Table Of Contents

What is an Escrow Account?

An escrow account is a temporary legal arrangement between two transacting parties where a third party holds the financial payment. The third party is usually a bank or an escrow agent. Having an escrow account reduces the risk of non-payment.

It is a temporary account that operates only up to the completion of the transaction. Once all the conditions between the buyer and the seller are settled, the account is terminated. Escrows usually require the depositing of a document that has monetary value. These documents could be legal instruments, deeds, written instruments, promises to pay, licenses, patents, cheques, bonds, or mortgages.

Key Takeaways

- An escrow account is a third-party arrangement two parties. It is a temporary agreement. The buyer and seller enter a contract. An escrow ensures that both parties fulfill the conditions mentioned in the contract.

- The buyer deposits the money in this temporary account till the seller ships the desired product. After receiving the product, the buyer confirms it to the escrow, who then disburses this sum in favor of the seller.

- It is used in real estate dealings, mergers, acquisitions, online sales, stock issuance, and public-private partnerships.

- An escrow can also be used for paying insurance premiums and property taxes in time.

Escrow Account Explained

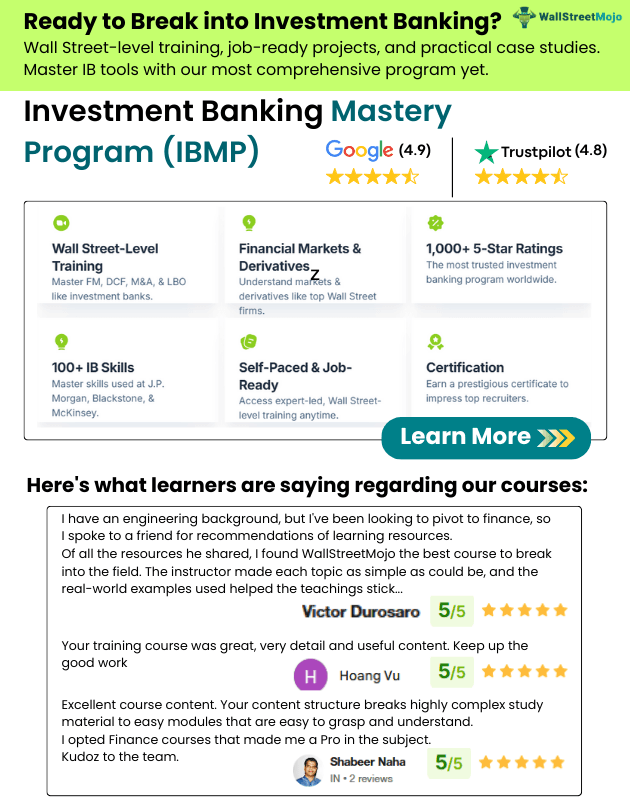

An escrow is a temporary account. The third-party releases funds only after the fulfillment of the contractual commitment. Thus, it mitigates the risk of deception. Moreover, it is a common practice when it comes to high-value goods and services, especially for long-term contracts. The contract is also known as an escrow agreement.

Various agents, companies, and financial institutions offer escrow services to the transacting parties and charge a certain fee in return. For example, escrow.com charges buyers, $32.50 for a $1000 wire transaction. The service charges $63 for PayPal and credit card transactions. This website allows its customers to buy or sell general merchandise, domain, electronics, jewelry, fashion apparel, watches, vehicles, products, and services priced between $100 and $10 million.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Escrow Account Process

Let us now discuss a simple escrow account process where a buyer purchases a product of high value from the seller.

