Table Of Contents

Exchange Traded Funds (ETF) Definition

An exchange traded fund (ETF) is a bundle of securities that replicate the performance of an underlying stock market index, commodity, sector, or assets. ETFs can be bought or sold over stock exchanges.

ETFs are very liquid, and their prices fluctuate during the market's trading hours. ETFs are regulated by The Securities and Exchange Commission (SEC). SPDR S&P 500 (NYSE Arca|SPY), iShares Russell 1000 Index (NYSE Arca|IWB), and Vanguard S&P 500 (NYSE Arca|VOO are some examples.

Table of contents

- Exchange Traded Funds (ETF) Definition

- An exchange traded fund (ETF) is a basket of stocks that traces the returns of an underlying asset, commodity, industry, sector, or market index.

- ETFs are similar to the other stock trading since they are listed on stock exchanges for intraday buying and selling.

- The prices do not fluctuate much from their Net Asset Value (NAV)—they are less volatile than other stocks.

- Due to low brokerage and commissions, the expense ratio of an ETF is lower than stocks.

Exchange Traded Fund Explained

Exchange traded funds (ETFs) can be defined as a basket of stocks that reflect an underlying stock index like S&P 500. These stocks are traded on stock exchanges. It is suitable for investors who want exposure to specific industries.

ETFs also attract investors with a shorter horizon—to implement scalp trading strategies. ETFs have an all-day trading window. The Securities and Exchange Commission (SEC) regulates ETFs. It can be managed both passively and actively.

The ETF's trading value is based on the NAV of the underlying stock. By doing so, it provides instant diversification—just like open-end funds. In addition, ETFs can be traded throughout the day—just like closed-end funds. Using the intraday facility, investors trade combinations of limit orders, stop orders, and short sells. It is mandatory to disclose holdings twice a day; therefore, ETFs provide better visibility to investors.

Index Funds are similar, but limited diversification and little to zero alpha over-index keep long-term investors away.

Many investors use platforms like Saxo Bank International to diversify their portfolios with ETFs. For those interested in trading ETFs, SAXO ETF provides access to a wide selection of global funds.

Types of ETFs

ETFs can be categorized into subtypes based on index, commodity, and sectors:

#1 - Fixed Income ETFs

Fixed income funds invest in low-risk securities like bonds—to ensure constant and regular returns. It diversifies the portfolio. However, returns are quite low.

#2 - Real Estate ETFs

They are more volatile than fixed-income funds. Even so, they attract investors by providing ninety percent of the income to fund holders. It generates better returns by assuming slightly more volatility.

#3 - Equity ETFs

In Equity ETFs, the underlying benchmark is a stock or equity. It is further classified into large-cap or small-cap funds.

#4 – Commodity ETFs

Commodity ETFs replicate the returns of commodities—oil, gold, silver, etc. There is a negative correlation between the US bond market and the commodity market. When the dollar value of bonds falls, there is an upward push observed in the commodity market.

#5 - Currency ETFs

Currency ETFs invest in the currency market—either in a single currency or a basket of currencies. Currency investments are undertaken to hedge foreign exchange risks. For example, having exposure to GBP may provide gains when Dollar depreciates in global markets.

#6 - Specialty ETFs

These ETFs are created to fulfill a specific purpose—foreign markets funds, derivative funds, inverse ETFs and leveraged funds. They are not as liquid as conventional ETFs but are still held by corporates to hedge investment risks arising from operating in a specific market.

#7 - Sustainable ETFs

As the name suggests, these funds comprise sustainable investment options that emphasize environmental, social and governance factors.

Investors interested in accessing a broad range of ETFs can explore options through the Hargreaves Lansdown ETF landing page.

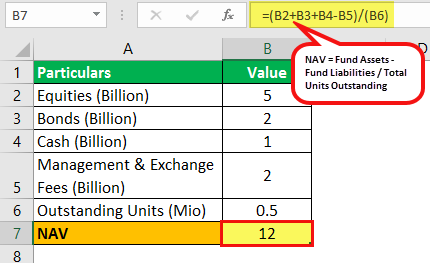

Calculation

The Net Asset Value (NAV) of ETFs differs from a usual mutual fund—although both are calculated at the end of a trading day (typically at 4 PM). While mutual funds are bought or sold at NAV, ETFs can be traded at various different prices—not just the NAV.

Thus, NAV calculations are essential for the following two purposes:

- It gives an indicative direction of funds (whether it is over or underpriced).

- The closing NAV can be used for a market to market accounting.

The following formula is used:

NAV=(Fund Assets-Fund Liabilities)/(Total Units Outstanding)

Example

Now let us look at an example to understand the calculation:

Consider an ETF that owns $5 billion in equities, $2 billion in bonds, and keeps $1 billion in cash. However, it owes $2 billion in management and exchange fees. There are 500 million outstanding units. Based on given values, determine the NAV.

Solution:

Calculation of NAV can be done as follows –

NAV = /0.5 = $12

However, the fund may trade at different prices during the day—say at $11.97 or $12.02, depending on demand and supply. Efficient traders track anomalies and nullify these NAV differences quickly.

Best Exchange traded Funds to Buy Now

The following list comprises promising ETFs for 2022:

- United States Natural Gas Fund LP (UNG)

- VanEck Oil Services ETF (OIH)

- SPDR S&P Metals & Mining ETF (XME)

- Simplify Interest Rate Hedge ETF (PFIX)

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

- iShares MSCI Brazil ETF (EWZ)

- iShares Latin America 40 ETF (ILF)

Advantages and Disadvantages

The pros of investing in exchange traded funds are as follows:

- Tax Efficient: ETFs return lower capital gains than mutual funds—investors are taxed less.

- Actively Traded Fund: Scalp traders benefit from day trading opportunities—a combination of stop orders, limit orders, etc., is made possible.

- Low Expense Ratio: Since an ETF mimics the performance of an index, it reduces expenses—fund management costs, sales, and distribution costs.

- Low Volatility: ETFs trade very close to their NAV—a sharp rise or fall is unlikely.

ETFs are prone to the following drawbacks:

- Less Diversified: Although investing in ETFs allows for more diversification than directly investing in the stocks, they are less diversified than the mutual funds.

- Little Margin: Price fluctuations are very close to NAV—marginal gains for intraday traders is meager.

- Limited Returns: They are low-risk investments, but the dividend yields are also low (when compared to equity investments).

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

An ETF is not a single stock—but a bundle of securities. The bundle tracks an underlying asset, market index, sector, or commodity. However, these funds can be bought or sold over stock exchanges.

ETFs allow full dividend payment—as allocated by the underlying stock or security. However, with most ETFs, dividends are automatically reinvested in the same fund—by allotting the additional units to the investors.

An ETF is a pooled investment product that can be traded over the stock exchange on an intraday basis. A mutual fund is registered on the stock exchange. Unlike an ETF, mutual funds cannot be purchased or sold on a stock exchange. Mutual funds are bought from respective fund houses.