Table Of Contents

Escrow Agent Definition

An escrow agent can be defined as an individual or a company that is probably better termed as a trusted third party that holds a document or an asset for the first party to deliver to a beneficiary or second party within a stipulated period or as soon as the event mentioned in the escrow agreement takes place.

The involvement of the escrow agent is mostly witnessed when two parties are involved in a dispute or disagreement, and they need time to resolve the matter. The agent is the one who holds the asset or property in question for both the parties in exchange for a fee. All the parties involved sign an escrow agreement to activate the conditions.

How Does An Escrow Agent Work?

An escrow company is also known as a title company. An agent can be an individual or an organization, and they are supposed to act neutral and unbiased to the related parties of any transaction. The roles and responsibilities are extensive and never-ending. An escrow agent in real estate dealings is concerned about purchasing and selling real estate property. They would need to secure the real estate property and examine all the documents to confirm if the parties adequately meet the terms of the sale transactions to those transactions or not.

An escrow agent in real estate transactions is concerned with buying or selling a real estate property. It works as a third party that acts neutral regarding the escrow agreement. These agents act neutral to trusted third-party transactions that involve parties that are unwary of each other.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Job Description

The responsibilities of escrow agent range from being a neutral intermediary between the parties involved in a transaction to requesting a preliminary title search for determining the title status of an asset. He also must ensure full compliance with the requirements of the lender, preparation of the deed and such other documents that are related to the escrow agreement, proration of the taxes, interest, rents, and insurance, and so on.

An escrow agent in transactions concerning real estate dealings is all about purchasing and selling real estate. Suppose an escrow agent is a title company in a real estate transaction, then in such a case. In that case, the company will need to hold the escrow agreement until and unless the parties meet all the same terms for that particular transaction. In transactions like real estate, would be required to secure the property and examine the related documents to confirm whether both of the parties duly meet the terms of the sale transaction.

Escrow Agent Fees

The fees usually tend to differ from agent to agent and their quality of service and experience in the industry. The negotiation skills of the parties to a transaction, too, can influence the fees.

Duties

An escrow agent acts as a neutral middleman that is charged with the responsibility of maintaining the escrow account. It is also responsible for overseeing the overall escrow process to ensure that all the sales conditions are duly met. Duties include:

- Preparation of escrow instructions

- Acting as a neutral intermediary between the parties involved in a transaction

- Proration of taxes, insurance, interest, and rents

- Procurement of purchase funds from the customers

- Receiving the loan funds from the customers’ lender

- Recording of the deed along with such other related documents

- Disbursement of the funds

- Preparation of the final statements for the parties that are involved in a particular transaction

- Ensuring 100 percent compliance with the seller’s requirements

- Preparation of the deed and such other documents that are related to escrow agreements.

How to Become?

One can choose to become an escrow agent, but it is always advisable to know that it is a responsible job, and it would require aspirants to sit right in front of their desktops for the longest hours. An agent's job does not require fieldwork, but meeting deadlines and preparing for closing could be very stressful. Therefore, an aspirant must always self-evaluate oneself and confirm if he is ready to accept and face the challenges underlying this profession and fits all the requirements for acquiring the job.

The escrow agent requirements that an aspirant must fulfill include the following –

- Degree Level - The degree level varies, but still, an undergraduate degree is highly preferred.

- Degree Field- The aspirant must have a degree in finance, business administration, or any other field that is directly related to the profession of an escrow agent.

- Experience -The experience may vary, but still, a minimum of one to two years of experience is highly preferred.

- License and Certification- It is mandatory to have a state license. However, an optional professional certification is also preferred.

- Key Skills - They must have strong oral and written communication skills, organizational skills, consumer-service skills, client handling skills, and skills in the analysis of written documents.

