Table Of Contents

What is the European Option?

A European option can be defined as a type of options contract (call or put option) that restricts its execution until the expiration date. In layman's terms, after an investor has purchased a European option, even if the price of the underlying security moves in a favorable direction, i.e., an increase in the price of the stock for call options and a decrease in the price of the stock for put options, the investor cannot take advantage by exercising the option early.

- A European option can only be executed on its expiration date, whether it's a call or a put option. It means an investor must wait to exercise it, even if the price of the underlying security moves in their favor.

- The European call option and the European out option are the two types of European options.

- Early exercise and selling are permissible in American options but not European ones. The profit is calculated by subtracting premiums paid from premiums collected.

Key Takeaways

- A European option can only be executed on its expiration date, whether it's a call or a put option. It means an investor must wait to exercise it, even if the price of the underlying security moves in their favor.

- The European call option and the European out option are the two types of European options.

- Early exercise and selling are permissible in American options but not European ones. The profit is calculated by subtracting premiums paid from premiums collected.

Types of European Option

#1 - European Call Option

Holders of such contracts can buy a predetermined quantity of the underlying at the expiration date at a predetermined price, also known as the strike price. The investor is bullish on the market.

#2 - European Put Option

Investors can sell a predetermined quantity of the underlying at the expiration date at the strike price. Investor opinion is bearish.

As we dive into the complexities of this topic, it becomes clear how foundational knowledge can lead to practical applications. Those interested in enhancing their skills further might find this Basic and Advanced Derivatives Bundle Course helpful for gaining deeper insights.

The Formula of the European Option

Black Scholes Merton Model or BSM model is more suited for pricing European options since one of the assumptions that this model rests on is that the options aren’t exercised early.

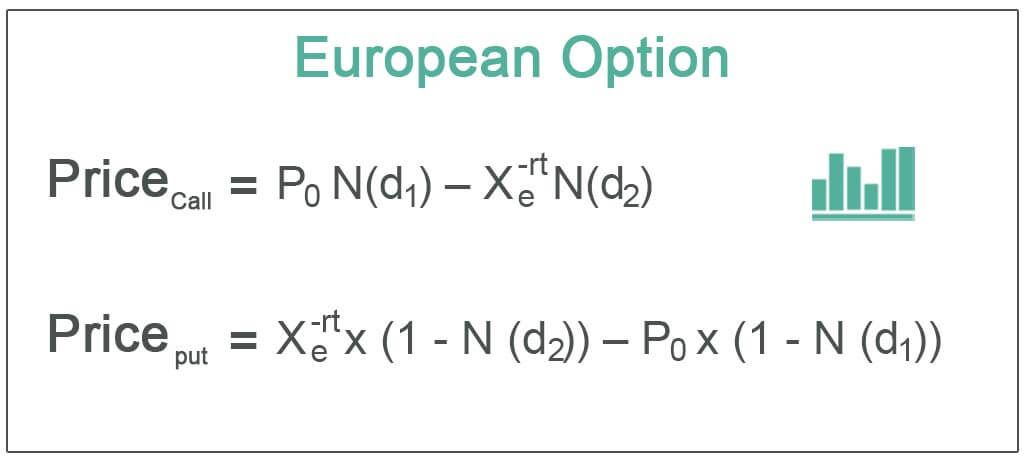

#1 - Pricing a European Call Option Formula

Price Call = P0N(d1) - Xe-rtN(d2)

Where,

- d1 = /v √t and d2 = d1 - v √t

- P0= Price of the underlying security

- X= Strike price

- N= standard normal cumulative distribution function

- r = risk-free rate

- v= volatility

- t= time until expiry

#2 - Pricing a European Put Option Formula

Price Put = Xe-rt *(1-N(d2)) - P0*(1-N(d1))

Where d1 and d2 can be calculated in the same way as in the call option pricing.

Practical Example of European Option

Stock XYZ is trading for $60. The strike price is $60. Volatility is 10%, and the risk-free rate is 5%.

Calculate the value of a 1-year call and put options written on it using the BSM model.

- Price of the Underlying Security (P0): $60

- Strike Price (X): $60

- Volatility (V): 10%

- Risk-Free Rate (r): 5%

- Time Until Expiry: 1

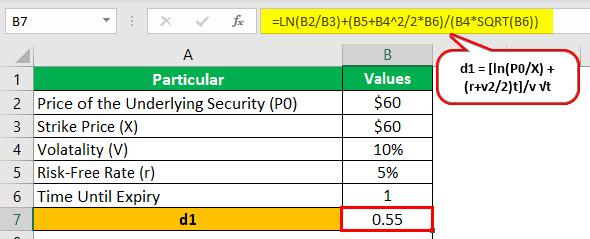

Calculation of d1

- d1 = /v √t

- = LN(60/60)+(5+10^2/2*1)/(10*SQRT(1))

