Table Of Contents

What Is An Employee Stock Purchase Plan (ESPP)?

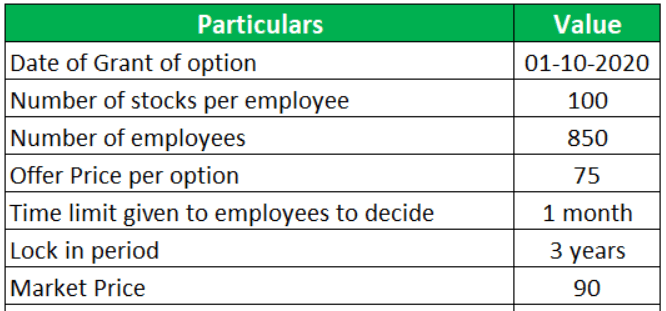

An Employee Stock Purchase Plan (ESPP) is an investment plan that allows employees of an organization to purchase their company's stocks at a discounted price, which is normally 5-15% less than the security's fair market value. The employers provide this scheme to help the eligible staff to contribute to this scheme to ensure time-to-time investments.

The participating employees invest in the stocks through regular payroll deductions, determined based on the difference in the prices between the date the plan is offered and the date on which it is purchased.

Key Takeaways

- Employee Stock Purchase Plan is an option granted by the employer to the employees, wherein the former offers a specific quantity of shares/stocks to each of the employees at a significantly discounted price.

- Employees take up this option and use the periodical deduction from the date of grant of option through the date of exercise of the price required to be paid.

- Employers provide such opportunities only to loyal and long-term employees who have proven their skill sets over the years.

- It also gives assurance of well-being to the employees, and it further strengthens the employer-employee relationship.

How Does An Employee Stock Purchase Plan Work?

The Employee Stock Purchase Plan is a scheme, which not every employee qualifies for. Employers assess the performance of a group of employees and choose the ones who have performed well over the years and are likely to continue serving the company for an extended period. Then, they quantify the figures based on the exercise price, eligible employees, and the number of options provided per employee.

On deciding all figures, the company typically waits for the stock to touch a 52-week high. It then provides information about the discount offered on such options. Next, the employees purchase the stocks at a discounted price. As soon as the staff chooses to invest, the employers start deducting the required amount from employees' monthly pay. The deduction begins from the grant date to the date of allotment. As soon as the company deducts a sufficient amount, it allows the respective shares to be owned by the employees.

All employees of the company, be it from its subsidiary company, or parent company, are eligible to participate, provided the conditions are met. In addition, the person should be under the company's employment from the start of the grant date to at least three months before the purchase date of the option.

On the other hand, those with less than two years of employment are not eligible for participation. Plus, those receiving higher compensation are also not eligible to participate. As per Section 414 of the Internal Revenue Service (IRS), higher compensation is anything greater than or equal to $130000. In addition, the terminated employees or employees working as part-time, seasonal, and contractual employees are not eligible to participate.

So far as the employee stock purchase plan tax is concerned, the amount is not taxed until employees earn or lose something while dealing in those stocks.

