Table Of Contents

What Is Equity Release?

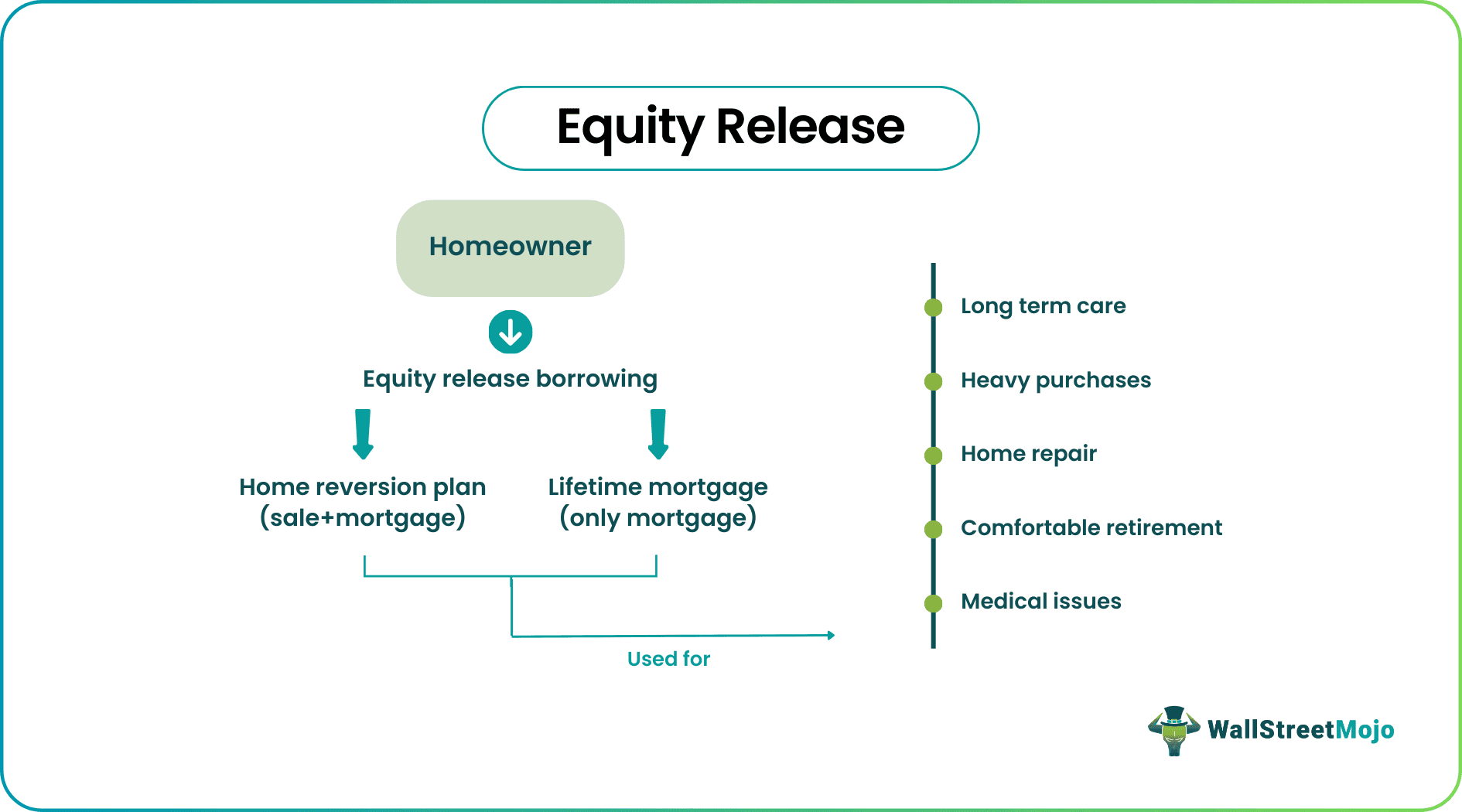

Equity release is the process of accessing the value of a house without selling it or moving out. The house owner should be above 55 years of age. If the home is mortgaged against any other loan, it is paid off first through release or other means. It can be beneficial if someone wishes to boost their income, pay off an existing mortgage, or cover care expenses.

It is the market value of the property minus the loan amount against it. Thus, the more the property value, the higher the release. It can unlock the house’s monetary worth by realizing cash against the physical structure. It is an additional income that covers long-term and heavy expenses, either a tax-free lump sum or small amounts drawn in installments. Additionally, one might use equity release to aid with debt repayment.

Key Takeaways

- Equity release helps realize the property value by cashing the physical structure without opting for a sale or moving out.

- Any house owner above 55 can get this benefit provided any other mortgage loan against the house is paid off first.

- Equity release depends on the house's market value and gives the owner additional income.

- The house owner can collect the money in a tax-free lump sum or small installments to cover long-term or heavy expenses like long-term care.

How Does Equity Release Work?

An equity release mortgage means accessing the house's market value without selling or moving out, provided any previous loan is paid off.

It allows access to the home's actual value, which is tax-free and can be used for varied purposes like retirement planning, home repair, heavy purchase, medical emergency, long-term care arrangements for the aged, etc. In addition, the equity release calculator calculates the release value based on the house’s market price minus any existing loan on the property.

