In the financial markets, the time of entry into the trade is crucial for traders and investors to employ strategies for booking profits or minimizing losses successfully. Let us now distinguish between the two different trading approaches, i.e., the late and early entries:

Table Of Contents

What Is Early Entry?

Early entry refers to a considerable price movement that occurs in the first 15 minutes of the opening of a daily trading session, specifically in a particular direction, i.e., either upwards (gap) or downwards (gap down). It is the market’s reaction towards a particular news, economic data, earnings release, etc.

The gap or gap down is an indicator of the market sentiments and helps intelligent investors book high profits from immediate trading moves during this timeframe. However, the early entry strategy needs more reliable signals for making trading decisions. Also, the ones captured may be false or baseless. Here, the win rate is low, while the risk-reward ratio is high.

Key Takeaways

- Early entry is a sharp price movement in one direction during the first 15 minutes of the commencement of a trading session. If the price trend is upwards, it is termed a gap, while a noticeable fall in stock prices is known as a gap down.

- It is often triggered by the market sentiments and investors’ reaction to a particular news report, earnings release, financial or economic information, or any other market-related factor.

- Although it aids investors in capitalizing on potential trading opportunities, such an approach holds high risk since the trading is based upon false or non-confirmed signals with a low win rate.

Early Entry in Forex Explained

An early entry in the foreign exchange market, i.e., executing the trade as soon as the trading session begins, before the trading signals are confirmed, can help the investor book successful swing trades. It is possible only within 15 minutes from the start of a trading session. However, it is challenging to determine the correct entry time in a Forex market due to its different mechanisms and market factors. Many traders believe that in a stable market scenario with no gap or gap down, entering early can mitigate the market risk and increase the chances of winning trades.

The forex market is driven by the demand and supply of foreign currencies in the international market, and investors who have robust information about the economic conditions or dealings between the nations can make profitable trades by entering the market early. These traders often trade at the support or resistance levels based on the initial (non-confirmed) signals. They rely on smaller moving average trading signals and often execute their move at the mid-candle level before the neckline breaks. However, their strategies are not backed by complete signals offered by various market indicators.

Examples

Early entry strategy is often undertaken by the investors who have a complete idea of the stocks and the market, the ones who closely follow the market news and insights. Now, let us explore some examples of how an early entry works in trading:

Example #1

Suppose an intraday trader, Miss. Jessy has been closely following the news and information about ABC Ltd., as she has invested $1200 in its stocks. Just before the trading session was about to begin, the news popped up that the company was going to sell off one of its units due to consistent losses arising out of it. Thus, Miss. Jessy used an early entry strategy to sell off 50% of her stocks at a profit of 7% as soon as the session began. Also, she placed an immediate stop-loss order for the remaining 50% of the stocks at $600, assuming that the price may go beyond that.

