Table Of Contents

What Is Equity Capital Market (ECM)?

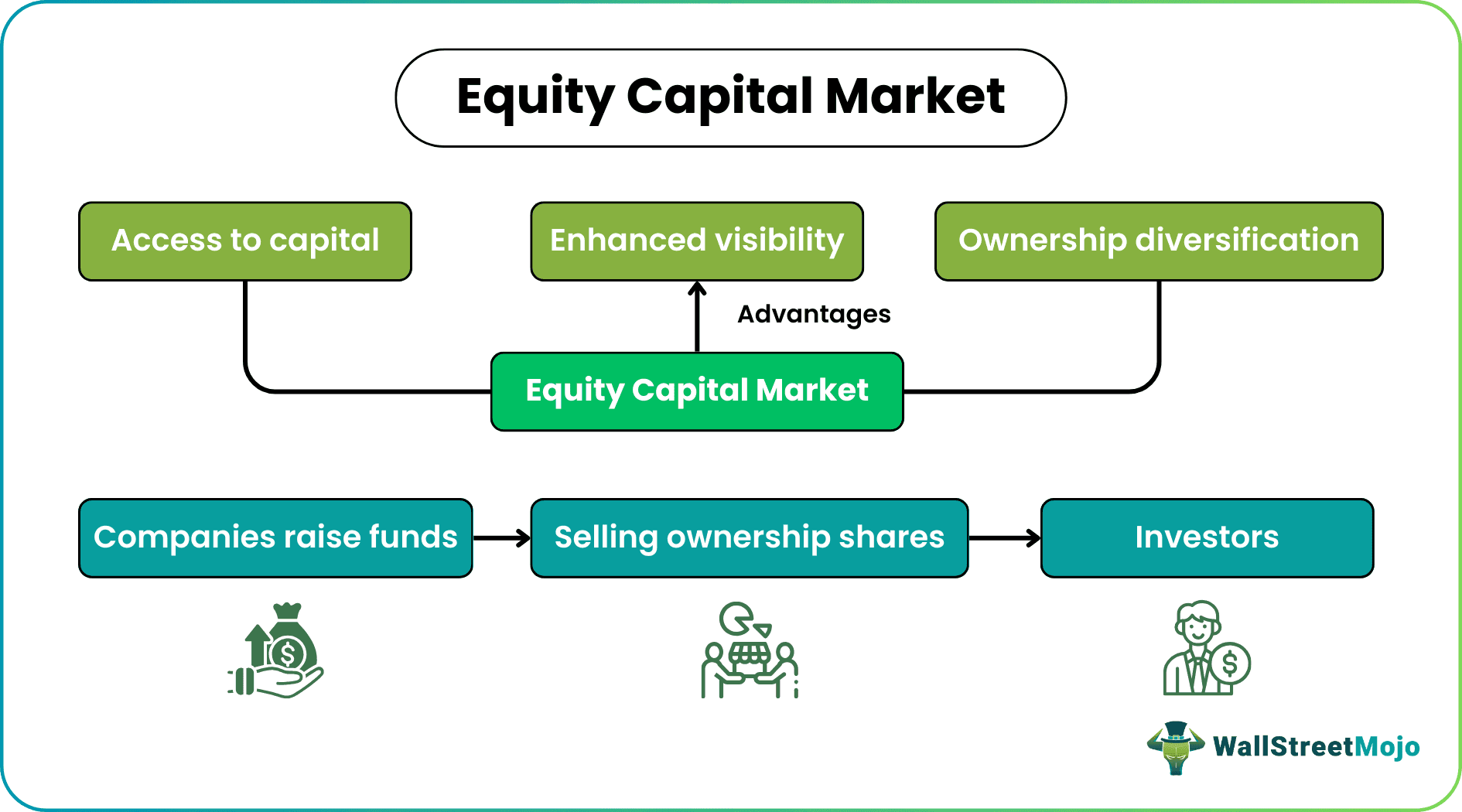

The Equity Capital Market (ECM) is a financial market segment where companies raise funds by issuing and selling shares of their ownership, known as equity, to investors. Its primary purpose is to facilitate the flow of capital from investors to businesses, enabling companies to raise funds for expansion, research, and other corporate activities.