- =0.55

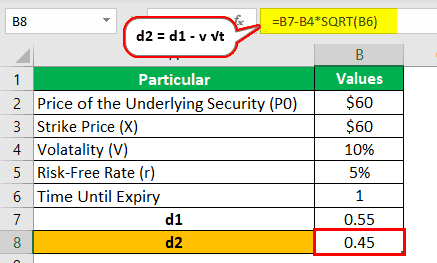

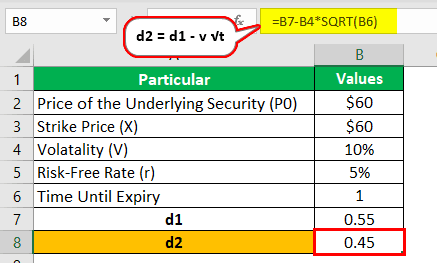

Calculation of d2

- d2 = d1 - v √t

- = 0.55-60*SQRT(1)

- = 0.45

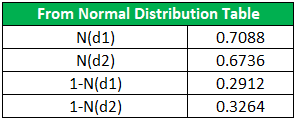

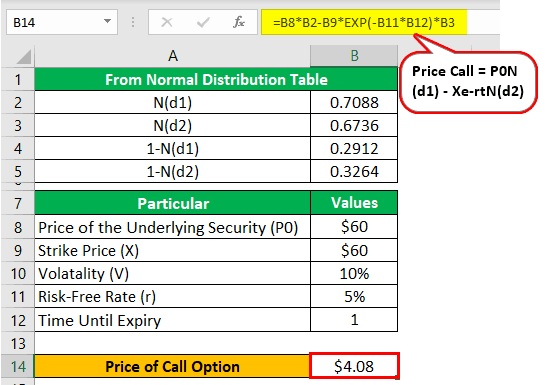

We got the following values from the normalization table.

So the calculation of the price of the call option using the above table

Price of call= $4.08

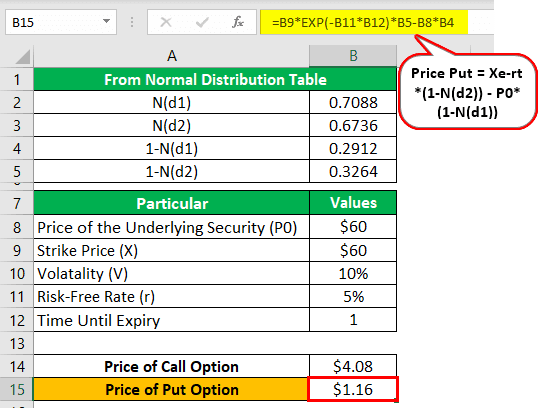

calculation of the price of the put option using the above table –

Price of put= $1.16

Prices are also calculated in the solved example excel sheet.

Before we move forward to its advantages and disadvantages, let’s talk briefly about the upper and lower price bounds for European call and put options.

- Lowest bound for a Call =0 (Option price can never fall below zero)

- Highest bound for a Call= P0 (Current value of the underlying)

- Lowest bound for a Put = 0

- Highest bound for a Put = Xe-rt (Present value of strike price)

How European Options Differs from American Options?

European Options differ from American options in that American option holders have the liberty of exercising the option anytime, be it on or before the expiration date. However, investors of such options can choose to sell their holdings in the market before the expiration date approaches. Under such circumstances, profit is essentially the difference between the premium earned and the premium paid.

Also, European and American options are mutually exclusive in the market. Both aren’t offered simultaneously, so investors don't have a choice.

Both these options differ on three grounds:

| European Options | American Options |

|---|---|

| It can be exercised only at its expiration date. | It can be exercised anytime during the life of the option. |

| Traded over the counter. | Traded only on exchanges. |

| Generally, have a lower upfront cost, i.e., premium. | Have higher premiums. |

| It can have stocks and foreign currencies as the underlying. | It can have stocks, bonds, commodities, and derivatives as the underlying security. |

Advantages

- There is a predetermined time of expiration of the contract that gives the investor some certainty.

- These options are less expensive than American options. Due to the added flexibility of any time exercise in American options, the upfront cost tends to be higher than in European options.

- This tends to be less risky, and the pricing complexity is also less due to the availability of limited options for contract execution.

Disadvantages

- European options though less risky than the American options aren’t devoid of risks. They can be subject to other types of unique risks. A meticulous approach has to be adopted to avoid such risks.

- One such risk is the trading lapse risk. Trading of European options closes at the end of the business day on a Thursday that falls before the third Friday of the expiration month. This can lead to an unexpected change in the price of the underlying.

- The settlement price might be tricky to determine due to the risk of a trading lapse.

- Investors can't exercise their options to take advantage of a favorable price move.

- Most such options are traded over the counter, so there isn’t much regulation, adding another degree of risk.

- The BSM model used for pricing might not be the most accurate due to some unreal assumptions involved in the calculation.

Limitation

- European options aren’t much accessible because they are traded over the counter.

- The pricing model makes certain assumptions of dividend, volatility, and risk-free rate being constant during the entire duration, which is unreal. Hence, prices might be different from the real world.

Conclusion

The naming of European and American options has nothing to do with the respective geographical locations. It simply gives an idea of when an option can be exercised. Most options traded in the US are known to be European options. Due to the difference in the features of the two options, investor expectations also vary. Like, an American option holder would expect the prices to move favorably before the expiration date arrives. However, the same isn’t true for European option holders who hope such changes happen only at expiration.