Example #2

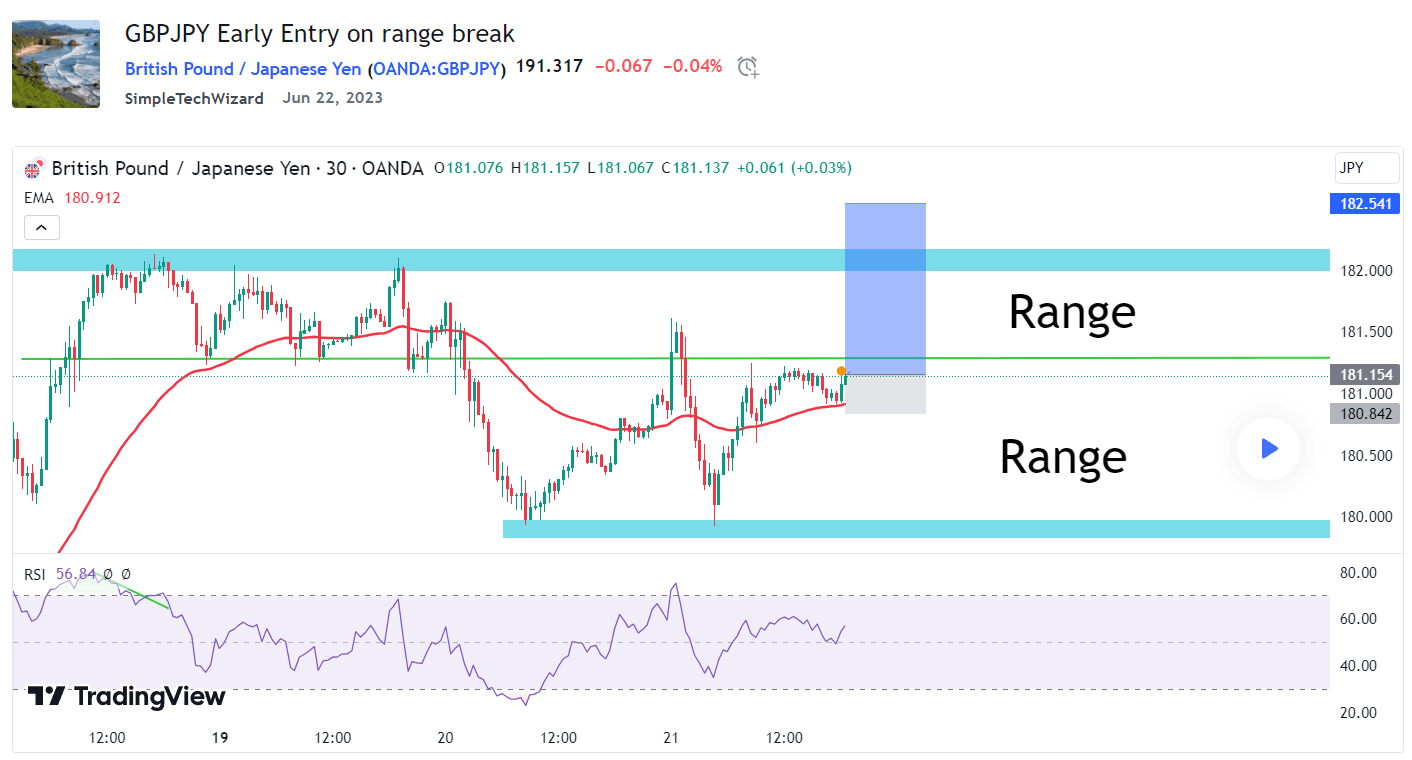

The TradingView presented the following chart to show the impact of early entry in Forex GBP JPY on the range break:

Affiliate Link - https://www.tradingview.com/chart/GBPJPY/u5C07gqj-GBPJPY-Early-Entry-on-range-break/

The early entry resulted in a new price range breaking, while the prevailing price seems to follow through. Also, it formed a double bottom, retesting the 50ema, from which the price is expected to move upwards.

Advantages

Investors often adopt different trading approaches based on their goals, risk-taking capacity, trading style, and market knowledge. One such move is early entry, which has the following benefits:

- High-Profit Margin: Entering the market early often results in capitalizing on significant price movements through immediate trading moves.

- Suitable For Impatient and Savvy Investors: It is suggested for those traders who have a keen knowledge of the market and cannot wait till the confirmation signals for trading.

- Lower Stop Loss: If the stock prices are falling rapidly in the initial minutes, then the traders can reduce their losses by exercising the stop loss orders immediately.

- More Trades: There is a high rush in the first 15 minutes when the session opens, including many buyers and sellers for the securities in the market.

- High Reward-Risk Ratio (RRR): The RRR is relatively high in early entry, I.e., the investors have a chance to book high returns while taking considerable risk.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Early Entry Vs. Late Entry

| Basis | Early Entry | Late Entry |

|---|---|---|

| 1. Definition | It is the starting 15 minutes of a trading session when there are massive uni-directional price movements, either upwards or downwards. | It is the time after the neckline breaks when the market provides confirmation signals for executing well-informed trading moves to make a sure-shot trade. |

| 2. Signals | Market sentiments drive incomplete or even false signals. | All the signals to support quality trades. |

| 3. Reward-Risk Ratio (RRR) | High | Low |

| 4. Win rate | Low | High |

| 5. Investors’ Emotions | Multiple losses can affect the investors emotionally. | Better quality trades can boost the investors’ confidence. |

| 6. Trade Volume | High | Low |

| 7. Support / Resistance | Traders execute the trade at support or resistance levels. | They enter the trade when they receive confirmation signals around these levels. |

| 8. Moving Averages | Traders gauge smaller moving averages for early signals. | Traders rely on longer moving averages for confirmed signals. |

| 9. Head and Shoulders | Entering a trade before the neckline breaks. | Executing a trading move after the neckline breaks. |

| 10. Trading Decisions | Made at the mid-candle level. | Taken at the candle’s close point. |