Table Of Contents

Embezzlement Meaning

Embezzlement is a white-collar crime where employees withhold or misappropriate funds or assets assigned to them. An embezzler intentionally and unethically uses owners' funds for personal gain. They falsify receipts and invoices to cover their tracks.

Embezzlers siphon funds or assets over a long period and keep manipulating the accounts to cover up. Stealing cash and the misuse of corporate credit cards for personal purchases are the most common forms of embezzlement. In addition, some embezzlers use technology to tweak computer systems, allowing them to perform unauthorized transactions.

Key Takeaways

- Embezzlement refers to a secret withdrawal of money by a person entrusted with management and utilization of funds for business operations.

- An embezzler takes advantage of the employers’ trust and intentionally misuses company funds and assets for personal gain.

- It is an organized way of draining a company's money or asset over a long period. Embezzlers cover up their crime by creating counterfeit receipts, documents, books of accounts, and reports.

Embezzlement Explained

Embezzlement is a fraudulent activity where a person secretly misappropriates assets from the employer. Initially, the fraudsters embezzle only a small amount of money. But soon, they start stealing systematically. Embezzlers adjust the company's accounts constantly and retain their employer's trust.

Trust makes capture even harder. No employer wants to doubt or second-guess their employees. Even when the employer encounters mild warning signs, they give the employee the benefit of the doubt. Familiarity gives victims a false sense of security.

The fraudsters take advantage of human decency. Even when the embezzler is caught, the management is too shocked to accept it. By the time they have evidence of a crime being committed, it is too late.

The company is also reluctant to confront the embezzler directly. Without solid proof of guilt, asking someone if they clandestinely swept away funds is an uncomfortable experience.

Embezzlement Elements

Some features of this fraud are as follows.

- The asset is owned by the owner or employer and not the embezzler.

- The employer authorizes the embezzler to perform transactions for day-to-day business operations.

- The most crucial element in embezzlement is trust; the employer highly trusts the employee or embezzler. Practically, most business hierarchies cannot function without some level of trust.

- Embezzlers are very aware of their actions and commit this crime intentionally.

Types of Embezzlement

An embezzler adopts any of the following ways to steal the entrusted funds or assets:

#1 - Cash Skimming or Siphoning

Most embezzlers who handle cash counters and front offices do this fraud. They keep some cash from the customers and deliberately omit recording the transaction in the computer system.

#2 - Kickbacks

Another illegal way employees make money is by conspiring with a vendor. On behalf of the firm, the employee makes high-price purchases that benefit the vendor, a co-conspirator. In lieu of illegal profits, the embezzler extracts a margin.

#3 - Cheque Kiting

Fraudsters intentionally write a check for a value greater than the account balance from an account in one bank. Then they write a new check from another account in another bank; again with insufficient funds. The second check serves to cover the non-existent funds from the first account. This way, the fraudsters falsely inflate the balance of a checking account to prevent the bouncing of checks.

#4 - Payroll

The embezzlers in the HR department of labor-intensive companies often enter the names of family members or friends in the employee registry. By doing so, they draw money against counterfeit paycheques.

#5 - Overtime

Some employees who are allowed overtime take undue advantage of the same by punching out the attendance late or punching in early despite not working for additional hours.

#6 - Lapping

Such misconduct occurs when companies authorize employees to accept bearer cheques or cash payments from customers. The entrusted person commits fraud by redeeming the cheque in the personal account instead of the company's account.

Effects

An embezzler breaks the trust of the employer. As a result, the employer faces monetary or asset loss on top of time erosion caused by legal proceedings. Such mishaps can push employers to become suspicious of all employees. In addition, such misdeeds disrupt internal administration, making it essential to have a robust control system within the organization.

Moreover, the manipulation of accounts leads to false reporting of corporate performance. It can ruin the brand image and existing deals with customers. If embezzlement becomes public, the shares of a listed company can dip.

