Table Of Contents

Economic Equality Definition

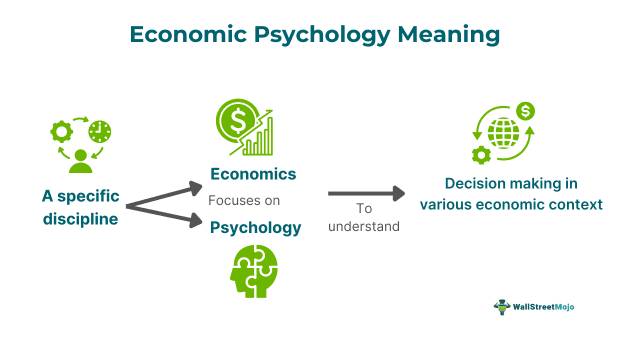

Economic psychology is the study of the impact of an economy on individuals and vice versa. It is an interdisciplinary branch of science that blends economics and psychology, an attempt to study people's decision-making processes in an economic context.

The concept explores central aspects of the decision-making process undertaken by adults. The aspects covered are based on the values, effects, and risks of decisions. This is of great importance in today's world as more and more people are empowered to make economic decisions. This is relevant to both personal and household economic decisions.

What Is Economic Psychology?

Key Takeaways

- Economic psychology is a branch of study that involves the study of the effect of decision-making of individuals in the economy and the economy on the individual.

- It focuses on the values, effects, and risks that affect individual choices. Furthermore, it provides insights into individuals' perceptions and responses to an economic event.

- The study unveils cognitive and emotional biases to understand the decision-making process, as they are considered deviations from individual goals. It further helps in correcting them and making them logical choices.

- It is different from behavioral economics, a study in the field of psychology that attempts to study people's economic decisions.

Economic Psychology Explained

Economic psychology is a discipline in science that aims to study how people make decisions in various economic contexts. This includes spending, saving, investing, and borrowing. It further delves into individual perceptions and their responses to economic elements. These include prices, risks, incentives, and uncertainties. This study helps us understand the psychological factors that influence an individual's financial behavior. These factors include attitudes, beliefs, values, emotions, goals, and intertemporal choice theories. It unveils the biases (cognitive and emotional) that impact decision-making processes. These biases are considered deviations from logic or rationality through distortion of processing information, evaluation of alternatives, and making decisions.

This is because economic decisions are impacted by the institutional settings in which they were conceived. Hence, it can be concluded that the adaptation process depends on the environment, and the branch of study helps in understanding it.

Understanding the subject helps identify biases and correct them. It also helps strategically deal with them through framing, feedback, and diversification, which improve decision quality. On an individual level, it helps understand the motivating factors for achieving financial goals. These factors can be applied to debt repayment and retirement plans. Thus, it helps in effective goal setting and efficient processing.

Examples

Let us look at some of the examples to understand the concept better.

Example #1

Imagine the case of a researcher who studies the habits of a designated population. These findings will help the researcher understand what to do in the future to advance the ideas.

Mr. B is a researcher who wants to understand the buying behavior of a small town in the USA. The town has inhabitants who are not associated with technology much. He wants to know if there is confirmation bias among the people. They tend to stick to traditional ways that confirm their existing beliefs. Since they believe in the danger of digital payments, they miss out on the convenience. Understanding their thoughts would help him strategically introduce technology in the town. He could use workshops to influence people on an individual level and motivate them to use technology for the achievement of their goals.

Example #2

A publication by Erich Kirchler and Kathrina Gangl, Introduction to Research Agenda for the Dimension of Economic Psychology, discusses the concept in detail.

It talks about how the study is a perception and gives insights into economic phenomena, financial decision-making behavior, etc. It highlights the facts, such as the introduction of the term "economic psychology" by Gabriel Tarde. The concept was pushed to be on independent research fields from the Journal of Economic Psychology's foundation. The Journal seeds were sown in 1981.

It mentions that the research in the fields was initially done to understand the human decision-making method and the development of applied research fields around consumption. The study has now expanded into a broader sense from its early days of research.

Economic Psychology vs Behavioral Economics

| Parameters | Economic Psychology | Behavioral Economics |

Concept

| It is a discipline that studies the psychological mechanisms of an individual's underlying economic behavior. | A study in the field of psychology that attempts to study the economic decisions people make. |

| Elements dealt with | Elements dealt with include judgments, choices, preferences, economic interaction, and related factors. | It helps in understanding why people make certain choices and deviate from rational choices. It studies what influences people and the changes needed to persuade them. The factors dealt with here are bounded rationality, herd mentality, choice architecture, etc. |

| Purpose | This discipline studies individuals' behaviors and decisions, including their impact on inflation, taxation, economic development, unemployment, consumer information, etc. | It also studies how different types of information impact people's decision-making. It delves into how individual cognitive barriers and biases affect socioeconomic and political outcomes. |