Table Of Contents

What Is Emotional Investing?

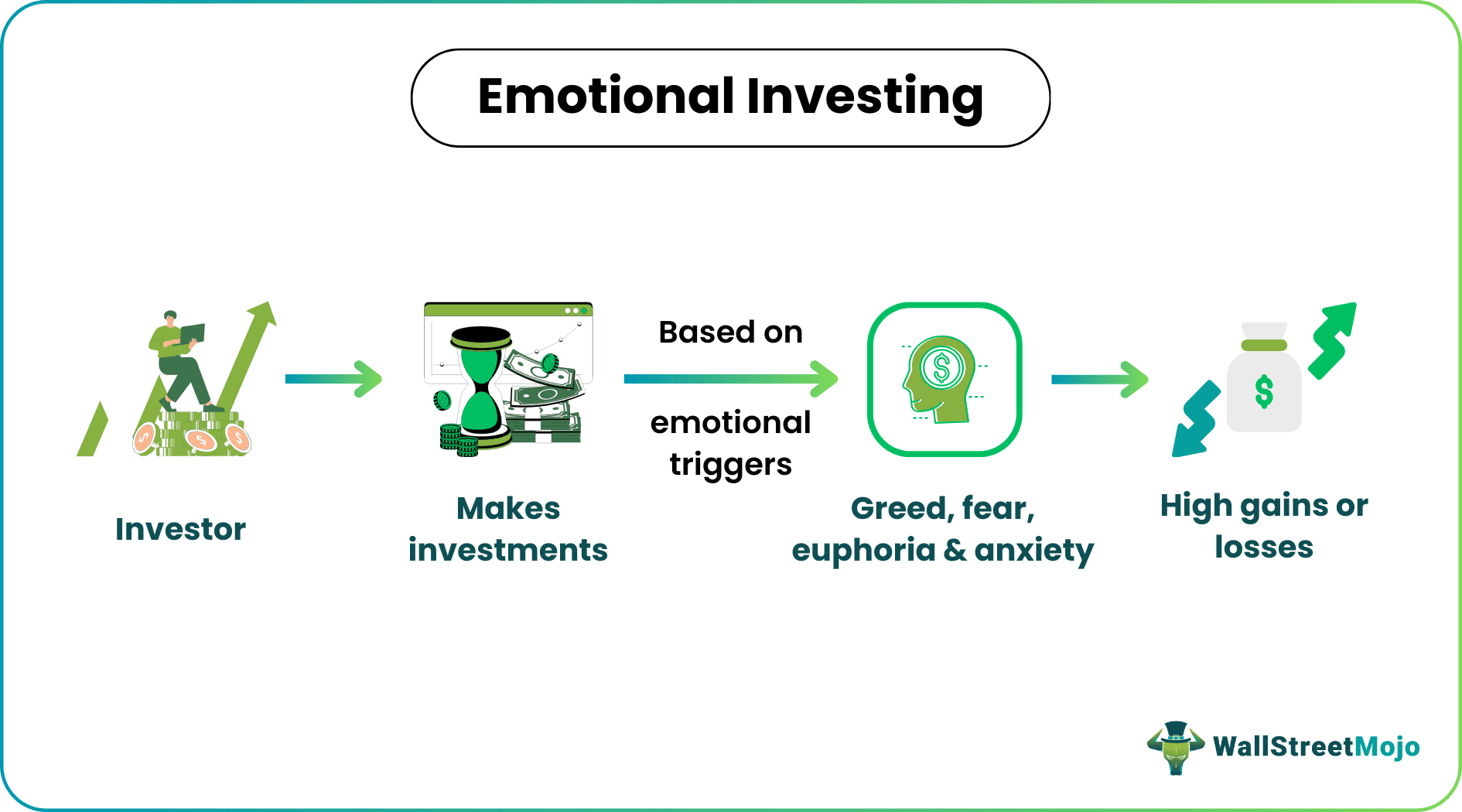

Emotional investing is a type of investment where decisions are guided by emotions rather than investing in fundamentals. They are more than often impulsive, without the basis of rationality, and often carry high risks. Investors who make emotional investments tend to have high losses.

