Table Of Contents

What is the Expected Return Formula?

Expected Return formula is often calculated by applying the weights of all the Investments in the portfolio with their respective returns and then doing the sum total of results.

The formula of expected return for an Investment with various probable returns can be calculated as a weighted average of all possible returns which is represented as below,

Expected return = (p1 * r1) + (p2 * r2) + ………… + (pn * rn)

- pi = Probability of each return

- ri = Rate of return with different probability.

Also, the expected return of a portfolio is a simple extension from a single investment to a portfolio which can be calculated as the weighted average of returns of each investment in the portfolio, and it is represented as below,

Expected return = (w1 * r1) + (w2 * r2) + ………… + (wn * rn)

- wi = weight of each investment in the portfolio

- ri = rate of return of each investment in the portfolio

Key Takeaways

- The expected return formula is calculated by weighting the individual returns of each investment in a portfolio and summing them up.

- Understanding the concept of expected return is essential for investors as it helps them assess an investment's potential profitability or failure.

- Investors can use the expected return calculation to make investment decisions by evaluating the projected returns of different assets.

- Having a clear understanding of the expected return on a portfolio is crucial for investors as it aids in predicting the success or failure of an investment.

How to Calculate Expected Return of an Investment?

The formula for expected return for investment with different probable returns can be calculated by using the following steps:

- Firstly, the value of an investment at the start of the period has to be determined.

- Next, the value of the investment at the end of the period has to be assessed. However, there can be several probable values of the asset, and as such, the asset price or value has to be assessed along with the probability of the same.

- Now, the return at each probability has to be calculated based on the asset value at the beginning and at the end of the period.

- Finally, the expected return of an investment with different probable returns is calculated as the sum product of each probable return and corresponding probability as given below –

Expected return = (p1 * r1) + (p2 * r2) + ………… + (pn * rn)

How to Calculate Expected Return of a Portfolio?

On the other hand, the expected return formula for a portfolio can be calculated by using the following steps:

- Step 1: Firstly, the return from each investment of the portfolio is determined, which is denoted by r.

- Step 2: Next, the weight of each investment in the portfolio is determined, which is denoted by w.

- Step 3: Finally, the calculation of expected return equation of the portfolio is calculated by the sum product of the weight of each investment in the portfolio and the corresponding return from each investment as given below,

Expected return = (w1 * r1) + (w2 * r2) + ………… + (wn * rn)

Examples

Example #1

Let us take an example of an investor who is considering two securities of equal risk to include one of them in his portfolio. The probable returns of both the securities (security A and B) are as follows:

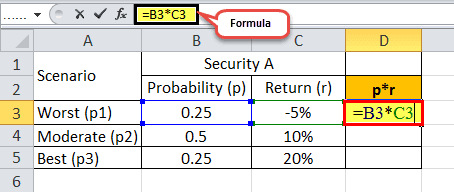

In the below-given template is the data for the calculation of Expected Return.

For the calculation of the expected return first, we will need to calculate the probability and return for each scenario.

- So, the calculation for Security A will be-

So, the calculation for Scenario Worst (p1)of Security A will be-

So, the calculation for Scenario Moderate(p2) of Security A will be-

So, the calculation for Scenario Best(p3) of Security A will be-

Therefore, the calculation of the Expected Return of Security A is:

Expected return of Security (A) = 0.25 * (-5%) + 0.50 * 10% + 0.25 * 20%

So, the Expected Return For Security A will be:

i.e., Expected Return for Security A is 8.75%.

- So, the Expected Return For Security B will be:

i.e., Expected Return for Security B is 8.90%.

Similarly, we can do the calculation of Security B for Expected Return as mentioned above:

Considering that both securities are equally risky, Security B should be preferred because of a higher expected return.

Example #2

Let us take an example of a portfolio that is composed of three securities: Security A, Security B, and Security C. The asset value of the three securities is $3 million, $4 million, and $3 million, respectively. The rate of return of the three securities is 8.5%, 5.0%, and 6.5%.

Given, Total portfolio = $3 million + $4 million + $3 million = $10 million

- rA = 8.5%

- rB = 5.0%

- rC = 6.5%

In below-given table is the data for the calculation of Expected Return.

| Security A | Security B | Security C | |

|---|---|---|---|

| Asset Value | $3 | $4 | $3 |

| Total Portfolio | $10 | $10 | $10 |

| Rate of Return of each Asset (r) | 8.5% | 5.0% | 6.5% |

For the calculation of the portfolio’s expected return first, we will need to calculate the weight of each asset.

So, the Weight of each investment will be-

Therefore ,the calculation of weight of each asset is wA = $3 million / $10 million = 0.3

- wB = $4 million / $10 million = 0.4

- wC = $3 million / $10 million = 0.3

So, the calculation of expected return for fortfolio is:

Expected return = 0.3 * 8.5% + 0.4 * 5.0% + 0.3 * 6.5%

So, Expected Return of the Portfolio= 6.5%.

Relevance and Use

- It is important to understand the concept of a portfolio’s expected return as it is used by investors to anticipate the profit or loss on an investment. Based on the expected return formula, an investor can decide whether to invest in an asset based on the given probable returns.

- Further, an investor can also decide on the weight of an asset in a portfolio and do the required tweaking.

- Also, an investor can use the expected return formula for ranking the asset and eventually make the investment as per the ranking and include them in the portfolio. In short, the higher the expected return, the better is the asset.