Table Of Contents

What Is Economic Value Added?

Economic value added (EVA) refers to the surplus value created on a given investment. It measures the actual profit that the firms make, which is calculated by finding out the difference between the operating profit and the cost of capital. This EVA is computed after the resultant is adjusted for the applicable taxes.

Being the profit that indicates the actual gain of a firm over a period, it is also known as the economic profit. EVA helps management to identify their loopholes, if any, and investors in making better and more informed investment decisions.

Economic Value Added (EVA) Explained

Economic value added (EVA) is the economic profit by the company in a given period. It measures the company's financial performance based on the residual wealth calculated by deducting its cost of capital from its operating profit, adjusted for taxes on a cash basis.

It helps to capture the true economic profit of a company like we calculated the Economic Value Added of investing gold in the above. The Economic Value Added example was developed and trademarked by Stern Stewart and Co. as an internal financial performance measure.

Based on the resulting EVA, a firm’s management makes relevant improvements for future growth and progress. In addition, it also becomes a metric that helps investors understand the actual position of the company so that they can decide whether to invest in it or not.

Formula

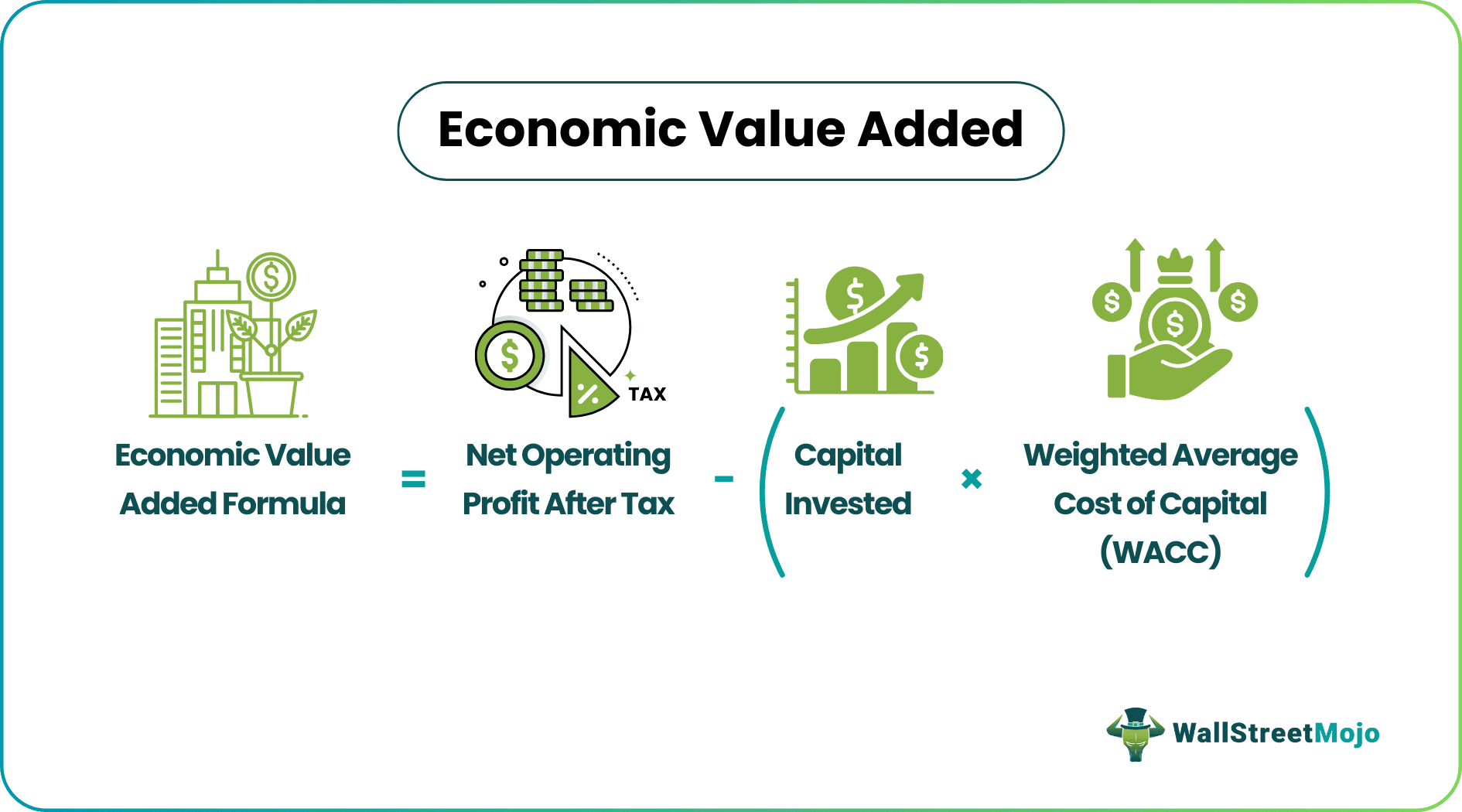

The economic profit of a firm can be calculated with the help of the following economic value added equation:

Economic Value Added EVA formula= Net Operating Profit After Tax - (Capital Invested x WACC)

How To Calculate?

To understand how to calculate the EVA, it is necessary that one knows of the elements that comprise its equation. The three main components of Economic Value Added (EVA) are:

- Net Operating Profit After Tax, which indicates the theoretical income with no debt or tax obligations to bear.

- Capital Invested, which signifies the fund firms raised by issuing securities to investors.

- Weighted Average Cost of Capital (WACC), which is the money that is spent to maintain resources and finances for operations.

