Table Of Contents

What Is The Equity Multiplier Formula?

The equity multiplier formula is the equation that derives the ratio of total assets to total shareholders’ equity.The result is the financial leverage of a company that determines what portion of the stockholders’ equity a company has used to fund what amount of assets.

The equity multiplier compares the company’s total assets with the firm’s shareholders’ equity. The higher the value, the greater the company’s financial leverage. However, a lower ratio is appreciated as it indicates that a company is not obtaining debts to meet its asset requirements.

Key Takeaways

- The equity multiplier entails the proportion of the company’s assets financed through equity financing.

- The equity multiplier formula divides the total assets of the company by its total shareholders’ equity.

- If the equity multiplier is high, the company probably has very little debt, and its ownership is very heavily diluted. However, a low equity multiplier indicates that the corporation is heavily indebted, which increases risk.

- This multiplier helps investors determine the risk involved in an investment proposition in a company. It also helps investors plan the course of their investment and determine ownership prospects.

Equity Multiplier Formula Explained

The equity multiplier formula includes two components – total assets and total shareholders’ equity. The equation is expressed as:

Equity Multiplier Formula = Total Assets/Total Shareholders’ Equity

Let us discuss the two components to understand their effects on business finances.

- Total assets include both current assets and noncurrent assets. While the examples of current assets Total assets include both current assets and noncurrent assets. While the examples of current assets are inventories, prepaid expenses, etc., the non-current assets examples are building, machinery, plants, furniture, etc. The balance sheet of the company lists all these to help businesses calculate the total assets.

- The total shareholders’ equity is one of the most critical financial statements every investor should look at. It includes both common shares and preferred shares.

The ratio of the two helps investors assess the financial leverage of a company, allowing them to make better investment decisions.

Video Explanation of Equity Multiplier

Examples

Example 1 (Manual)

Here's a practical example to understand this formula better.

Tee Wear has the following information –

- Current Assets - $36,000

- Non-current Assets - $144,000

- Total Shareholders’ Equity - $540,000

Let us find out the equity multiplier of Tee Wear.

First, let us calculate the total assets.

- Total assets = (Current Assets + Non-current Assets) = ($36,000 + $144,000) = $180,000.

- Total shareholders' equity is already given as $540,000.

Therefore, using the formula, the equity multiplier derived is –

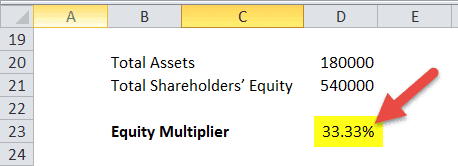

- Equity multiplier = Total Assets / Total Shareholders’ Equity = $180,000 / $540,000 = 1/3 = 33.33%.

Depending on the industry standard, businesses can determine whether this ratio is higher or lower. Every investor needs to look at other companies in similar industries and glance at different financial ratios to get a better idea of where each of them stands.

Example 2 (Excel)

Let us now consider the same example to check how to use the equity multiplier formula in Excel with the two inputs - Total Assets and Equity Multiplier. Here, the available details help calculate the equity multiplier ratio easily in the template provided.

Firstly, let us find out the total assets.

Now, let us calculate the equity multiplier.

Equity Multiplier - Godaddy vs. Facebook

- The above graph shows that Godaddy has a higher equity multiplier at 6.73x, whereas Facebook's Equity Multiplier is lower at 1.09x.

- Therefore, it implies that Godaddy has more assets per unit equity and is over-dependent on debt to finance its assets. On the other hand, Facebook has a very Equity Multiplier (~1.09), it is independent of debt.

Interpretation

By using this multiplier, an investor is able to know whether a company invests more in debt or more in equity.

- If the equity multiplier ratio is higher, the company is too dependent on debt for its financing. In addition, it also means that investing in the company would be too risky for an investor.

- If the equity multiplier ratio is lower, the company is mainly sourced by equity, and debt financing is low. Moreover, it also indicates that the company doesn't have much financial leverage to grow well shortly.

- The idea of finding out the equity multiplier is to balance both – debt and equity ratio. There's no rule of thumb, but if a company has a debt-equity ratio of 2:1, it can be said that it's maintaining a great balance between debt and equity.

It is difficult to know the real picture of the company by just looking at one ratio, and the same holds true for the equity multiplier ratio as well. Hence, it is recommended to investors also look at dividend-related ratios, profitability ratios, debt-equity ratios, and other financial ratios to have a holistic view of the company’s approach. Thus, tracing all ratios gives a solid base to make a prudent decision.