Embezzlement Charges

The charges and penalties imposed on an embezzler differ from one state to another. Every country has a different embezzlement law. In New York, if embezzlers are found guilty of misusing funds or assets worth $1000, they are sentenced to a year's imprisonment and up to $1000 in fines.

If the embezzled sum is between $1000 to $3000, the fine can reach up to $5000 on top of four years imprisonment. Embezzlement between $3000 to $50,000 results in a jail term of up to seven years and a fine of not more than $5000.

Similarly, if an individual illegally draws between $50,000 and $100,000, the penalty exceeds $15,000, with a maximum imprisonment of 15 years. Any misappropriation higher than $100,000 leads to a maximum of a 25-year jail sentence on top of $30,000 in fines.

Embezzlement Examples

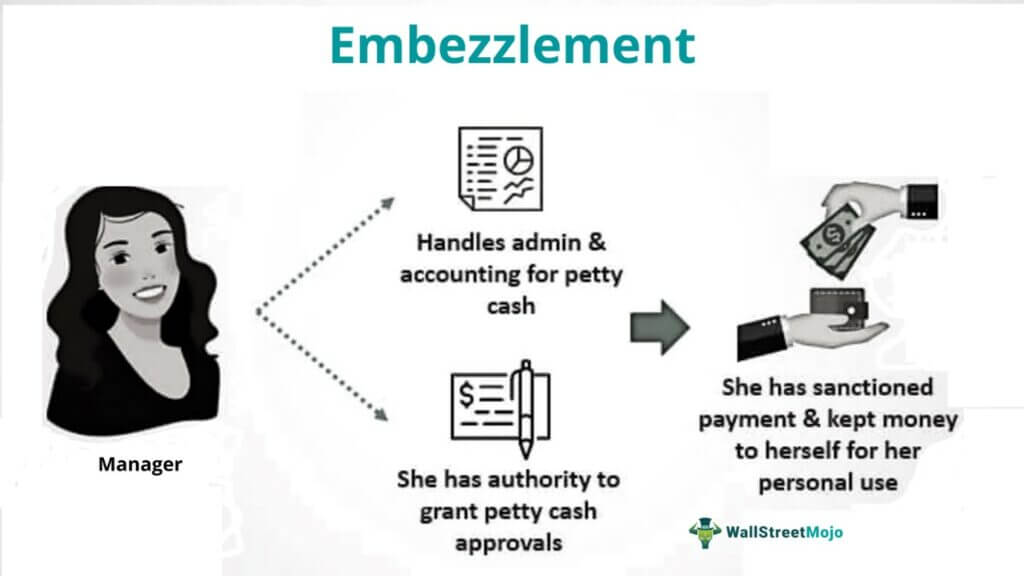

Let us consider a hypothetical to understand the practical application of the concept. Kriston handles the admin and accounting for petty cash expenses for supercomputers ltd. She has been managing the said department for years now. She is authorized to handle petty cash expenses incurred by the employees and business operations.

Petty cash expenditures constitute a small amount, and the firm trusts Kriston. As a result, there is no auditing of expense statements. Kriston, on the other hand, sanctions payments in the name of certain petty expenses and keeps the withdrawn money for herself. Kriston committed fraud.

August 2010 saw a popular embezzlement case. Mark Hurd, the chief executive of Hewlett-Packard, allegedly used company funds for personal benefits. He was expelled immediately. Apparently, Mark was found padding his expense account. An expense account is a facility that allows employees to make business-related payments on the company's behalf.

Embezzlement vs Theft

Law enforcement considers embezzlement more serious than theft. Unlike embezzlers, thieves do not cultivate trust with the victim of the crime. The laws for punishment and imprisonment differ according to the jurisdiction.

The verdict or sentencing on the cases involving theft depends on the stolen money or the asset value. Fines charged for theft are usually low. In comparison, embezzlement is considered a serious felony carrying heavier penalties.