Table Of Contents

Estate Tax Meaning

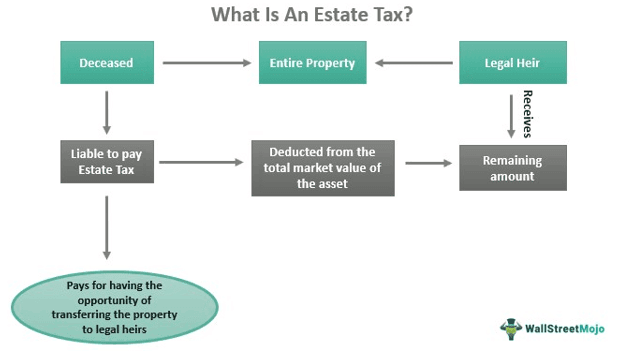

Estate tax refers to the tax on the privilege, allowing owners to exercise the right to transfer their property to legal heirs after they die or under other circumstances as per the law. These taxes ensure that the population's wealth is properly distributed and utilized and does not get accumulated in a few hands. The estates include cash, securities, real estate assets, trusts, annuities, insurance, business interests, etc.

Whether the tax levied would be an estate tax or inheritance tax is determined based on where the property owner stayed at the time of death and what is the total worth of the asset in question. The authorities levy this tax only if the value of the transferable property crosses a specific limit. The taxpayers, therefore, have to pay the tax only on the amount that exceeds the minimum threshold.

Key Takeaways

- The estate tax is the tax levied on the deceased for having an opportunity to transfer the assets and property to the legal heir after death.

- It is a tax on privilege rather than a tax on property. The amount is deducted from the gross fair market value of the deceased's assets before they get transferred to the heirs.

- IRS determines the minimum threshold based on the current market value of the property rather than its original cost.

- These taxes are not applicable if the legal heir is the deceased's spouse.

How does Estate Tax Work?

The estate tax does not imply a property tax. Instead, it is a tax on the privilege, which allows people to transfer their property to the legal heirs to ensure there is someone to look after their assets when they leave the world. This, in turn, increases the monetary obligations of the deceased.

The concept was first introduced in 1889 as part of a death tax program in Great Britain, while it was levied in the United States to accumulate funds for Spanish-American War in 1898. Though the same was revoked in 1902, the US imposed it again in 1916 to fund the First World War.

There is an estate tax limit that individuals need to consider before deciding whether they need to pay the tax or remain exempted. Taxpayers must be aware of the minimum threshold decided by the tax authorities, as they are liable to pay the tax only on the amount that exceeds that limit. The limit for such tax changes with the law of the land. The state governments determine the minimum threshold every year based on various parameters.

The Internal Revenue Service (IRS) determines the minimum threshold for the purpose based on the fair market value of the property rather than the cost of it at the time the owner purchased it. Therefore, the more valuable the assets, the more the tax imposed. In short, it is directly proportional to the wealth acquired by an individual.

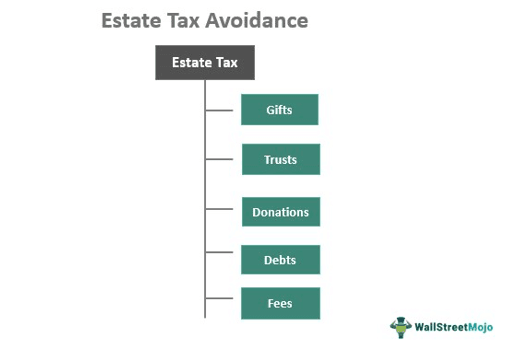

Individuals can avoid paying these taxes by spending on gifts, trusts, charitable donations, estate-driven debts, or fees. Such an initiative reduces the tax payable by deducting those amounts in the final calculation.

However, these taxes levied at the federal level are integrated with the Federal Gift tax. This is to ensure that no owner uses lifetime giving as a reason to justify the non-payment of these taxes.

Example

Let us consider the following example to understand the definition and applicability of this concept:

Joe left assets worth $15 million for his family after his death. His wife, Rose, would have inherited the property without paying the estate tax if she were alive. However, as Joe's spouse wasn't alive, his two kids were the legal heirs of his property.

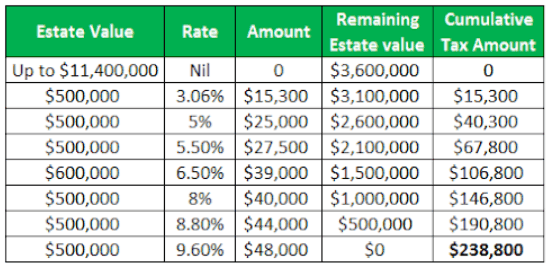

Therefore, the estate taxes calculated for Joe's kids will be:

The fair market value of the assets = $15 million

The threshold limit = $11.4 million

The amount to be taxed for each kid = $15,000,000 – $11,400,000

= $3,600,000 (each)

= $7,200,000 (both)

To calculate the amount to be taxed, let us go through the estate tax rate applicable that year:

Therefore, the tax payable by each kid = $238,800

Exemptions

While estate tax exemption for 2021 applied to deceased individuals whose assets are worth less than $11.70 million, the same has increased to $12.06 million in 2022.

These are not levied on the spouse. After death, if the deceased's estate is passed on to the spouse, then no such taxes are levied. However, if the heir is anyone other than the deceased's spouse, the person will be liable to inherit the amount after tax deductions.

Estate Tax vs Inheritance Tax

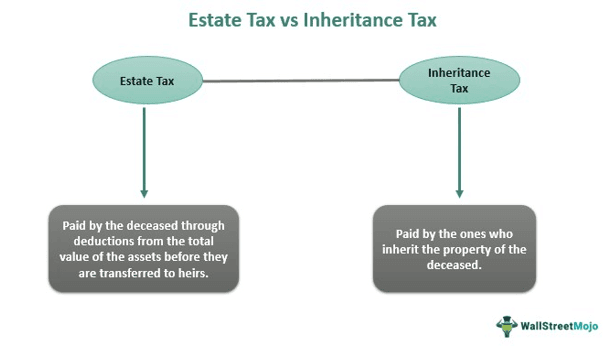

Estate tax and inheritance tax are the terms that often confuse taxpayers. However, the difference between these two taxes is simple and clear.

The former is levied against the privilege of individuals to have a successor to look after their assets after them. Hence, it is paid through deductions from the gross asset value of the deceased before the property is transferred to the legal heir.

On the contrary, the inheritance tax is what the inheritors pay against whatever they acquire from the deceased.