Table Of Contents

What is a Due Diligence Checklist?

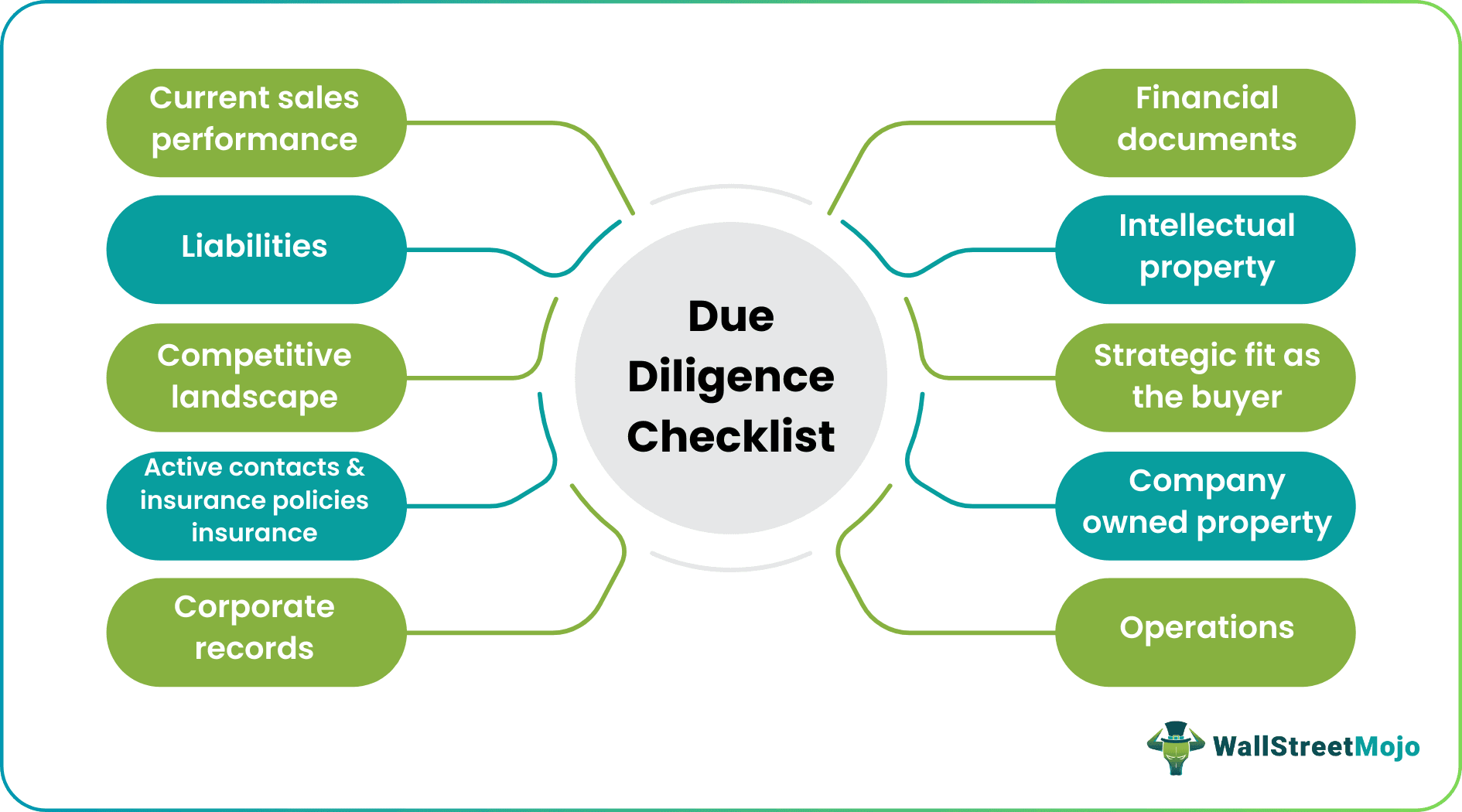

A Due Diligence Checklist is a certain number of details or documents that prospective buyers should review during their potential investments, mergers and acquisitions (M&A). The checklist helps the buyer examine all materials before finalizing the decision. A detailed checklist contains several hundred items assigned to specific people on the due diligence team.

When prospective buyers begin discussing buying a company, they will send over the checklist to the company. Then, the company will assemble an online data room to share all diligence documents with the buyer. The data room has the checklist as a table of contents with all the items clearly labeled against the items mentioned.

