Table Of Contents

What Is Eclectic Paradigm?

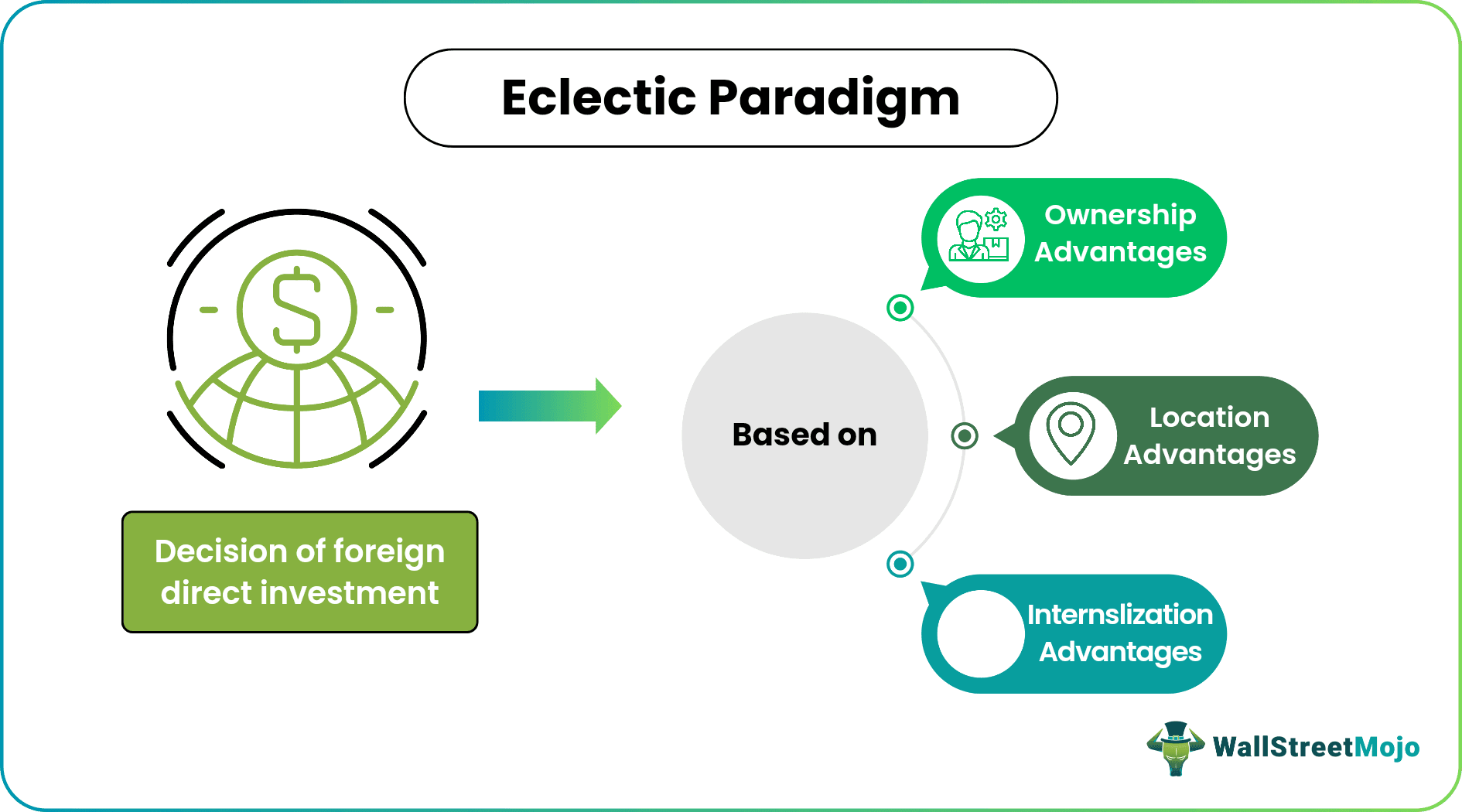

The Eclectic Paradigm, or the OLI framework, refers to a three-tiered holistic approach adopted by companies while making decisions regarding the suitability and lucrativeness of foreign direct investments (FDI). The theory suggests that a company avoids open market transactions when the in-house cost of accomplishing the same actions is comparatively feasible.

Such a framework is constructed around three primary components or advantages: Ownership (O), Location (L), and Internalization (I). It provides a mechanism for identifying and comparing the benefits and challenges of international business to support the firm's decision regarding foreign market entry. Hence, the OLI framework helps mitigate losses and risks in foreign direct investments (FDI).

Key Takeaways

- The eclectic paradigm or OLI framework is a model that supports the international business theory while analyzing given opportunities on three key parameters, i.e., ownership, location, and internalization.

- It believes that the business refrains from open market transactions or foreign direct investments if the cost of executing the same function internally is low, making the activity more economical.

- Companies employ Dunning's eclectic paradigm theory to gauge the complexities and benefits of internationally expanding their operations and FDI decision-making.

- The framework is criticized for employing a generalized approach, oversimplifying international business challenges, and overlooking complexities other than the standard OLI factors.