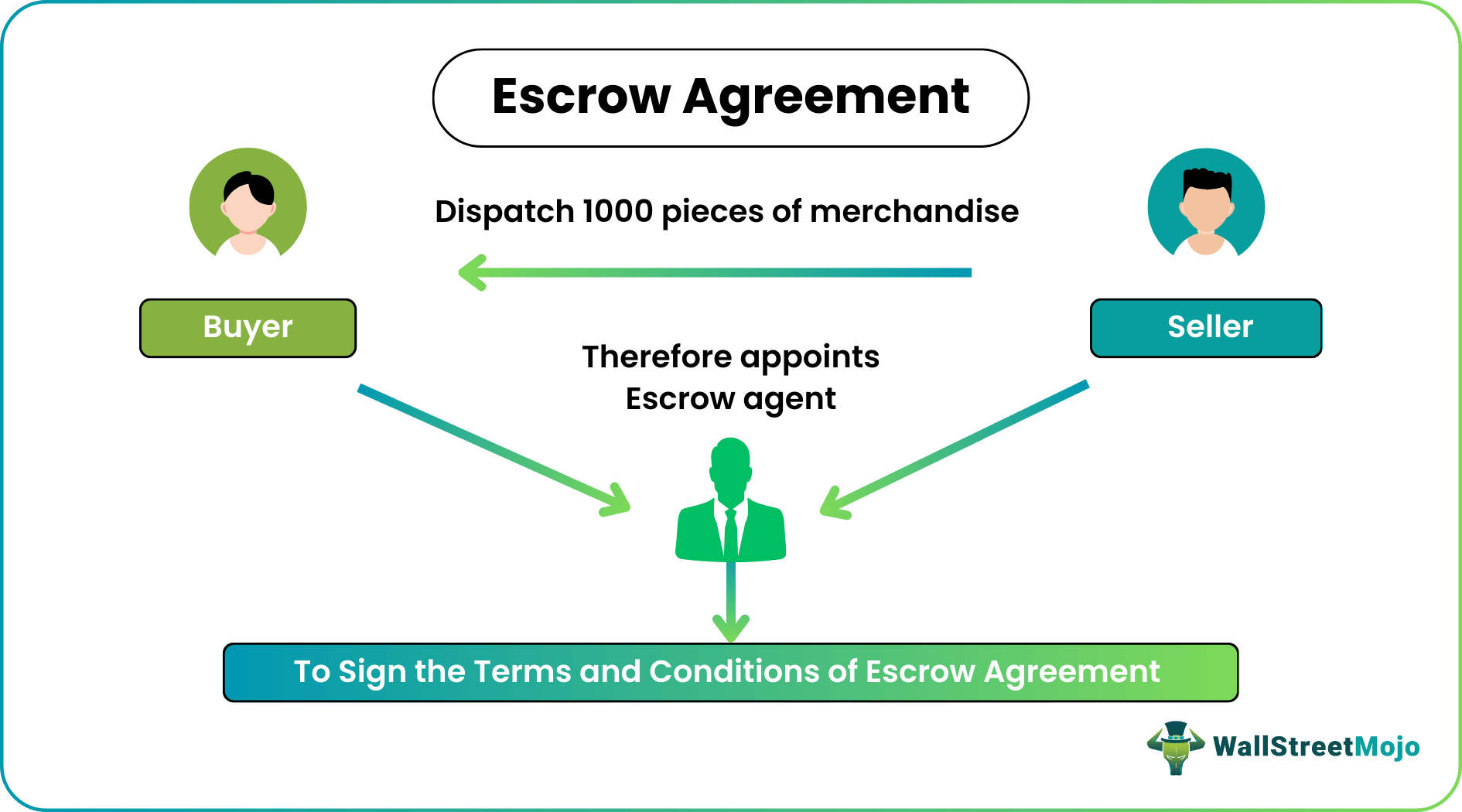

The buyer and the seller enter a deal through an escrow, and both agree to comply with the contract's terms and conditions. Upon agreement, the following steps ensue:

- The buyer pays the transaction amount to the escrow account. Consequently, the third party notifies the seller.

- Next, the seller delivers the product to the buyer. Upon which, the buyer verifies the the product.

- Finally, the escrow transfers the sum to the seller's account on receiving confirmation from the buyer.

It is important to note that once the buyer receives the product and the seller gets the payment, the escrow account ceases to exist.

