Table Of Contents

What Is An Earnout?

An earnout is a financial arrangement between seller and acquirer wherein the seller will receive additional compensation if the business under consideration achieves specified financial goals. Generally, these financial goals are stated as gross sales percentages or earnings. In some cases, the earnout payments are delayed or there are disagreements between the parties that make such deals a hassle for both parties involved.

Often this earnout payment is used to bridge the valuation gap. If a person who is selling the business is asking more price than what is asked by the buyer, then, in that case, such a provision is helpful. The seller gets paid only if the predetermined future level of EBITDA or financial targets is achieved as decided by the parties concerned.

Table of contents

- What Is An Earnout?

- An earnout is a financial agreement between a business seller and an acquirer. The seller can receive additional compensation if the business meets specific financial goals, such as gross sales percentages or earnings.

- The earnout allows the buyer and seller to set a mutually agreed-upon price for the business and bridge any valuation differences.

- The payout level of the earnout is based on various factors, including the size of the business, and helps reduce risks for the buyer. The seller benefits from an earnout when the business achieves the predetermined financial position.

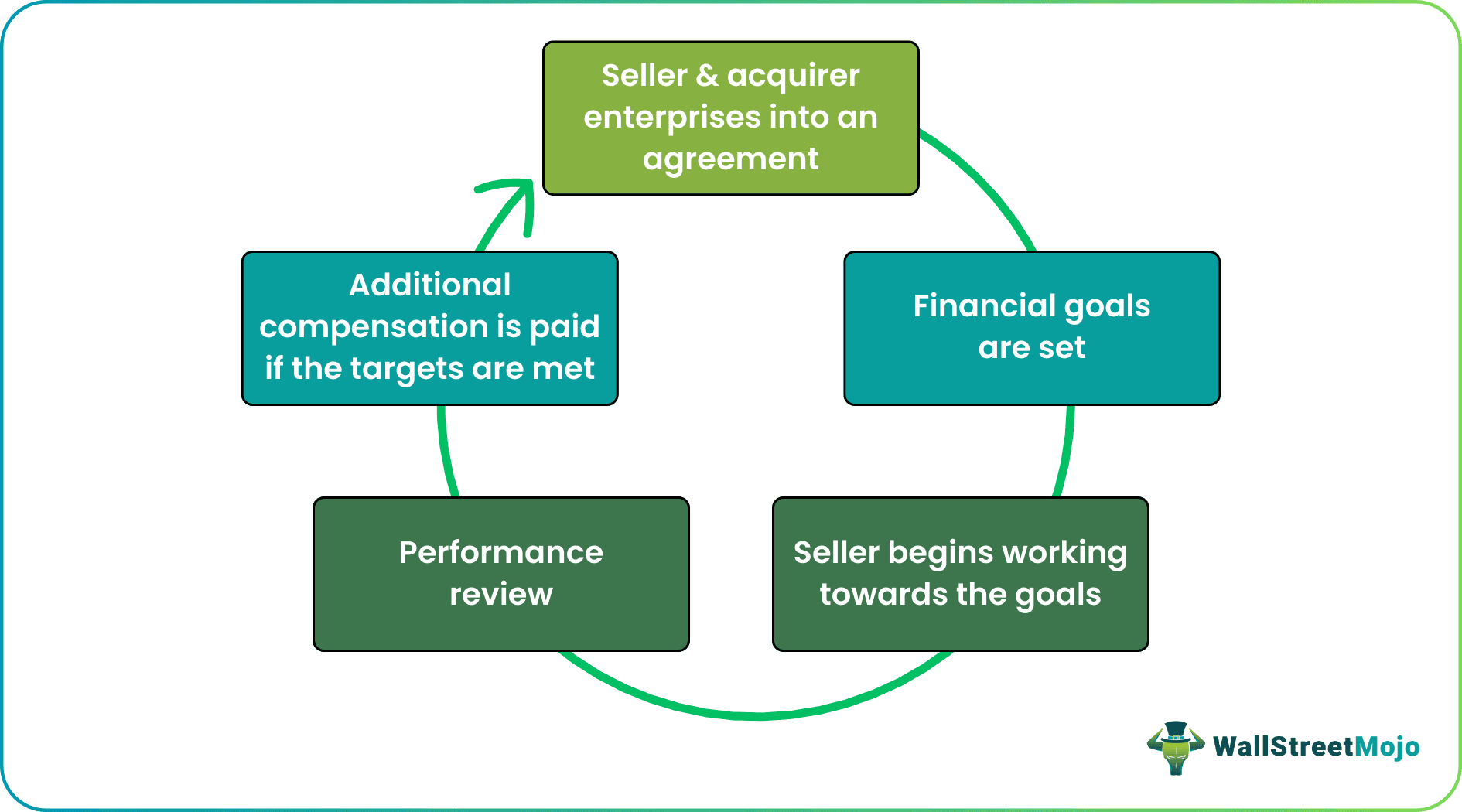

How Does An Earnout Work?

