Table Of Contents

What Is Earned Income?

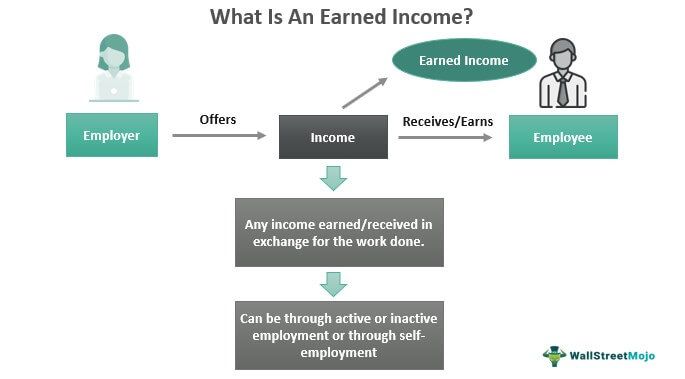

Earned income refers to the total amount of money one receives in exchange for the work one performs under the employment contract. The amount can be the salary, including bonuses, incentives, and other monetary rewards. In a self-employment setup, the net earnings become the income earned for that period.

All taxable earnings that an individual generates in exchange for some work done are earned ones, including payments received for disabilities. However, an income is said to be earned only when the monetary benefits are received from employment, be it regular, inactive, or business ownership, and those are a part of the gross income.

Key Takeaways

- Earned income refers to the income by the person, which can be the amount of salary, wages or employee compensation, etc.,

- received from the employer during the employment or the income by an individual from their own business.

- It refers to all the income earned from inactive employment, gross income, or business running.

- The Earned Income Tax Credit (EITC) is a type of tax rebate/credit made available to those whose earned amount is below a certain threshold, as decided by the IRS every year.

- Such income includes all monetary benefits one receives for the work done, involving personal efforts, and doesn't include anything obtained without effort, such as dividends, gifts, etc.

Earned Income Explained

As the name implies, earned income is the income one earns and not just receives for anything. When a person works hard to earn money, it is the income earned, while the income generated without effort does not fall under the category of earned income credit. Per the Internal Revenue Service (IRS), such income includes wages or salary, commission, bonus, and business income after adjusting for expenses incurred to earn the same during the taxable year, which is usually the calendar year in the United States.

It is important to understand the fact that this is different form passive income that do not need the active participation in trade or business or in the employment system. They include income from investments or properties on rent.

Revenue vs Income Explained in Video

Eligibility

As per IRS guidelines, the following income forms parts of earned income credit:

- A person receives long-term disability benefits before the minimum retirement age.

- Benefits from strike received on account of involvement in union activities collectively called union strike benefits.

- Earnings or net of expenses received from rendering services as a minister or member of the religious community.

- Earnings (net of expenses) in the capacity of a statutory employee

- Royalties, commission, and tips as received

Some of the income that does not form part of earned income include:

- The dividend payments received from stocks and the interest income from bonds and deposits

- Income received from retirement

- Benefits accrued on account of unemployment

- Social Security Benefits such as pension or annuity payments

- The alimony and child support benefits

Tax Credits & Implications

The Earned Income Tax Credit (EITC) is a type of tax rebate/credit made available to those whose earned income is below a certain threshold, as decided by the IRS every year to calculate gross earned income. Thus, to register a claim, the earners need to have an income earned with a specific adjusted gross income (AGI) and credit limits per the tax years, be it current, previous, or next.

In addition, the Social Security Number (SSN) is a must for an individual to obtain EITC, as the details are required for all spouses and dependent qualifying children to enjoy rebates. The earned income credit deductions are provided based on the marital status of the person and the number of qualifying children.

Whether individuals file the tax credit or return jointly with their spouse or not, the exemption for dependent care expenses for qualifying children adjusts from the income. The concerned taxpayers must have been a citizen of the United States for not less than half a year from the year for which they claim such credit.

How To Calculate?

There are some simple steps to be followed in the calculation of earned income which are detailed below:

It is necessary to check whether the individual is eligible for the credit or not in order to calculate earned income credit. This is the first step to go ahead with the process. The eligibility details are elaborated above. All avenues of compensation should be considered. Regarding a family, the qualification of the children should also be considered. They must be either below 19 years, or if they are a full-time student, then they should be below 24 years.

Next, the calculation for gross earned income should be done by considering all the income sources that are eligible as per the list given above. Then the individual should send the tax return details for submission. The IRS will begin the process according to the laws that may change occasionally. Thus, the above steps are essential in order to calculate earned income credit.

Examples

Let us understand the earned income definition better with the help of the below-mentioned examples:

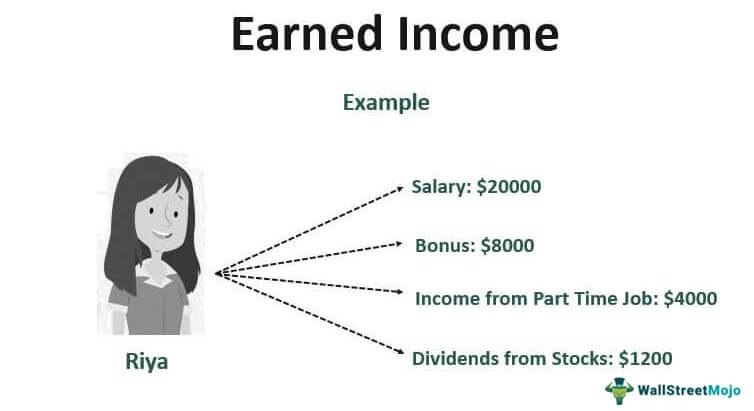

Example #1

Riya works as a risk manager with Union Global and has earned the following income during the year:

- Salary: $20000

- Bonus: $8000

- Income from providing part-time consultancy: $4000

- Stock dividends: $1200

Further, Riya also received:

- Alimony worth $5000 from her separation

- Interest on bonds amounting to $3000

For calculation, the following income will be added:

| Particulars | Amount |

|---|---|

| Salary | $20,000 |

| Bonus | $8,000 |

| Income from providing part-time consultancy | $4,000 |

| Total Earned Income | $32,000 |

On the other hand, other incomes received by Riya were not included in the calculation.

Example #2

Katherine decided to file an EITC claim after the death of her husband in 2022. Thus, she researched the details to know the limits and amount she was eligible to claim. Here is what she came across:

| Children or Relatives Claimed | Filing as Single, Widowed, or Head of Household | Filing as Married/ Filing Jointly |

|---|---|---|

| Zero | $16,480 | $22,610 |

| One | $43,492 | $49,622 |

| Two | $49,399 | $55,529 |

| Three | $53,057 | $59,187 |

For the tax year 2022, however, the investment income limit as decided by IRS authorities was $10,300 or less, and the maximum credit amount per that was:

- No qualifying child = $560

- 1 qualifying children = $3,733

- 2 qualifying children = $6,164

- 3 or more qualifying children = $6,935

Earned Income Vs Unearned Income

While annual earned income includes all income generated or received in return for the work an individual performs or services an entity offers, unearned income is anything that is received without putting in any effort. For example, if a person receives gifts in cash or wins the prize money, such earnings fall under unearned earnings. The latter's nature is also referred to as a passive income.

Besides that, the IRS also differentiates between them based on their tax purposes. For example, the tax levied on the sources of annual earned income and passive income differs hugely. While none of the unearned earnings are subject to employment taxes, like Medicare, Social Security, etc., most remain exempt from payroll taxes.

Unlike earned income, unearned money cannot be used to contribute to retirement schemes.