Table Of Contents

What Is EBIT Margin Formula?

EBIT Margin Formula is the profitability ratio which is used to measure that how far the business is able to manage its operations effectively and efficiently and is calculated by dividing the earnings before interest and taxes of the company by its net revenue.

It helps in the assessment of a company’s profitability owing to the core operations. The investor uses the EBIT margin equation as a decision tool to calculate what percentage of the gross income will be retained by the company as operating profit.

EBIT Margin Formula Explained

The EBIT margin formula can be calculated first by deducting the cost of goods sold COGS and operating expenses from total / net sales, then dividing the result by the total / net sales and expressed in percentage. EBIT margin is also known as Operating margin.

EBIT Margin Formula is represented as,

Alternatively, the EBIT Margin Formula can also be computed by adding back taxes and interest expense to the net income (non-operating income and expense adjusted) and then dividing the result by total /net sales.

EBIT Margin Formula is represented as,

Methods

Let us check the two methods that help derive the EBIT Margin Formula:

Method 1: Operating Margin Equation

The Operating Margin equation can be computed in the following five steps by using the first method:

- Firstly, the total sales can be noted from the income statement.

- Now, the COGS is also available in the income statement. It is calculated by adding the beginning inventory to the additional inventory purchase during the accounting period and then deducting the closing inventory.

COGS = Inventory at the beginning of the year + Additional inventory purchase – Inventory at the end of the year - Now, gather the operating expenses from the income statement. It includes various direct costs and indirect costs, which may include labor costs, administrative expenses, etc.

- Now, the operating income is computed by deducting COGS (step 2) and operating expenses (step 3) from the total sales Step 1.

Operating income = Total sales – COGS – Operating expenses. - Finally, the Operating margin equation is derived by dividing the operating income (step 4) by total sales (step 1), as shown below.

EBIT Margin Formula= (Total sales – COGS – Operating expenses) / Total sales * 100%

Method 2: EBIT Margin Formula

It can be done using the following steps:

Step 1: Firstly, one can capture the net income from the income statement. Ensure that the net income is adjusted for non-operating income (deduct) and expense (add back).

Step 2: Now, the interest expense can be found available in the income statement.

Step 3: Now, one can also collect taxes from the income statement.

Step 4: Next, the operating income is derived by adding back the interest expense (step 2) and taxes (step 3) to the net income (step 1).

Operating Income = Net income + Interest expense + Taxes

Step 5: Now, note the total sales from the income statement.

Step 6: Finally, the EBIT margin formula is derived by dividing the operating income (step 4) by total sales (step 5), as shown below.

Operating Margin Equation= (Net income + Interest expense + Taxes) / Total sales * 100%

Examples

Let’s see some simple to advanced examples to understand the calculation of the EBIT Margin equation better.

Example #1

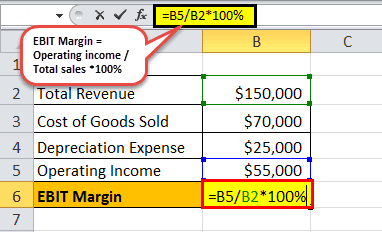

Let us take an example to compute the EBIT margin for a company called PQR Ltd. The company is in the business of producing customized roller skates for both amateur and professional skaters. The company has generated $150,000 in total sales at the end of the financial year, along with the following expenses.

- Cost of goods sold: $70,000

- Depreciation expense: $25,000

Above is data for calculation of EBIT Margin for a company PQR Ltd

To find EBIT Margin, we need to first calculate the Operating Income of company PQR Ltd

Now, Operating Income can be calculated as,

Operating income = Total revenue – Cost of goods sold – Operating expense

= $150,000 - $70,000 - $25,000

Therefore, the Operating Income of company PQR Ltd= $55,000

Now, we will calculate the EBIT Margin of company PQR Ltd

Operating Margin = Operating income / Total sales *100%

= $55,000 / $150,000 * 100%

= 36.67%

Therefore, the Operating margin of PQR Ltd is 36.67%.

Example #2

Now let us take the example of Apple Inc.’s financial statement for the last three accounting periods, which is publicly available. Based on publicly available financial information, the EBIT margin of Apple Inc. can be calculated for the accounting years 2017 to 2018.

The below table shows data for calculation of EBIT margin of Apple Inc.for accounting years 2017 to 2018.

We will first calculate Operating Income Using First Method for Apple Inc,

Operating Income for Sep 30,2017

Operating Income of Apple Inc for Sep30,2017 can be calculated as,

Operating Income =Total Sales - Cost of Goods Sales(COGS) - Operating Expenses

= $229,234 Mn - $141,048 Mn - $11,581 Mn - $15,261Mn

Operating Income for Sep30,2017 = $61,344Mn

Operating Income for Sep 29,2018

Operating Income of Apple Inc for Sep 29,2018 can be calculated as,

Operating Income = Total Sales - Cost of Goods Sales(COGS) - Operating Expenses

= $265,595 Mn - $163,756 Mn - $14,236 Mn - $16,705 Mn

= $70,898 Mn

Now, we will calculate Operating Income Using Second Method for Apple Inc,

Operating Income for Sep 30,2017

Operating Income of Apple Inc for Sep 30,2017 can be calculated as,

Operating Income = Net income + Interest expense + Tax

= $48,351 Mn + $2,323Mn + $15,738Mn

= $61,344 Mn

Operating Income for Sep 29,2018

Operating Income of Apple Inc for Sep 29,2018 can be calculated as,

Operating Income = Net income + Interest expense + Tax

= $59,531 Mn + $3,240 Mn + $13,372 Mn

= $70,898 Mn

Operating Margin of Apple Inc for Sep 30, 2017

Therefore, calculation of EBIT Margin of Apple Inc for Sep 30 2017 will be

EBIT Margin = Operating Income / Net sales *100%

= $61,344Mn / $229,234 Mn * 100%

= 26.76%

Therefore, the Operating Margin of Apple Inc. during 2018 stood at 26.76%.

Operating Margin of Apple Inc for Sep 29, 2018

Therefore, calculation of Operating Margin of Apple Inc for Sep 29, 2018 will be

Operating Margin = Operating Income / Net sales *100%

= $70,898 Mn / $265,595 Mn * 100%

= 26.69%

Therefore, the Operating Margin of Apple Inc. during 2018 stood at 26.69%.

Relevance

The EBIT margin formula is a profitability metric that helps to determine the performance of a company, which is computed by determining the profit before interest payment to lenders or creditors and tax payment to the government. This profitability metric is measured in terms of percentages, like most other financial terms. Since the EBIT margin equation measures profit only in terms of percentage, financial users can utilize this metric to compare differently sized (large corporate, mid-corporate, and small & medium enterprise) companies across the industry. However, there remains a limitation of the EBIT margin formula that it is particularly useful when comparing similar companies in the same industry.