Table Of Contents

What Is An Exchange Traded Note (ETN)?

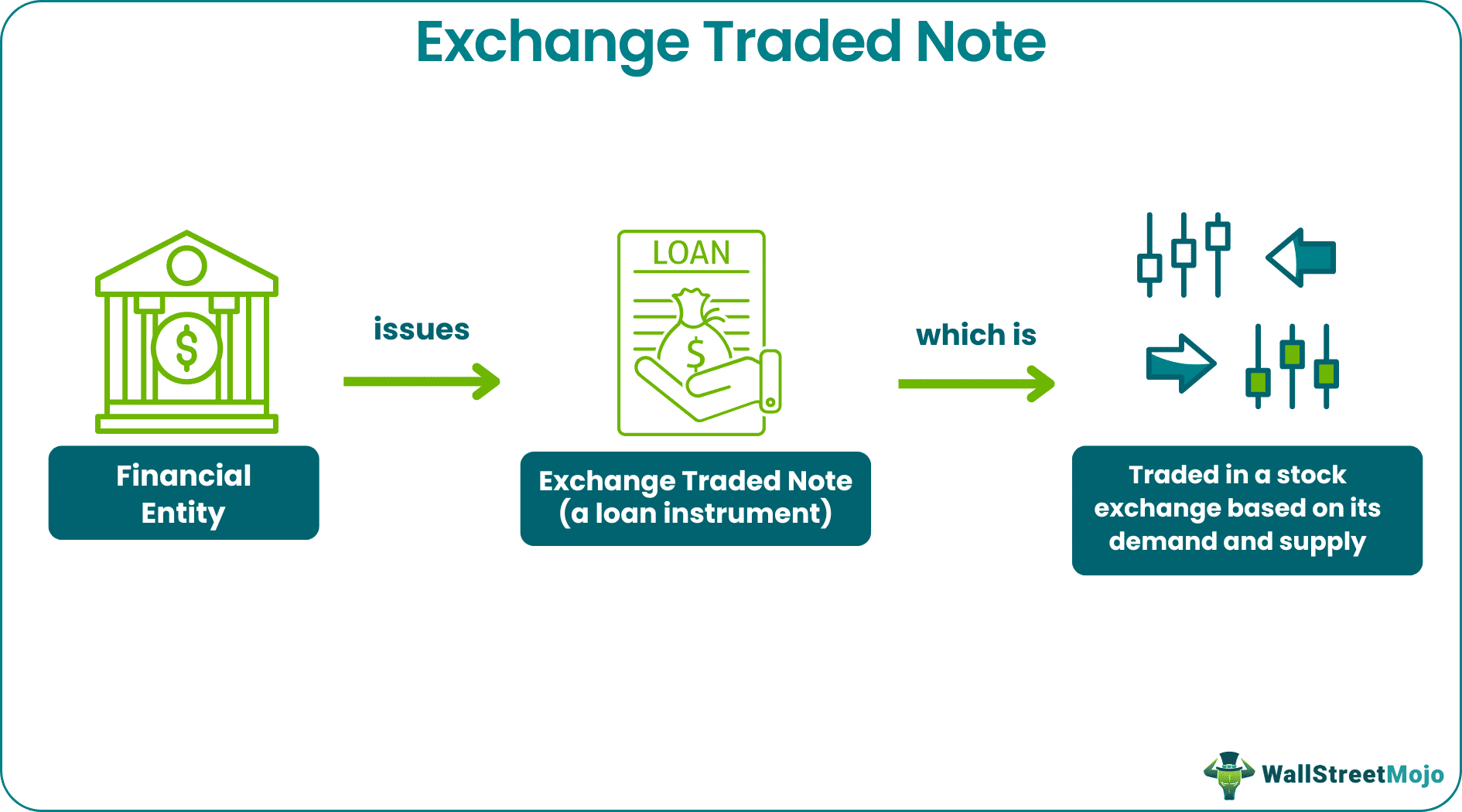

An Exchange Traded Note or an ETN is a financial instrument that a bank or any sizeable financial entity issues and is traded on a stock exchange. It is an unsecured debt instrument that tracks a financial asset’s performance. It is traded on a stock exchange based on its demand and supply.

An ETN does not provide any interest revenue to the investor. Instead, the investor’s profits or losses are procured from an index or asset class’s performance that it tracks. It comes with a predetermined maturity period, but an investor may sell it before maturity. An exchange traded note maturity period usually ranges between 10 to 30 years.

Key Takeaways

- An ETN is an unsecured loan instrument that banks or large financial institutions issue. These instruments are traded in a stock exchange. They track the performance of an underlying index or asset.

- The instruments have a maturity period between 10 to 30 years. However, they can be sold before they mature. Additionally, the issuing company may also repurchase them from the ETN holder.

- The returns on an ETN depend on the asset’s performance in the financial market and the issuing company’s credit situation. The investors do not receive any monthly interest or dividend payments. They receive an earning only after the ETN’s maturity period.