Types of Escrows

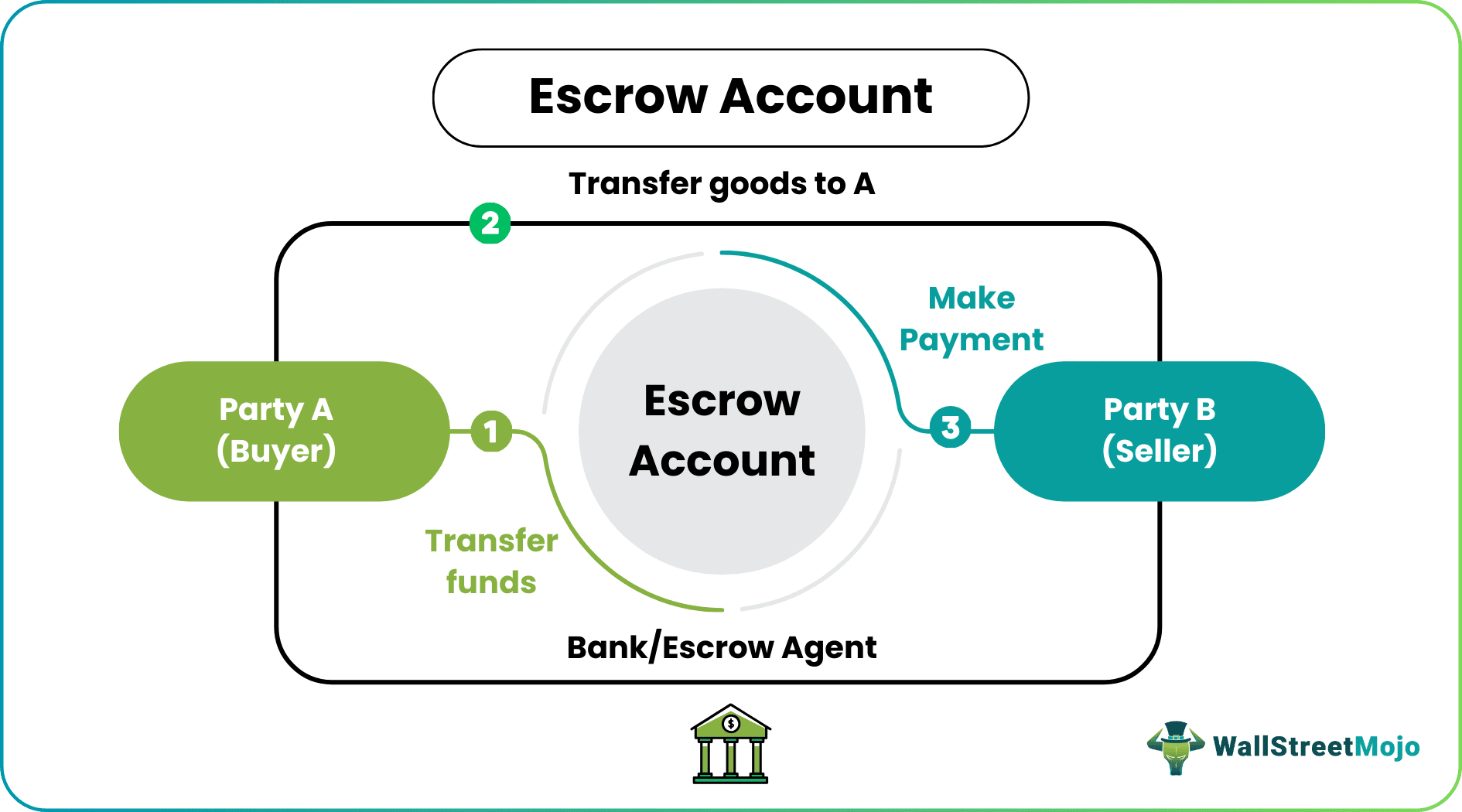

An escrow can be used in a variety of dealings and transactions. Following are the types of escrow accounts:

#1 - Real Estate

While buying any property, it is often a concern that the buyer will make the whole payment and still not get possession on time. So, to mitigate this risk, an escrow is opened where the buyer deposits the money. The amount is transferred to the builder only when the possession of the property is assigned to the buyer.

