table of contents

- Expense tracking is the systematic monitoring and recording of financial expenditures to manage and control personal or organizational budgets.

- Maintaining a comprehensive log of financial outflows, encompassing purchases, bills, and various expenses, provides a transparent overview of expenditure destinations.

- By adopting this approach, individuals or businesses can scrutinize expenditure trends, proficiently oversee budgets, and make well-informed financial choices grounded in up-to-date information.

- It facilitates the identification of areas for potential cost savings, empowering individuals or businesses to optimize their financial resources and enhance overall fiscal responsibility.

Expense Tracking Explained

Expense tracking entails recording all expenses to attain a comprehensive understanding of one's budget. Typically applied to a specific project or within a defined period, this approach enables individuals or entities to remain within budgetary limits and make necessary adjustments as needed.

This process encompasses keeping a detailed log of receipts, invoices, reimbursements, and credit card statements to ensure accuracy in financial records. For business owners, understanding how to track expenses is crucial for maintaining precise financial figures. Even with the assistance of an accounting professional, comprehending tracking aids in enhancing overall business and financial management skills.

Let us understand its importance in detail:

- Budget creation: Tracking expenses offers insight into spending habits, aiding in choosing the most suitable budgeting method. By comparing income with expenditure, it provides a clear overview of profits and losses, influencing budgeting strategies.

- Identifying tax deductions: Categorizing expenses during tax preparation maximizes potential deductions, crucial for businesses aiming to save on taxes. Thorough it ensures organized records, enabling businesses to claim all eligible deductions.

- Cash flow management: It plays a pivotal role in managing cash flow. It helps in identifying issues and potential areas for cost-saving measures, ensuring a positive cash flow by aligning income with expenditures and preventing financial imbalances.

Expense tracking empowers businesses and individuals to achieve financial stability through well-informed budgeting and resource allocation.

How To Track Expenses?

Let us understand the steps to be undertaken by individuals and businesses to track expenditures for proper finance management.

#1 - Tracking Business Expenses

These are the steps for expense tracking for businesses:

- Utilize a dedicated bank account and card: Maintaining a separate business account and using a company credit card ensures clarity between personal and business finances. This separation simplifies tax deductions and aids in easier financial management, potentially saving time during audits.

- Choose an accounting method: Deciding between cash and accrual accounting methods is crucial for clear income and expense reporting. Cash accounting suits small businesses by recording transactions when payments are received, while accrual accounting, though more complex, provides a comprehensive financial view.

- Software saves time by automating receipt organization: This digitization ensures efficient record-keeping, eliminating concerns about losing physical receipts and enabling easy retrieval and categorization.

- Use cloud-based accounting software: Leveraging cloud-based accounting software streamlines expense tracking by centralizing and categorizing expenses. These platforms automate essential functions, providing accessibility and real-time updates and enhancing expense management.

- Regular Expense Review: Despite the assistance of software, it is still essential to regularly review and categorize expenses. Timely approval and automated processes facilitated by expense management software ensure staying updated with business expenditures.

#2 - Tracking Individual Expenses

Individuals can follow these steps and tips to track their expenses effectively:

- Comprehensive expense documentation: A robust expense tracking system should encompass recording all expenses, both actual and estimated. Early estimation facilitates accurate projections based on actual outcomes.

- Monitoring expenditure trends: Monitoring expenditure trends across time aids in pinpointing areas where costs escalate or decline. This insight is valuable for recognizing areas that require more stringent budgeting or opportunities for savings.

- Utilizing a self-tracking mechanism: Employing a self-tracking mechanism enables individuals to manage their expenses conveniently. This system can encompass online tools, paper-based methods, or a combination of both for efficient expense monitoring.

Examples

Let us look at expense tracking examples to understand the concept better.

Example #1

Consider a small bakery owner who maintains a dedicated folder for receipts and invoices. Each day, they record expenses like ingredient purchases, equipment maintenance, and utility bills in a simple spreadsheet. At the end of the month, they review the spreadsheet to track costs, identify any fluctuations, and ensure that expenses align with the bakery's budget. This process helps them manage finances effectively and make informed decisions about purchasing ingredients or upgrading equipment.

Example #2

Venmo has introduced a new feature, Venmo Groups, aiming at simplifying the tracking and splitting of group expenses directly within the app. Users can now manage shared expenses seamlessly, eliminating the need for external tools like spreadsheets or other expense-sharing apps. The feature allows for easy calculation of each member's share, making it convenient to add expenses, track owed amounts, and settle balances within the group.

With persistent groups, users can continually track expenses over time. While the feature is initially available to a limited audience, Venmo plans to roll it out to all users in the coming weeks. Although it may not offer the advanced features of dedicated expense-sharing apps, Venmo Groups provides a user-friendly solution for integrated expense management within the popular payment app.

Benefits

The benefits of expense tracking are as follows-

- Understanding expense allocation: Recording expenses helps in understanding their purpose, whether they cater to monthly essentials, leisure, or other categories. This knowledge allows for wiser spending decisions and prompt adjustments if allocations are inappropriate.

- Tracking average expenditure: Maintaining expense records aids in knowing average daily, weekly, and monthly spending. Detecting deviations from the norm facilitates evaluation, ensuring money is directed towards essential items or even savings and investments.

- Distinguishing between essential and unnecessary costs: Expense journals assist in distinguishing between necessary and unnecessary spending. They reveal ineffective shopping habits and unexpected large expenditures, aiding in the creation of emergency funds and curbing unnecessary expenses.

- Facilitating financial planning: It simplifies financial planning by ingraining budgeting habits. It establishes ease in handling daily expenses, consequently easing long-term financial planning and fostering confidence in achieving overarching financial goals.

- Setting transaction limits: Understanding average expenses and their nature helps in setting daily transaction limits. It assists in controlling expenses by regulating cash withdrawals, transfers, and debit transactions through convenient methods like myBCA for BCA Debit cards.

Frequently Asked Questions (FAQs)

The best expense tracking app often depends on personal preferences and needs. However, some popular choices include apps like You Need A Budget (YNAB), Wallet, and Expense Tracker 2.0. These apps offer features like customizable categories, budgeting tools, receipt scanning, and syncing with bank accounts for automatic expense logging. Users should explore different apps to find one that aligns with their specific requirements and ease of use.

To set up expense tracking in Excel, begin by creating a spreadsheet with categories for expenditures. Input transaction details regularly use formulas for calculations and leverage features like pivot tables to gain insights into spending patterns.

Expense tracking apps prioritize security through encryption and authentication protocols. Reputable apps employ advanced measures to safeguard user data, such as secure servers and encrypted connections, ensuring the safety of financial information during transactions and analysis.

Recommended Articles

This article has been a guide to what is Expense Tracking. Here, we explain it along with how to track it, its examples, and benefits. You may also find some useful articles here -