Table Of Contents

Equity Meaning

Equity is the net worth of a business. It signifies an investor’s ownership in a company. During liquidation, it is the amount of assets received by the shareholder after paying off liabilities and debt.

It is calculated as the difference between assets and liabilities featured on the balance sheet of a company. It represents a company's net asset value in front of investors, financiers, and the public. An organization with sound financial health always has positive equity, which means it owns more than it owes.

Table of contents

- Equity Meaning

- Equity is a stake in business ownership; investors can claim the net asset value upon liquidation.

- A public company can turn its ownership into numerous small units of shares. These are then offered to investors. In doing so, the firm acquires capital to finance its projects.

- The book value of equity is computed as follows:

Equity = Total Assets – Total Liabilities.

Also, the market value of equity is calculated as follows:

Market Capitalization = No. of Equity Shares Outstanding × Current Market Price Per Share.

How Does Equity Ownership Work?

Equity mirrors a company's financial health and efficiency in front of the outside world. It signifies the net worth of a business, i.e., the value of assets after paying off all the debts and liabilities. A public company can convert its equity into several small units called shares. These shares are sold to prospective investors. This way, the listed company acquires capital.

When an investor invests in a company's stake, they become equity shareholders and gain ownership in the firm's net assets. Shareholders can transfer their stocks to another party, making the latter the next shareholder. In the company's balance sheet, equity values can change. These additions or deductions are brought out by changes in realized profits, changes in unrealized profits, issuance of new shares, purchase of existing shares, and dividend declaration.

Investing in equity ownership is riskier than investing in other financial instruments. Investors have no control over the workings of a company. Any loss encountered by the firm is directly reflected in the shareholders' earnings.

Equity Features

These shares hold the following characteristics:

- Limited Liability: Shareholders’ liability is limited to their shareholding. Even at the time of liquidation, they are not liable to pay any additional amount

- Ownership: Shareholders enjoy partial ownership in the net assets of the firm

- Voting Rights: Shareholders get the right to vote and join the company's member meetings. In corporate meetings they can input their opinions and suggestions.

- Claim Over Firm's Asset: Shareholders have the right to claim company's remaining assets once preference shareholders and other liabilities are paid off.

- Dividends or Capital Appreciation: Shareholders get the right to receive dividends. However, this depends on the company's policy—whether they pay dividends on the particular year or not. If not, the profits get added to capital appreciation.

- Redemption on Liquidation: A company's shareholder is repaid only upon the firm's liquidation. This too is limited to available surplus once all liabilities and preference shareholders are paid off.

Formula

The book value is computed as follows:

Total assets include all current, fixed, tangible, and intangible assets represented on the company's balance sheet. The liabilities comprise short-term debts, long-term debts, and other liabilities recorded on the balance sheet.

Examples of Equity

Let us assume that a company, ABC Ltd., is engaged in textiles manufacturing. Let us calculate the equity of ABC Ltd. on March 31, 2021. The Balance Sheet details are as follows:

Solution:

Calculating the book value of equity:

Equity = Total Assets – Total Liabilities

= $51,500,000 – $11,000,000

= $40,500,000

Let us look at another example. According to Cisco's quarterly balance sheet ending on October 30, 2021, we can see that the equity is computed as $42,701.

Source: investor.cisco.com

Calculation:

Equity = Total Assets – Total Liabilities

= 95,981 – 53,280

= $42,701

Market Value

The Market Capitalization of publicly traded common stock can be construed as the company's worth based on its market standing or its demand among investors.

The Market Capitalization formula is as follows:

Market Cap = No. of Equity Shares Outstanding × Current Market Price Per Share

Example: A company has 250 million outstanding shares, trading at $65 per share. In this case, the market capitalization can be calculated as follows:

Market Capitalization = 250,000,000 × 65

Market Capitalization = $ 16,25,00,00,000

The market valuation of any company is sensitive to multiple factors—the level of competition, economic condition, positive news, negative news, government regulations, and corporate performance.

Types

In business, there have been two different types of equity, as explained below:

#1 - Owner’s Equity

The ownership value of a sole proprietary firm is evaluated after deducting the overall liabilities from the company's total assets. It is a deciding factor in mergers and takeovers.