Here, Capital Invested x WACC stands for the cost of capital. This cost is deducted from the Net Operating Profit After Tax to arrive at the organization's economic profit or residual wealth.

Examples

Let us consider the following examples to understand the economic value added meaning in more detail:

Example #1

Let us say, gold seems to be a good instrument to invest in with a high-profit margin.

- Total investment (i.e., price at which gold is purchased) = $ 1000

- Brokerage paid to the dealer for the purchase of gold = $ 15

I want to sell off the gold during a liquidity crunch in a year.

- The selling price of gold = $ 1200

- Brokerage paid to the dealer on sale of gold = $ 10

In the above Economic Value Added example,

- Economic Value Added = Selling price – Expenses associated with selling the asset – Purchase price – Expenses associated with buying the asset

- Economic Value Added = $ 1200 - $ 10 - $ 1000 - $ 15 = $ 175

If we see the profit, then the profit on selling gold was $ 1200 – $ 1000, i.e., $ 200. But the actual creation of wealth is only $ 175 on account of expenses incurred. So this is a very crude example of Economic Value Added (EVA).

Example #2 - Net Operating Profit After Tax (NOPAT)

This represents how much the company's potential cash earnings will be without its capital cost. Therefore, it is important to deduct tax from the Operating Profit to arrive at the true operating inflow that a company will earn.

NOPAT = Operating Income x (1 - Tax Rate).

EVA Example for calculating Net Operating Income After Tax is as follows:

ABC Company

Abstract of the Revenue Statement

| Particulars | 2016 | 2015 |

|---|---|---|

| Revenue: | ||

| Project Advisory Fees | $ 2,00,000 | $ 1,86,000 |

| Total Revenue (A) | $ 2,00,000 | $ 1,86,000 |

| Expenses: | ||

| Direct Expenses | $ 1,00,000 | $ 95,000 |

| Total Operating Expenses (B) | $ 1,00,000 | $ 95,000 |

| Operating Income (C = A minus B) | $ 1,00,000 | $ 91,000 |

| Tax Rate | 30% | 30% |

| Tax on operating income (D = C * Tax Rate) | $ 30,000 | $ 27,300 |

| Net Operating Income After Tax (C minus D) | $ 70,000 | $ 63,700 |

Example #3 - Capital Invested

This represents the total capital invested through equity or debt in a company.

Continuing with the above EVA example of ABC Company, let us say the company has invested $ 30,000. $ 20,000 is through equity funding, and the rest ($ 10,000) uses long term debt.

