Table Of Contents

What Is An Escrow Agreement?

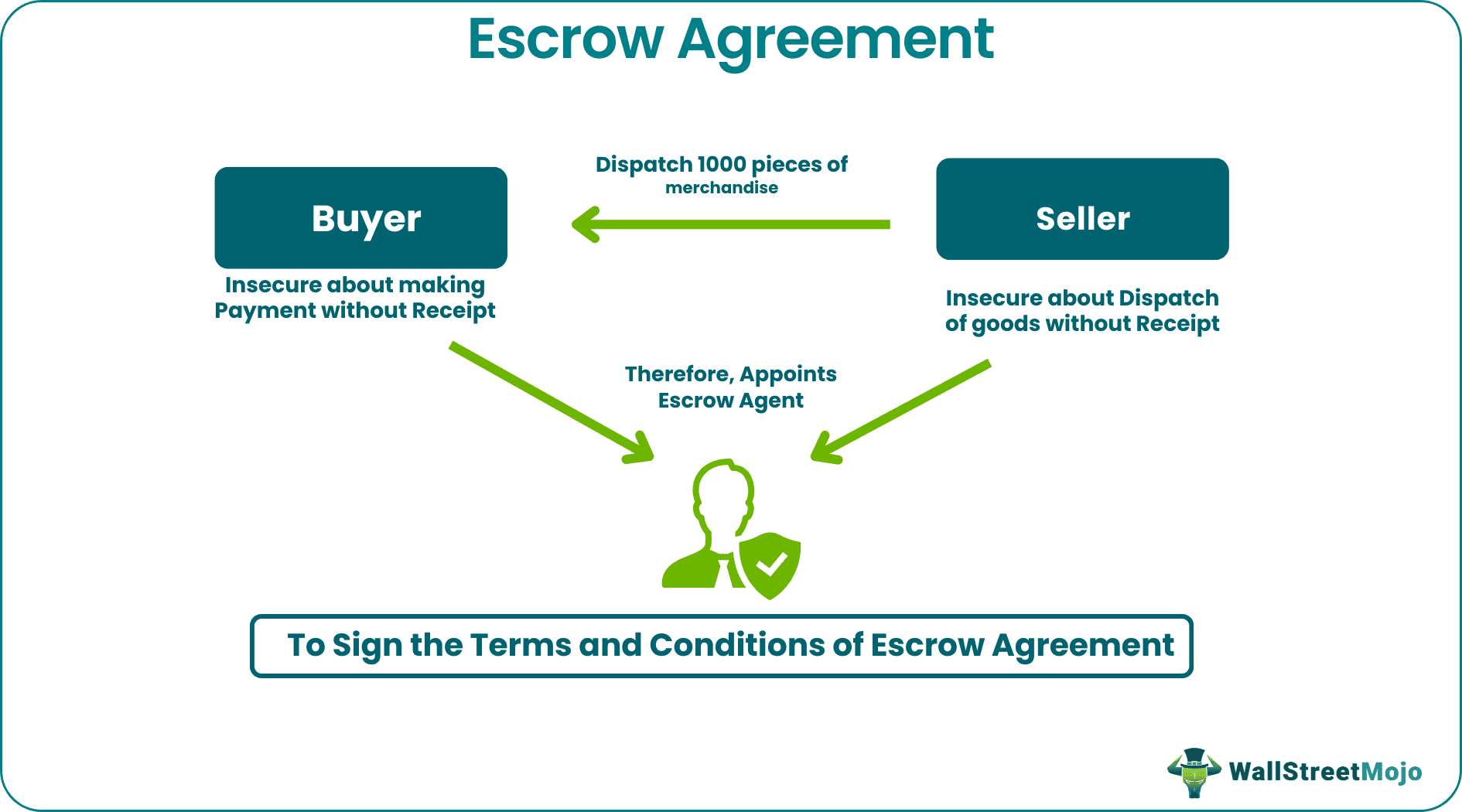

The escrow agreement is a financial agreement in which a third party holds the financial payment between two parties. A third party is an independent person who holds the funds to ensure the security of the transaction.

The payer may resist making payment to another party before the performance of the obligation, whereas the receiver may resist performing the duty before receiving the payment. A third party acts as an escrow agent who holds the transaction money to secure the trust factor among the two parties in a transaction.

How Does Escrow Agreement Work?

Escrow agreement is a contract whereby three parties come into an agreement to carry out smooth transaction related to any deal. The three parties consist of a depositor, a beneficiary, and an escrow agent. In the process, the payer deposits some valuables in an escrow account, signing an agreement that does not allow a refund before the performance of obligations. Such deposits secure both parties from any fraud.

