Table of Contents

What Are Economic Trends?

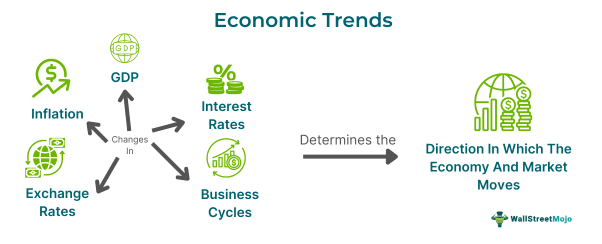

Economic trends refer to the patterns that determine the direction in which the economies or markets are moving over the period. Such movements can be upwards, downwards, or sideways. These macroeconomic changes can be gauged through the changes in employment level, inflation, GDP, and other indicators.

Analyzing these trends can help individuals and businesses discover potential opportunities, prepare for unfavorable circumstances, strategically plan their course of action, and make sensible business and investment decisions. In the era of globalization, tracking the world's economic trends—especially US economic trends—is crucial for international companies to understand global trade and economic

scenarios and respond effectively to shifts in major markets.

Key Takeaways

- Economic trends refer to the pattern of market movement over a period determined by various economic indicators.

- Such movements can be directed upwards, downwards, or sideways.

- The latest economic trends in 2024 worldwide include a potential labor shortage, a decline in Fed interest rates,

- moderate growth of the real estate sector, an increasing consumer confidence index, and rapid economic growth.

- Some of the ways to identify economic trends are economic indicators, economic environment, stock market trends, interest rate fluctuation, news updates, and expert opinions.

Economic Trends Explained

Economic trends are the identified patterns in the markets and economies, whether upwards, downwards, or sideways. It is a scale to gauge the financial performance of a nation or the world over a period. Business organizations and entrepreneurs strategically plan their business operations after analyzing the macroeconomic climate. Moreover, investors and traders use the anticipated economic trend data to decide their financial market strategies.

Some of the prominent trends include:

- Inflation: The rise in general price levels of the goods and services in an economy over the period determines the scope of profitability for establishing businesses in such areas.

- Economic Indicators: Economic indicators like inflation rates, unemployment rates, gross domestic product (GDP), and consumer confidence index (CCI) help to understand macroeconomic trends.

- Interest Rates: The bank interest rates, including interest on loans and borrowings, interest on deposits, etc., reflect the economic climate of a nation.

- Business Cycle: Many of the business decisions, like investment, inventory, supply, and workforce, rely upon the type of business and economic cycles.

- Exchange Rates: The import-export industry players often look out for the economic outlook of exchange rates and their impact on the business.

However, one must understand these trends are mere assumptions of future outlook based on past market performance. Moreover, short-term fluctuations in a rapidly changing economic scenario need to be considered. Therefore, it is crucial to consider the other economic factors along with these trends for robust decision-making.

How To Identify?

An understanding of the current and potential micro and macroeconomic trends is crucial for individuals, investors, businesses, economists, and stock market players to make informed financial decisions. However, it is tricky to find out the recent economic trends; mentioned below are some of the ways to do so:

- Analyzing Stock Market Trends: The financial market movements and trends reflect an economy's health and the market sentiments that shape the overall economic outlook.

- Scanning Economic Environment: The best way to identify the macroeconomic trends is through the screening of the external factors that influence the economy, i.e., legal, political, technological, social, environmental, and ethical concerns.

- Using Economic Indicators: The various economic measures, such as the gross domestic product (GDP), income level, unemployment rate, inflation rate, consumer confidence index (CCI), etc., determine the economic condition of a nation.

- Being Updated With Business and Economic News: The national and international conditions, incidents, and events that affect the economies or businesses can positively or negatively influence the economic outlook. Therefore, following such updates becomes critical for trend analysis.

- Gauging Interest Rates Changes: The interest rates serve as a monetary policy tool in the hands of the central bank. Therefore, figuring out the reasons behind their fluctuation can help to get an idea about the current economic trends.

