Table Of Contents

What Is An Escalation Clause?

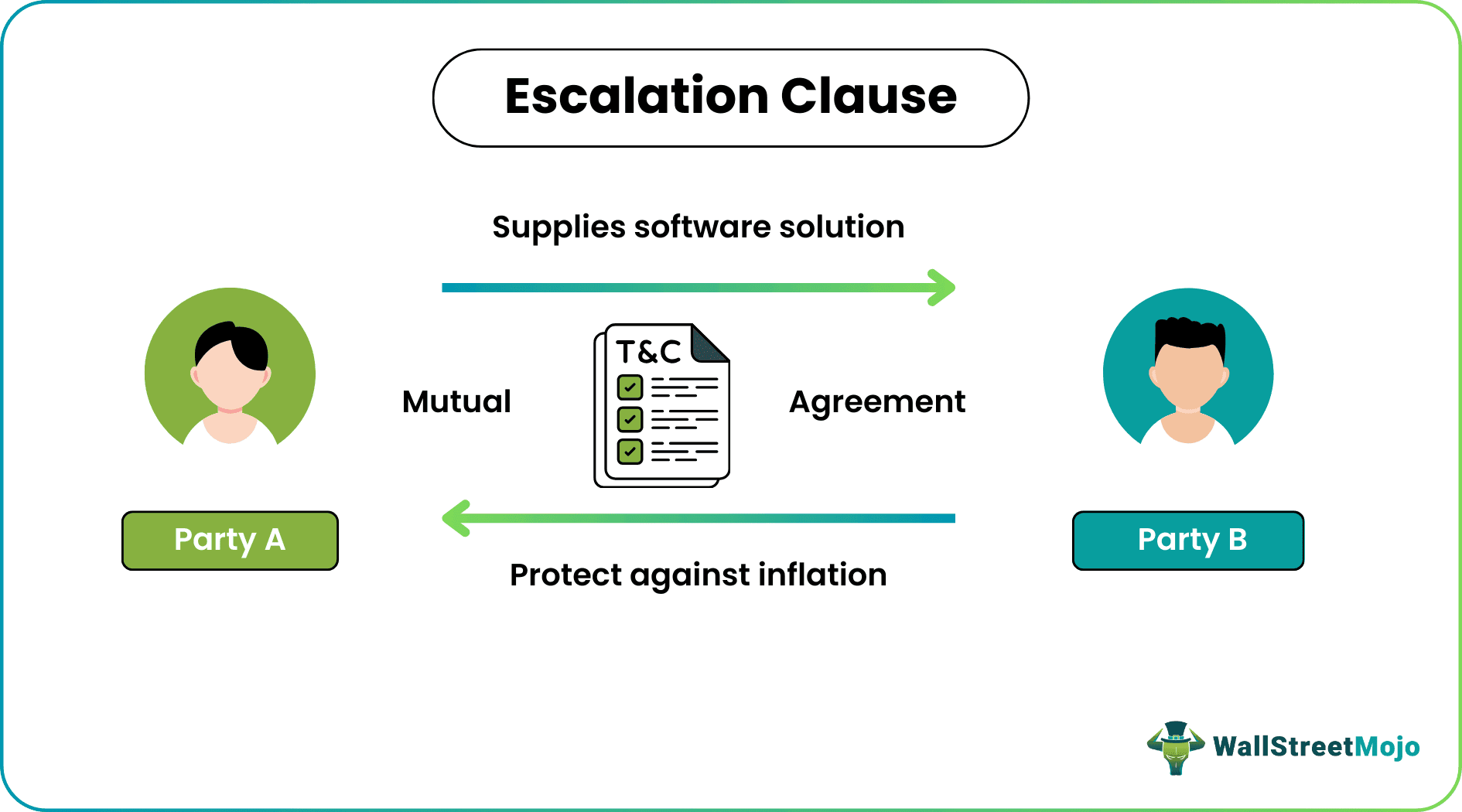

An escalation clause is a prearrangement in a contract that allows for adjusting prices or rates based on changes in a specified index or factor, such as the cost of living or the price of a commodity. It aims to guarantee any specific turnaround in the agreed-upon price that has been decided by the two parties.

It aims to ensure that prices or rates are fair and reasonable. In addition, it helps avoid disputes and can be used as a risk management tool by both parties. However, contracts may avoid such clauses, known as the no escalation clause.

Key Takeaways

- An escalation clause provides price or rate adjustments depending on changes in a specific index or factor, like the cost of living or the price of a particular good.