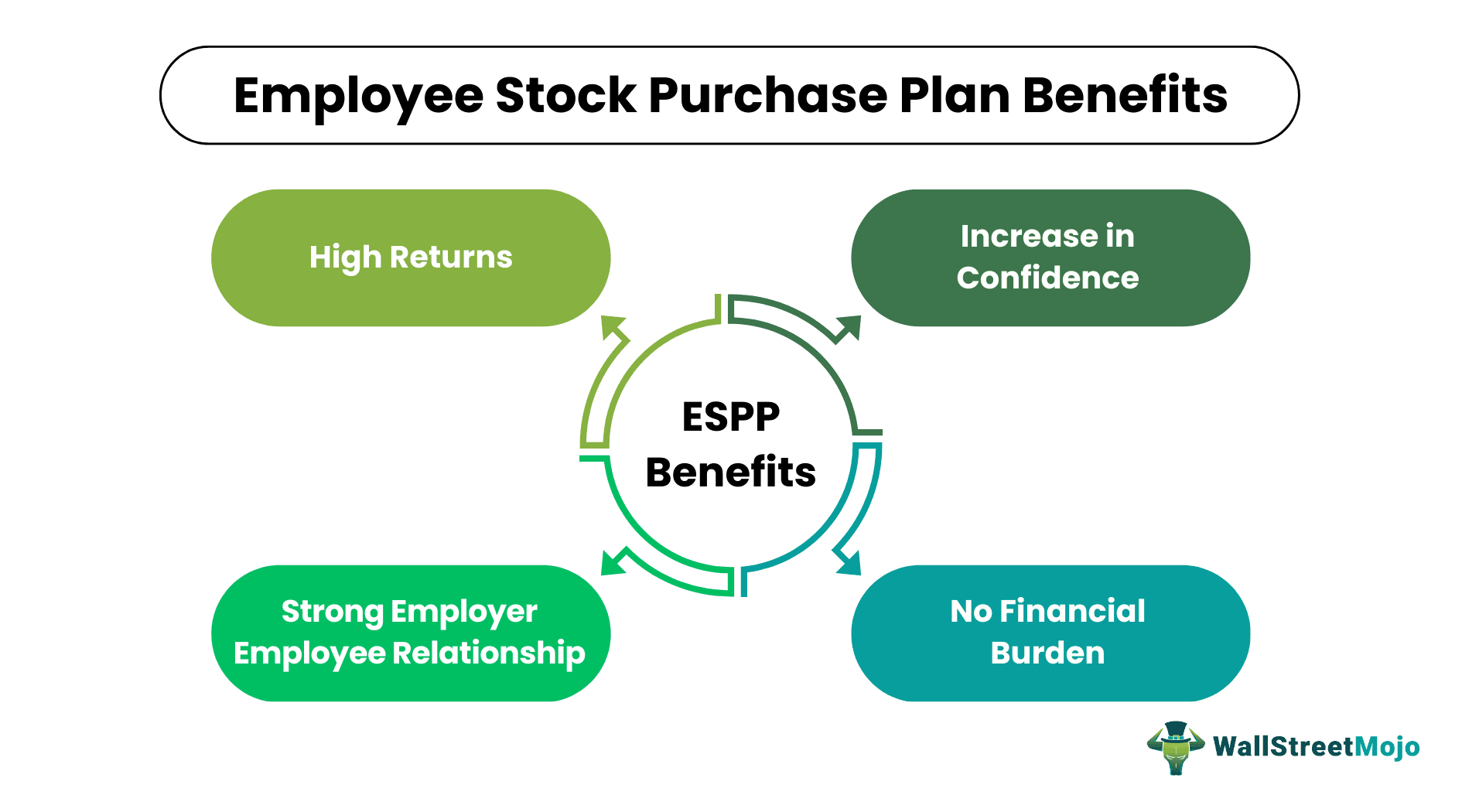

Benefits

The best thing about ESPP is that it helps employees enjoy a significant gain, i.e., the difference between the exercise and market prices, on the very first day of allotment. In addition, the entire process ensures seamless execution of the stock purchase plans.

The return from an immediate sell-off of the stocks is usually higher than the interest rate offered by a normal savings account. Employee confidence increases as they feel connected to the issuing company and its future goals. There is no financial burden on the employee to purchase the option since the employer deducts the amount periodically.

As the perks are over and above the standard salary package received, the employer-employee relationship strengthens. Moreover, an ESPP allows employees to sell these stocks immediately or hold them for a certain period to gain higher returns.

Example

Let us consider the employee stock option plan example based on the information that a company provided:

Let us calculate the employee’s gain with respect to the above information:

The employee, here, earned a 20% return in just a month by subscribing to the option. However, the employees are given an option to sell immediately or wait for the lock-in period. In this case, the lock-in period applies to stocks as well as employment.

Employee Stock Purchase Plan vs Stock Options

ESPP and stock options might appear similar terms, but they differ significantly. While the former depends on the employees' choice and eligibility, the latter is a scheme employers decide whether an employee should opt for.

The amount of stock an employee is eligible to purchase depends on the type and structure of the scheme, the purchase price after the discount, and the amount employees can afford to get deducted from their payroll. On the other hand, the amount of stock available for purchase under the stock options depends on the grant size.

The ESPP comes with a fixed offering and purchase timing, while the stock options have a set term within which employees can exercise the options post vesting.