An earnout is a deal within an acquisition where the seller provides the finance to the business and the acquirer or buyer’s payment is stretched over a long-term period based on the performance of the business.

Thus, the Earnout clause provides the opportunity to the seller and the buyer to decide the mutual price for the financial transaction and bridge the valuation gap. It is a contractual provision according to which the seller in the future will receive additional compensation if the business under consideration achieves specified financial goals. There is no hard and fast rule in the case of the Earnout; instead, the pay out level depends on several factors such as the size of the business, etc.

It is a contractual provision that the seller of a business will obtain future compensation if the business achieves certain predetermined financial goals.

These payments help eliminate uncertainty for the buyer. They will have to pay only if a certain level is achieved and the seller will also receive benefits if the business achieves growth in the future.

Examples

A few practical or daily life occurrences help understand any concept in depth. Let us understand the concept of earnout payments with the help of a few of examples.

Example #1

X Ltd is running a textile business in which during the last financial year, sales were $ 400 million, and the earnings were $ 100 million. A person, Mr. Y, wants to buy the business X Ltd. at $ 200 million. The top management of X Ltd is also ready to sell their business, but they believe that this price is very low, and it will also undervalue the future growth prospects of the business.

To reach a solution and bridge, the gap parties decided to use an earnout method where it is decided that the upfront cash payment will be made of $ 200 million to the seller or the owner of X Ltd by Mr. Y and the earnout payment of $ 200 million will be given in case the if the earnings reach at the level of $ 300 million with the period of four years window or else $ 100 million will be given as the earnout money to the seller if the sales reach the level of only $ 150 million. If these targets are not met, the seller will not be paid anything in the future.

Therefore, the owner asked for $ 400 million as the price for his business, to which Mr. Y denied agreeing.

It is an example where the two parties made a financial agreement. One party decided to sell the business to the other party because some money will be paid upfront and some if a predetermined future earning level is achieved. It helped bridge the gap between the buyer and the seller of the business.

Example #2

X is the owner of the business bakery and has a valuation expectation of $ 50 million of the business. One buyer approached him, but he is ready to give only $ 35 million as the purchase price as, according to him, this is the correct valuation of the business as per the current market conditions.

Both parties have their expectations, leading to a gap of $ 15 million ($ 50 -$ 35 million). Now both parties decided to bridge this gap with the help of the Earnout which is a financial arrangement made between the parties to purchase a business where the seller finances some portion of the purchase price, and the payment of the financed amount back to the seller is contingent on getting a predetermined future earnings level.

Hence, in the present case, it is decided that the seller will get paid $ 5 million per year for the next three years if the business under the new buyer achieves an EBITDA of $ 25 million per year.

Example #3

Creo Medical Group PLC acquired Albyn in July 2020 for EUR 24.8 million. The earnout clause of this acquisition also stated a performance-based payment of up to EUR 2.7 million.

90% of Albyn’s share capital had been acquired by the acquiring company in 2020. However, the remaining 10% were to be acquired in the following two years based on the performance.

In March 2022, Creo declared that the targets had been achieved in full and they acquired the remaining 10% stake worth EUR 2.4 million.