Also, have a look at Return on Invested Capital Ratio

Example #4 - WACC

The weighted Average Cost of Capital is the cost the company incurs for sourcing its funds. The importance of deducting the cost of capital from the Net Operating Profit is to deduct the opportunity cost of the capital invested. The formula to calculate the same is as follows:

WACC = RD (1- Tc )*( D / V )+ RE *( E / V )

The formula looks complicated and scary, but it is fairly simple if understood. It is much easier if the formula is put in words as follows:

Weighted Average Cost of Capital = (Cost of Debt) * (1 – Tax Rate) * (Proportion of debt) + (Cost of Equity) * (Proportion of equity)

This makes the formula easier to understand and also self-explanatory.

Now, understanding the notations of the formula:

- RD = Cost of Debt

- Tc = Tax Rate

- D = Capital invested in the organization through Debt.

- V = Total Value of the firm simply calculated as Debt + Equity.

- RE = Cost of Equity

- E = Capital invested in the organization through Equity

An important point to note about this formula is that the Cost of Debt is multiplied by (1 – Tax Rate) as there is tax saving on interest paid on debt. On the other hand, there is no tax saving on the cost of equity, and hence the tax rate is not taken into account.

Let us now look at how WACC is calculated.

ABC Company

| Particulars | 2016 | 2015 |

|---|---|---|

| Equity | $20,000 | $17,000 |

| Debt | $10,000 | $ 7,000 |

| Sources of Funds (A) | $30,000 | $24,000 |

| Fixed Assets | $20,000 | $18,000 |

| Current Assets | $20,000 | $16,000 |

| Less: Current Liabilities | $10,000 | $10,000 |

| Uses of Funds (B) | $30,000 | $24,000 |

| Cost of Debt | 8% | 8% |

| Cost of Equity | 10% | 12% |

WACC for the year 2016

- = 8% * (1- 30%) * ($ 10,000 / $ 30,000) + 10% * ($ 20,000 / $ 30,000)

- = (8% * 70% * 1/3) + (10% * 2/3) = 1.867% + 6.667% = = 8.53%

WACC for the year 2015

- = 8% * (1- 30%) * ($ 7,000 / $ 24,000) + 12% * ($ 17,000 / $ 24,000)

- = (8% * 70% * 7/24) + (10% * 17/24) = 1.63% + 8.50% = 10.13%

Example #5 - Calculation

From the above, we have all three factors ready for Economic Value Added calculation for 2016 and 2015.

Economic Value Added (EVA) for the year 2016 = Net Operating Profit After Tax - (Capital Invested * WACC)

- = $ 70,000 – ($ 30,000 * 8.53%)

- = $ 70,000 - $ 2,559 = = $ 67,441

Economic Value Added (EVA) for the year 2015 = Net Operating Profit After Tax - (Capital Invested * WACC)

- = $ 63,700 – ($ 24,000 * 10.13%)

- = $ 63,700 - $ 2,432 = = $ 61,268

Example #6 - Calculating Colgate's NOPAT

Let us have a look at the Income Statement of Colgate.

source: Colgate SEC Filings

- The operating Profit of Colgate in 2016 is $3,837 million

The operating profit above does contain noncash items like Depreciation and Amortization, Restructuring costs, etc.

In our EVA example, we aIn our EVA example, we assume that the book depreciation and economic depreciation are the same for Colgate, and hence, no adjustment is needed when calculating NOPAT.

However, restructuring cost needs to be adjusted for. Below is the snapshot of Colgate's restructuring costs from its Form 10K.

- Colgate's restructuring charges in 2016 = $228 million

Adjusted Operating Profit = Operating Profit + Restrucutring Expenses

- Adjusted Operating Profit (2016) = $3,837 million + $228 million = $4,065 million

For calculating NOPAT, we required the tax rates.

We can calculate the effective tax rates from the income statement below.

source: Colgate SEC Filings

Effective Tax rate = Provision for Income Taxes / Income Before income taxes

- Effective tax rate (2016) = $1,152/$3,738 = 30.82%

NOPAT = Adjusted Operating Profit x (1-tax rate)

- NOPAT (2016) = $4,065 million x (1-0.3082) = $2,812 million

Also, check out an article on Non-recurring items

Example #7 - Colgate's Invested Capital

Let us now calculate the second item required for calculating Economic Value Added, i.e., Invested Capital.

source: Colgate SEC Filings

Invested capital represents the actual debt and equity invested in the company.

