Table Of Contents

What Are Economic Indicators?

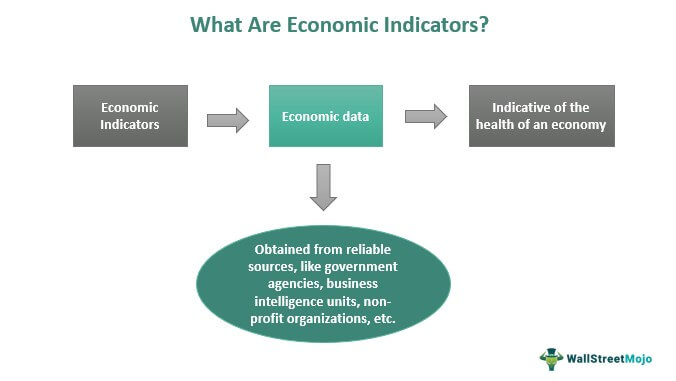

Economic indicators are datasets or statistical representations of details that help indicate and assess the economic health of any nation. Knowing about these determinants or key economic indicators helps individuals, analysts, and entities make more informative and wiser investment decisions, given the direction towards which an economy seems to move.

These data are collected by government organizations, non-profit firms, or other business intelligence entities through the surveys and research that they conduct from time to time. The economic indicators not only help evaluate the health of one economy but also lets analysts understand its effect on a global scale. This is what makes studying these determinants even more critical.

- Economic indicators are determinants or financial data that indicate the direction of movement of an economy, thereby helping investors decide whether it is the right time to invest or better to wait.

- The data is collected from reliable sources, including government bodies, business intelligence agencies, etc.

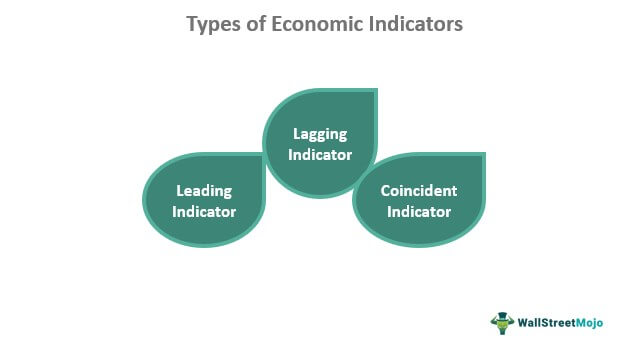

- Leading, lagging, and coincident indicators are three economic indicators that help understand the health of an economy.

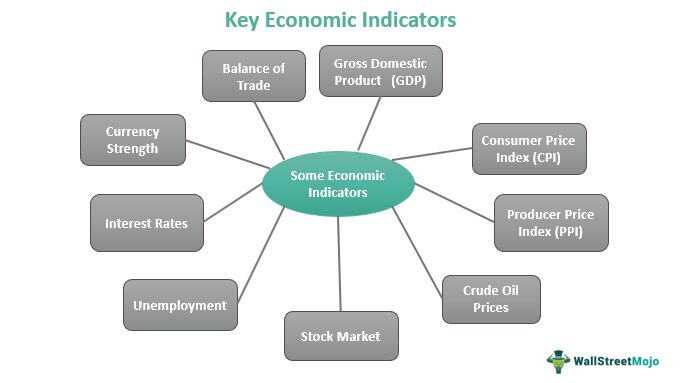

- Some such indicators are Gross Domestic Product (GDP), unemployment rate, crude oil prices, Consumer Price Index (CPI), Gross National Product (GNP), interest rates, share prices, etc.

Economic Indicators Explained

Economic indicators enable analysts to evaluate the overall health of an economy. The size of the economy changes from time to time, given the goods and services produced and consumed by the population. These indicators reflect those changes to track if the economy is growing or contracting over time.

Investors focus on these determinants to decide whether it is a good time to invest. The economic data comes from multiple reliable sources, helping analysts understand where a nation's economy is moving. While the System of National Accounts (SNA) has an integrated system of accounts that allows users to compare economic activities and progress per international standards, the Balance of Payments (BOP) keeps a check on the overseas transactions of an economy. In addition, Government Finance Statistics deals with the income and expenditure records with the Monetary and Financial Statistics, providing a compilation guide.