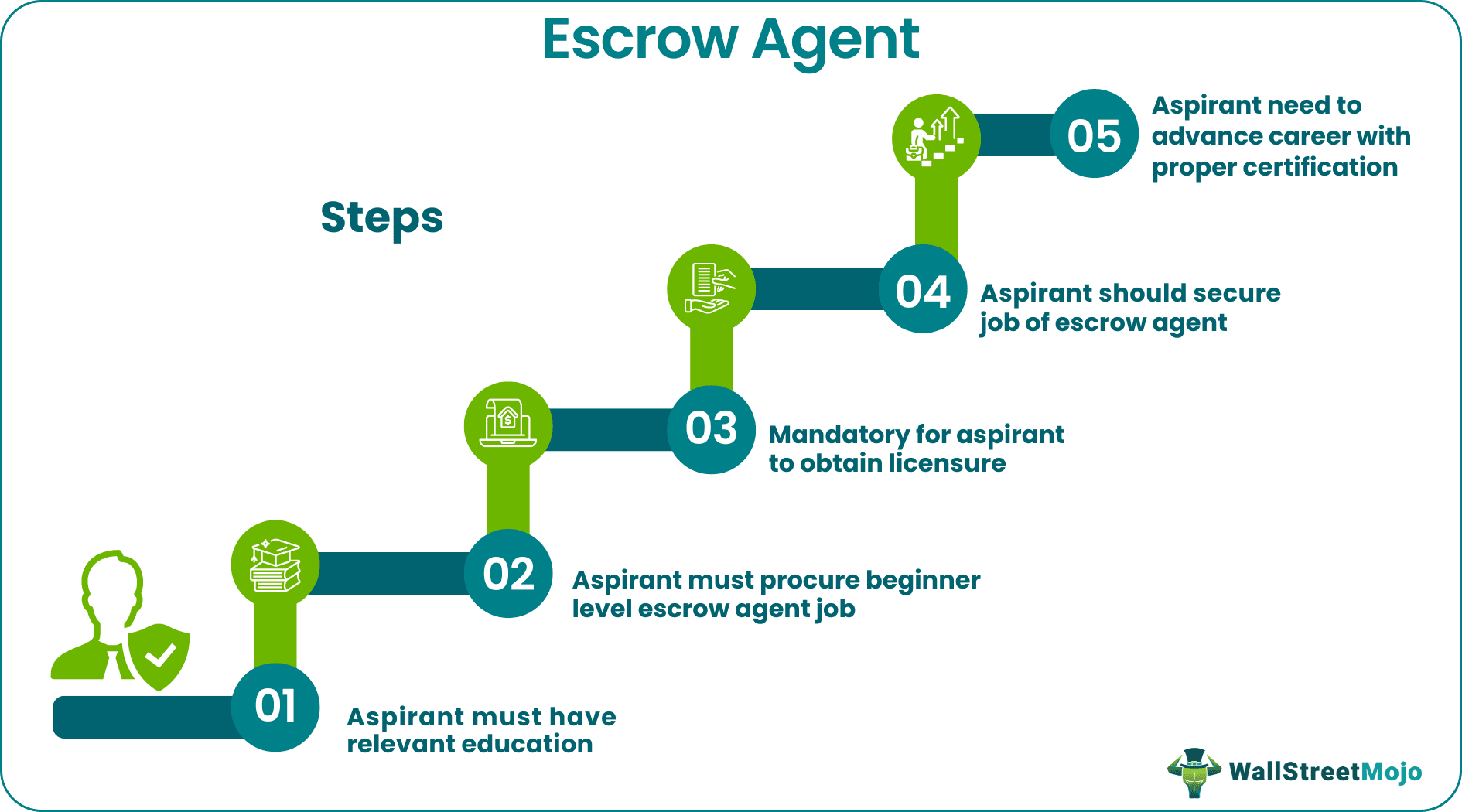

Steps to Become Escrow Agent

The following are the steps to become escrow agent -

Education

An aspirant must have the necessary and relevant education.

Procure a beginner level job

An aspirant who qualifies for the first step must procure a beginner-level job.

Obtain licensure concerning escrow

After qualifying the first two steps, it becomes mandatory for an aspirant to obtain licensure concerning escrow.

Secure the job of an escrow agent

In the fourth step, an aspirant would require and secure the job of an escrow agent.

Advance the career with proper certification

An aspirant will need to advance his career with proper certification in the last step.

Escrow Agent vs Closing Agent

The job of an escrow agent and closing agent might look similar, but in reality, these are poles apart from each other.

- A closing agent works for an escrow agent or a title company.

- A closing agent is responsible for holding your deposits in a separate escrow account, preparing closing statements, and obtaining title insurance.

- A closing agent merely facilitates the transfer of an asset to the buyer from the seller, while the roles and responsibilities of an agent are far way too much.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.