Table Of Contents

Equity Research Jobs (Careers)

Equity Research Analysts job includes both sell and buy-side firms that typically involve the different brokerage houses present in the market, Non-Banking Financial Corporation (NBFC), different securities firms, mutual fund companies, etc.

An equity Research career is about financial statement analysis, economic analysis, comparable company analysis, valuations, recommendations, investment decisions, research report writing, management interactions, etc. This job fits well for those who enjoy and understand financial modeling, are passionate about analyzing companies, have the right decision-making attitude, and meet rigid deadlines.

Table of contents

- Equity Research Jobs (Careers)

- Equity Research Job Criteria and credentials

- Equity Research Associate Job

- Equity Research Analyst Job

- The good side of the equity research

- The evil side of the equity research

- What is expected from you at equity research jobs?

- Hierarchy and roles

- Who provides you with equity research jobs?

- Work culture in Equity Research Career

- Equity research Salary

- Quality of work

- Exit Opportunities

- Tips for making an Equity Research Career

- Recommended Articles

Equity Research Job Criteria and credentials

- You can join right after their graduation or after attending an MBA program. For the bachelor’s degree, specialization in economics, finance, or business would be helpful, along with accounting knowledge and good computer skills.

- Further up, a master’s degree, again in economics, finance, or business, would increase your chances.

- Many get into equity research, spend almost 5-10 years working and then look for analyst job positions in the industry.

- Another credential that can be important to crack the equity research jobs is having an internship experience in an investment banking firm, which would prove your interest and inclination toward an equity research career.

- Apart from this, CFA is one such credential that could provide you with a good base to get into equity research. This CFA credential can prove useful if you clear the three levels of the CFA examination, meet the educational and work experience rule the institute specifies. Check out the CFA Dates and Schedules

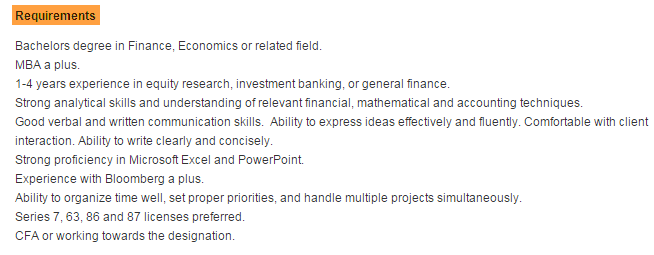

Have a look at the below screenshot to know the criteria specified by the equity research firm/division in an equity research job opening for the position of associate and analyst.

Equity Research Explained in Video

The good side of the equity research

- The ever-evolving economy directly affects investment banking and equity research careers. If you are well updated about the market conditions, you would be interested in doing this job.

- The work is not as monotonous as it gets in other finance jobs. You will have new deals to work on every time, which would be different from the other.

- This job is challenging as you would also compete with analysts at other equity research firms and want to keep your best foot forward.

- There is a lot of hard work time that you would use in publishing your research. But from there comes the motivation as your name would get published with the work you have done.

- You would develop detailed knowledge about a sector.

- You also get to interact and communicate with senior management teams and investors.

- The compensation in the form of salary and bonus too would be satisfactory for the hard work you put in. Check out the differences between investment banking and equity research.

The evil side of the equity research

- In not-so-good economic conditions getting a job in this field becomes difficult as there is tough competition and job positions are also fewer.

- The industry is fast-paced; hence the great work you do would get irrelevant quickly. Also, you might feel that you are not appreciated enough for the hard work you put in.

- The working hour is comparatively longer than the routine corporate finance jobs and is a deskbound job.

- You will have to face work pressure not only from your company but also from your clients.

What is expected from you at equity research jobs?

- The Equity Research Skills sets that you would need to excel at equity research jobs include financial analysis, business analysis, financial modeling, writing reports, making presentations, and sound judgment.

- It would be best if you were well versed with accounting and finance concepts and should be aware of corporate strategies and keep updated on the issues and regulations of the industry.

- You need to have good communication skills as you would constantly be in touch with your clients and learn about their management teams.

