Table Of Contents

What Are ECN Brokers?

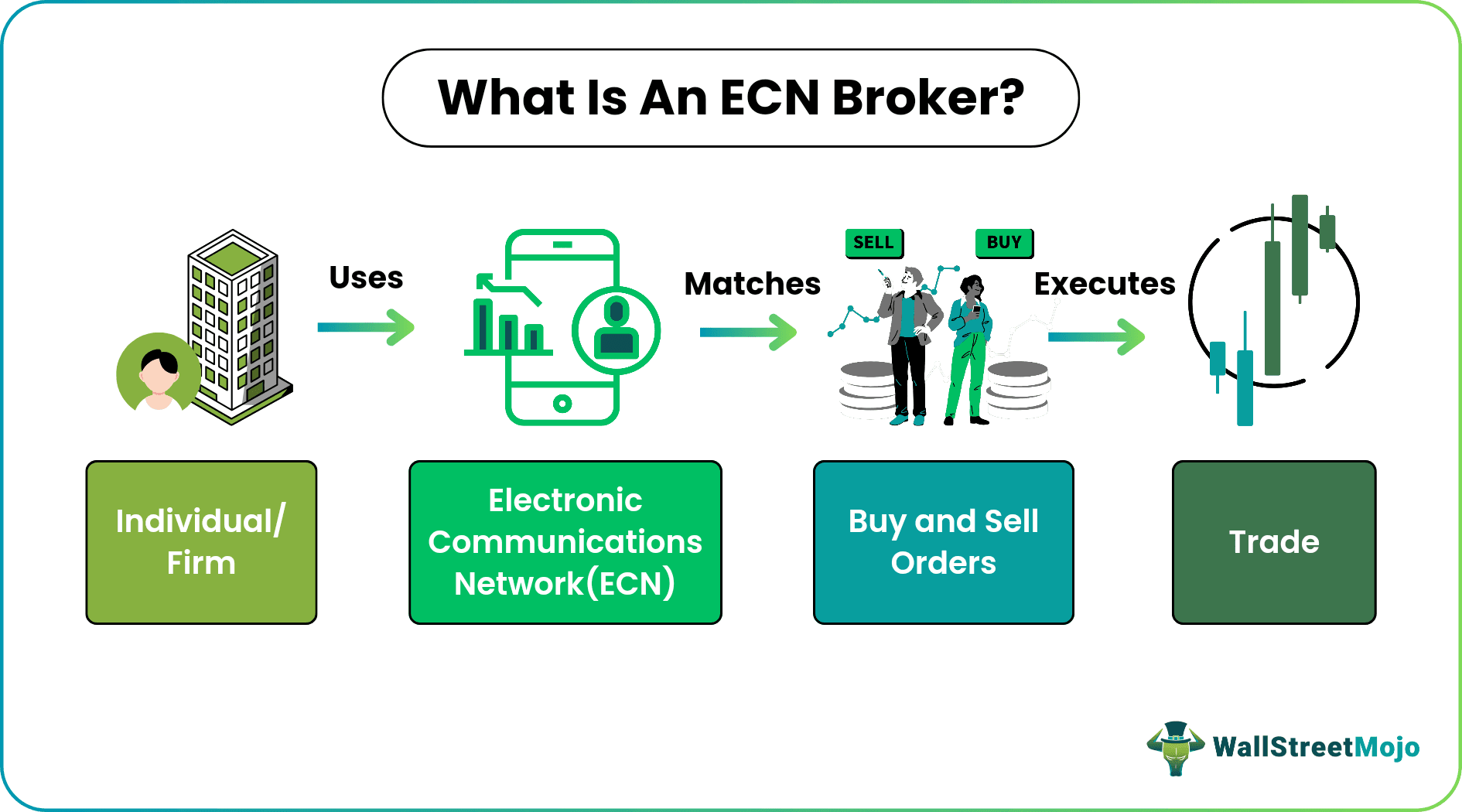

An ECN broker is an individual or company that uses an electronic communications network (ECN) to match buy and sell orders and connect traders with other participants in the currency and stock markets. The ECN is a network of financial institutions and trading experts who participate in transactions without a financial intermediary.

These brokers have real-time access to ask (buy) and bid (sell) prices in addition to aggregating the highest and lowest price quotations from different market players, which they share with their clients for trading. Also, they provide investors with tighter bid-ask spreads, cheaper trading costs, and more liquidity. They give traders more freedom and earning potential.