- Taking Expert Opinions: Market experts and economists are in deep waters when it comes to global economic trends. Therefore, it is often advisable to consider their views and advice on the latest economic trends in business and investments.

10 Top Economic Trends

Talking about these trends in 2024 will shape a bigger picture of global business, investment, and policymaking. Let us discuss the top 10 global economic trends of 2024 and 2025 below:

- The real estate sector has shown moderate growth due to limited inventory and high existing mortgage rates. The sector shows a 4.4% annual growth, while the home's average sales price at 2023's end was $382,600.

- The Federal Reserve is expected to curtail the interest rates throughout 2024, anticipating a continuous decline in the inflation rate.

- The labor market, especially the childcare industry, would still face tremendous labor shortages, while in January 2024, only 6.1 million workers were available for 9 million job openings.

- Although the consumer confidence index shows a higher consumer confidence in the market, their spending capacity can be compromised due to increasing household debt.

- The creator economy is experiencing rapid growth, driven by brand investments and consumer purchases on social media platforms, with projections to reach $480 billion by 2027.

- Generative AI is expected to have a transformative influence over the economy, improving productivity and efficiency in various sectors and potentially adding $15.7 trillion to the global economy by 2030.

- The baby boomers would face inadequate retirement savings and rising healthcare costs, while Gen Z struggles with student debt and financial concerns, affecting their economic behaviors and prospects.

- As climate-related disasters increase, there is a risk of significant economic damage, with high recovery and insurance costs, which potentially impact global GDP forecasts.

- Also, significant investments in renewable energy are expected as part of climate change mitigation efforts, which could boost global GDP over time.

- The rising geopolitical tensions, especially in the Middle East and Eastern Europe, pose threats to global GDP growth and could lead to higher inflation and disruptions in energy markets.

Examples

Over the period, these trends have changed, fostering new opportunities and challenges for people, business entities, and societies. Some of its relevant cases are discussed below:

Example #1

Suppose a developing nation marks a GDP growth of 3.9%, 4.6%, and 5.1% between 2021 and 2023. Also, the unemployment rate decreased by 7.3% in the three years. This indicates an upward current economic trend with an increase in job opportunities and income prospects for the people. The improving economic outlook can be accredited to various government measures such as tax relief and grants to domestic business entities and SMEs.

Example #2

In 2023, China encountered significant concerns due to the recent economic trends 2023, including a real estate crisis, which resulted in declining consumer confidence, deflation, and a surge in youth unemployment. Despite these challenges, the IMF forecasts a growth rate of 5.4% in 2023, while it dropped to 4.6% in 2024.

The real estate sector, contributing roughly 30% to GDP, faces risks, with potential zero growth by 2027 if the bubble bursts—Moody's revised China's credit rating outlook to negative amid concerns about bailouts and government support. Also, the foreign investment went negative in 2023 for the first time on record.

Simultaneously, youth unemployment peaked at 21% in June 2023. Thus, consumer confidence dropped, impacting retail sales growth below projections. Moreover, deflation worsened, with the consumer price index falling 0.5% in November 2023.

Importance

The analysis of these trends is crucial for the success of a business and the growth of individuals in society. Let us now discuss its significance:

- Capitalize On Market Opportunities: The economic trends in the business help entrepreneurs and investors identify potential emerging markets for investment. It can be gauged through industrial growth rate, consumer price index, etc.

- Informed Decision Making: Investors and traders often analyze the future economic outlook to determine the stability and return potential from investing in a particular market or economy. Also, the business uses such insights to make financial, human resource, supply chain, and inventory decisions.

- Facilitates Risk Analysis and Management: These trends aid in anticipating and dealing with potential external threats and challenges such as customs duty, taxes, trade barriers, and import-export restrictions.

- Decide Future Course Of Action: The businesses can plan their future steps and develop contingent plans to face upcoming situations.

- Identify Economic Stability: Investors and businesses often look for stable economies and markets to derive high profits with low risk-taking. Therefore, such an analysis facilitates investors in finding growing economies with untapped potential.