Table Of Contents

What Is Euro Overnight Index Average (EONIA)?

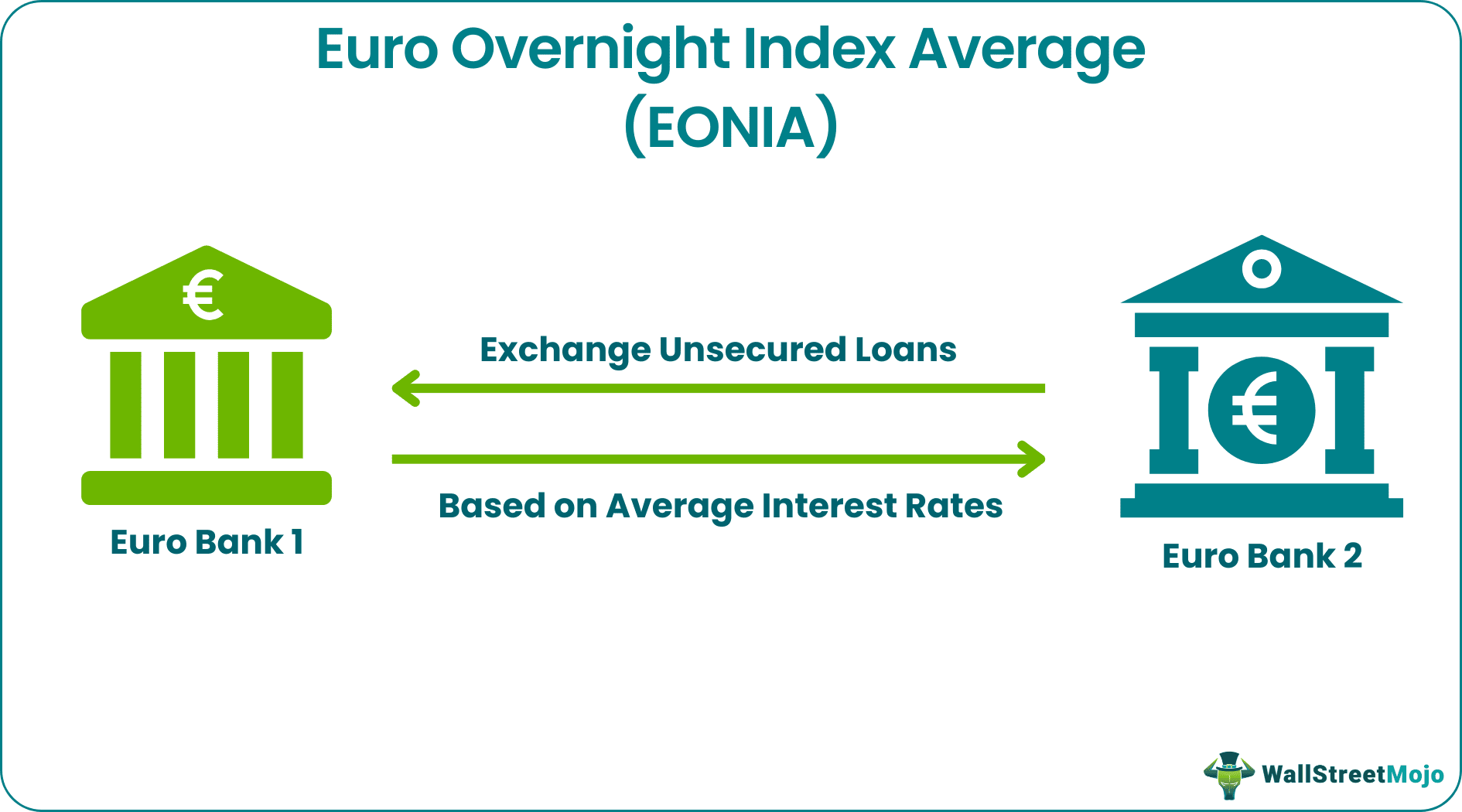

The Euro Overnight Index Average (EONIA) was an interest rate benchmark for the euro interbank money market. It represents the average interest rates at which eurozone banks offered unsecured loans to each other on an overnight basis.

The primary aim of the Euro overnight index average was to serve as a reference rate for overnight borrowing costs within the euro area. It provided a reliable benchmark for financial institutions and market participants to gauge short-term funding costs and evaluate the performance of their investment portfolios.

Key Takeaways

- Euro overnight index average (EONIA) was a weighted average of the interest rates at which eurozone banks offered unsecured overnight loans to each other.

- It was a benchmark interest rate for overnight borrowing costs within the eurozone. It is a reference rate for various financial products and contracts.