Key Takeaways

- ECN broker meaning describes a person or firm that uses an electronic communications network to match buy and sell orders and connect traders with other market players in the currency and stock markets.

- They have real-time access to ask (buy) and bid (sell) prices and the ability to aggregate the highest and lowest price quotations from various market participants.

- These brokers give traders more detailed, easy to understand, and transparent information about trading, along with narrower bid-ask spreads, lower trading fees, and higher liquidity.

- Unlike dealing desk brokers, they send trading orders to liquidity providers, including banks, and hedge and mutual funds.

ECN Broker Explained

An ECN broker facilitates transactions using the electronic communications network (ECN) based on traders' purchase and sale interests. In addition, brokers provide traders with more detailed and accessible information about trade orders, for example, the highest bid and lowest ask, and place them on their behalf.

The ECN is an automated trading system that executes trades quickly and at lower costs. Small investors use the ECN to access the currency and stocks markets and place orders. The network then matches buy and sell orders with appropriate market participants and liquidity providers, such as banks and hedge and mutual funds.

The ECN matches orders that meet the needs of the individual traders based on several factors such as security type, lot size, pricing, etc. Then, the network executes the trade after automatically matching the buyer and seller. With the ECN broker Forex, individual traders come together on a single platform to participate in global trading.

These brokers trades per the relevance and suitability of their clients, not against them. Because all traders can access the centralized database, the trading system is transparent, and brokers cannot alter it. They offer narrower bid-ask spreads but at a higher and fixed commission. These brokers provide trade orders directly to the ECN, sending them to securities market intermediaries.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

ECN Broker vs. Dealing Desk Brokers

An ECN broker is a No Dealing Desk (NDD) broker who differs from a dealing desk broker in the following ways:

| ECN Broker | Dealing Desk Broker |

|---|---|

| Do not pass on trade orders to market makers | Executes trades by going polar opposite of the trade |

| Matches trading participants electronically | Passes on the trade order to the market maker |

| Passes the trade orders to liquidity providers | Incurs losses if their client wins a trade and vice-versa |

| Directly connects buyers and sellers | Last choice of investors |

Example

Let us consider the following ECN broker example to understand the concept better:

Stella places an order for 10 shares of Apple stocks into an ECN system. On the other side, Robert orders 8 shares of the same firm using the same platform. Finally, the network matches Stella with a seller offering the same shares and executing the trade.

On the other hand, Robert’s shares were put on hold as no sellers in the ECN matched his requirements. The deal, therefore, remained open until the system found a seller ready to sell 8 shares of Apple stocks.