Investors who let their feelings influence their investment decisions may fall victim to several financial mistakes. Psychological forces like greed, fear, euphoria, or panic fuel the tendency. They can cause investors to act impulsively and irrationally without proper research and make choices that may result in losses. This makes them deviate from their long-term investing objectives.

Key Takeaways

- Emotional investing involves making investment decisions driven by emotions rather than rational analysis.

- Common emotional pitfalls include fear, greed, confirmation bias, and herd mentality.

- Emotional investors make mistakes by trying to time the market, reacting strongly to the news, lacking diversification, ignoring fundamental analysis, chasing past performance, not managing risk adequately, and being influenced by emotional biases.

- Emotional investing can be avoided by developing a long-term plan, having knowledge of fundamentals, practicing discipline, and seeking professional advice. Knowing these mistakes can help investors make more rational and informed decisions.

Emotional Investing Explained

Emotional investing is when investors make decisions on investments based on strong emotions, such as fear, greed, euphoria, or panic, rather than rational analysis and evaluation. This can lead to impulsive and irrational choices that may not align with the long-term investment goals of the investor. Decisions made by investors are affected by emotions. Like other business decisions, emotions are a major factor when investing.

When making them, it influences human behavior that is congruent with economic forecasts. These investing choices are more reactive since the investor bases them more on market volatility and swings than on fundamental analysis and study. Additionally, understanding emotional investing behavioral finance helps gain insights for market research.

Emotional investors also make choices based on what others are doing, such as purchasing a specific stock if others are doing the same (herd mentality). Impulsive judgments based on short-term market changes are indications of emotional investing, which ignores basic principles, including asset allocation, risk tolerance and diversification. Emotional investors may also lack portfolio diversification and become too fixated on one stock or industry, which increases risk during a downturn. Over time, diversifying portfolios among various asset classes and industries can lower risk and boost investment performance.

Emotional investors could ignore contrary facts in favor of information confirming their preconceived notions about a particular investment, which could be another reason. Similarly, overtrading can eventually raise transaction costs and reduce investment returns. This confirmation bias may prevent them from making well-informed decisions based on unbiased analysis. Emotional investors can avoid risks of emotional investing, manage their finances better and preserve a secure financial future by keeping these in mind.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Mistakes

Some of the mistakes made by emotional investors are:

- Trying to Time the Market: Emotional investors often try to predict when to buy or sell investments based on their emotions. They may buy when prices are high due to excitement or sell when prices are low due to fear. However, predicting short-term market movements is difficult and can lead to poor investment outcomes. Emotional investors may miss out on potential gains by selling during market downturns or buying at inflated prices during market peaks.

- Reacting to Market News: Emotional investors tend to make impulsive investment decisions based on news events, especially negative ones. They may react quickly to sensationalized headlines or short-term market fluctuations without considering the long-term results of the investment. This reactive behavior can result in buying or selling without considering the fundamentals of the investment.

- No Diversification: Emotional investors often put their money into a single stock or industry due to emotional attachments or FOMO (fear of missing out) on the investment. This lack of diversification in investor portfolios increases the risk of losses if the specific investment performs poorly. A well-diversified portfolio spreads investments across different assets and can help reduce the impact of one investment's performance on the overall portfolio.

- Ignoring Fundamental Analysis: Emotional investors overlook the importance of analyzing a company's financial health, earnings potential, and market position. Instead, they may rely on rumors, grapevine, or emotional biases when making investment decisions. This can lead to investing in companies without strong fundamentals or missing out on solid investment opportunities.

- Chasing Past Performance: Emotional investors often fall into the trap of chasing investments that have recently performed well. They may invest in assets or funds that have experienced significant gains, driven by the fear of missing out on further profits. However, investments that have already had substantial increases tend to be overvalued, and their potential for future returns may be limited.

- Little to No Risk Management: Emotional investors may not give enough consideration to managing risk within their investment strategy. They may take on excessive risks without considering their risk tolerance or the potential downside. This lack of risk management can lead to significant losses during market downturns.

