Table Of Contents

What Is Economic Value Of Equity (EVE)?

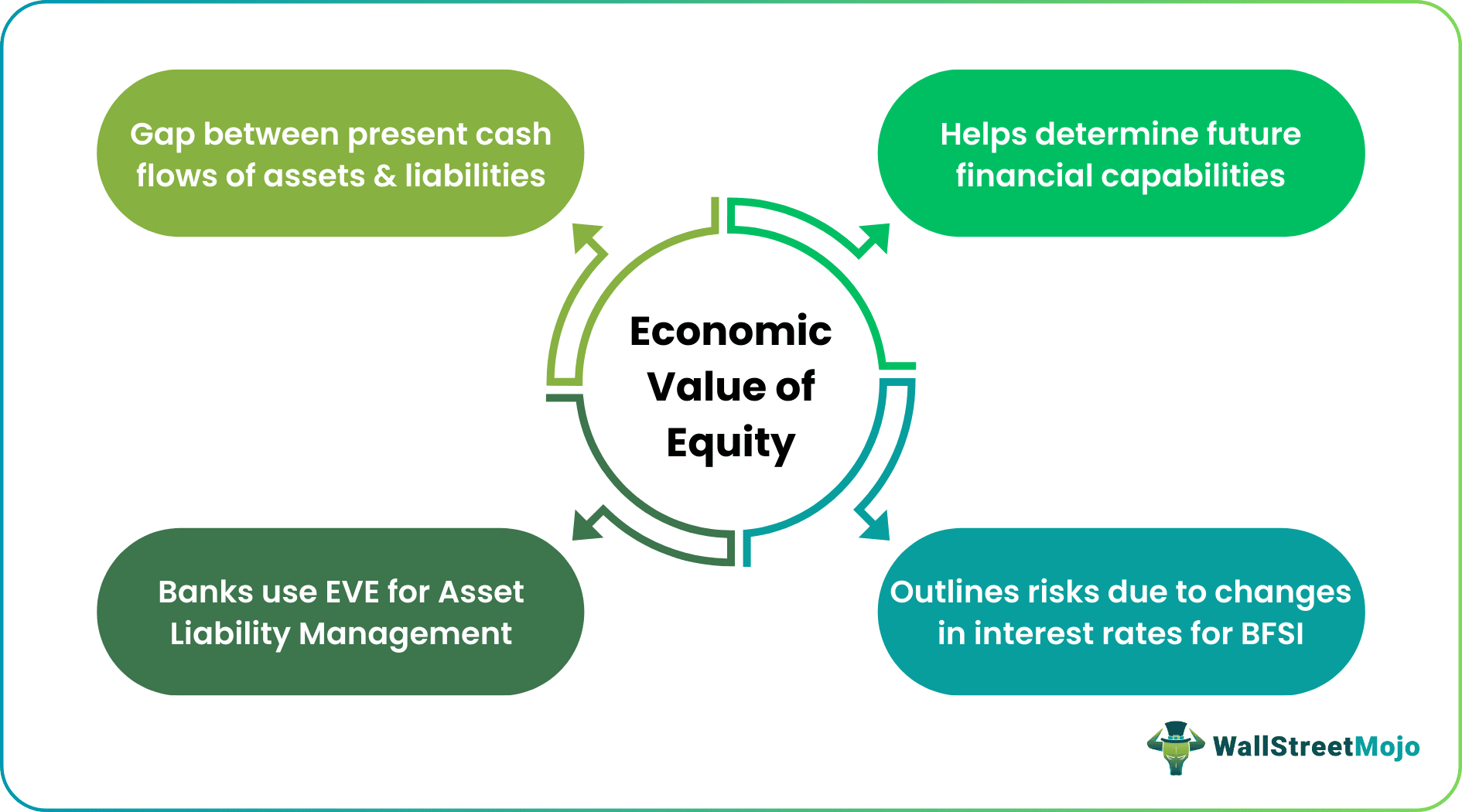

The Economic Value of Equity is a financial indicator that helps banks and financial institutions estimate the effects of interest rate changes on their equity. It considers the present cash flow of assets and subtracts the present cash flow of liabilities to derive an entity’s financial position with respect to equity. In the context of a company, it is used to determine the company's future cash flows.

The EVE is a financial metric for long-term estimations. Regulators in the banking sector have mandated banks to track EVE and perform scenario analysis periodically. The US Federal Reserve has issued guidelines that make the periodic analysis of EVE compulsory. The Basel Committee on Banking Supervision prescribes stress tests with a 2% margin (plus or minus) as part of assessing the effects of interest rate changes on relevant aspects of the banking sector and the economy.

Key Takeaways

- The economic value of equity is a fairly useful representation of the change in an entity’s equity due to changing interest rates. It gives organizations, particularly banks, a picture of the market value of their equity.