Any person above 55 years is eligible for this arrangement, and if they opt for a lifetime mortgage, the property remains with them throughout their life. However, the equity release calculator considers the property’s market price and the owner’s age and health. But unlike ordinary mortgages, the lender does not check the borrower's creditworthiness, and there is no monthly repayment system. But if a homeowner wants to opt for this method, it is a good idea to check with a solicitor before going for it.

Lease vs Rent - Explained in Video

Types

There are various types of equity release mortgages, as given below:

- Home reversion plan – A portion of the entire house is sold to the reversion provider, who pays in a lump sum of installments. The owner stays in the place itself, which should be insured. If the entire property is not sold, the value of the part not sold remains the same. When the last borrower expires, this part is also sold, and sale proceeds are divided among reversion providers.

- Lifetime mortgage – This is a loan against the property value, which is repaid once the owner expires or goes out for long-term care. Unlike the reversion plan, the owner retains the house ownership since there is no sale. This type of release is more common.

Examples

Let us understand the concept with some examples:

Example #1

Alex, a 58-year-old staying in their sprawling villa on the outskirts of California, the United States, has decided to borrow money to secure their retired life. As per the market price, their estate is valued at $700,000. However, they already have an existing loan of $100,000 against the house.

Alex's solicitor informs Alex that the best option would be an equity release from the house, a loan arrangement against the house, with no monthly installment payment hurdles, which suited Alex perfectly since Alex was about to retire. Alex can also continue to stay in their home for their lifetime and collect the money in a lump sum from the release provider without any tax payment.

This arrangement impressed Alex, who requested his solicitor to immediately start the procedure of selecting the best release provider in the city. First, however, he had to pay back the loan of $100,000, which he did after getting the released fund.

Thus, their retirement life was secured with $600,000 ($700,000 - $100,000). From this example, we see that the above method is excellent for people who want lifelong financial security without the problem of loan repayment within a limited time.

Example #2

A survey reveals that many homeowners above 55 are now opting to convert their property value into cash despite rising interest rates. They are taking huge loans to be paid back after they expire or leave the property and go elsewhere by selling it. They can either opt for a lump sum release or withdraw as and when they need. The reasons are, however, different for each. Some are trying to save inheritance tax, some are arranging for funding to help other family members, and some want to save for their retirement days.

Pros And Cons

An equity release from a house has some pros and cons, as mentioned below:

Pros

- Manage creditors – The payment can be used to manage payments to creditors and reduce debt.

- Stop lawsuits – Sometimes, property owners face lawsuits due to non-payment of the loan. Such cases can be avoided by using the release money.

- It can be written off early – There is no fixed term for paying back the release money. However, if the owner chooses, they can pay it back early too.

- Used to make heavy payments – Owners can use the money to make hefty expenses like long-term care.

- It is tax-free – The entire release payment is tax-free.

- No immediate pressure to pay back the release money – The release money is paid back automatically once the owner expires or moves out.

- The owner can continue staying in the house - The owner stays there as long as they wish to because equity release does not involve the sale or moving out.

- No rent is paid to the release provider – The owner need not pay any rent to the release provider.

Cons

- Interest payment - If it is a lifetime mortgage, then the equity release interest rates are much higher than the standard loan, which results in a massive increase in the release value. In the case of home reversion, the mortgage value will also increase if the home value rises, thus, increasing the interest amount further.

- Immediate profit is given more importance – Sometimes, people who opt for equity release may not understand which plan suits them. As a result, they might look at the immediate benefit rather than long-term value, resulting in a wrong decision.

- The inheritance value of future generations is reduced – Due to a mortgage on the property, the value inherited by the next generation decreases.

- It is another loan – The release money given to the owner is a loan that is paid back once the owner expires or moves out.

- The owner may not get the correct value – The release provides may not always quote the actual market value of the house, which results in a loss to the owner.

- If the house market value falls, it becomes a debt – If the property’s market price goes down, the release amount becomes a different debt to the owner because, after the sale, the proceeds will not cover the mortgage amount.

- Provider’s permission is needed for any extra member to stay – If any additional member has to stay with the owner, sometimes the release provider's approval is required.

- The owner has to pay all bills/taxes/repairs – The release amount is calculated based only on the property market price. It does not consider the repair and maintenance costs. They are paid from the owner's pocket.

Equity Release vs Remortgage

Equity release unlocks the property’s cash value without moving out or selling it. Remortgage is shifting the mortgage of the exact property to another lender. However, the fundamental differences between them are as follows:

| Equity Release | Remortgage |

|---|---|

| Access the house’s market value and get release money. | It is shifting the mortgage loan from one lender to another. |

| The money can be paid back during the whole lifetime of the owner or selling the property after the owner’s death or moving out. | The money has to be paid back during the loan term. |

| The equity release interest rates are higher than a regular loan. | The interest rates are lower than loans on release. |

| There are no monthly payments. | There are monthly payments. |

| This loan is available only if the house owner is above 55 years. | This loan is available to any borrower who can pay back the loan. |

| The fund is more since the loan is based on property market value. | The loan amount is based on the creditworthiness of the borrower. Thus, the fund is less. |