Escrow is a deposit of a document or formal instrument or a money deposit with monetary value, e.g., Documents or legal instruments like deeds, written instruments, promise to pay, license, patents, checks, bonds, mortgage, etc.

In an escrow agreement, three persons are involved – depositor, beneficiary, and escrow agent. An agreement between two parties provides specific guidelines or directions for the party who accepts the escrow delivery.

The deposit owner is putting the escrow with the third party, who is an independent party to both the parties involved and keeps it with him until the promise the depositor fulfills. The third-party cannot return the depositor's property without a performance of his obligation.

Escrow agreements have proved essential for secure transactions among various businesses. It avoids insecurities and maintains trust among unknown parties, which enhances the smooth working of businesses.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Components

The main components are as follows -

- Details of the three parties involved

- Important aspects of the promise to be fulfilled

- Deposits made in escrow

- Conditions to the release of escrow funds

- Obligations and liabilities of the escrow agent

- Expenses and fees associated

- Legal Jurisdiction

Types

The types of escrow agreement depend on the businesses that use it. Below are the seven types of businesses, which indicate the forms in which these agreements exist. Let us have a look at them:

#1 - Banking

In banking businesses, Escrow is used to protect automatic banking and vending equipment like ATMs; the money is deposited in the vending machine (ATMs) before completing the transaction between the customer and the bank.

#2 - Law

Escrow is used in the judiciary cash settlements also. The defendant deposits money with the escrow fund of law, and the fund distributes the money as per the settlement of the law.

#3 - Real Estate

Escrow payments are mostly made in real-estate transactions due to the substantial payment amount. The buyer makes earnest money checks to an escrow to show his credibility in buying the properties. These agreements are used for attorneys, title agents, and notaries.

#4 - Mergers & Acquisitions

Escrow agreements are used in M & A arrangements to secure warranties and indemnities offered by the seller because of the high credit risk on the seller to recover all the money. These agreements not only complete the transfer of assets but are extended to longer periods.

#5 - Gambling

Since gambling is based on a contingent future event, such agreements are mostly used in these transactions. A disinterested person becomes a stakeholder to hold the money until the event and distribute the funds accordingly.

#6 - Securities Industries

These agreements are famous in securities industries for initial public offerings, under stock option plans, depositories, etc. to secure the allotment money or deposits amount of the investors.

#7 - Businesses

These agreements are commonly used in various transactions of businesses for their financial security.

Examples

Let us consider the following instances to understand escrow agreement meaning better along with exploring how it works:

Example #1

Suppose a buyer and seller initiate a transaction where the seller has to dispatch 1000 pieces of merchandise to the buyer. The seller is insecure about the dispatch of goods without payment, whereas the buyer is insecure about making a payment without receipt of goods. They both agreed to appoint an escrow agent and signed the terms and conditions of the escrow agreement.

The buyer deposited the required amount of money in escrow with the agent, and the seller shall send verification. The seller shall dispatch the ordered merchandise and provide the tracking information to the agent and the buyer. Then, on receipt of goods by the buyer, the agent shall release the deposited amount to the seller.

Example #2

In May 2023, Maryland attorney Brian O’Neill was sentenced to nine years of imprisonment by the US District Judge Valerie Caproni because of defrauding his clients with the funds he held under an escrow agreement. O’Neill defrauded a medical equipment firm by making a false claim of holding more than five million dollars in escrow, thereby making the latter yet another victim in the matter.

This example shows how violating the escrow agreement can lead to severe punishments.

Template

Internet Escrow Agreements

As the traditional agreements seem to take backseat, the internet escrow contracts are dominating the commercial sector. The latter allows money deposits with an independent licensed third party to protect buyers and sellers.

Types

There are various types:

- Third-Party Agreement: This is the most basic type where parties to the agreement are a software vendor, a licensee, and a software escrow agent. This agreement is suitable for a single licensee who needs a software escrow agreement, and the vendor doesn’t provide such agreements to other licensees.

- Multiple Party Agreement: When a software vendor provides escrow arrangements for all licensees, the software vendor keeps one escrow account for all the licensees. It becomes more comfortable for the vendor to manage all the escrow payments through one standard account.

- When multiple licensees are spread over various software with a single software vendor, one central agreement for all licensees and software is developed for effective management.

- When a single licensee buys software from multiple vendors, they face problems with multiple escrow account. So, licensee creates one single escrow account for all software vendors, which becomes flexible for the licensee to manage the transactions.

- Minimum Service Escrow: This agreement is used when a software vendor does not charge fees from the licensee for the software to provide minimum service or use of the software. So, they develop a joint escrow account for multiple licensees to add or remove them without any notification when the minimum service period is over.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.