Table Of Contents

What Is Economic Data?

Economic data refers to quantitative measures or statistics that determine the financial condition and health of a particular region, nation, or market in relation to its past data. Central banks, government agencies, intergovernmental organizations, and the U.S. Census Bureau provide such statistics to facilitate economic analysis.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

These insights aid companies in forecasting potential market opportunities and challenges. Moreover, they help devise their marketing strategies and decide their business goals. Indeed, the government uses this data to make monetary and fiscal policy decisions. The central banks, based on such measures, determine the money supply and interest rate changes.

Key Takeaways

- Economic data refers to quantitative statistics that show the financial health or condition of a market, region, or country. It provides a comparative insight into economic performance over time.

- The Central banks, government agencies, inter-governmental organizations, and the U.S. Census Bureau maintain such insights.

- These measures are derived from economic indicators like GDP, inflation rate, unemployment rate, trade balance, etc.

- These economic statistics are useful to the government and central banks in framing economic policies. Companies and other organizations employ such data to predict future financial trends and decide their marketing strategies.

Economic Data Explained

Economic data is the quantitative insight that presents the financial fitness of a market, region, or country in a given period compared to past statistics. Thus, such measures facilitate the comparison between the past, current, and future financial patterns and trends of the various regions, countries, and markets. The economic insights can be gauged with the help of economic indicators like Gross Domestic Product (GDP), international trade, consumption, inflation rate, trade balance, unemployment rate, personal income, and investment.

There are four types of economic data, as discussed below:

- Time-Series Data: Such data is represented in the time sequence, i.e., in years, quarters, months, weeks, and days.

- Cross-Sectional Data: It analyzes data over a specific period or different points in time; thus, the order of observations and time is irrelevant.

- Pooled Cross-Sectional Data: Such type of insight includes both time-series and cross-sectional data.

- Longitudinal Data: The panel data states the time-series data individually for every cross-sectional person.

Sources

The economic data calendar is available at the national, international, public, and private levels as presented by different agencies and organizations as discussed below:

- Government Agencies: Agencies like the Bureau of Economic Analysis (BEA) provide Federal Reserve Economic Data. Other government agencies also facilitate macroeconomic statistics and reports.

- Central Banks: The central bank also represents the monetary and financial insights of an economy or market.

- Intergovernmental Organizations: The World Bank, World Trade Organization, and International Monetary Fund provide international economic data to represent global trade and interactions.

- U.S. Census Bureau: The U.S. Census Bureau provides critical population, demographic, and economic data for the nation.

Examples

Such data insights serve as crucial parameters for economic decision-making. Let us understand its relevance through the following examples:

Example #1

Suppose the economic data this week of a nation indicates a rising inflation rate over the last three years. Hence, the central bank undertakes contractionary monetary policy measures by increasing the interest rates of bonds and reducing the bond prices. Such measures would decrease the money supply in the economy, thus reducing the purchasing power of the consumers and slowing down the rate of inflation.

Example #2

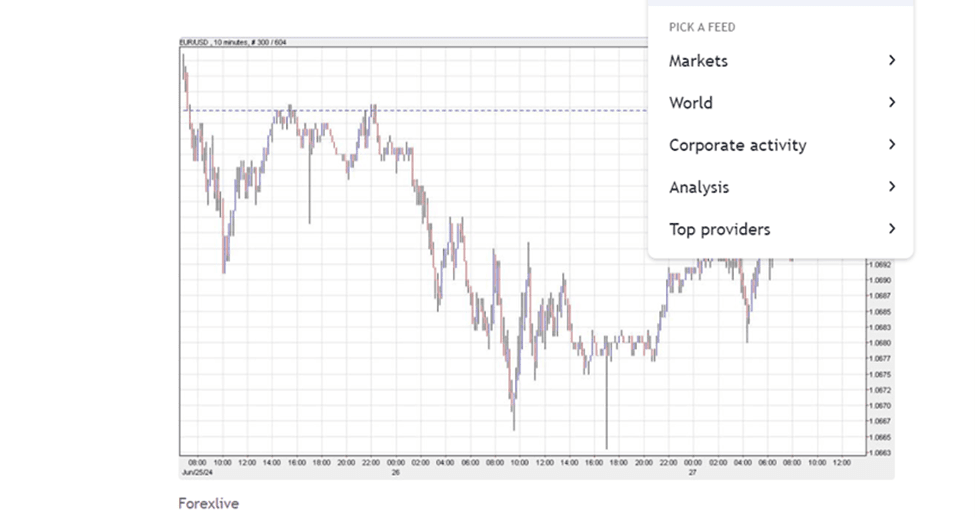

As of June 27, 2024, the economic data presented on TradingLink showed a mixed scenario: while the first quarter’s GDP experienced a slight upsurge, the inflation rate was higher, while the corporate profit figures lowered. Also, the durable goods orders (excluding defense and aircraft) dropped by 0.6%, which was against the expectation of a 0.1% increase. The initial jobless claims were as expected, while the trade balance is anticipated to decline slightly in the second quarter’s performance. Apparently, the euro rose by 15 pips in comparison to the USD; however, the USD showed a minor drop in the other markets.

Additionally, the Fed funds futures market is currently expecting a 45-basis point reduction in interest rates this year, although this anticipation has somewhat lowered over the week. Such a decline is because of the above-expectations inflation rates in Australia and Canada, which indicate that central banks have to be careful about rising inflation in the housing and rent markets.

How To Analyze?

Economists, researchers, and policymakers often use economic data to make critical macroeconomic decisions and predictions. However, businesses also analyze such insights when planning their marketing moves. Given below are the basic steps for analyzing these economic measures:

- The primary consideration is selecting a relevant, authentic, and reliable source of economic data, such as statistics available on the official websites of accredited government agencies or organizations.

- Next is scrutinizing and organizing the data to eliminate inconsistencies, missing figures, and other discrepancies.

- The other step is to represent the data in charts, maps, graphs, and tables to visualize the prevailing trends and patterns.

- Then, the researchers can use the various statistical measures to quantify the data. They can use regression, descriptive, time series, or inferential statistics for this purpose.

- Next, the findings and results of the statistical implications are interpreted.

- The last step is to crosscheck the results and evaluate them for relevance, reliability, accuracy, and validity.

Importance

Such data insight is critical for identifying the direction and condition of the economy due to the following reasons:

- Economic Forecasting and Analysis: The analysis of economic measures provides an understanding of past, current, and future economic patterns to determine potential risks.

- Economic Comparison and Communication: Publishing houses and the media report such data. This enables the comparison of the financial well-being of various markets or countries.

- Monetary and Fiscal Policy Decisions: Such data helps the government to devise effective fiscal and monetary policy measures to fulfill macroeconomic goals like price stability, decreased unemployment, improved standard of living, and economic growth in the nation.

- Interest Rate Changes: The central banks can use these insights to curb economic adversities like inflation, stagnation, or increasing exchange rates through interest rate adjustments.

- Controlling Money Supply: These measures are also helpful in regulating the supply of money in the economy to control inflation or other economic challenges.

- Devising Marketing Strategies: Businesses employ economic measures to formulate marketing strategies that capitalize on the prevalent and upcoming market trends and profit from these insights.

- Setting Economic Benchmarks: These insights decide the benchmarks by identifying the highest levels of economic performance by nations, markets, and regions.

- Shaping Consumers’ Savings and Consumption Levels: As such data demonstrates, changing economic conditions affect consumers’ buying, saving, and consumption of goods or services.