Table Of Contents

What is the Exchange Rate Formula?

The exchange rate is defined as the rate based on which two countries are involved in the trade exchange of marketable items or commodities. It is the cost of exchanging one currency for another currency. Mostly, exchange rate formula economics pans out in a floating market where the prices increase or decrease based on demand and supply.

It is vital to also note that the currencies of some countries are pegged or anchored upon the value of another, usually a large economy’s currency. The changes in these rates affect businesses and the demand and supply of products purchased or sold overseas. The rate is determined by market interest rates, GDP, and unemployment rates in respective countries.

Key Takeaways

- The exchange rate is when two trading nations exchange commodities or other marketable goods. It is the price of converting one currency into another.

- The usage of exchange rates is essential since it makes international trading easier. Additionally, it aids the lender's successful offshore investment decisions.

- Exchange rates are also tradable in future markets, making them useful for hedging against the exposure exchanged between several nations.

Exchange Rate Formula Explained

An exchange rate is a fundamental concept in international finance that determines the value of one country's currency in terms of another country's currency. A foreign exchange rate formula reflects the rate at which one currency can be exchanged for another. Exchange rates play a crucial role in global trade, investment, tourism, and financial transactions.

Exchange rates are typically expressed as pairs, where the first currency is the "base currency," and the second currency is the "quote currency." The exchange rate tells you how much of the quote currency you need to acquire one unit of the base currency.

Exchange rates have a significant impact on cross-border transactions. When a currency appreciates, imports become cheaper but exports may become more expensive, potentially affecting trade balances. Exchange rates also influence international investment decisions, as they determine the value of returns denominated in different currencies.

Governments and central banks often intervene in foreign exchange markets to stabilize their currency's value or achieve specific economic goals. Exchange rates can be fixed (pegged) or floating, depending on whether they are determined by market forces or controlled by authorities.

Exchange rates are dynamic and can fluctuate frequently due to the complex interplay of economic, political, and market factors. Understanding exchange rates is crucial for businesses, investors, travelers, and policymakers to make informed decisions in a globalized economy.

Formula

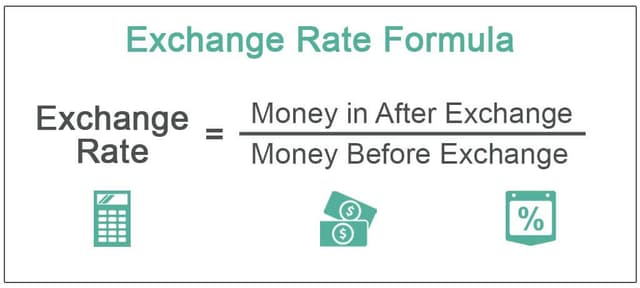

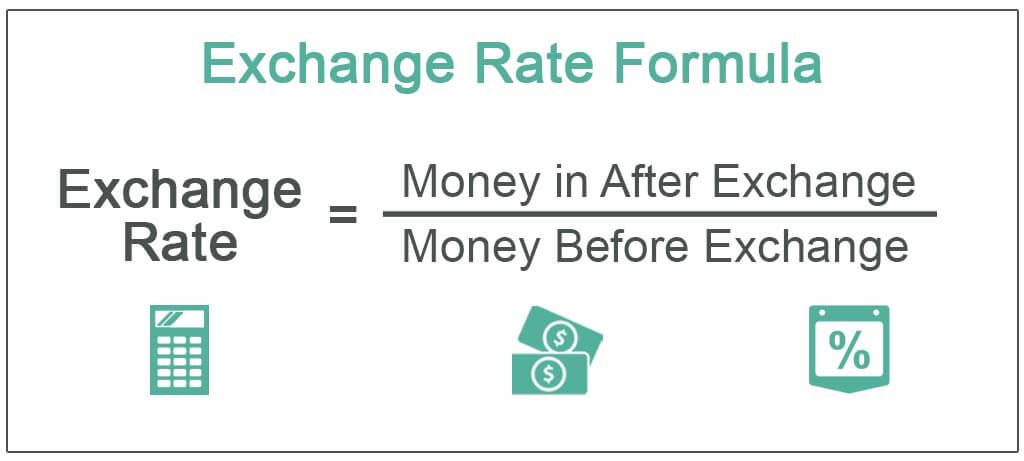

Since it is used by market experts and traders alike to understand the rates and demand of a particular currency, it is vital to understand the foreign exchange formula. One can calculate the exchange rate as per the below-mentioned relationship: –

Additionally, it can also be determined as per the below-mentioned relationship: –

Here, money after exchange corresponds to foreign currency, and the money before an exchange is regarded as domestic currency. The exchange rate is determined by making up pairs between different currencies. The financial institutions or the central banks of the respective nations help determine the currency pairs.

How To Calculate?