The equity capital market plays a crucial role in fostering economic growth by connecting companies needing capital with investors seeking opportunities for potential returns. It allows investors to become partial company owners while allowing businesses to access a broader pool of funding beyond traditional loans and debt financing.

Key Takeaways

- Equity Capital Market (ECM) involves companies raising funds by selling ownership shares to investors. This provides a pathway for companies to secure capital for growth and expansion.

- Investors in ECM become partial owners and share in potential profits and losses. While there's potential for substantial capital appreciation, the market's volatility can pose risks.

- New shareholders often gain voting rights, which can influence company decisions. However, this may lead to a dilution of control for existing stakeholders.

Equity Capital Market Explained

The Equity Capital Market (ECM) is where companies raise funds by selling ownership shares to investors. It enables initial public and secondary offerings, fostering economic growth by connecting companies with investors. The ECM's efficiency and transparency are crucial for maintaining investor confidence, stimulating innovation, and facilitating a broader range of funding options beyond traditional loans.

Investors, in turn, become partial company owners and potentially benefit from capital appreciation and dividends. This market mechanism allows companies to acquire the resources needed to pursue ambitious projects, enhance their visibility, and contribute to overall market dynamism.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

Let us look at the types of equity capital markets:

- Initial Public Offering (IPO): Companies going public for the first time issue shares. This gives them a significant infusion of capital and allows investors to become partial owners.

- Follow-on Offering or Secondary Offering: Companies that are already public may issue additional shares to raise more capital. This can be for expansion, debt reduction, or other corporate purposes.

- Rights Issue: Existing shareholders are given the right to purchase additional shares at a discounted price, allowing the company to raise capital from its current shareholders.

- Private Placements: Companies issue shares to a select group of private investors instead of the general public. This is often used for raising capital from institutional investors or high-net-worth individuals.

- Preferential Allotment: Similar to a private placement, but shares are offered to existing shareholders first. This maintains their ownership percentage and can help raise capital for specific projects.

Instruments Traded

Let us look at the instruments traded, including:

- Common Stocks: These represent basic ownership in a company. Shareholders have voting rights and the potential for dividends, a portion of the company's profits.

- Preferred Stocks: These shares typically don't have voting rights but offer higher priority for dividends and assets in case of bankruptcy.

- American Depository Receipts: ADRs allow investors to own shares in foreign companies. They are traded on U.S. exchanges and represent ownership in the foreign company's stock.

- Exchange-Traded Funds: ETFs are investment funds that are traded on stock exchanges. They can track a specific index or sector and provide investors with diversified exposure to a range of stocks.

- Real Estate Investment Trusts: REITs are companies that own, operate, or finance income-generating real estate across various sectors, offering investors a way to invest in real estate without directly owning properties.

- Warrants: These are derivative securities that give the holder the right to purchase a company's stock at a certain price within a specified timeframe.

- Convertible Bonds: Bonds can be converted into a specific number of the company's shares at a predetermined conversion ratio. They offer a mix of debt and equity features.

Examples

Let us look at the examples to understand the concept better.

Example #1

Consider XYZ Technology, a private tech company with a groundbreaking software application. To fund its expansion, XYZ decided to go public through an IPO. It issues 10 million shares at an IPO price of $20 per share, valuing the company at $200 million. Investors who buy shares become partial owners of XYZ Technology. For instance, Investor A purchases 1,000 shares at the IPO price of $20 each, investing $20,000.

Meanwhile, Investor B opts to wait. After a few months, the stock price rose to $30 due to strong demand and positive news about the company's growth. As a result, investor A sees the value of their shares increase, potentially leading to capital gains, while investor B misses the lower IPO price and now has to buy shares at a higher cost.

Example #2

Assume a company called 'TechMed Innovations', a healthcare startup specializing in wearable medical devices, is poised for a breakthrough with its innovative remote patient monitoring technology. To expand, TechMed collaborated with a venture capital (VC) firm. The VC firm invests $10 million in exchange for a significant ownership stake in the company. This strategic partnership infuses capital and provides invaluable industry insights and connections.