- To maintain and update the financial models in line with any new information that affects the stocks you are studying. Again it would be best if you communicated the same to the sales force, traders of the investment bank.

- After gaining enough experience understanding accounting, corporate finance, and capital markets, you would be asked to analyze a cluster of stocks within a specific industry.

- Since you are allotted a specific stock to study, you need to know everything about them and become experts to make investment recommendations.

- It would be best if you had to study the official financial information published by the equity issuing company through the sales report, annual financial statements, etc. and use it to predict future trends.

- As discussed above, you would be expected to provide intuitive investment ideas and recommend a buy/sell/hold rating on the companies you analyze. It is communicated to the interested parties such as the institutional investors, traders, general public via research reports, and formal presentations.

Let’s summarize the key accountabilities of an equity research analyst career;

- To make the quarterly updates.

- To write event updates.

- Updating the sales, dealing, and trading team about the latest events in the sector/company

- To build investment ideas/views that are distinctive in the market.

- To bring the maximum number of companies under coverage in the sector, they track over some time.

Hierarchy and roles

The structure of the equity research jobs is where you would have one head person who would generally make the decisions, and others follow them.

Listed below is the equity research job hierarchy found in an equity research division of an investment bank. However, it might not get as hierarchical as the one discussed here. It is often restricted only to associate and analyst and the vice president position.

Associate

In inequity research jobs, the associate position is for those who are fresh graduates right from college. Their academic credentials would be given due to weight, age, and internship experience. Typically a candidate with 1-2 years of work experience or someone who has cleared CFA level 1 or 2 would be recruited for this position. It is like a starting point where you would learn about the companies covered by your boss or the team you are part of.

Role:

- Your role involves updating the earnings model, industry models using spreadsheets, and database software such as Excel and Access.

- You will have to summarize news and recent developments that can affect the valuation of the companies.

- It would be best if you regularly scripted research notes on company news and earnings.

- You would have to prepare a quarterly earnings report, one of the critical research reports.

- You would be involved in conversations with clients once your manager feels that you are comfortable with the work.

- Discuss deals with clients and try to build a reputation by performing well on behalf of your team.

- After spending a few years as an associate, you would be promoted to the next level in line, the Analyst.

Analyst

This equity research career position can be achieved depending on how quickly you can get hold of the companies under study, discuss the stock industry that you have analyzed, communicate ideas, and give formal presentations. To become an analyst, you need an advanced degree in business administration and prior work experience as an associate.

Role:

- You would be allotted a set of companies/industries to work upon and be responsible for their research.

- As an analyst, you would have to maintain relations with clients, company management, and other industry experts. You would discuss the expected changes in the industry that could affect the stock prices of the companies you are covering.

- You would have to monitor trends in particular industries, conduct research on those industries and recommend a buy/sell/hold recommendation on the stock. Such research, of course, has to be backed up by reliable research.

Senior analyst

After having served as an associate or an analyst, the next position in equity research career progression is that of a senior analyst. As a senior analyst, you would be an expert on specific industries such as consumer goods, automobile manufacturing, pharmaceuticals, etc. The senior analyst level positions would need at least five years of work experience, an MBA or finance-based degree from a reputed college, or the CFA charter. Useful comparison – CFA or MBA

Role:

- Analyze the activities and earnings of companies under the research of a particular sector.

- As a buy-side analyst, you would be producing research for hedge funds, mutual funds, or investment management companies. By "buy-side," we refer to the clients buying the securities and making investment strategies.

- As a sell-side analyst, you would be working for investment banks where the salespeople recommend the individual and institutional clients on investments through the research they produce. See the critical differences between Sell side vs. buy-side

Who provides you with equity research jobs?

Equity research is used in many areas. Primarily, these are the companies that need Research Analysts:

- Stock Brokerage

- Mutual Funds

- PE firms

- Venture Capital Firms

- Banks

- KPO’s

- Credit Rating Firms

- Media Companies

- DataBase Firms

- Accounting firms

Below is an exhibit of the job description.