- It protects against inflation and ensures fair and reasonable prices or rates. It can also safeguard parties from losses due to inflation or market fluctuations and help to avoid disputes.

- It can be used as a risk management tool by both parties in the contract. It should specify the formula or index used to determine the adjusted price or rate, the frequency of adjustment, and the cap or maximum amount to which the cost adjusts.

How Does An Escalation Clause Work?

An escalation clause specifies a formula or index determining the adjusted price or rate. The procedure or index depends on the Consumer Price Index (CPI), the cost of living, or the price of a specific commodity.

For example, if a lease agreement has an escalation clause based on the CPI, the rent for the property will be adjusted annually based on the change in the CPI. For example, if the CPI increases by 3% over a year, the rent will also increase by 3%. It will also specify the adjustment frequency, which can be annually, semi-annually, or monthly. Additionally, the clause will usually set a cap or maximum amount to which the price or rate adjusts.

It's worth noting that these are usually only included in long-term contracts where inflation or market fluctuations may significantly affect one of the parties.

The process for applying it typically involves the following steps:

- The parties agree to include such a clause in the contract.

- The clause will include the specific conditions under which the price or compensation will get a hike, such as a change in the cost of materials or labor.

- The clause will also specify the method for determining the new price or compensation, such as a formula or index.

- If the specified conditions fall in, one party will notify the other party of their intent to invoke the escalation clause.

- The parties will then negotiate the new terms and agree.

- If there is no agreement, the parties may resort to dispute resolution methods outlined in the contract, such as arbitration or mediation.

How To Write?

An escalation clause can be in a variety of ways, but it should generally include the following elements:

- The formula or index will determine the adjusted price or rate.

- The frequency of adjustment (e.g., annually, semi-annually, monthly)

- A cap or maximum amount that adjusts the price.

Here is an example of a rent escalation clause:

"Rent for this property shall be adjusted annually on January 1st based on the change in the Consumer Price Index (CPI) as reported by the Bureau of Labor Statistics. The rent shall not exceed 4% of the current rent per year."

In this example, the adjustment formula depends on the change in the CPI; the adjustment frequency is annually, and the cap is 4% of the current rent per year.

It's essential to ensure that the formula or index used is accurate and easily accessible for both parties to check. Also, it's necessary to ensure that the cap is reasonable and fair for both parties.

Examples

Let us understand it in the following ways.

Example #1

Suppose a small software company, Tech Soft Inc., is entering into a 5-year contract with a large retail chain, "Retail Co" for supplying their software solutions. Retail Co is concerned that the cost of software solutions may increase over time due to various reasons such as inflation, increased cost of raw materials, etc.

To address Retail Co's concerns, Tech Soft Inc. agrees to include an escalation clause in the contract. The clause is as follows:

"The price of the software solutions shall be adjusted annually on January 1st based on the change in the Consumer Price Index (CPI) as reported by the Bureau of Labor Statistics. The price shall not exceed 5% per year's current price."

This clause ensures that Retail Co is secure from price increases due to inflation and that Tech Soft Inc. can still earn a fair return on its investment. In addition, both parties agree on the terms of the escalation clause, which is in the final contract.

It's also important to note that both parties should consult an attorney to ensure that the clause is legally binding and enforceable.

Example #2

According to real estate data analytics company CRE Matrix in October 2022, Raiden Infotech Pvt Ltd. agreed to lease approximately four lakh square feet of data center space from Amanthin Info Parks for twenty-eight years in Navi Mumbai. The monthly rent for the agreement is about nine crores.

The MIDC rented the land to Amanthin Info Parks, Raiden Infotech India, its licensor, and this agreement has all been signed.

Pros And Cons

An escalation clause contract can be a valuable tool for protecting against inflation or changes in market conditions, but it also has pros and cons.

Pros

1. It protects against inflation and ensures fair and reasonable prices or rates.

2. It can also protect parties from losses due to inflation or market fluctuations.

3. It can help avoid disputes and ensure contract fulfillment.

4. It can also be used as a risk management tool by both parties in the contract.

Cons

1. It can also be disadvantageous for the party to pay more due to the clause.

2. It can also lead to uncertainty or unpredictability in pricing or costs.

3. If the formula or index used in the clause is inaccurate or easily accessible, it can lead to disputes or disagreements.

4. It may take time to predict future market conditions and inflation rates.

5. A cap may also be too low for one party and too high for another.