#2 - Mergers, Acquisitions, and Other Business Deals

In business ventures, escrows play a significant role. For example, the acquirer can deposit the deal amount in an escrow. After getting full possession of the target firm, the escrow releases this sum to the target firm. Parties employ an escrow for credit sales of goods and services also.

#3 - Project Financing

When it comes to project financing, banks worry that a company may divert the loaned amount to other projects. In such scenarios, banks and companies agree to transfer the loan amount to an escrow. The escrow then pays the project as per completion, i.e., making partial payment at different stages of the project.

#4 - Issue of Shares

When escrowed shares are issued, they are kept safe in a third-party account. The amount is transferred to the shareholders only after certain conditions are met. For example, many firms issue restricted shares to their employees as compensation. But the employees can redeem these shares only when they fulfill associated conditions.

#5 - Public-Private Partnerships

There are specific projects where both government and private agencies are involved. In such cases, profit-sharing models are used. Toll plazas and coal extractions are examples of revenue sharing. Herein comes the need for an escrow. The third party ensures that both parties stick to the terms of the contract.

#6 - Online Sales

For online transactions, the trust level is meager. The buyer is unsure if the product will ever be delivered or if it will meet desired standards. Thus, in such dealings, the buyer makes payment to an escrow. The escrow pays the seller only upon the delivery and verification of the product.

#7 - Taxes and Insurance

The homeowners employ escrows, they could be home loan providers or mortgage firms. The escrows facilitate the monthly payment of insurance premiums and taxes.

Examples

Example #1

Let us assume that company A takes over company B. Now company A does not want to make full payment to company B till the transition is complete. In this case, company A will deposit the payment into a third-party account. This third party is an escrow. Once company B transfers the possession of all the assets, properties, and documents, the escrow will release the payment.

Example #2

Let us assume that a government enters into an agreement with C company for coal extraction. The terms of the contract established that C company will bear all the expenses. Further, the revenue sharing percentage between the government and C company will be 30% and 70%, respectively. In this case, all the costs for coal extraction will be borne by the C company. When revenue is generated, it will be deposited into a central account. This belongs to an escrow. The escrow will distribute revenue to both parties according to the agreed 30/70 percentage.

Advantages

The parties go for an escrow account to avail the following advantages:

- Safe and Secure Transactions: An escrow ensures that the contracting parties sincerely fulfill commitments. Thus, the transaction is virtually risk-free.

- Builds Trust: Dealing via an escrow facilitate a higher degree of trust between parties. This further leads to more future dealings where both the parties make a profit.

- Facilitates Monthly Tax and Insurance Payments: The homeowners hire escrows; home loan providers or mortgage firms. This arrangement helps homeowners pay loans and mortgage in time.

- Customized Transactions: Such an account includes tailor-made conditions in context to the contract between two parties.

- Money-Back Assurance: If the seller fails to supply the goods or services or meet the desired standards, the money will be repaid to the buyer.

Disadvantages

An escrow account, when opened for insurance and tax purposes, it has various disadvantages. The escrow may calculate the tax amount incorrectly. This could be caused by property value changes. Besides, monthly mortgage payments can be pretty high when it includes tax and insurance charges.

Moreover, there are chances of being trapped in escrow fraud. Some miscreants create fake accounts to fool the parties and steal their money. Additionally, escrow fees can be hefty at times; this varies depending on the mode of payment.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

What is the escrow account?

It is a temporary account held by a third party. This is usually a bank or an escrow agent. Further, the escrow facilitates the transaction on behalf of the two parties. The entire purpose of having an escrow is to reduce the risk of non-payment. This protects both parties from a breach of contract.

How does an escrow account work?

An escrow is a secure way of transacting. When the two parties enter a transaction and consent on the contractual terms, the buyer deposits the sum in a third-party account. Once the seller delivers the goods to the buyer, the deposited amount is disbursed.

Can I take money out of my escrow account?

The parties cannot withdraw the money or assets held in an escrow unless the contractual obligations are fulfilled. The escrow is managed by a third party. This could be an escrow agent, a bank, a financial institution, or a company providing such a service. Without consent, deposited funds or assets cannot be retrieved.