Table Of Contents

What Is Ex Gratia Payment?

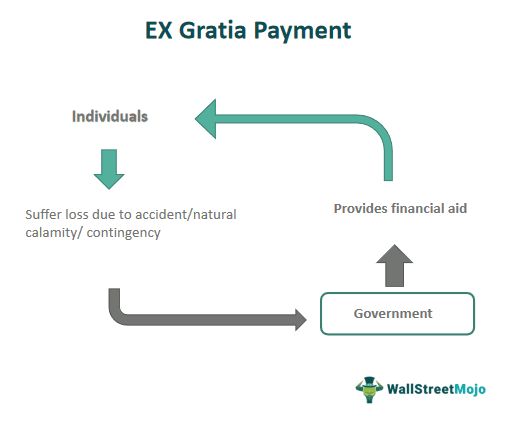

Ex-gratia is a Latin word that means "by favor," any payment made voluntarily to the person who suffers from any casualty, accident, or contingency that has caused financial and non-financial loss to the accused person normally by the Government, an organization, social institutions or non-government organizations.

The party who will make the payment in such a case will not have to admit that it is a liability on their part. It is a totally voluntary process, and they are not obliged to pay the party who suffers the casualty. These type of payments are not very common.

Key Takeaways

- Ex- gratia payments are often made to compensate individuals with loss or harm. These payments are made as a gesture of kindness or sympathy and are uncommon.

- Ex-gratia payments are called 'golden handshakes' or 'golden boots.'

- This payment can be avoided as it is optional. Furthermore, it is a moral obligation and is not performance-linked.

- Moreover, these payments are not usually made in response to a legal claim or as a way of admitting liability but instead as expressing goodwill.

- Therefore, these payments are taxable under federal and state tax laws in the US.

Ex Gratia Payment Explained

Ex Gratia payment is the type of payment that usually the government pays to any individual who has suffered from any kind of heavy loss due to natural calamity or accident. The loss might be financial in nature of non financial in nature.

By voluntary nature, as per the ex gratia payment rules, the payer is not legally obliged to make such payments. Instead, the payer is paying gratitude towards a person's loss and suffering. Ex- gratia payments are called 'golden handshakes' or 'golden boots. However, this kind of payment is subject to state and federal income taxes, making them taxable in nature.

It is a settlement package with no legal liability but a moral obligation, out of which payment is made to avoid further legal matters in the court of law. It is often termed as a gesture of goodwill for something bad that had happened with you or your loved ones.

It is unlike an insurance company where the insurer is legally obliged to pay for the claim of the insured in case the policy holder faces any contingency that is covered under the insurance policy. Thus, this is not a voluntary payment.

Examples

Let us go through some examples to understand the ex gratia payment rules.

- Company planning for layoffs will pay ex gratia payment to affected employees over and above statutory payments, which are legally due.

- E.g., Severance pays in some cases if paid voluntarily, or ESOPs (Employee stock option plans) are given to resigned employees voluntarily.

- Another ex gratia payment example is that Malaysia Airlines had given ex- gratia payments to the families of each passenger aboard missing in the flight accident.

- The Prime minister of Malaysia announced ex- gratia payments to the judges affected by the 1988 Malaysian constitutional crisis.

- The US Department of Defense announced this payment to the families of each non-US personnel killed in the friendly fire accident in the 1994 Black Hawk shootdown incident.

- PM of India announced this payment to families of CRPF personnel killed in the Pulwama terrorist attack in J&K state. Recently in India, the coal minister raised ex- gratia for fatal mine accidents by three times.

- An insurance company may make an ex gratia payment to its policyholders when the claim is not tenable. However, the company chooses to make such voluntary payments to have friendly relationships with stakeholders and maintain good customer rapport.

- USS Vincennes fired upon Iran Air Flight and killed hundreds of individuals; the US government announced this payment to victims' families.

Thus, the above are some ex gratia payment example.

Calculation

Now let us simplify and understand how to calculate ex gratia payment.

It is voluntary; there is no particular method to calculate such payments. These payments are given on the giver's wish and the funds' availability with the giver. Any person gives these unless those are outside the scope of the employer-employee relationship. It's the lump sum amount paid. There is no limit on this payment as it is voluntary. It's more wish-based, based on gratitude. However, employers' other contributions, like bonuses, provident funds, and gratuity, are limit bound. Therefore, this is how to calculate ex gratia payment.

Taxability

The taxability of such ex gratia payment policy differs from country to country. There is a tax break for such non-contractual payments up to a certain amount. The employer pays you ex gratia, at the time of tax filing, the employee must select an appropriate box to avoid tax on such income. The threshold limit in Britain is around Euro 30,000. April 2020 onwards, an employer will be required to pay NIC on any part of termination payment above Euro 30,000. The employer may pass on such a burden of tax to employees by reducing their payments. The employee, in turn, may go to the employment tribunal and may get Euro 30,000 compensation but will be subject to tax. These payments made above Euro 30,000 must be reported to HM Revenue and customs.

- These ex gratia payment policy are taxable under federal tax and state tax laws in the US.

- In India, these payments are taxable per slab rates applicable to an individual. If corporations receive such payments, then the flat tax rate will apply.

Ex Gratia Payment Vs Bonus

A bonus is a statutory expense, whereas, in ex gratia, there is no liability to pay. The minimum bonus rate is 8.33%, and the maximum goes up to 20%. No such limits in ex gratia as it is a lump sum payment. Ex-gratia is usually paid to employees who are not covered by the bonus. Payment of bonuses is a liability and cannot be avoided.

On the other hand, ex gratia payment can be avoided as it is not compulsory. Ex gratia is a moral obligation, whereas a bonus is legal. Bonus payments are performance-linked. On the other hand, ex- gratia payments are not performance-linked. Payment of bonus is performance-linked; hence, it needs not to be given to all employees; however, if the employer announces ex gratia payment, it should be paid to all employees irrespective of performance pay and any other factor whatsoever. This payment cannot be a bonus; it is in addition to the bonus.