Work culture in Equity Research Career

- As Research associates/analysts, you would usually be in the office at around 7 am and leave by 7-9 pm. The average working hours are somewhere between 60-70 hours per week. It can be considered favorable compared to investment banking jobs, where analysts could work up to 100 hours a week but expect it to be a 9-5 job.

- The working hours worsen during the earnings season as the financial models need to be updated and new reports are issued. You might have to stretch the hours to 12-14 hours every day then.

- There are also conferences which you need to attend. They can get hectic because you constantly interact with people all day and then get back to your desk and work till late at night.

- Working weekends are limited to situations like preparing an urgent report/earnings period.

- The work culture at an equity research firm is generally reserved in nature. You are expected to be cool and composed, and keep an eye on the market events and how the stock will perform in the coming future.

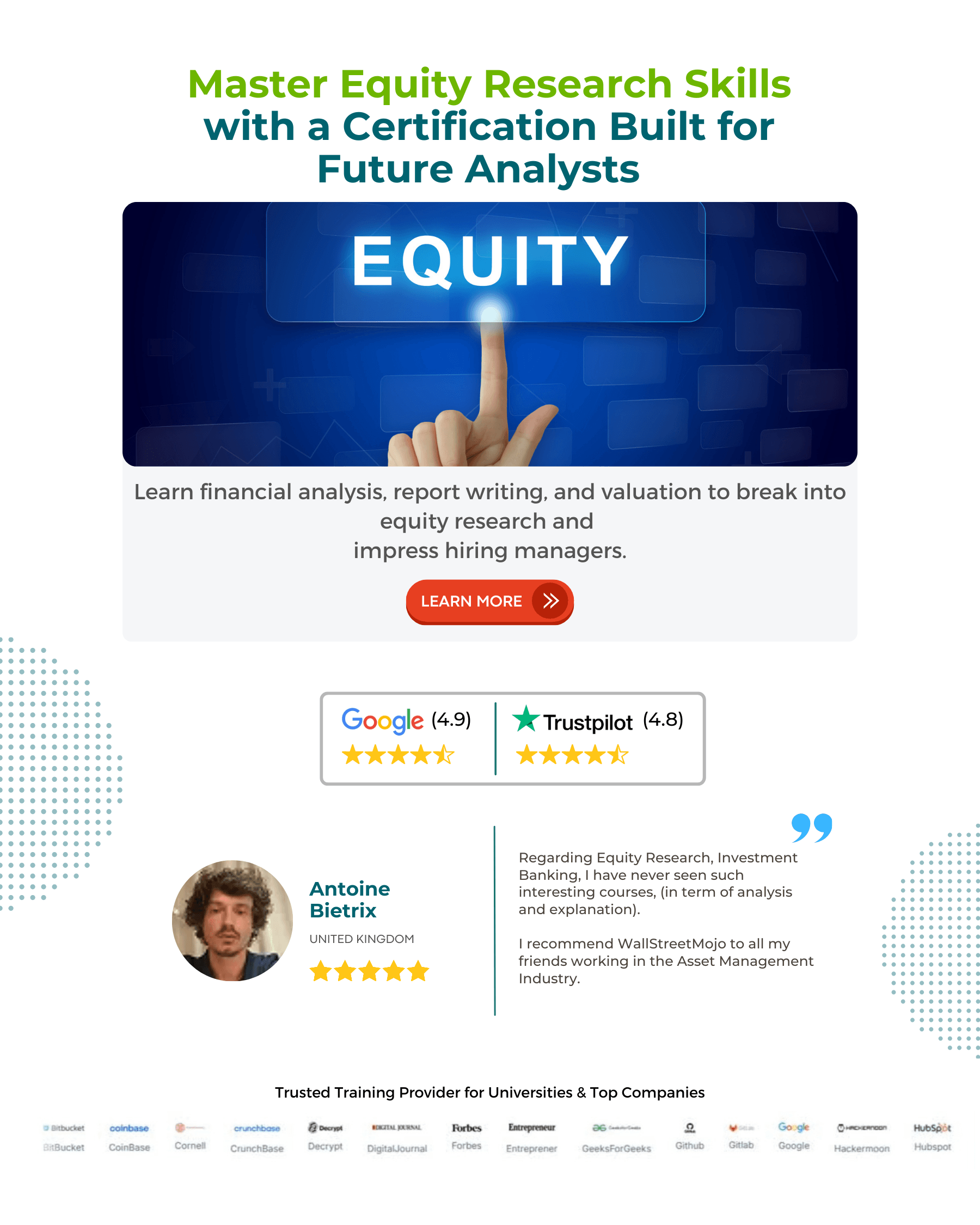

Equity research Salary

You could expect an equity research career as financially rewarding. The salary would increase with good experience and credentials. Your salary would include an element of an annual bonus based on your performance. The bonus is small initially, but as you are established, and work gets published, the bonus can be a pretty big figure.

Below is the excerpt from the Financial-Salary-Guide-2014 by Robert half. It shows the average salary for financial analysts, which includes equity research careers.

Quality of work

- You would get to continuously interact with salesforce and traders, portfolio managers, and analysts' investment summaries when the company earnings are reported. It helps you to learn a great deal.

- You could develop your financial modeling skills by constantly updating and analyzing companies’ financial forecasts. However, your work would be focused mainly on the operating model.

- Research associates are usually not exposed to live transactions and their negotiations; hence you do not get complete insights against the investment banking division.

