Essential Tips For Balancing Credit Management With Everyday Financial Services

Table Of Contents

Introduction

Whenever we hear the word "credit," it automatically makes us think of credit card debt, loans, and other liabilities. Indeed, today, every individual takes on some kind of credit to fulfill financial requirements. Having said that, not managing credit effectively can cause one to fall into a debt trap; moreover, their credit score takes a significant hit, and the borrower may face legal consequences.

Nevertheless, when you are wise with your money, managing credit has its perks, too. For instance, it can increase your credit score. This, in turn, leads to you getting better loan offers with low interest rates. In this article, we will discuss some of the key tips that you can implement in your finances to balance credit management and become better with everyday financial services.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

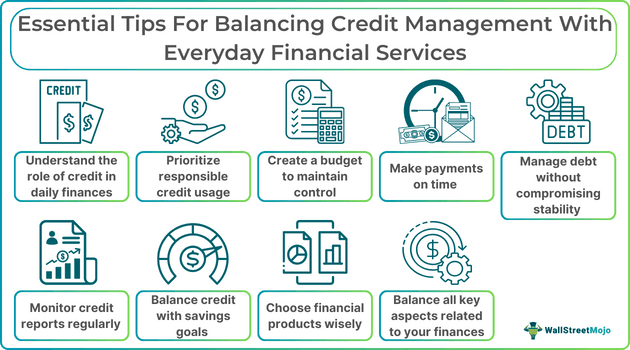

Essential Credit Management Tips

- Understanding The Role Of Credit In Daily Finances

- Prioritizing Responsible Credit Usage

- Budgeting To Maintain Control

- Making Payments On Time

- Managing Debt Without Compromising Financial Stability

- Monitoring Credit Reports Regularly

- Balancing Credit With Savings Goals

- Choosing Financial Products Wisely

- It's All About Balance

Top 9 Tips

The top nine credit management tips are as follows:

#1 - Understanding The Role Of Credit In Daily Finances

There was a time when people only believed in cash in hand and did not seek financial assistance from anyone. However, over time, there has been a revolution in the way people operate and manage their finances. With so many financial products and services, it has become a lot easier for people to get credit; the most common example is a credit card or a NinjaCard.

Credit plays a key role in daily finances; how you manage and balance your credit considering different expenses really defines your financial stability and discipline. The better you manage your credit, the better your chances of getting loan offers, easy processing, and low interest rates. Moreover, managing credit effectively will make you eligible for high-value loans.

#2 - Prioritizing Responsible Credit Usage

A simple tip here is only to borrow what you need. When you take credit, having the money with you feels good, but don't forget that you have to repay it and, most importantly, with interest, so no matter how much you can borrow today, remember that you will pay back a lot more than that in the future. When you get the credit, it becomes your responsibility to use the credit sincerely.

#3 - Budgeting To Maintain Control

This, again, is a pro tip for balancing credit management. Create a detailed budget and stick to it without making any excuses or adjustments. Taking loans and buying things on a credit card is not the problem; not being able to repay the debt and getting overwhelmed by it is the issue. The debt burden wipes out savings over time and significantly impacts the day-to-day lives of people as they start to lose control from a financial standpoint.

Generally, it all starts to happen because of no budget and a lack of proper utilization of credit. Also, having no understanding of cash flow management is a factor that may cause one to lose financial control.

#4 - Making Payments On Time

When you avail of credit from any lender, you repay it over time. Paying back the amount can be a challenging task as it becomes a part of your everyday financial services and is easier said than done. Typically, the credit repayment spans over months. This simply means that when you are getting credit, you have to make payments every month for a specific period to repay the amount with interest.

It could be a loan or a credit card bill. Still, the important thing is to make sure that you make payments on time without any error or delay. This is because defaulting on repayments directly affects your credit score. Note that a low credit score is a sign that you are not good with your credit management. Never make this mistake.

#5 - Managing Debt Without Compromising Financial Stability

This is the area where most people suffer; they take credit, and now they have to repay it slowly with regular monthly payments. They make sure they have a certain amount available every month, but to make this happen, they often compromise their financial stability and find it difficult to make ends meet during the whole credit period. A simple tip or advice would be to conduct proper research, and, before you take the loan, picture yourself paying it back every month for a really long period. If you think you can do it without having to compromise on savings, then only take on the debt. This is an essential part of credit management. You can have your savings and emergency funds and still cater to your credit if you plan accordingly.

#6 - Monitoring Credit Reports Regularly

When you are focused on balancing credit management, our advice to you will be to make sure you have access to your credit reports and that you check them on a regular basis. You must be aware of the key figures, highlights, and other data and have it all well interpreted for your knowledge. Although the chances of finding any error are very less, if you spot any error, mistake, or inaccuracy in your credit report, report it immediately following the standard procedure. The smallest error can tamper with your credit score, which is bad for your credit profile.

#7 - Balancing Credit With Savings Goals

Pay yourself first, every month, just like you pay off the debt; take a small amount and start saving. It's okay if you cannot invest, but you can always save, and that is all the difference you need to make. Balancing credit management requires a lot of discipline, but with wise decisions and small contributions separately, you can become better at saving while tending to your credit. Have a system, write it down, and make a goal that you will save a certain amount of money by the end of a specific period.

#8 - Choosing Financial Products Wisely

As an individual, you are targeted by companies that utilize different offers and schemes to sell their financial products. Do not fall for them. When multiple lenders target you for different financial products, implement smart credit strategies, think critically about your needs and your financial stability, and take action based on it. There are hundreds of financial products, but you need to understand that not all are for you, and practically, you cannot opt for each one of them.

#9 - It's All About Balance

At last, the only thing you should focus on is creating the right balance between all the aspects of your finances. Balancing credit management requires you to pay attention to all factors, such as your personal expenses, savings, investments, emergency funds, and everything that needs money. Use all the credit management tips that we discussed in this article and manage your finances in a more efficient manner, ensuring stability.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.