Table Of Contents

What Is Excise Tax Examples?

Excise tax is a form of indirect tax, in which the tax is levied on all forms of manufacturing goods, sale of goods and services. This tax is not directly levied on individual consumers but applied directly to the producer of goods and services before the sale enters the market.

This tax is further passed on to the beneficiaries of the products purchased, including the taxes within the price of the product. In this article, we take the examples of excise tax wherein each example states the topic, the relevant reasons, and additional comments as needed.

Excise Tax Examples Explained

Excise tax play a crucial role in a government, which enables them to get revenue. When the taxes are higher, the revenue income to the government increases, else if the price of the goods and services increases, the taxes also increase in the same proportion, which also increases the revenue for the government. These taxes received by the government, in turn, use them towards the betterment of the country.

Let us understand what is an example of excise tax. It is a form of indirect tax, categorized by the government. In the case of specific taxes collected, it is easier to administer based on the price of the goods and services sold. Whereas in Ad valorem taxes take care of any frequent change in the price of the goods and services sold and don’t need indexing of the rates as in specific tax.

The tax imposed on products that are harmful to health also has health benefits as this reduces the consumption of the products sold with higher taxes. The case studies mentioned below will give a clear idea about what is an example of excise tax.

Top 3 Excise Tax Examples

Let us look at some examples of excise tax.

Example #1

Consider a company High Breweries Limited located in Salt Lake City, US, which produces 2000 liters of Brewery in 24 hours. High Breweries has to pay an excise tax to the federal tax department and has an excise tax of $5 per liter. Calculate how much excise tax should High Breweries Limited must pay on a daily basis to the tax department?

Solution:

Calculation of excise tax payable will be –

As we recognize, the taxes levied are based practically on the quantity of Brewery produced per day. This is a classic example of a specific excise tax applied to the quantity delivered.

The total Excise tax liability for High Breweries Limited = 2000 * 5 = $10,000

High Breweries Limited needs to pay $10,000 in excise tax to the federal tax department for producing 2000 liters of the Brewery on a daily basis.

Example #2

One of the localities Mr. Coxman from Atlanta City would like to sell his house, the amount listed for selling the house, is $450,000. The Atlanta state charges 1.2% up to $200,000 and 1.5% between $200,001 to $ $500,000. Calculate the amount of excise tax that the buyer would be paying.

Solution:

This type of tax is levied as a percentage of the goods and services sold to the market. In this case, the property taxes are put on to the seller to be paid.

The excise tax amount that would be paid by the buyer will be zero; the tax should be paid by the seller of the property. The buyer usually doesn’t pay this tax.

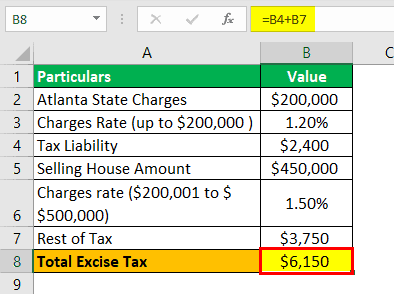

Calculation of total excise tax will be –

Tax Liability will be -

- Tax Liability = $200,000 * 1.2%

- Tax Liability = $2,400

Rest of Tax will be -

The rest of the selling price calculation for the rest of tax is,

- Rest of tax = ($450,000 - $200,000) * 1.5%

- Rest of tax = $3,750

Total Excise Tax will be -

Thereby, the cumulative excise tax that should be paid by the seller of the property = $2,400 + $3,750 = $6,150

Mr. Coxman has to pay a total excise tax of $6,150 on the selling price of the property.

Example #3

Consider a company Zig Ltd in the United States manufacturing cigarettes; a pack of cigarettes sold at the store cost’s a market price of $2, whereas another pack of cigarettes costs $4. However, in 2019, California State added an excise tax of $4.5 per pack of cigarettes, irrespective of the market price fixed by the company per packet. Moreover, the city where the cigarettes are sold has added an excise tax over the state tax of $2 on the pack of cigarettes sold. Therefore, calculate the total excise tax for two categories of cigarettes sold in the store.

Solution:

This is a specific excise tax category where a fixed tax is added to a certain product, in this case, cigarettes. Many state governments, along with the city, have added taxes are included in the market price of the product. This serves as a source of revenue to the state and the city government and also helps to reduce the purchase of unhealthy products to make them costly.

Specific Excise Tax will be -

Specific Excise tax = California State + City Tax = $4.5 + $2 = $6.5

Total Cost per Cigarette Pack for First Type -

Total cost per cigarette pack for first type = Market price per cigarette pack + specific excise tax added

- Total cost per cigarette pack for first type = $2 + $6.5

- Total cost per cigarette pack for first type = $8.5

Total Cost per Cigarette Pack for Second Type –

- Total cost per cigarette pack for second type = $4 + $6.5

- Total cost per cigarette pack for second type = $10.5

Thus the above Let us look at some examples of excise tax gives a clear explanation of the same.