- It included a credit risk premium, reflecting the average interest rates on unsecured lending transactions and incorporating a component for the credit risk associated with the borrowing banks.

How Does Euro Overnight Index Average Work?

EONIA, or Euro Overnight Index Average, is a standard interest rate in the eurozone. This is to measure banks' average overnight borrowing costs. It reflects the interest rate at which participating banks offer unsecured loans to each other in the euro money market. EONIA is crucial in pricing and valuing various financial instruments. Moreover, it is a reference rate for loans, derivatives, and other financial contracts.

Here's a simplified overview of how the EONIA works:

- Panel of Contributing Banks: The European Central Bank (ECB) established a committee of contributing banks, typically central banks operating within the eurozone. These banks provide transaction data related to their overnight lending activities.

- Data Collection: Each contributing bank report the actual interest rates at which it lends funds to other banks in the interbank market for overnight loans. The data included each transaction's amount, maturity, and interest rate.

- Calculation: The ECB collects the reported transaction data and calculates the EONIA rate. The analysis uses a weighted average methodology, where the corresponding transaction volumes weighted the interest rates.

- Publication: The ECB published the EONIA rate daily. The rate at the end of the business day reflects the average interest rates for overnight loans among the contributing banks.

- Benchmark Rate: EONIA serves as a benchmark or reference rate for overnight borrowing costs within the eurozone. Financial institutions and market participants could use this rate to price various financial instruments and contracts, including derivatives, money market instruments, and bank loans.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us understand it better with the help of examples:

Example #1

Imagine a bustling eurozone money market where multiple banks engage in overnight lending transactions with each other. These transactions involve banks lending unsecured funds to one another to manage their short-term liquidity needs.

At the end of each day, participating banks report the interest rates at which they offer overnight loans to other banks within the eurozone. These rates reflect the prevailing market conditions and the perceived creditworthiness of the borrowing banks. In practice, the European Central Bank (ECB) collects transaction data from participating banks, calculates the weighted average rate, and publishes the EONIA rate for the specified reference period. The weights are typically determined by the volume or size of lending transactions conducted by participating banks.

The EONIA rate represents the average interest rate at which banks lent each other on an unsecured basis for overnight durations within the eurozone. The ECB publishes the EONIA rate daily, and market participants use it to price and value financial instruments, manage interest rate risk, and assess funding costs.

Thus by providing a transparent and widely accepted benchmark, EONIA facilitates efficient and fair pricing in the eurozone money market, contributing to the stability and functioning of the financial system.

Example #2

Another example of EONIA in the news is its discontinuation and the transition to ESTER (Euro Short-Term Rate). This transition has been a significant development in the financial industry. The European Central Bank (ECB) announced the decision to replace EONIA with ESTER to improve the integrity and reliability of the overnight reference rate.

The discontinuation of EONIA and the transition to ESTER garnered attention in financial news and markets because it marked a shift towards a risk-free overnight benchmark rate in the eurozone. Furthermore, the move aligned with global regulatory reforms to address concerns about the accuracy and representativeness of benchmark rates.

The transition from EONIA to ESTER aimed to enhance the reliability and robustness of the benchmark rate by incorporating a wider range of transactions, including those with money market funds, and removing the credit risk component. Besides, this shift reflects efforts to align with international best practices and promote risk-free rates in financial contracts and products.

Reforms

The Euro Overnight Index Average (EONIA) had undergone specific reforms and transitioned to the Euro Short-Term Rate (ESTR). These reforms address the shortcomings of EONIA and align with international best practices. Here are some of the critical reforms:

- EONIA 2.0: In 2017, EONIA underwent a reform project called "EONIA 2.0." The objective was to address the declining volume of underlying transactions and enhance the robustness of the benchmark rate. Additionally, the reform aimed to broaden the data sources used in calculating EONIA.

- Calculation Methodology: Instead of relying solely on actual overnight unsecured lending transactions, EONIA began incorporating additional data sources, including money market statistical reporting (MMSR) data provided by participating banks. Moreover, this change allowed for a more comprehensive and representative calculation of the benchmark rate.

- Panel Composition: The composition of the panel of contributing banks for EONIA went for review and updation. Efforts now ensure a broader representation of banks in the eurozone, thereby increasing the representativeness of the benchmark.

- Regulatory Compliance: The reforms in EONIA were driven by regulatory requirements, including the European Benchmark Regulation (BMR). Moreover, the BMR aimed to enhance the reliability and integrity of benchmark rates, including overnight reference rates like EONIA.