As a result of the VC funding, TechMed accelerates its research and development efforts, bringing its remote monitoring device to market faster. The device gains rapid adoption by hospitals seeking efficient patient care solutions, leading to increased demand and revenue growth. The VC firm benefits from TechMed's success through its ownership stake, while the startup secures the resources needed to revolutionize patient healthcare.

Advantages And Disadvantages

Let us look at the advantages and disadvantages of equity capital market transactions:

Advantages

- Access to Capital: ECM provides companies with substantial funds for expansion, innovation, and other strategic initiatives.

- Diversification of Ownership: By issuing shares, companies can spread ownership among larger investors, reducing risk for individual shareholders.

- Enhanced Visibility: Going public or participating in ECM transactions can raise a company's profile, attracting attention from customers, partners, and potential investors.

- Institutional Support: Institutional investors' participation can bring credibility and expertise, fostering growth and improving corporate governance.

Disadvantages

- Loss of Control: As ownership is distributed among shareholders, founders and original stakeholders might face diluted control over the company's decisions.

- Costs and Compliance: Going public or conducting ECM transactions often involves significant expenses related to regulatory compliance, legal, and accounting services.

- Market Volatility: Stock prices can fluctuate, leading to investor anxiety and short-term market pressures that might not align with a company's long-term strategies.

- Short-Term Focus: Publicly traded companies might face pressure to meet short-term financial expectations, potentially impacting long-term strategic decisions.

Equity Capital Market vs Investment Banking

Let us look at the differences between equity capital markets and investment banking.

| Parameters | Equity Capital Market | Investment Banking |

|---|---|---|

| Definition | Market for companies to raise funds by issuing equity shares to investors. | Financial services that assist companies in raising capital and financial deals. |

| Key Role | Facilitates fundraising through equity offerings, like IPOs and secondary issues. | Offers advisory, underwriting, and mergers/acquisitions services to clients. |

| Activities | Includes IPOs, secondary offerings, rights issues, and convertible securities. | Encompasses a broader range of services, including M&A, underwriting, capital raising, and risk management. |

| Compensation | Companies raise capital by selling shares. Investors gain ownership. | Earns fees for services rendered, such as underwriting, advisory, and more. |

| Focus | Primarily focuses on equity-related transactions. | Involves advisory, M&A, and broader financial services beyond ECM. |

| Regulatory Compliance | Involves adhering to regulations for disclosure and transparency. | Requires complex regulatory considerations for various financial transactions. |

Equity Capital Market vs Debt Capital Market

Let us look at the differences between the equity capital market & debt capital market.

| Parameters | Equity Capital Market (ECM) | Debt Capital Market |

|---|---|---|

| Nature of Capital Raised | Equity shares offering ownership stakes | Debt securities like bonds or loans |

| Purpose of Capital | Expansion, research, corporate activities | Operational needs, projects, refinancing |

| Investor Influence | Potential influence through voting rights | No influence on company decisions |

| Risk and Returns | Investors share profits/losses, volatile | Fixed interest payments, less volatile |

| Control and Ownership | Dilutes ownership, no obligation to repay | No dilution, regular interest payments |

| Market Volatility | Subject to stock price and market changes | More stable due to fixed interest rates |

| Regulatory Compliance | Stringent regulations, disclosure | Regulatory rules for bond issuance |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Participating in ECM allows investors to potentially benefit from capital appreciation and share in a company's success. However, the stock market's volatility can expose investments to risks of value fluctuations. Companies can tap into a broader pool of funds but must share ownership and decision-making control with new shareholders, potentially impacting their existing stakeholders' control over the company.

ECM plays a crucial role in a company's growth by providing access to substantial funds for expansion and innovation. Additionally, going public through ECM enhances a company's visibility and credibility, attracting attention from customers, partners, and potential investors. However, it also subjects the company to regulatory requirements and public scrutiny, necessitating transparent financial reporting and compliance with disclosure standards.

Investment banks often underwrite and facilitate ECM transactions, assisting companies in determining the offering price, managing the issuance process, and ensuring regulatory compliance. They also provide financial advice and access to their network of investors, contributing to the success of the company's capital-raising efforts.