Now that we understand the basics of this concept and its formula, let us understand how to calculate it to ensure we understand the exchange rate formula economics.

- Firstly, determine the amount to be transferred or exchanged from domestic currency to foreign currency.

- Next, the individual can access foreign exchange markets through trading platforms or through financial institutions to determine the available exchange rates prevalent between the two nations

- Next, multiply the exchange rate with the domestic currency to arrive at the foreign currency.

Examples

After understanding the concept’s basics, formula, and calculations, let us apply the theoretical knowledge into practical application through the examples below.

Example #1

Abraham, a trader who wants to invest in the exchange-traded funds traded in US markets. The trader has INR 10,000 to invest in the exchange-traded funds traded in the offshore market. However, the trader lives in India, and 1 INR corresponds to 0.014 USD.

Help the trader determine the value of INR investment in terms of US currency.

Solution:

Use the below-given data to calculate the money after the exchange rate.

| Particulars | Value |

|---|---|

| Exchange Rate | 0.014 |

| Money Before Exchange | ₹ 10,000 |

Determine the value of exchange in terms of US dollars as displayed: -

The value of exchange in terms of US dollars = 0.014*10,000

Value of Exchange in Terms of US dollars will be:-

Money in After Exchange = $140.

Therefore, the trader would get $140 in USD dollars when he approaches a bank or a foreign exchange institution to convert INR to USD currency.

Example #2

Let us take the example of an individual planning a trip from the USA to the European Union. He has a planned budget of $5,000. The travel agent informs the traveler that if he exchanges US dollars to Euro, he will get €4,517.30.

Help the traveler determine the exchange rate between the USA and the Euro.

Solution:

Use the below-given data for the calculation of the exchange rate.

| Particulars | Value |

|---|---|

| money After Exchange | € 4,517.30 |

| Money Before Exchange | $5,000 |

Determine the exchange rate between US and Euro as displayed: -

Exchange Rate (€/ $) = € 4,517.30 / $5,000

Therefore, exchange Rate will be:-

Exchange Rate (€/ $) = 0.9034

Therefore, the exchange rate between the US and Euro is 0.9034. Therefore, if the traveler plans to raise the budget, he can consider the above-calculated exchange rate.

Example #3

Let us take the example of a trader from the USA to make investments in the UK financial market. He has a planned budget of $20,000. The offshore broker informs the trader that if he exchanges US dollars for the British pound, he will get £15,479.10

Help the trader determine the exchange rate between the USA and UK.

Solution:

Use the below-given data for the calculation of the exchange rate.

| Particulars | Value |

|---|---|

| Money After Exchange | £15,479.10 |

| Money Before Exchange | $20,000 |

Determine the exchange rate between US and Euro as displayed: -

Exchange Rate (£/ $) = £15,479.10 / $20,000

Therefore, Exchange Rate (£/ $) will be:-

Exchange Rate (£/ $) = 0.77

Therefore, the exchange rate between the US and the pound is 0.77. Therefore, if the trader plans to raise the budget, he can consider the above-calculated exchange rate.

Calculator

A calculator has been provided for the perusal of the reader.

How Does It Affect Import And Export?

Exchange rates play a significant role in shaping a country's trade dynamics by influencing its import and export activities. Here's how exchange rate formula economics affect imports and exports:

Imports

- Appreciation of Domestic Currency: When a country's currency appreciates (increases in value) relative to other currencies, it becomes stronger. This makes imports cheaper since you can buy more foreign currency with your own currency. As a result, consumers and businesses can afford to purchase more foreign goods and services at a lower cost. This can lead to an increase in imports.

- Cheaper Foreign Goods: A stronger domestic currency means that the cost of foreign goods and services decreases. This can make imported products more attractive and competitive, leading to an increase in the demand for imports.

Exports

- Depreciation of Domestic Currency: A depreciation (decrease in value) of the domestic currency makes exports more affordable for foreign buyers. Foreign consumers and businesses need to spend less of their currency to purchase the same amount of the domestic currency, leading to an increase in demand for domestic products.

- Boost Export Competitiveness: A weaker domestic currency makes the country's goods and services cheaper for foreign buyers. This enhanced affordability can make domestic products more competitive in international markets, potentially boosting export volumes.

- Inflationary Pressures: A depreciated currency can also lead to higher domestic inflation, as the cost of imported goods rises. While this can be a concern for domestic consumers, it can also make domestically produced goods more appealing compared to imported alternatives.

Relevance and Uses

The exchange rates are critical to be employed because it helps facilitate foreign trade. It additionally helps the lender make good investments in the offshore arena. It also helps tourists traveling across the globe to determine the cost of travel from domestic countries to offshore locations. Finally, the exchange rates also help indicate how well the domestic country holds the purchasing power concerning the foreign nations.

The foreign exchange rate formula can be traded in forward markets as well; hence can be utilized for hedging corresponding to the exposure traded between different countries.