EONIA was eventually discontinued in 2022. As a result, the transition to ESTER (Euro Short-Term Rate), a new overnight reference rate, further addresses EONIA's limitations and aligns with international best practices.

EONIA vs EURIBOR

EONIA and EURIBOR are benchmark interest rates that serve different purposes. Here's a comparison between the two:

#1 - Purpose

Euro Overnight Index Average (EONIA) represents the average interest rates at which eurozone banks offer unsecured overnight loans to each other. It is a reference rate for overnight borrowing costs within the euro area.

On the other hand, Euro Interbank Offered Rate (EURIBOR) represents the average interest rates at which a panel of European banks is willing to lend funds to each other in the interbank market across various maturities, thus, ranging from overnight to one year. It is a reference rate for different financial products, including mortgages, loans, and derivatives.

#2 - Calculation Methodology

EONIA was calculated and published by the European Central Bank (ECB) and reflected transaction data from a panel of contributing banks. It represented actual transactions in the overnight unsecured interbank market and was a weighted average of these rates.

At the same time, EURIBOR is calculated by the European Money Markets Institute (EMMI) based on submissions from a panel of banks. Each bank reports the interest rate at which it estimates it could borrow funds from other banks within the eurozone money market, without providing collateral, at a specific maturity. The published rate is a trimmed average of these submissions.

#3 - Tenors

EONIA is an overnight rate, representing borrowing costs for a single day.

On the other hand, EURIBOR is available in multiple tenors, from overnight to one year. It provides rates for various short- to medium-term borrowing periods.

#4 - Underlying Transactions

EONIA is based on unsecured overnight lending transactions between eurozone banks, meaning loans are provided without collateral.

On the other hand, EURIBOR represents interbank lending transactions with various maturities, including secured and unsecured transactions.

#5 - Regulatory Focus

EONIA has undergone reforms and has been replaced by the Euro Short-Term Rate (ESTR) as the recommended overnight reference rate for the eurozone. The transition aims to address shortcomings and align with international best practices driven by regulatory requirements.

On the other hand, EURIBOR has also undergone reforms to enhance its transparency. The reform process aimed to strengthen EURIBOR's governance and calculation methodology.

EONIA vs Ester

Here's a comparison between the two:

#1 - Purpose

Euro Overnight Index Average (EONIA) represented the average interest rates at which eurozone banks offered unsecured overnight loans to each other. Its primary aim was to serve as a reference rate for overnight borrowing costs within the euro area.

On the other hand, Euro Short-Term Rate (ESTER) replaced EONIA as the recommended overnight reference rate for the eurozone. It represents the wholesale euro unsecured overnight borrowing costs of eurozone banks. The primary objective of ESTER is to provide a robust and representative overnight reference rate.

#2 - Calculation Methodology

EONIA was calculated by the European Central Bank (ECB) based on transaction data provided by a panel of contributing banks. It was a weighted average of actual overnight unsecured lending transactions between banks.

The ECB also calculates ESTER. It is based on transaction-level data from various financial institutions, including banks and money market funds. ESTER represents the weighted average of overnight unsecured borrowing costs derived from these transactions.

#2 - Underlying Transactions

EONIA was based on unsecured overnight lending transactions between banks in the eurozone money market.

On the other hand, ESTER is based on a broader set of unsecured overnight borrowing transactions, including between banks and money market funds. This more comprehensive range of transactions increases the representativeness of ESTER.

#3 - Risk-Free Rate

EONIA included a credit risk premium, representing the average interest rates on unsecured lending transactions. It did not solely reflect the risk-free borrowing costs.

At the same time, ESTER is considered a risk-free rate as it means the overnight borrowing costs without a credit risk component. It aligns with global efforts to promote risk-free rates in financial transactions.

#4 - Regulatory Compliance

The reform of EONIA and the adoption of ESTER were driven by regulatory requirements and efforts to align with international best practices. The transition from EONIA to ESTER aimed to address shortcomings and improve the reliability and integrity of the benchmark rate.

On the other hand, the introduction of ESTER as the new overnight reference rate aligns with the EU Benchmarks Regulation and the recommendations of international bodies such as the Financial Stability Board (FSB).

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

While EONIA was widely used, it needed to undergo reforms to meet regulatory requirements and align with international best practices. The transition to ESTER was part of the regulatory initiatives to improve the integrity of benchmark rates.

Historical EONIA rates are still available; therefore, they can be accessed through various financial data providers or by referring to the archived publications by the European Central Bank.

Yes, EONIA included a credit risk premium. The rate reflected the average interest rates on unsecured lending transactions, which incorporated a component for credit risk associated with the borrowing banks.