Table Of Contents

What Is Entrepreneurs' Relief?

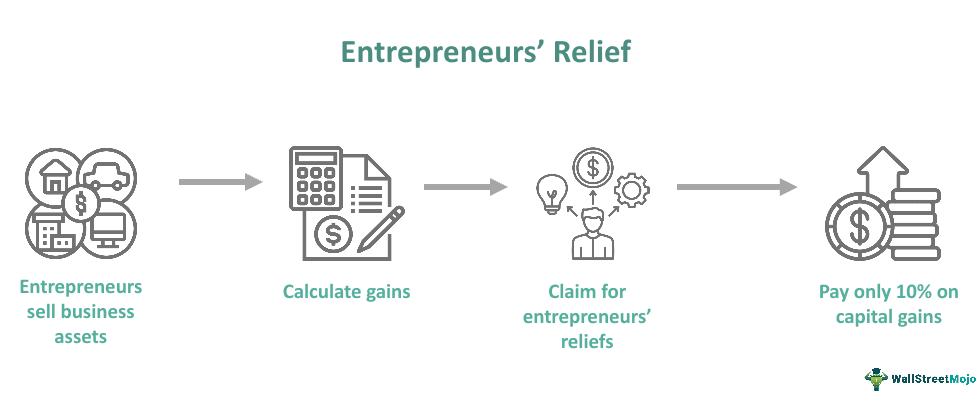

Entrepreneurs' relief is a provision that allows businesses tax relief by letting them sell all or part of their assets and pay only 10% as capital gains from the profit they earned. It is applicable till the limit of £10 million. Businesses often do it for multiple reasons and to save on taxes.

It is a UK-based tax scheme to help businesses grow by incentivizing their qualifiable assets. Entrepreneurs' relief only applies to individuals who are sole traders, business partners, or limited company shareholders operating in trading. From time to time, a revised entrepreneurs' relief is amended by the UK government.

Key Takeaways

- Entrepreneurs' relief is a tax scheme in the UK that enables individuals to sell their business assets, either fully or partially, and only pay 10% as capital gains tax on the resulting profit.

- Applicants must meet specific requirements and qualifying conditions to qualify for this tax relief.

- There is no restriction on the number of times entrepreneurs can claim the relief, but the maximum relief amount is capped at £10 million.

- Individuals who do not qualify for this relief are subject to a higher capital gains tax rate of up to 20% on the profit generated from selling a business asset.

How Does An Entrepreneur's Relief Work?

Entrepreneurs' Relief is a tax provision in the United Kingdom that allows businesses and individuals to sell their business assets and pay a reduced capital gains tax rate of 10% instead of the standard rates of 20% to 25%. It was introduced in 2008, replacing Business Asset Taper Relief, and was later renamed Business Asset Disposal Relief in 2020. Certain criteria, qualifying conditions, and restrictions must be met to claim this tax relief.

Over time, the authorities have made changes to the Entrepreneur's Relief system to ensure its effectiveness. However, it has also faced criticism from experts and foundations. The Resolution Foundation, for instance, has referred to it as the worst tax break in the UK, and studies suggest that it may not be delivering the intended benefits and has cost the public approximately £25 billion.

Entrepreneur's Relief allows employees, directors, trustees, partners, and sole traders to reduce their capital gains tax, providing flexibility to use the funds for personal purposes or reinvest in their businesses. It's worth noting that the details about selling furnished properties seem unrelated to Entrepreneur's Relief and might pertain to other property-related tax provisions or requirements.

Applicants must calculate the gain from property disposal, and if they sell multiple properties, they can combine the gains and deduct the annual capital gain tax allowance of £12,300. After that, they would only be required to pay 10% of the remaining gain.

Qualifying Conditions

Entrepreneurs' relief has undergone revisions and regulations since its introduction. However, the primary qualifying conditions for entrepreneurs' relief commonly include the following:

- The applicant must be a sole trader, business partner, or shareholder of a limited company actively engaged in trading.

- The applicant should hold at least 5% ownership of company shares and possess voting rights, including shares received through an Enterprise Management Incentive share scheme.

- They should have lent assets to the company for business purposes.

- The applicant may be a trustee, employee, or officer holder within the company.

- The company should be involved in trading activities or be the holding company of a trading group. The applicant can still sell shares within three years if the company ceases trading.

- An essential qualifying factor is that the applicant must have been a sole trader, partner, or owner of the business or assets for at least one year prior to the date of selling the business or shares or the date of business cessation.

Calculation Example

Suppose Ryan, a business owner in London, decides to sell some of his business assets to secure funds for his business expansion. He meets all the qualifying conditions for entrepreneurs' relief tax, which allows him to pay a reduced capital gains tax rate of 10% on the profit earned from selling the assets.

Ryan owns company shares that he purchased for £450,000. The current market value of these shares is approximately £990,000, resulting in a profit of £540,000 when he sells them. According to the entrepreneurs' relief tax, Ryan must pay only 10% of the tax on the profit, which amounts to £54,000.

After paying the capital gains tax, Ryan has £486,000 (£540,000 - £54,000) left. This favorable outcome is possible because he claimed entrepreneurs' relief. Had he not claimed it, he would have been subject to a higher % tax rate of 20%, resulting in a payment of £108,000 (£540,000 * 20%).

While this example provides a simplified illustration, it is important to note that claiming entrepreneurs' relief in the real world can involve complexities and considerations specific to individual circumstances.

Restrictions

Certain restrictions apply to entrepreneurs' relief on the maximum amount an individual can claim over their lifetime:

- From April 6, 2008, to April 5, 2010, the limit was £1 million.

- From April 6, 2010, to June 22, 2010, the limit increased to over £2 million.

- From June 23, 2010, to April 5, 2011, the limit was further set to £5 million.

- Since April 6, 2011, and to the present day, the limit has been set at £10 million.

- The UK government has continuously adjusted the entrepreneurs' relief limit to provide increased incentives for businesses.

- Any gains above the £10 million limit will be only subject to a capital gains tax (CGT) rate of 20%.

Taxpayers can only claim Entrepreneurs' Relief when they dispose of a business or sell business assets. When dealing with real estate property assets, if the property is used for private purposes after the disposal, it loses the eligibility to be treated as furnished holiday lettings (FHL). If the applicant owns multiple UK properties, the authorities treat them as one business for the purposes of furnished holiday lettings (FHL).