Table Of Contents

Earnest Money Meaning

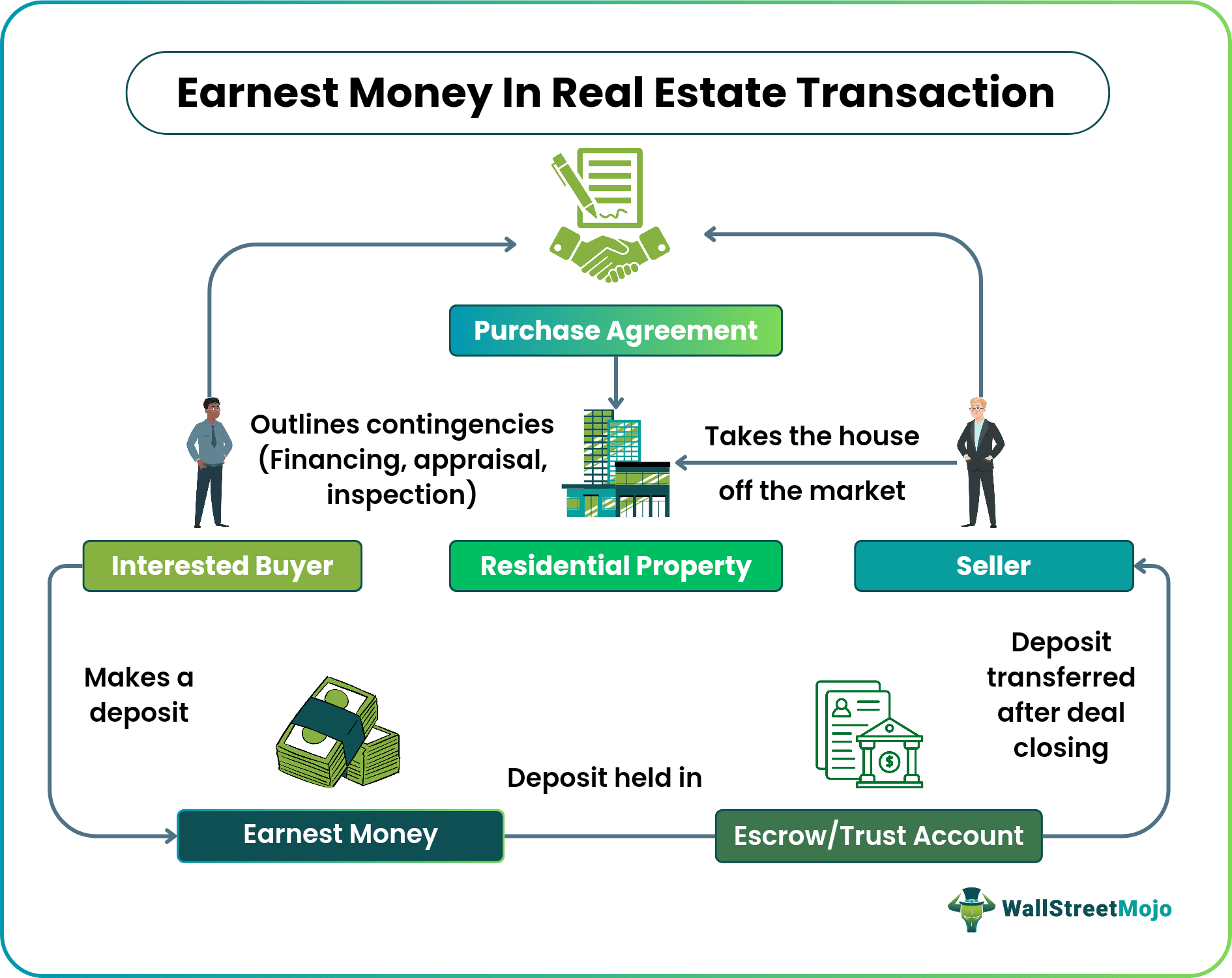

Earnest money is a good faith deposit that a buyer makes to the seller to indicate their serious interest in buying their property. This amount acts as an incentive for the seller if the buyer cancels the deal at the last minute. Also, it gives the buyer enough time to arrange funds and do various checks on the property.

Both parties enter into a real estate contract or a purchase agreement. It outlines various contingencies like an appraisal, inspection, and mortgage, protecting their respective interests. The buyer makes the deposit that could be a percentage (1-3%) or a fixed sum of the property’s sale price. An escrow account managed by a third-party broker holds the deposit till the deal gets closed and then distributes it to the seller.

Key Takeaways

- Earnest money is a good faith deposit, which the buyer pays to the seller as a security against the property they want to buy.

- The deposit amount, also known as pre-down payment, acts as a token of confirmation. It assures the seller that the buyer is serious about the purchase.

