Let us look at the following table to understand the differences between both concepts, which stand as a crucial part of real estate for landlords and tenants.

Table Of Contents

What Is An Expense Stop?

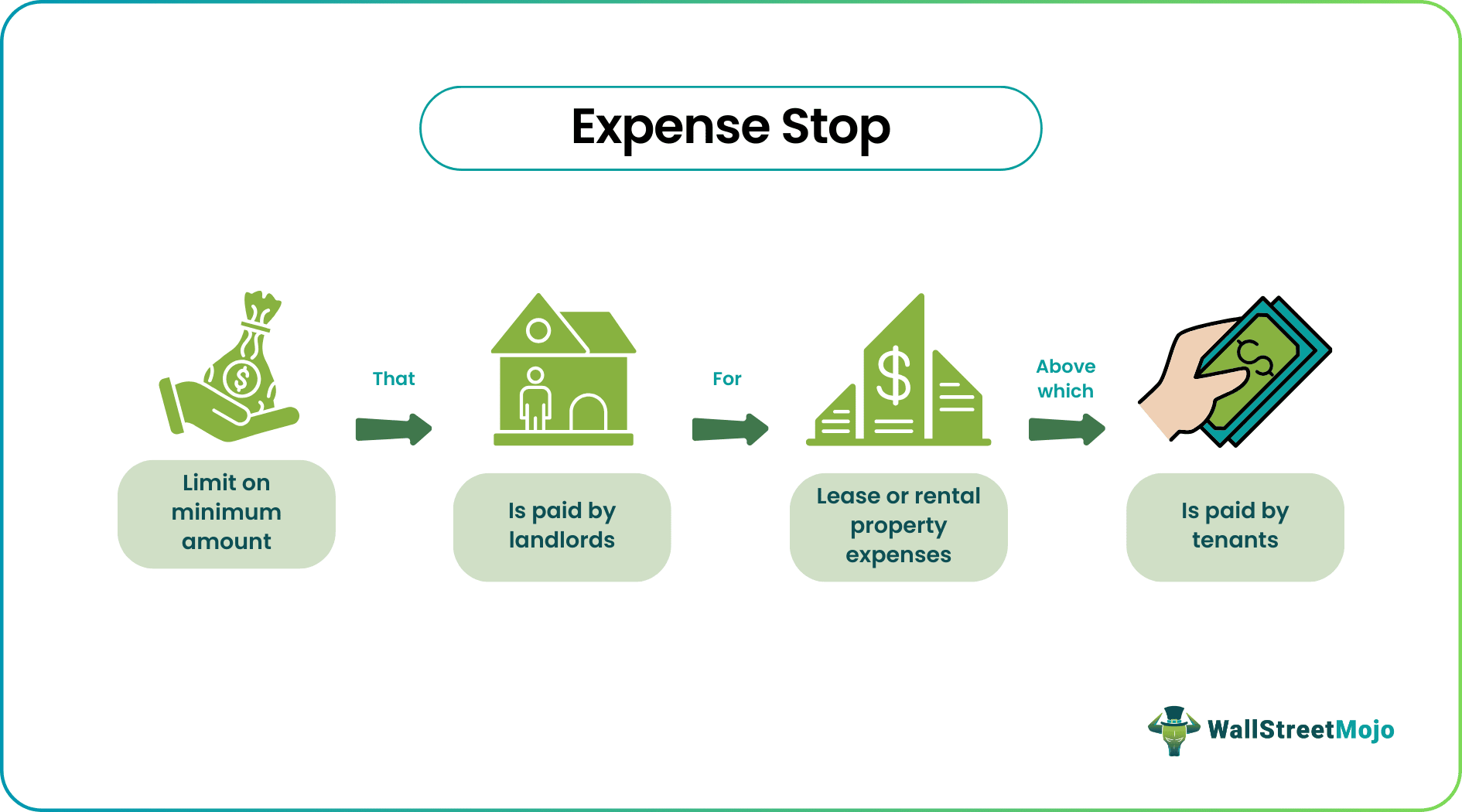

An Expense Stops in real estate describes a limit on the maximum amount of expenses that a landlord will cover toward a property. If this expense goes beyond the set limit, it is the tenant who becomes liable to pay the remaining amount. Typically, this is stated as dollars per square foot.

Under a lease, the occupier pays the base rental amount, and the landlord covers all other costs (like standard area maintenance fees) unless they exceed a predetermined sum, known as an expense stop. This approach is helpful in cases where the leased space is housed in a brand-new structure with no historical operating expense data.

Key Takeaways

- Expense stops are a part of the lease that sets a cap on the total amount of costs that the landlord will pay.

