Table Of Contents

End-To-End Meaning

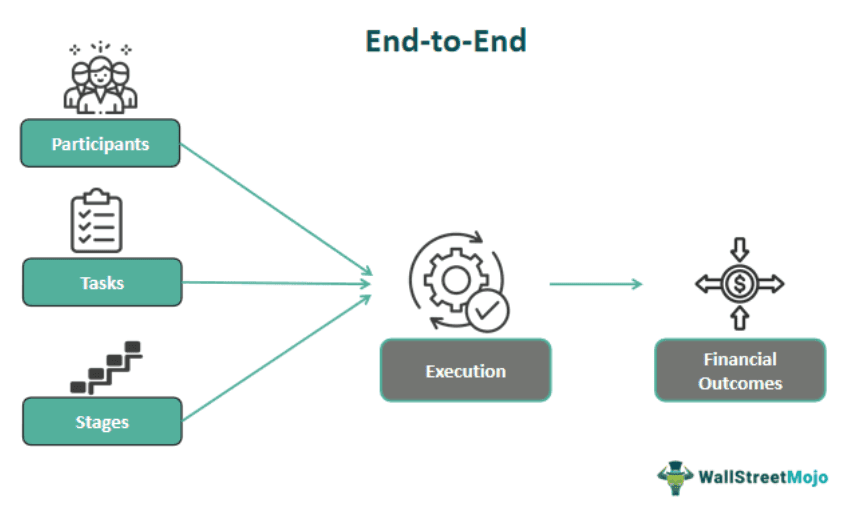

End-to-end in finance refers to the complete sequence of activities or steps involved in a specific financial task or operation, starting from the initial initiation point and ending with the outcome or result. The aims of an end-to-end in finance are closely tied to the goals and objectives of the specific financial task or operation.

The aims of an end-to-end in finance align with the goals and objectives of the specific financial task or operation. Generally, the goals revolve around improving efficiency, accuracy, transparency, and overall effectiveness in achieving desired outcomes. It encompasses all the stages, tasks, participants, and systems that contribute to the execution and completion of a financial.

Key Takeaways

- An end-to-end in finance refers to a complete sequence of activities in a specific financial task or operation, from initiation to outcome.

- End-to-end enhances efficiency, accuracy, transparency, compliance, and alignment with organizational goals in financial activities.

- Implementing end-to-end improves efficiency, accuracy, cost savings, better risk management, compliance, transparency, faster decision-making, and adaptability to change.

- To design a practical end-to-end, define objectives, map flows, identify stakeholders, gather requirements, analyze the current state, set milestones,

- consider automation, design controls, allocate resources, implement communication, pilot and test, provide training, monitor and improve, and ensure compliance.

End-To-End Explained

An "end-to-end " refers to a comprehensive and interconnected sequence of activities that span from the initial starting point to the final desired outcome of a particular task or operation. It encompasses all the stages, tasks, participants, resources, and technologies involved in completing the process coordinated and efficiently.

The origin of the concept of end-to-end traces back to industrial engineering and business management. It gained prominence during the rise of manufacturing and supply chain management, particularly in the mid-20th century. As businesses sought to optimize their operations and improve efficiency, they recognized the importance of viewing tasks and activities as part of larger, interconnected workflows.

In finance, end-to-end emerged as organizations recognized the need to streamline financial activities, reduce errors, ensure compliance, and align financial operations with broader business objectives. The end-to-end principles were unique to the challenges and requirements of financial tasks, leading to the development and implementation of efficient and integrated financial workflows.

How To Design?

Designing an end-to-end in finance involves a strategic approach with crucial steps to ensure efficiency, accuracy, and compliance. Here's a concise step-by-step guide:

- Define Objective: Clearly state the purpose and desired outcome of the financial process. Identify key performance indicators (KPIs) for measurement.

- Mapping: Create a visual representation of the entire process flow. Illustrate the sequence of activities from initiation to the final result using flowcharts or diagrams.

- Identify Stakeholders: Recognize individuals, departments, and external parties involved in the process. Understand roles and responsibilities for effective collaboration.

- Gather Requirements: Collect detailed input, output, and resource information for each step. Consider compliance rules and regulations that must be adhered to.

- Analyze Current State: If the process already exists, assess its current status. Identify bottlenecks, inefficiencies, and areas requiring improvement.

- Set Milestones: Break the process into critical checkpoints to track progress. Indicate decision points and actions required at each milestone.

- Automation Opportunities: Identify tasks suitable for automation using technology. Choose software or tools to streamline the process and enhance efficiency.

- Design Controls: Integrate control mechanisms and checkpoints to ensure accuracy and compliance. It includes approval process, validation checks, and reconciliations.