Total Debt = Notes and Loan Payable + Current Portion of Long-Term Debt + Long Term Debt

- Total Debt (2016) = $13 + $0 + $6,520 = $6,533 million

source: Colgate SEC Filings

Adjusted Equity = Colgate Shareholders Equity + Net Deferred tax + Non Controlling Interest + Accumulated Other comprehensive (income) loss

- Adjusted Equity (2016) = -$243 + $55 + $260 + $4,180 = $4,252 million

Colgate's Invested Capital (2016) = Debt (2016) + Adjusted Equity (2016)

- Colgate's Invested Capital (2016) = $6,533 million + $4,252 million = $10,785 million

Example #8 - Find WACC of Colgate

We note above that Colgate's number of shares = 882.85 million

Current Market Price of Colgate = $72.48 (as of closing 15th September 2017)

Market value of equity of Colgate = 72.48 x 882.85 = $63,989 million

As we have earlier noted,

Total Debt = Notes and Loan Payable + Current Portion of Long-Term Debt + Long Term Debt

- Total Debt (2016) = $13 + $0 + $6,520 = $6,533 million

Let us now find the cost of equity of Colgate using CAPM model

- Ke = Rf + (Rm – Rf) x Beta

We note from below that the risk-free rate is 2.17%

source – bankrate.com

For the United States, Equity Risk Premium is 6.25%.

source – stern.nyu.edu

Let us look at the Beta of Colgate. We note that Colgate's Beta has increased over the years. It is currently 0.805.

source: ycharts

Also, check out the article on CAPM Beta Calculation

- Cost of Equity = 2.17% + 6.25% x 0.805

- Cost of Equity of Colgate = 7.2%

- Interest Expense (2016) = $99

- Total Debt (2016) = $13 + $0 + $6,520 = $6,533 million

- Effective Interest Rate (2016) = $99/6533 = 1.52%

Let us now calculate WACC

- Market Value of Equity = $63,989 million

- Value of Debt = $6,533 million

- Cost of Equity = 7.20%

- Cost of Debt = 1.52%

- Tax rate = 30.82%

WACC = E/V * Ke + D/V * Kd * (1 – Tax Rate)

WACC = (63,989/(63,989+6,533)) x 7.20% + (6,533 /(63,989+6,533)) x 1.52% x (1-0.3082)

WACC = 6.63%

Example #9 - Colgate's Economic Value Added EVA Calculation

Economic Value Added formula= Net Operating Profit After Tax - (Capital Invested x WACC)

- Colgate's NOPAT (2016) = $4,065 million x (1-0.3082) = $2,812 million

- Colgate's Invested Capital (2016) = $6,533 million + $4,252 million = $10,785 million

- Economic Value Added (Colgate) = $2,812 million - $10,785 million x 6.63%

- Economic value added = $2097 million

Accounting Adjustments

Now since we have understood the basics of EVA calculation, let us go a bit further to understand what can be some of the real-life accounting adjustment involved, especially at the Operating Profit level:

| Sr. No. | Adjustment | Explanation | Changes to Net Operating Profit | Changes to Capital Employed |

|---|---|---|---|---|

| 1 | Long-term expenses | There are certain expenses that can be classified as long-term expenses such as research and development, branding of a new product, re-branding of old products. These expenses may be incurred in a given period of time but generally have an effect over and above a given year. These expenses should be capitalized while EVA calculation as they generate wealth over a period of time and not just reduce profit in a given year. | Add to Net Operating Profit | Add to Capital Employed. Also, check out Return on Capital Employed |

| 2 | Depreciation | Let us categorize depreciation as accounting depreciation and economic depreciation for the purpose of understanding. Accounting depreciation is one which is calculated as per Accounting policies and procedures. In contrast, economic depreciation is one that takes into account the true wear and tear of the assets and should be calculated as per the usage of assets rather than a fixed useful life. | Add accounting depreciation Reduce economic depreciation | The difference in the value of accounting depreciation and economic depreciation should be adjusted from the capital employed |