Advantages

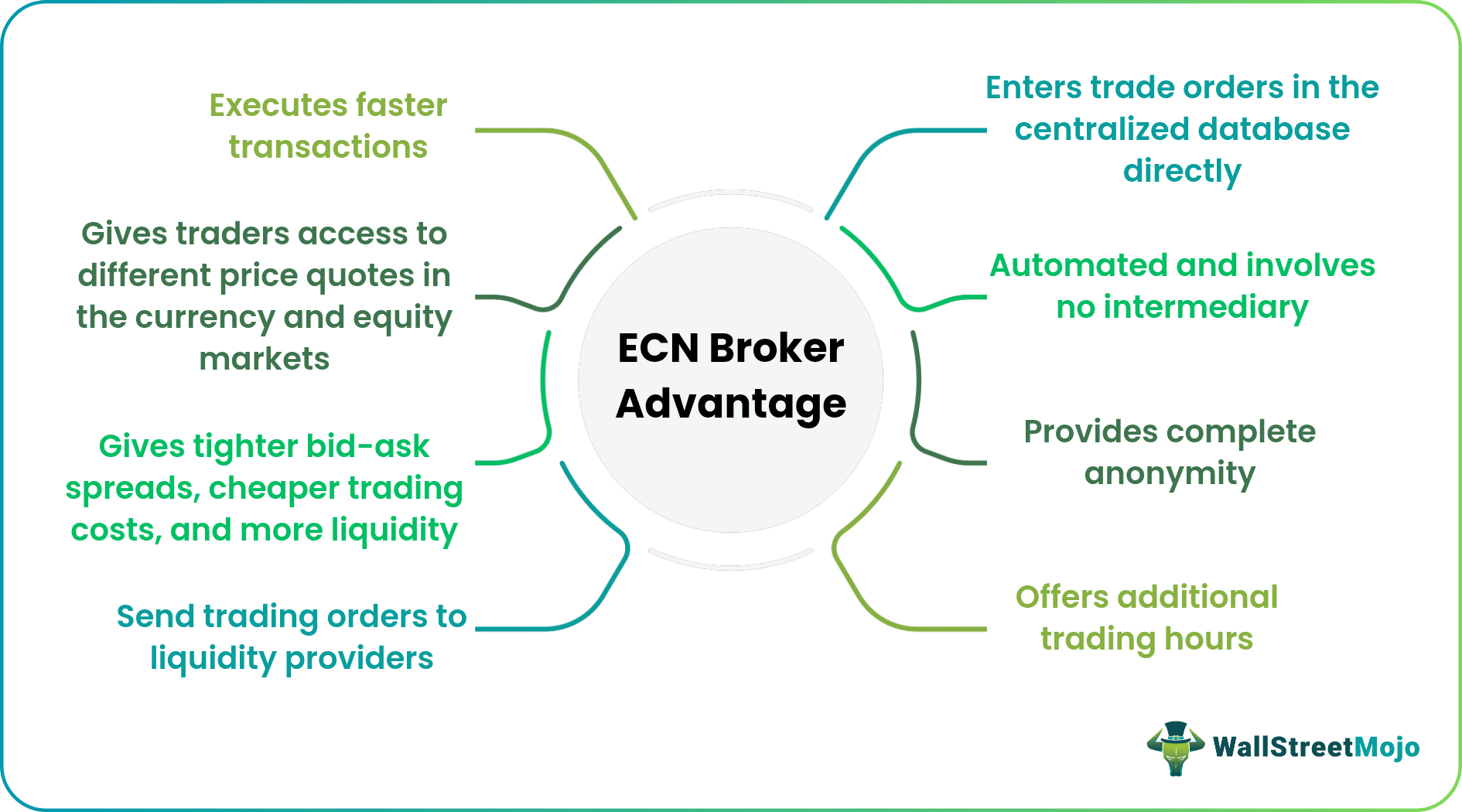

ECN brokers make it easier for traders to purchase and sell stocks electronically, and they provide numerous benefits:

- Allow liquidity providers to enter trade orders into the centralized database directly

- Make price quotations available to clients for trading

- Provide complete anonymity to investors and attracts large-scale transactions

- Give traders access to different price quotes via a centralized system where they get the best bid and ask prices in the market

- Automated and involves no intermediary, so process the transaction faster

- Help traders enter the currency and equity markets and match their trading requirements with other participants in the ECN

- Keep the trade orders open even after the stock and currency exchanges are closed until the best buy and sell matches are found

- Offer additional trading hours to investors to participate in trading

- Provide stricter bid-ask and lower and transparent trading costs

Limitations

While ECN brokers have several advantages, they also have some disadvantages, such as:

- Fragment the market

- Match buyers and sellers per their requirements, exposing them to insular trading risks

- Cause the price disparity for the open market outside

- Has higher minimum account values and trade sizes

- Not suitable for higher-volume investors

- Lower-volume investors do not pay the ECN fees

- True ECN brokers charge a higher, fixed commission for using the system and executing trades

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

An ECN broker uses the electronic communications network (ECN) to facilitate transactions based on traders' purchase and sale interests. ECN is a computerized trading platform that allows traders to execute trades more quickly and at reduced costs. These brokers give traders more detailed and transparent information regarding trade orders, such as the highest bid and lowest ask, and place them on their behalf.

An ECN broker is not the same as a market maker. The former is a No Dealing Desk (NDD) broker who electronically matches trading participants and passes trade orders to liquidity providers such as banks, mutual funds, and hedge funds via the ECN. On the other hand, market makers execute deals by taking the other side of the trade and profiting if their clients lose money and vice versa.

An ECN broker executes a trade in the following steps:

- Places trade orders in the centralized database on behalf of interested sellers and buyers

- Matches orders that meet the needs of the individual traders with relevant market players, based on factors like security type, lot size, pricing, etc

- Directly feeds trader orders to the ECN, which then distributes them to securities market intermediaries

- Completes the transaction after automatically matching the buyer and seller