- Allocate Resources: Determine necessary resources like personnel, technology, and budget for each stage. Ensure proper allocation to prevent bottlenecks.

- Implement Communication: Establish clear communication channels among stakeholders. Define how information will be shared and how issues will be reported.

- Pilot and Test: Test the process with a smaller group before full implementation. Identify and resolve any issues to refine the process.

- Provide Training: Train stakeholders involved in the process. Create comprehensive process documentation with step-by-step instructions and best practices.

- Monitor and Improve: Continuously track performance using defined KPIs. Gather feedback and analyze data to identify areas for enhancement.

Uses

End-to-end in finance has several vital uses across various financial activities and organizational functions. Here are some key uses of it:

- Efficiency Enhancement: Designing and implementing end-to-end helps organizations streamline operations by eliminating redundant steps, reducing manual effort, and optimizing resource allocation. This leads to improved efficiency in financial activities, saving time and resources.

- Workflow Standardization: End-to-end standardized work by defining a precise sequence of tasks and activities. This consistency helps reduce errors and variations, leading to more reliable outcomes.

- Risk Management: Effective end-to-end incorporates risk management measures at various stages. This helps organizations identify and mitigate potential risks, such as fraud, data breaches, and compliance violations, ensuring greater financial security.

- Compliance and Governance: Many financial processes are subject to regulatory requirements and industry standards. Designing strategies keeping in mind ensures that activities are carried out according to legal and ethical guidelines.

- Quality Assurance: The systematic nature of end-to-end allows quality control mechanisms to be integrated at critical points. This ensures that financial data, transactions, and outcomes meet predetermined standards.

Examples

Let us understand it better with the help of examples:

Example #1

Suppose Mark is running an e-commerce store that sells electronics. The end-to-end here would be the complete sequence of steps involved in fulfilling a customer's order, from when they place the order to when they receive their product and receive payment.

- Order Placement: The process begins when a customer orders on the website.

- Inventory Check: The system checks the inventory to ensure the product is available.

- Order processing: The order is processed, and a packing list is generated.

- Packing and Shipping: The product is picked from the warehouse, packed, and a shipping label is generated.

- Shipping and Tracking: The product is shipped using a courier service, and the customer is provided with a tracking number.

- Delivery: The customer receives the product.

- Payment processing: Once the product is delivered, the payment is made, and the transaction is completed.

Example #2

In 2023, NewGen Software, a trailblazer in digital transformation, unveiled an upgraded version of its NewGenONE platform. The enhanced platform empowers organizations to accelerate their journey toward digitization, automation, and efficiency. NewGenONE offers a comprehensive suite of tools to streamline end-to-end processes across various sectors.

With a focus on seamless integration and enhanced user experience, the latest version of NewGenONE facilitates smoother collaboration and decision-making. The platform's robust automation capabilities promise reduced manual effort and improved accuracy in financial operations. It caters to diverse industries, including banking, insurance, and healthcare, enabling them to adapt to evolving market demands effectively.

NewGen Software's continuous innovation in digital solutions underscores its commitment to driving business growth through technology. The upgraded NewGenONE platform is a testament to the company's dedication to providing cutting-edge solutions that elevate operational excellence and customer satisfaction.

Benefits

Here are some key benefits of end-to-end:

- Improved Efficiency: End-to-end eliminate redundant steps, reduce manual intervention, and streamline workflows. This leads to quicker task completion, reduced turnaround times, and overall operational efficiency.

- Enhanced Accuracy: A standardized process with defined steps and controls minimizes errors and inconsistencies. Automation and standardized procedures contribute to higher accuracy in financial transactions and data.

- Cost Savings: Efficient processes reduce resource wastage, such as time and materials, leading to cost savings. Streamlined workflows can also lead to a reduction in labor costs and operational expenses.

- Consistent Quality: Standardized processes ensure every activity is carried out consistently, resulting in higher outputs and outcomes.

Limitations

Some typical limitations are:

- Complexity: Designing and implementing end-to-end can become complex, especially in large organizations with intricate workflows. Managing the various interdependencies and ensuring all tasks are well-coordinated can be challenging.

- Rigidity: Overly standardized processes can sometimes become rigid and resistant to change. This can be a problem when external factors or business requirements evolve, requiring adjustments to the process.

- Customization: Some financial activities may require customization based on unique circumstances. Over-reliance on standardized processes might not accommodate these exceptions effectively.

- Time and Effort: Developing comprehensive end-to-end demands time, effort, and resources. Organizations may need to invest in process analysis, documentation, training, and ongoing maintenance.

- Resistance to Change: Employees accustomed to previous ways of working might refrain from adopting new processes, especially if they perceive the changes as disruptive or requiring additional effort.