Table Of Contents

Endorsement Definition

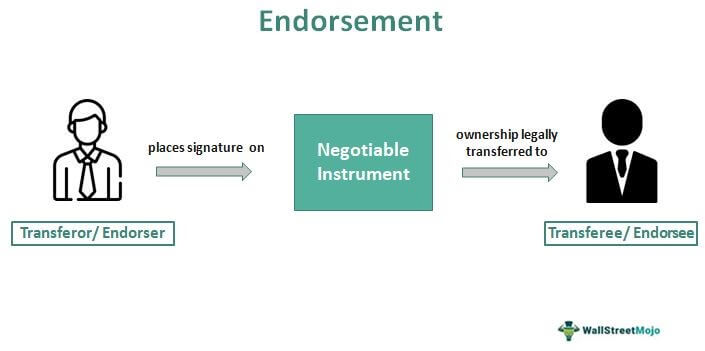

Endorsement is the act of signing, usually on the back of a negotiable instrument, to legally transfer its ownership to another party. It certifies certain aspects regarding the instrument, such as validity, enforceability to the transferee, and any subsequent holder.

The person making an endorsement is the endorser, and the individual to whom the endorser transfers the instrument is the endorsee. If there is no space to sign on the back of an instrument, the holder may sign on a piece of paper attached to it. Signature endorsements are of various types, such as blank, special, restrictive, and partial.

Table of contents

- Endorsement Definition

- Endorsement, in legal matters, of an instrument refers to the action of signing or placing an equivalent stamp on its back, thereby transferring the ownership legally to another individual.

- There are 7 types of endorsements. They are facultative, partial, conditional, restrictive, blank or general, special or full, and blank or general.

- The term has different meanings. For example, it can also mean a public declaration of support for something or someone.

- If an instrument is payable to two individuals, both must sign it.

Endorsement Explained

Endorsement meaning refers to placing a signature or an equivalent stamp on any negotiable instrument to authorize its transfer to another party. Individuals may put their signature on an instrument to restrict payment, incur the endorser’s liability, or negotiate it.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

That said, one must note that this term’s meaning may not be the same. It can also refer to an amendment made to a document or contract, for example, an insurance endorsement. Moreover, it also refers to a public statement of support for a service, product, or person.

Suppose two parties are negotiating order paper and not bearer paper. In that case, the individual to whom it is payable must make sure to endorse the instrument before transferring it to another party. The endorsement may change the order paper to bearer paper and vice versa. Moreover, it may restrict the rights of any subsequent holder.

Endorsing negotiable instruments is not always necessary for their transfer. For example, one does not need to endorse commercial paper if it is bearer paper. Therefore, in this case, the voidable and involuntary transfer can constitute negotiation.

Also, if any instrument is payable to two parties, for example, D and B, signatures of both are necessary for negotiation.

Types of Endorsement

Besides knowing endorsement meaning, you must be aware of its different types.

Let us look at them in detail.

#1 - Blank/General

In this case, the endorser places only their signature on the negotiable instrument and does not write the name of a party who will receive the payment.

#2 - Full/Special

The act is special or full when an endorser or transferor signs the instrument and writes the payee’s name too. As a result, the latter becomes entitled to sue for the amount payable on the instrument.

#3 - Restrictive

This limits the principal features of an instrument and restricts its further negotiability. Endorsers have the right to prohibit the subsequent transfer of an instrument. It prevents the risk of the drawer losing their money owing to fraud or forgery.

#4 - Conditional

In this case, the endorser places their signature under such writing, which makes their liability due thereon depending upon the occurrence of a particular event.

#5 - Facultative

Here, the endorser gives up some right to which they have entitlement. For instance, endorsees are responsible for giving notice of dishonor to the endorser. In case they fail to provide this notice, the latter will be free from their liability.

#6 - Partial

This arrangement allows the transfer of only a portion of the amount payable on an instrument to the endorsed.

#7 - Sans Recourse

This type of endorsement relieves the endorser from all the liability against subsequent holders of the negotiable instrument.

Examples

Let us look at a few endorsement examples to understand the concept better:

Example #1

Suppose Nick issued a check for his son, Jim, to help him meet some urgent expenses. The former put his signature on the check correctly, and the latter endorsed the check with his signature only. This is an example of endorsement in blank. In this case, the check becomes payable to the bearer. It means that if Jim misplaces it and it falls into the wrong hands, Nick can lose his funds to an unknown person.

Example #2

Let us say that Jack holds a check endorsed by John. Jack writes over John’s signature, “Pay to the order of Ross”.

Jack will not have the liability of an endorser. This is an endorsement in full from John to Ross.

Example #3

Post Federal Reserve Board amendments, since July 1, 2018, banks require their clients to add the words “For Mobile Deposit Only” below the endorsement on mobile check deposits. The amendments in Regulation CC aim to safeguard financial institutions and their clients from the malicious or accidental deposit of the same check multiple times.

Frequently Asked Questions (FAQs)

What are endorsements in insurance?

Insurance endorsement refers to an amendment made by the insurance company to a policy based on the insured’s request. It serves as an extension of the current policy.

Where is the endorsement on a check?

In most cases, individuals can find the space allocated for endorsing a check by turning it over. They can find a box or a simple line on the check that says, “Endorse Here.” There might be another line instructing individuals not to place their signature or stamp below that line.

What is an endorsement stamp for checks?

A pre-inked stamp allows individuals to endorse bank deposit slips or checks without needing to handwrite the details, thus saving time and effort. Note that endorsement stamps must have a bank account number for both business and personal checking accounts.

What is an endorsement contract?

This agreement allows a company or any business organization to use a person’s name and social status to promote their products and services. Alternatively, it can allow an organization to spread awareness concerning a specific issue. Usually, the endorser is very popular in a specific field.