The macro economic indicators that help analysts evaluate the economic condition of a nation include the Gross Domestic Product (GDP), the Consumer Price Index (CPI), the Producer Price Index (PPI), unemployment, the stock market, crude oil prices, interest rates, Balance of Trade, currency strength, etc. These indicators not only give a clue about the growing or contracting economy of a nation but also indicate the extent to which the global economy would be affected.

Purpose

The key economic indicators of development help assess the pace of growth of an economy. In addition, they indicate the contraction rate if the growth is in the negative direction. If the determinants reflect the future changes, it helps investors decide if it's the right time to select a security to invest in or take a trade.

On the other hand, if the indicators run parallelly, they allow analysts to make preparations before the situation worsens. However, sometimes, they indicate the changes that have already occurred in the economy. In that case, the information helps track and identify specific patterns so that the economy remains prepared for the next time such events occur.

Most Important Indicators

Let us understand the most important micro and macro economic indicators.These depict the health, performance, and stability of an economy. Let us understand them through the explanation below.

- Gross Domestic Product (GDP): Measures the total value of goods and services produced within a country's borders, indicating the overall health of the economy.

- Unemployment Rate: Reflects the percentage of the labor force actively seeking employment but currently unemployed, serving as a key indicator of job market conditions.

- Inflation Rate: Tracks the percentage increase in the general price level of goods and services over time, impacting consumer purchasing power and overall economic stability.

- Consumer Price Index (CPI): Measures changes in the average prices paid by consumers for a basket of goods and services, providing insight into inflation trends.

- Retail Sales: Indicates the total revenue of retail establishments, serving as a gauge of consumer spending patterns and economic activity.

- Stock Market Indices: Benchmarks like the S&P 500 or Dow Jones Industrial Average offer insights into overall market sentiment and investor confidence.

Video Explanation of Economic Indicators

Types

Key economic indicators are of three types – leading, lagging, and coincident. Leading indicators are those that indicate the changes that are about to hit an economy. As the changes regarding the progress or deterioration in the economy are predicted, analysts utilize the derived information to spread further and allow individuals and entities to make decisions. For example, the yield curve, new business formations, and share prices are some of the leading indicators.

Lagging economic indicators come to notice when the economy is already affected. These determinants might not alert individuals and entities beforehand, but they help them to assess and identify the pattern so that they are careful in similar events the next time. For example, the unemployment rate indicates the changes that have already affected the economy.

Coincident indicators are the factors that reflect the changes in the economy parallelly. It means these determinants change with the changes in the economy, signaling growth or contraction as and when it happens. GDP moves in the direction of the economy. Hence, it is considered a coincident economic indicator.

Examples

Let us consider the following micro and macro economic indicators to check how the whole concept works in the practical sense through the examples below.

Example #1

GDP refers to the dollar value of the goods and services a nation produces. The movement of the GDP and economy follows the same direction. This means if the former increase, the latter grows, and vice-versa. When the GDP witnesses a plunge, it indicates a decrease in the prices of the products and services manufactured and delivered. This deterioration affects the stock market, which reflects the performance of the companies via their stocks.

When the prices of goods and services reduce, it incurs losses for the brands, affecting the stock price movements. This, in turn, not only affects one economy but also impacts the global economy significantly.

Example #2

The rise and fall in the unemployment rate also mark the changes in the economy. When there are job losses or lack of employment, it automatically indicates that the economy has been suffering turmoil for quite a long time before leading to an employment crash.

However, being a lagging economic indicator, it might not give an economy a chance to prepare, but it helps to identify patterns leading to such situations. As a result, the analysts remain alert and are ready in case the same events occur again in the future.

Frequently Asked Questions (FAQs)

Leading indicators, as the name suggests, show economic growth or contraction. This means that these determinants predict the changes in the economy, letting analysts prepare for the good and bad situations ahead. Some examples of leading indicators are manufacturing or building activities, stock prices, yield curves, etc.

Global Purchasing Managers' Index (PMI), US employment, consumer spending, exports, personal consumption expenditures, Euro-Area inflation, etc., are some indicators that help measure the global economy.

Economic indicators help assess the macroeconomic performance and stability of an economy or the world. The analysts, using these indicators, come to know of the past and future economic turmoil and accordingly identify patterns and make preparations to avoid the same to whatever extent possible.

Recommended Articles

This has been a guide to what are Economic Indicators and definition. Here, we explain their role, types, and purpose, along with examples. You may learn more from the following articles -