Eclectic Paradigm (OLI Framework) Explained

The eclectic paradigm enables companies to decide whether to opt for investments in foreign markets when they possess distinctive merits or capabilities that make internal production more profitable compared to alternatives, like licensing or exporting. John Dunning formulated this ideology in the 1970s under the purview of international business theory. The paradigm aids companies in making decisions regarding investments in the target country and developing strategies for managing their overseas operations.

Dunning's eclectic paradigm consists of three core components:

- Ownership Advantages: It accounts for the unique strengths and assets a company possesses that motivate it to expand via FDI and have a competitive edge on a global scale. Such advantages comprise technological excellence, brand recognition, managerial insight, and access to critical resources.

- Location Advantages: The company analyzes the benefits of operating within a specific foreign market to gauge the favorability of foreign investment. These factors involve market size, demand dynamics, resource availability, labor costs, infrastructure quality, and governmental regulations.

- Internalization Advantages: It considers the merits of integrating certain business operations within a single corporate entity instead of relying on external markets. When the transaction costs associated with coordinating and conducting business with external entities are extensive or high, internalizing these activities through FDI can be more efficient.

The eclectic paradigm offers a comprehensive framework for analyzing and interpreting the intricate decision-making process that underlies a company's choice to engage in foreign direct investment. By studying the ownership, location, and internalization advantages of international business, the framework provides a holistic view of the factors that collectively determine the appeal of FDI prospects.

Examples

Dunning's eclectic paradigm examples showcase how companies strategically apply the framework's elements—ownership, location, and internalization—to effectively navigate international expansion, foreign investments, and global operations. Let us understand how it works.

Example #1

Assume ABC & Co. makes world-class furniture. The company decides to apply the eclectic paradigm theory to ascertain how it should expand its operations. The implications of the OLI framework in ABC’s context can be explained as follows:

- Ownership Advantage: The furniture's design, sturdiness, and durability create the company's USP.

- Location Advantage: Selecting locations for manufacturing furniture based on natural wood reserve, wood quality, and government regulations offers the company location-specific competence and advantages.

- Internalization Advantage: Establishing manufacturing plants in countries with ample wood supply can be economical for the business.

Once this framework is established, ABC & Co. can make decisions pertaining to business expansion, operations management, and business development.

Example #2 - Samsung Electronics Manufacturing

Samsung's global manufacturing operations can be explained using the eclectic paradigm as follows:

- Ownership Advantages: The company's ownership advantage comes from its technological competence and innovative product range. For instance, one of the products it manufactures is flat-panel televisions.

- Location Advantages: Samsung selects manufacturing locations based on skilled labor availability, supplier access, and infrastructure.

- Internalization Advantages: By owning and managing its production facilities, Samsung internalizes its production efficiency and quality control expertise.

Example #3 - Coca-Cola's Bottling Partnerships

Coca-Cola's bottling partnerships exemplify the eclectic paradigm. Let us see how it works. The following are the salient features of its implementation:

- The ownership advantage for Coca-Cola lies in its globally recognized brand and beverage recipes.

- Coca-Cola chooses bottling partners in different regions based on distribution networks, local regulations, and market reach.

- By partnering with local bottlers, Coca-Cola internalizes its production standards and adapts to regional market conditions.

Advantages

In the current scenario, when distance no longer restricts the global expansion of companies, the OLI framework serves as a crucial decision-making tool for foreign market investments due to the following benefits it offers:

- Comprehensive Analysis: This approach considers ownership, location, and internalization advantages, resulting in a multi-dimensional consideration of the factors influencing foreign investment choices.

- Universal Applicability: The framework's versatility makes it suitable for diverse industries and scenarios, allowing businesses to tailor strategies to specific business and operational circumstances.

- Strategic Insight: By evaluating the various dimensions, firms can strategically assess and finalize the most appropriate entry mode (such as exporting, licensing, or foreign direct investment) into foreign markets that facilitate, establish, or promote their operations.

- Risk Management: Thorough analysis supports identifying and mitigating risks associated with entering foreign markets, aiding in more informed decision-making.

- Sustainability: The paradigm prompts firms to consider focusing on long-term advantages, fostering sustainable growth, and enabling competitive positioning in global markets.

- Sensible Resource Allocation: It assists firms in efficiently allocating resources by pinpointing suitable entry modes and markets based on their unique strengths and advantages.

- Identifies Challenges: The framework's multifaceted approach enhances its predictive capabilities, enabling firms to anticipate potential market challenges and opportunities.

- Flexibility: The framework accommodates changes over time, empowering firms to periodically reassess and adapt their strategies according to the prevailing market conditions.

Criticism

The eclectic paradigm, while providing valuable insights, is criticized for its following limitations:

- Oversimplification: It sometimes oversimplifies the complexities of the global business dynamics, which can expose companies to FDI failure risks.

- Generalization: Its generalized approach fails to consider the unique characteristics of various industries and situations.

- Overlooks Other Complexities: The framework's emphasis on ownership, location, and internalization does not encompass other international business challenges like cultural nuances, regulatory complexities, and swift technological advancements.

- Limited to Fixed or Necessary Factors: The paradigm struggles to account for instances where firms diverge from the typical OLI factors in their decision-making.