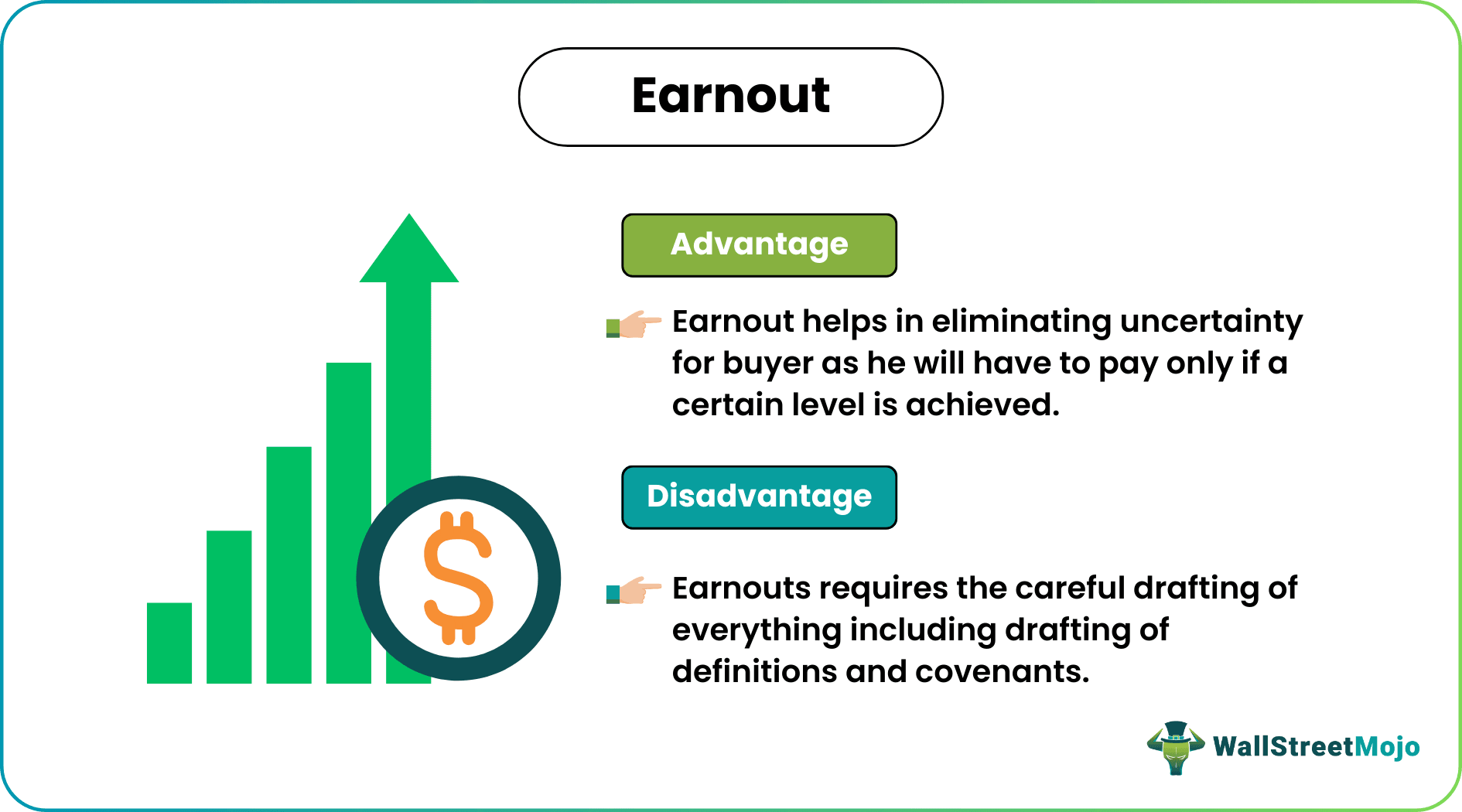

Advantages

Let us understand the advantages of acquiring a company after agreeing to earnout payments through the discussion below.

- Earnout helps eliminate uncertainty for buyers as they will have to pay only if a certain level is achieved. It is also beneficial for the seller as he will also receive benefits if the business achieves growth in the future.

- There is no hard and fast rule in the case of the Earnout; instead, the payout level depends on several factors such as the size of the business, etc. So, it is very helpful in bridging the gap if it exists between the parties (buyers and sellers) having different expectations.

Disadvantages

Despite the various advantages listed above, there are a few factors that act as a hassle or hurdle in the process. Let us understand the disadvantages of drafting an earnout clause during an acquisition.

- Earnouts Payments are complex as it requires careful consideration of the milestones or the metrics that will be required and ensuring that appropriate incentives are there for a mutual benefit like the proper alignment of incentives among the concerned parties, consideration of proper milestones, etc.

- It requires the careful drafting of everything, including definitions and covenants. All the terms and conditions have to be drafted properly, as even a single confusion can cause problems among the parties in the future.

Frequently Asked Questions (FAQs)

A reverse earnout is a type of contingent consideration structure in which the seller of a company is entitled to receive additional payments from the buyer if certain predetermined targets are not met. This structure is often used when the buyer is uncertain about the future performance of the acquired company and wants to reduce its risk exposure.

The tax treatment of earnouts can vary depending on the jurisdiction and the specifics of the earnout structure. In general, the tax treatment of an earnout payment will depend on whether it is classified as an additional purchase price or as compensation for services. It may be subject to capital gains tax if classified as an additional purchase price. It may be subject to income tax if it is classified as compensation for services.

Contingent consideration and earnout are deferred payment structures used in mergers and acquisitions. Contingent consideration is a broader term that encompasses any type of payment dependent on achieving certain future events or milestones. Earnout, on the other hand, is a specific type of contingent consideration tied to the acquired company's future financial performance.

Recommended Articles

This article has been a guide to what is an Earnout. Here we explain its examples, how Earnout payments work, advantages, and disadvantages in detail. You can learn more about financing from the following articles –