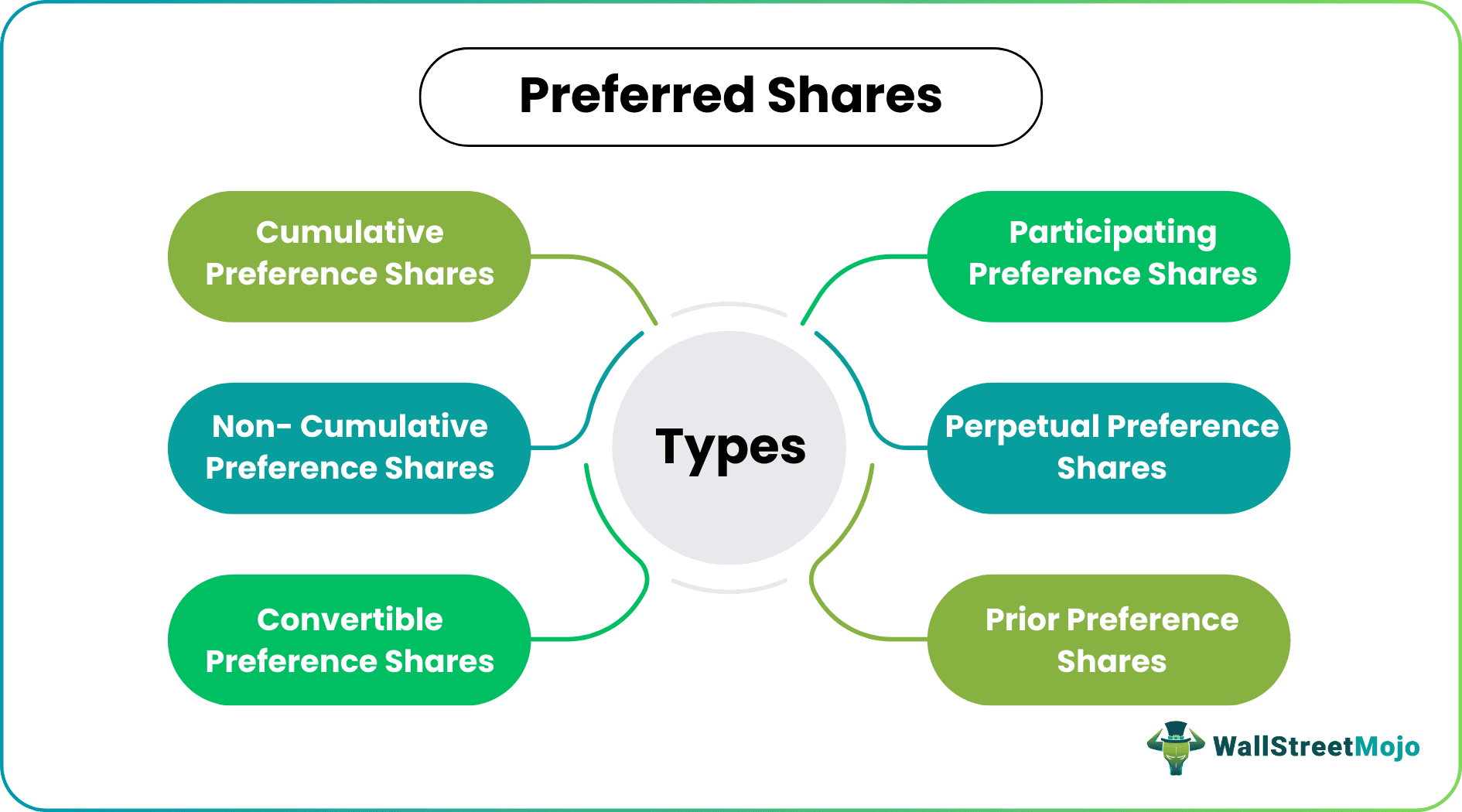

#2 - Stockholder's Equity

When it comes to a public company, the shareholder's equity represents the proportion of net assets received during liquidation.

Following are the various equity accounts:

- Common Stock: Common stocks gather the initial investment. Investors gain ownership of business assets. These stakeholders enjoy voting rights and superior control over the company's management.

- Preference Stock: The preference stakeholders don't get any voting rights in the company. They do, however, earn dividends and get paid before other shareholders.

- Treasury Stock: Sometimes companies buy their shares back. These redeemed shares are termed treasury stocks.

- Additional Paid-in Capital: Any amount that the shareholders pay above the par value of the common or preferred stocks is the additional paid-in capital—also known as contributed surplus.

- Retained Earnings: It is the reserve of profits maintained by businesses after paying dividends to the shareholders.

Importance

Issuing shares benefits both the investors and the firm. Let us see how:

For the Company

An organization's net worth is made public in front of the world. Given below are some other benefits:

- Business Capital: Dividing into small portions and issuing shares generates capital for the firm. This can be used to start or continue multiple projects.

- Market Capitalization: It determines a firm’s market capitalization.

- Builds Brand Image: When a company consistently holds a positive position, it indicates a healthy financial condition establishing its strong brand presence in the market.

- Leverage Free Financing: As the firm accumulates capital from the public by providing them partial ownership in the business, it no longer needs to rely on external debts.

For the Investors

Investors expect phenomenal returns on the investment. Following are some of the other advantages of purchasing shares:

- Business Ownership: Investors relish owning a share (though minimal), it is a matter of pride.

- Beats Inflation: The rate of return is usually higher than the rate of inflation, so it increases the shareholders' purchasing power.

- High-Rate of Return: Investors can earn significant profits on their investment through dividends, capital gain, or stock appreciation.

- Easy to Invest: The procedure is easier than other investments. All an investor needs is a broker—who takes care of everything else.

Frequently Asked Questions (FAQs)

Stocks are a type of equity financing. In the corporate world, equity represents ownership. Stocks are a bundle of small units. These small units of business ownership are offered to the investors. This way, firms raise capital.

Holding a portion of corporate ownership is a big deal. The easiest way to purchase equity is by investing money in the relevant company's stocks.

Equity is the net worth of a company or its ownership stake, which may or may not be available for trade over the stock exchanges. There is always a book value and market value for the equity. A stock is a tiny portion of the firm's equity or ownership available for public trading.

Recommended Articles

This has been a guide to What is Equity and its Meaning. Here we discuss equity formula, calculations, examples, stocks, and types. You can learn more from the following articles –