- The real estate purchase agreement outlines contingencies allowing the buyer to assess the property in all respect to make sure they are not involved in an inappropriate property deal.

- In case of any problem with the property appraisal, finance, or inspection contingencies, the buyer can terminate the contract. However, they must do so before the contingency dates specified in the contract if they want the earnest money refund.

How Does Earnest Money Deposit Work?

When a buyer comes across a residential property and develops an interest in buying it, they contact the seller. However, the seller always requires a guarantee to make sure the buyer turns up, and they do not have to relist the property. The buyer pays them a refundable good faith deposit, also called a pre-down payment, as a token of confirmation. Interestingly, this upfront deposit does not obligate the buyer to purchase the property. But it protects the seller from potential financial loss if the deal cancels.

Step-By-Step Process

- Both buyer and seller sign a real estate contract, stating the contingencies involved in a real estate deal. It also ensures the buyer that the property is up to the market standards in all aspects.

- The buyer pays the good-faith amount to the seller to show they are seriously interested in the deal. A real estate broker or a title company holds the deposit in an escrow or trust account.

- The deposit money is negotiable and could be a percentage (1-3%) or a fixed amount of the property’s purchase price. It varies based on the housing market demand and the property value.

- After paying the security amount, the buyer can inspect the property from all aspects within the contingency period.

- The buyer undergoes house appraisal first. And, if they discover that the value of the property is less than the asked price, they have the option to back out of the deal.

- The property seekers can opt for a termite inspection or structural inspection too. If they find any structural problem in the house, they can turn down the deal.

- They can get the earnest money refund immediately after informing the seller of any issues with the property discovered during the inspection.

- If the contingency period is over and the buyer backs off at the last minute, the seller can keep that deposit amount and use it as compensation against the fake guarantee.

Examples (House/Real Estate)

To understand the concept of earnest money deposit more clearly, let us consider the following examples.

Example #1

Rob, a property seeker, came across a residential property and found it quite attractive. He then contacted Maria, the owner of the residential property. The cost of the property was $400,000. Maria asked him to pay 3% as the earnest deposit in an escrow or trust account.

They both signed a purchase agreement. Maria gave Rob 30 days to close the deal before she would credit the deposit amount to her account. After signing the contract, Rob checked the property price, features, and other conveniences it offered. He was all okay with everything.

On the 31st day of the deal, Rob got to know about another property in the same area available at $300,000. He wanted to cancel the contract with Maria. But she informed him that he would not get his $12,000 refunded as the contingency period was already over. As soon as Rob terminates the deal, the escrow company releases the deposit amount to Maria.

Example #2

In March 2021, Bayer CropScience signed a real estate purchase agreement with Agile Real Estate. As part of the deal, the former will sell its land parcels located in Thane, Mumbai, India, to the latter that deposited ₹2.6 billion as the earnest amount.

Example #3

Usually, the delayed home loan application and other issues leading to untimely lending decisions would make the buyer considered a defaulter. Situations where buyers are at fault, such as scenarios where they quit their job voluntarily, get involved in large debts, etc., would necessarily give the seller the right to retain a security deposit. But that is not the case every time.

Financing contingency in a real estate contract is confusing most of the time. For instance, an addendum from the Greater Capital Area Association of Realtors suggests that the buyer should make a written loan commitment by the financing deadline. However, their failure to do so will not make them deem default or void the contract. Instead, it requires the seller to declare the contract void. Either way, the seller will not retain the earnest or token money even if the contingency period is over.

Is Earnest Money Refundable?

As per the earnest money definition, it is a refundable security deposit, but under certain circumstances. The real estate contract outlines contingencies, which give leeway to the buyer not to get involved in a bad deal after paying the deposit. The buyer should take action within the contingency schedule because once it gets over, the deposit cannot be refunded, instead retained by the seller.