| 3 | Non-cash expenses | These are expenses that do not affect the cash flow of a given period. EVA Example: Foreign exchange contracts are reported at fair value as on the reporting date. Any loss incurred is charged to the Income Statement. This loss does not lead to any cash outflow and should be added back to the Net Operating Profit. | Add to Net Operating Profit | Add to capital employed by adding it to Retained Earnings |

| 4 | Non-cash incomes | Similar to non-cash expenses, there are non-cash incomes which do not affect the cash flow of a given period. These should be subtracted from the Net Operating Profit. | Subtract from Net Operating Profit | Subtract from capital employed by subtracting it from Retained Earnings |

| 5 | Provisions | To arrive at accounting profits, numerous provisions are created, such as deferred tax provisions, provision for doubtful debts, provision for expenses, allowance for obsolete inventory, etc. These are provisional figures and do not actually affect the economic profit. In fact, these provisions are generally reversed on the first day of the next reporting period. | Add to Net Operating Profit | Add to capital employed |

| 6 | Taxes | Tax should also be calculated on actual cash outflow rather than the mercantile system where all accruals are taken into account, and only then tax is deducted. | Tax is supposed to be deducted after calculating Net Operating Profit. So it is directly deducted, and no other adjustments are required. |

Importance

The very basic objective of every business is to maximize shareholder value. Therefore, the investor is the key stakeholder around which all business activities are focused.

The key factors which are important while maximizing shareholder value are:

- Wealth maximization is more important as compared to profit maximization. There is a difference between the two. Wealth Maximization aims to accelerate the worth of the organization as a whole. Maximizing profit can be said to be a subset of maximizing wealth. EVA focuses on wealth creation.

- Economic Value Added (EVA) considers the Weighted Average Cost of Capital. It goes with the logic that it is important to cover the cost of equity and not just the interest portion of the debt.

- Organizations tend to focus on profits and ignore the cash flow. This often leads to a liquidity crunch and can also lead to bankruptcy. Economic Value Added (EVA) focuses on cash flows more than profits.

- Taking the Weighted Average Cost of Capital takes into account both short-term as well as long-term perspectives.

Advantages And Disadvantages

Like any other financial ratio/indicator, even Economic Value Added (EVA) has advantages and disadvantages. So let us have a look at the basic pointers for the same.

Advantages

- As discussed above, it helps to give a clear picture of wealth creation compared to other financial measures used for analysis. It considers all costs, including the opportunity cost of equity, and it does not stick to accounting profits.

- It is comparatively simple to understand.

- EVA can also be calculated for different divisions, projects, etc., and the appropriate investment decisions can be taken for the same

- It also helps to develop a relationship between the use of capital and Net Operating Profit. This can be analyzed to make the most out of opportunities and make appropriate improvements wherever necessary.

Disadvantages

- There are a lot of assumptions involved in calculating the Weighted Average Cost of Capital. It is not easy to calculate the cost of equity, which is a key aspect of WACC. On account of this, there are chances that EVA itself can be perceived as different for the same organization and the same period. In the above Economic Value Added example, the cost of equity has changed from the year 2015 to the year 2016. This can be one of the major factors due to a decrease in EVA.

- Apart from the WACC, other adjustments are also required to the Net Operating Profit After Tax. All noncash expenses need to be adjusted. This becomes difficult in the case of an organization with multiple business units and subsidiaries.

- A comparative analysis is difficult with Economic Value Added (EVA) on account of the underlying assumptions of WACC.

- EVA is calculated on historical data, and future predictions are difficult.

Economic Value Added vs Residual Income

Though both concepts get its foundation from economic profit concept, they are considered similar. However, there are certain differences between EVA and residual income that one must know of, be it a firm or investor.

Let us have a quick look at some of the differences between them:

- EVA calculates the asset utilization on the basis of net operating profit after tax, while the residual income computes the assets utilized based on the net operating profit.

- Residual income is considered more effective than EVA as the latter is obtained after tax adjustments.

- The residual income is the income calculated using the net operating profit before tax, while the EVA is calculated using the net operating profit after tax.