Exchange Traded Note (ETN) Explained

An Exchange Traded Note or ETN is an unsecured loan instrument that a large financial entity, like a bank, issues. It trades on the stock exchange based on its demand and supply. It tracks the performance of a financial asset or an index. The earnings that an investor derives from it come from the performance of the asset or index that it tracks. The investor does not get any interest revenue from this note.

An exchange traded note maturity period is long-term and spans between 10 to 30 years. However, the investor may sell it before its maturity. Or he may keep it till it matures and acquire the returns. An investor may sell an ETN before its maturity and make his earnings from the difference between the buying and selling price. On maturity, the issuing company promises to pay the ETN holder an amount that reflects the index’s performance in the stock exchange.

Furthermore, the issuing company pays the ETN holder the investment amount at maturity. However, an ETN holder may not receive any return if something like bankruptcy happens to the issuing company. If the company cannot repay the investor the promised amount, the ETN holder’s investment will amount to nothing. Or he might get a return much less than the initially invested amount.

An ETN holder does not gain ownership of any substantial asset. Instead, the ETN merely tracks the asset performance, and the investor receives the returns on its performance. For example, an ETN for gold does not give the holder ownership of that gold. It only tracks the gold index or the asset.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples

Let us understand the concept of an ETN with the help of the following examples:

Example #1

Suppose an investor, John, anticipates that gold’s value will likely increase. So, he invests $500,000 in a gold ETN that tracks gold’s value in the financial market. The gold ETN has a 15 years maturity period. At maturity, the ETN value increases by 10%. John receives the principal amount of $500,000 and a return of $50,000 based on the asset’s performance in the stock exchange. The total amount Mr. John gets is $550,000, along with a little management fee deduction. This is an exchange traded note example.

Example #2

On February 21, 2023, UBS investment bank announced the quarterly coupon payments on ETN. They declared quarterly coupon payments for the ETRACS Alerian MLP Index ETN Series B. ETRACS ETNs are senior unsecured instruments that UBS AG issued, and it trades on the NYSE Arca. They can be purchased and sold through a financial advisor or a broker. This is another exchange traded note example.

Advantages

The advantages of an ETN are as follows:

- ETN holders gain access to some markets for specific securities like currency, international markets, and commodities futures. Small investors cannot easily access these markets due to their high minimum investment requirements and commission price. ETNs make these markets accessible for even small investors and institutions as they hold no such restrictions.

- ETNs are liquid instruments that can be bought and sold during normal stock exchange trading hours. The issuing company can repurchase the ETNs every week. The ETN holders can track the asset performance in the financial market like a stock price performance.

- ETN holders are not liable to pay taxes every month as they do not receive any monthly interest or dividend returns. The profits or losses and earnings on ETNs defer until their maturity. As a result, an ETN holder enjoys tax savings.

Risks

The risks of exchange-traded notes are as follows:

- ETNs are subject to exchange traded note credit risk. This risk implies that the investor will not receive any returns if the ETN asset underperforms in the market or the issuing company goes bankrupt. Additionally, they will not receive their principal amount as well. It is a high-risk investment as even some negative news about the issuing company may adversely affect the ETN’s performance. As a result, the ETN holder will put himself under the threat of the asset underperforming in the financial market.

- ETNs have fewer investment options as they have a low market demand. The prices fluctuate and vary greatly, despite the issuing company’s attempts to keep the cost constant.

- One of the risks of exchange traded notes includes inadequate liquidity. ETNs are less liquid than stocks; the holder can sell them weekly. Thus, it risks the investors facing losses during the entire holding period.

Exchange Traded Note vs Exchange Traded Fund (ETF)

The differences are as follows:

- Exchange Traded Note: Banks issue these unsecured loan instruments, which are traded in a stock exchange. The ETN holder does not receive any interest or dividend return monthly. These instruments are subject to both market and the issuing company’s credit risk. The investor is not liable to pay any tax as there are no interest or dividend earnings until the instrument reaches maturity.

- Exchange Traded Fund: This is a fund type where several securities pool together into a single fund and trade in a stock exchange. The investors are eligible to receive dividend returns on exchange traded funds. It is subject only to market risks. The investor is liable to pay taxes on the monthly dividend from this fund.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

ETNs can be purchased and sold on exchanges like all other exchange-traded instruments. A broker or a financial advisor can help an investor buy ETNs. They are traded in a stock exchange and can be short-called on a down or up-tick. Furthermore, an ETN holder usually requests the issuing company to repurchase the ETN for cash.

No, ETNs do not come with principal protection. If the asset underperforms in the financial market or the issuing company defaults, the investor may receive zero earnings. If the issuing company cannot repay any amount, the investor will not receive any returns. The investor may even lose the principal amount he invested into buying the instrument. In addition, this instrument is subject to the issuer’s credit risks.

No, ETNs are not equity security. It is an unsecured loan instrument. The ETN holders do not get ownership of that particular asset. They receive returns based on the asset’s performance in the stock exchange. An ETN is merely a debt instrument.