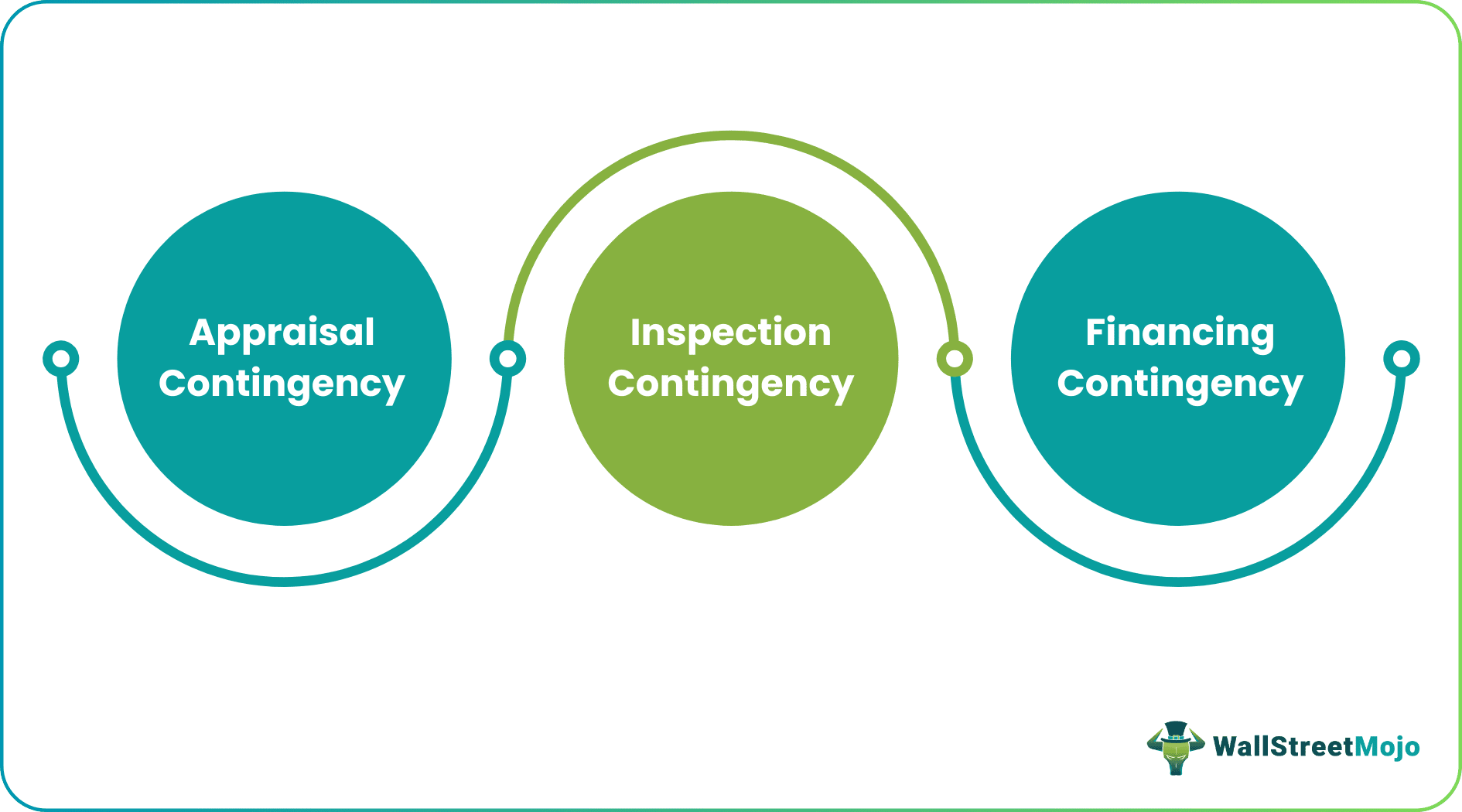

- Appraisal Contingency - If the buyer finds that the selling price of the property is more than what it should cost based on its condition, they can cancel the deal and get a refund.

- Inspection Contingency - The buyer is free to get the property inspected against structural issues or termites. If they are dissatisfied in any manner after the property assessment, they are free to cancel the agreement and get a refund.

- Financing Contingency - If the buyer’s loan application or lending decision remains pending for any reason (other than something that the buyer is accountable for), they can cancel the real estate contract and get a refund.

Whatever may be the reason, the cancelation should occur before the contingency period gets over. If the buyer reports any of the issues or tries to cancel the deal later, they will not get the refund. However, the buyer will get the earnest money refund in case the seller cancels the contract.

Protecting Your Earnest Money

The buyer can take the following steps to ensure their escrow deposit preserved and refunded when required:

- Have a purchase agreement prepared and signed by both parties without fail. Make sure it mentions financing, appraisal, and inspection contingencies.

- They must be cautious enough about the specific contingency dates mentioned in the purchase agreement.

- There must be an escrow account held by a third party like a real estate broker or title or settlement company that will store the token money.

- All decisions related to property purchase should be taken within the defined time, especially if it is about canceling the deal.

- Keep the contract clauses in written form. Relying on verbal agreements could be dangerous even if the seller is someone very close.

Frequently Asked Questions (FAQs)

Earnest deposit is a good faith deposit paid by the buyer to the seller as a token of confirmation that they are seriously interested in buying the property.

Yes, the earnest or token money is refundable but under certain conditions and before contingency dates. If the buyer finds the deal to be inappropriate for any reason, they can get a refund. They must also ensure that the contract specifies the problems discovered during the inspection. There is no refund if the buyer changes their mind, but there is always a refund if the seller terminates the deal.

Earnest deposit is a pre-down payment and acts as a security deposit, which is refundable before a particular period. However, if the deal closes successfully, the amount goes toward the down payment.