- In reality, the initial years would be restricted to performing monotonous tasks of creating research notes and updating the senior analyst’s marketing material.

Exit Opportunities

You may have to work as an associate for 3-4 years and then work as an analyst for several other years before getting promoted.

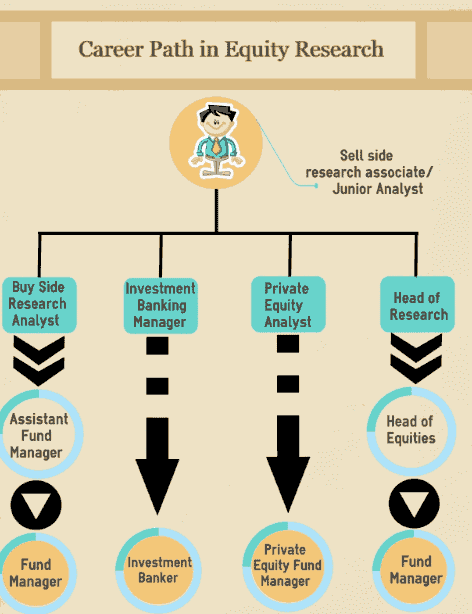

The below picture explains the exit options/career paths one has after being a sell-side research analyst.

- After you have worked as an associate/analyst, the next opportunity could be found within the same equity research firm by moving up in the hierarchy. We have already discussed the same above while seeing various positions and their roles in equity research.

- The next best would be to switch over to the buy-side. Here you would be working for the hedge fund managers or the portfolio managers. The skillset for both is similar as you analyze investments and make recommendations. The buy-side offers an even better lifestyle and investing. The buy-side is hugely competitive, even for research associates. One tip could be that the associates should enhance their profile by receiving the CFA charter and going to business school before getting into the buy-side.

- Working on the sell-side, you would analyze many company financials and understand their effects. Hence you can get into typical corporate finance roles that perform similar financial analysis jobs.

- Getting into private equity (PE) could be another exit option. However, this can get tough as you are not working on transactions at equity research jobs and hence the profile differs a bit. That does not mean it is impossible to get into PE. As an Equity research analyst, you would be well versed with investment research only that this will be with respect to private companies and not public.

Tips for making an Equity Research Career

- It is preferable to have an MBA specializing in finance or a CFA charter.

- Invest your initial years in understanding the markets and practicing technical & fundamental analysis.

- Basic knowledge of stock exchanges and how they work;

- Go in for internships to practically understand what happens at equity research jobs.

- If you lack an MBA from the top institutes or do not have enough experience, try and build your research reports. Various courses can teach you.