- The economic value of equity model is complex. It may work well for some financial instruments, but other indicators may be needed to understand future risk and cash flow positions better.

- Assessing the EVE at regular intervals is mandatory per the rules and regulations of various banking and financial regulators. The Federal Reserve is the governing body for such matters in the US.

Economic Value Of Equity Explained

The economic value of equity is a financial measure and a long-term economic indicator of the future expected cash flows of a company, bank, or financial institution. Banks and financial institutions measure this parameter to evaluate how interest rate changes are likely to affect their equity. Banks investigate risk exposure and streamline functions like asset liability management (ALM), liquidity management, hedging, compliance, etc., using EVE.

Per the economic value of equity model, the current market value of assets and liabilities is directly related to interest rates. It means the value varies with interest rate changes. Most entities consider EVE a form of risk analysis. Businesses make strategic plans based on certain estimations and projections, and EVE is one of them. Banks and financial institutions can initiate suitable measures to mitigate investment, capital, and interest rate risks based on the EVE numbers.

The economic value of equity sensitivity analysis helps banks and financial institutions precisely understand the changes prompted or triggered by interest rates. This study makes equity calculations easy. Positive values signal profitable investment, while negative values may indicate adverse effects in a given period. Based on this computation, banks formulate new strategies or revise existing ones to ensure effective asset liability management. They make the necessary adjustments to insulate operations, and consequently, equity, from interest rate variations.

For a bank, a low EVE figure typically means its equity is highly sensitive to interest rate changes. Simply put, it determines the future financial stability of a company or bank based on its sensitivity to interest rate fluctuations.

How To Calculate?

Here is the economic value of the equity formula.

Economic Value of Equity (EVE) = ∆Present Value of Assets – ∆Present Value of Liabilities

Where,

∆Present Value of Assets = Current or present value of all asset cash flows

∆Present Value of Liabilities = Current or present value of all liability cash flows

Using this formula, executing activities like capital planning, capital erosion analysis, risk management, statutory compliance handling, and strategic decision-making is possible.

Examples

Below are two examples of the economic value of equity.

Example #1

Assume ABC Bank, a local traditional bank, with a reasonable reserve, assets, and financial products operates in a small town. It assesses the EVE regularly. A financial crisis hits, triggering an economic slowdown. People stop depositing cash in the bank, and the interest rates are constantly fluctuating.

The banking sector is now in trouble. ABC Bank undertakes financial and operational reviews and checks the EVE to understand its risk exposure. The bank studies the economic value of equity calculation. When ABC Bank’s asset cash flows are subtracted from its liability cash flows, a positive value is returned. This positive net present value (NPV) indicates adequate financial stability, holding the power to mitigate future risk exposure.

Example #2

The fall of Silicon Valley Bank has been analyzed in a recent Forbes article. The many adverse indicators, which were largely ignored, have been highlighted in this article. The failure to recognize the dire situation has been called a governance crisis. Around six major points, including the bank's assets and liabilities position, the held-to-maturity securities (HTM), and loans, among other things, have been questioned. Per reports, SVB was functionally bankrupt by July 31, 2022.

Among these, the economic value of equity was a major indicator. SVB records state that EVE sensitivity was observed over a period, but concrete action was not initiated to correct the situation. By December 2021, the EVE was expected to fall by 27% (an approximate change of $5.7 billion) if interest rates rose by 200 bps. The long-term 10-year treasury rate was 1.89% in December and closed at 3.76% in March 2023.

All the parameters, including EVE, seem to have been left unacknowledged in this case. The failure of SVB is considered among the biggest crises in recent banking history.

Importance

The importance of the economic value of equity has been discussed below:

- It is a long-term risk indicator that helps calculate the interest rate risk exposure, helping entities finalize finance and investment activities.

- It helps banks implement, monitor, and modify the asset liability management (ALM) structure and optimize profits and overall profitability.

- The EVE is a long-term measure, providing substantial data for long-term business planning and decision-making.

- When a firm computes and studies its economic value of equity, it can outline its potential financial capacities and future risk appetite.

- When an entity understands its future risks and the financial stability attainable at a given point, risk mitigation measures can be initiated in anticipation of negative impacts. This is especially true for banks and financial institutions looking to combat possible interest rate fluctuations.

Limitations

The limitations of EVE are:

- The EVE or NPV of financial instruments other than bonds cannot be calculated as they may have no maturity date and stay active for an uncertain period.

- It only determines the expected cash flows based on which a company is required to apply other metrics to assess the risk and potential financial loss.

- The economic value of equity calculation is based on current assets and liabilities cash flow value. However, internal or external factors and global market conditions can influence future cash flows, which are typically ignored during the analysis.

- Interest rate fluctuations pertaining to complex financial instruments or concepts cannot be easily calculated using the EVE method. This shortfall increases the scope for subjective judgment and interpretation.