- If the costs exceed this ceiling, the tenant is responsible for the balance. It is usually expressed in terms of dollars per square foot.

- It involves the property owner setting the expense limit and agreeing to pay all operational costs for the first year of the lease.

- The limit provides cost control and transparency. Landlords are spared unnecessary financial constraints while tenants are made aware of their duties beyond the expense limit barrier.

How Does An Expense Stop Work?

Expense stops in real estate are a fixed operational cost decided by the landlord. The tenant shall pay any expenses that exceed this amount. In essence, any operational expenses below this limit are the landlord's responsibility, and any that surpass it is the tenant's responsibility. Typically, the limit is stated in square feet or square meters, but it can be expressed in any mutually agreed-upon amount.

It shields the owner of the property from growing costs during the duration of the agreement. In this kind of situation, the property owner usually agrees to cover all operating costs for the lease's first year (referred to as the base year amount) and establishes the limit for expenses. As the lease or rent agreement gets signed, it protects the property owner from bearing the growing expenses.

The owners may cover operating costs for the base year or first year through this. Additionally, it urges tenants to exercise caution when using their space and to assume accountability for any excess expense. It provides cost management and transparency, which helps both landlords and tenants. Tenants are made aware of their responsibilities beyond the expense limit barrier, and landlords are able to avoid taking on unwarranted financial burdens

However, obstacles can sometimes appear, such as disagreements over going above the recommended amount or trouble projecting future costs precisely. Proper communication and documentation are essential to guarantee clarity and avoid misconceptions.

Examples

Let us look into a few examples to understand the concept better.

Example #1

Let us assume that Daisy, a clothing store owner, leases a retail space with a lease agreement that includes an expense stop clause for maintenance costs. The landlord covers up to $20,000 per year for maintenance expenses. However, during the first year, the total maintenance expenses exceed the $20,000 limit, causing Daisy to be responsible for an additional $5,000. This additional expense could impact her overall operating costs and profitability.

The expense stop clause ensures financial responsibility, transparency, and predictability for Daisy. It also allows the landlord to limit their financial obligations, covering only up to the specified amount, reducing their financial burden. The clause encourages tenant accountability, encouraging them to be mindful of expenses and take responsibility for costs exceeding the limit. It is thus promoting accountability and ensuring tenants contribute their fair share towards property maintenance.

Example #2

A study provides insights into the expenses stop clause and also reflects how certain provisions, like gross-up provision help tenants from bearing rapidly growing expenses.

These clauses permit landlords to charge tenants for building maintenance, operations, and utility services. Tenant-paying expenses that are above the stop or base year amount are the tenant's responsibility in leases with expense stop or base year clauses. If the building is not entirely occupied in the base year, the tenant's expense limit will be low in the absence of a gross-up provision. The tenant's proportionate share will be computed using the increase in operating expenses resulting from more excellent building occupancy if the building is wholly occupied in a subsequent year.

The tenant's proportionate share will be computed using the increase in expenses resulting from more excellent building occupancy if the building is wholly occupied in a subsequent year. To shield renters from an unexpected rise in operating costs in later years, the landlord may inflate the base year's variable operating expenses by using a gross-up provision.

Advantages And Disadvantages

Some of the advantages and disadvantages of the expense stop lease are given as follows.

Advantages

- The landlords, through this clause, aim to be protected from unwarranted and unexpected expenses throughout the lease period.

- It gives the landlords an opportunity to be financially prepared. The expenses, once decided, can help in better planning their budget.

- It makes the lease process transparent.

- It brings in the element of predictability and reduces financial uncertainty.

- It gives landlords the space to allocate resources to other obligations they have.

Disadvantages

- Tenants should be aware of their spending to stay under the limit set.

- Tenant-landlord issues that may arise if costs surpass the stop amount.

- Accurate future spending estimation is difficult to achieve, which can cause under- or overestimation.

- With the provision in place, the landlord might need help to draw in tenants.

Expense Stop vs Base Year

| Basis | Expense stop | Base year |

|---|---|---|

| 1. Concept | It sets a specific limit or cap on certain expenses that the landlord is responsible for covering. | The base year in a lease agreement refers to a designated period that serves as a reference point for calculating and comparing operating expenses. |

| 2. Purpose | Its purpose is to define a threshold beyond which the tenant assumes responsibility for any additional expenses with regard to the property. | Its purpose is to establish a starting point from which any increases in operating expenses can be measured and allocated between the landlord and tenant. |

| 3. Calculation | Its calculation is usually based on a fixed amount or a percentage of the total expenses incurred by the landlord. | The base year is typically determined as a specific calendar year or the initial year of the lease term. |