- Influence of Emotional Biases: Emotional investors are susceptible to biases that can cloud their judgment. It includes referring to a particular price or event and making decisions based solely on that reference point (anchoring bias). They may also fear losses and stick to the same stock (loss aversion), which can lead to poor investment decisions.

Examples

Let us consider a few examples to understand the concept.

Example #1

Suppose Dan is an investor. Like many other investors, Dan became aware of XYZ stock through the media, which was reporting on its recent surge in price and the buzz surrounding it. The news portrayed XYZ stock as a great investment opportunity, highlighting its potential for substantial profits. Excited by the positive coverage and influenced by the herd mentality, Dan decided to invest in XYZ stock without conducting his careful analysis.

This decision led to overpaying for the stock, neglecting fundamental analysis, increased risk exposure, emotional rollercoaster, and lack of diversification. Herd mentality often results in a concentration of investments in a particular stock or sector, exposing Dan to increased risk. He may also face emotional ups and downs, leading to impulsive decisions.

Additionally, his lack of diversification increases the vulnerability of his portfolio to the performance of a single investment. Dan's decision to invest in XYZ stock based on herd mentality highlights the importance of conducting thorough research, analyzing fundamentals, and making informed decisions. Investors must conduct their research and make informed decisions rather than relying solely on the actions and opinions of others.

Example #2

The dot-com bubble of the late 1990s is one well-known example of emotional investing. The rapid rise of internet-related stocks created a euphoric market environment. The hope of making rapid money and FOMO motivated investors to invest in the newly emerging internet companies. The market conditions were positive, and more and more people invested, and prices started ballooning. But when the bubble burst in 2000, the inflated equities fell, leaving many investors with substantial losses.

How To Avoid?

Some of the measures that can be adopted to avoid emotional investing are:

- Long-term plan: Creating a long-term plan with clear investment goals is essential. The plan should align with the investor's risk tolerance and long- and short-term goals.

- Strong fundamentals: Deepening one's understanding of basic financial concepts and investment ideas is essential. Understanding the basics of investing, market cycles, and risk management will help them make more rational decisions driven by logic rather than instinct. Additionally, understanding emotional investing behavioral finance helps gain insights for market research, which can be used for making wise investment choices.

- Emotional awareness: A strong knowledge coupled with emotional awareness provides a framework for decision-making. It helps in avoiding rash decisions motivated by fleeting emotions. Recognizing emotions such as fear, panic, and greed and actively working on controlling them can save an investor from financial disasters.

- Discipline: Adopting a disciplined investing strategy helps in avoiding rash investment decisions. This entails sticking to the laid-out investing plan, avoiding pointless trades, and rejecting the urge to time the market swings.

- Budgeting: Planning and disciplined investment strategies require proper budgeting. Investors could opt for methods such as the 50/30/20 rule, which helps them control the amount of expenses. In such cases, investors will have a specific budget in mind and are highly unlikely to go beyond the budget.

- Seeking professional advice: Investors could consult a financial advisor who can offer unbiased advice and assist them in navigating emotional biases. A professional can provide an objective viewpoint, help investors stay focused on long-term objectives, and provide them peace of mind during volatile market situations.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Recognizing emotional investment decisions involves being aware of your feelings and impulses when making investment choices. Signs may include making impulsive trades based on short-term emotions like fear or greed, reacting strongly to market news, or disregarding a well-thought-out investment plan in favor of emotional impulses. Monitoring your decision-making process and assessing if it's driven by emotions rather than rational analysis can help identify emotional investing.

Emotional investing often leads to behavioral biases, including confirmation bias, herd mentality, and loss aversion. Confirmation bias can cause investors to seek information that confirms their emotional decisions, while herd mentality makes them follow the crowd without critical analysis. Loss aversion leads to an aversion to realizing losses, which can result in poor decision-making. These biases can amplify the negative effects of emotional investing.

The benefits of emotional investing are limited, primarily driven by short-term emotional gratification. However, the risks are substantial. Emotional investing can lead to impulsive decisions, poor timing, and a lack of diversification, increasing potential losses.