Table of contents

- What is a Due Diligence Checklist?

- Top 10 Items to Review as Part of M&A Due Diligence Checklist

- #1 - Financial Statements & Other Accounting Documents

- #2 - Intellectual Property

- #3 - Company-Owned Property

- #4 - Operations (Review of Employees and Management)

- #5 - Corporate Documents and Records

- #6 - Active Contracts and Insurance Policies

- #7 - Legal, Tax, and Environmental Liabilities

- #8 - Current Customer Pipeline / Sales Performance

- #9 - Competitive Landscape/Industry

- #10 - Strategic Fit as the Buyer

- Frequently Ask Questions (FAQs)

- Recommended Articles

- Top 10 Items to Review as Part of M&A Due Diligence Checklist

- ·A due diligence checklist helps a buyer maintain a standard process for evaluating all potential investments or M&A.

- A technical due diligence checklist will serve as a table of contents in the data room assembled by the company for the prospective buyer to review.

- This is not an exhaustive list, and a prospective buyer should spend a lot more time to consult an attorney or other expert when crafting their due diligence checklist and evaluating any company.

Top 10 Items to Review as Part of M&A Due Diligence Checklist

A technical due diligence checklist will be unique to each company, but below is a list of the top 10 items to review for any prospective merger and acquisition.

Each item could contain many sub-sections with more items, and the entire list can contain hundreds or thousands of items. For eg: monthly cash flows since company commencement could be 120 documents alone for the last ten years. Therefore, the data room will have hundreds if not thousands of documents, and it is imperative that the room stays organized, and that all parties are aware of any changes or updates to the data room.

#1 - Financial Statements & Other Accounting Documents

The prospective buyer will need to review all historical financial statements and projections for future performance. It should include monthly financial statements, available statement audits, analysis of profit margin growth over time, future projections and budget estimates, etc. It should also cover current working capital, upcoming capital expenditures, aged accounts receivable reports, and EBITDA calculations.

#2 - Intellectual Property

Any intellectual property can be a huge portion of a company’s valuation. A review of all intellectual property should include any domestic, foreign, or pending patents owned by the company and company practices for protecting their property (such as NDA and non-compete agreements). They should also have registered trademarks or copyrighted products, correct use of software purchased by the company, any liens or encumbrances on the company’s intellectual property.

#3 - Company-Owned Property

The prospective buyer should include a detailed review of all company assets. It includes any real property leases or deeds, title reports, real property interests, sale agreements, an inventory of all personal property, and warranties.

#4 - Operations (Review of Employees and Management)

A company is nothing without its people, and a seller must understand the company culture and quality of the team. This review should include an organizational chart with a detailed biographical description of professional experience for all management members. The company must provide information on any labor disputes, employment agreements, compensation schedules, benefits summary, employee handbook, etc. They should also give a review of any recent employee resignations or terminations.

#5 - Corporate Documents and Records

This includes any charter documents for the company and its subsidiaries, stock option, and sale agreements. The buyer must also look into stockholder meetings and board of directors meetings except those at the time of inception.

#6 - Active Contracts and Insurance Policies

Although cumbersome, a buyer must review all contracts and insurance policies that the company is involved in. This will help them examine if there are any potential liabilities. This review should include all loan or financial agreements, acquisition agreements, exclusivity contracts, all partnership, joint venture or operating agreements, operating contracts, power of attorney agreements, general liability insurance, health insurance, employee liability insurances, umbrella policies, and any other contracts or insurance policies that have a material impact on the deal. This step definitely should be managed by an attorney to protect any liability.

#7 - Legal, Tax, and Environmental Liabilities

The legal due diligence checklist includes all the legal responsibilities the seller should abide by. The prospective buyer will need to review any liabilities that will come with purchasing the company. This includes any litigation (pending, threatened, or settled) since company inception that is civil, criminal, or governmental. The prospective buyer must also assess any potential for antitrust implication and liability by purchasing the company. Additionally, the buyer should compare all reported incomes to their tax returns for the last five years. They should also check for any government audits or other practices to protect against excess tax liability. Finally, the company must disclose any environmental liabilities, such as EPA notices, hazardous substances, environmental audits, and contractual obligations.

#8 - Current Customer Pipeline / Sales Performance

The buyer must understand the nature of the customers of the company as well as its concentration and diversification. This includes understanding who the top consumers are, the concentration risks, the customer satisfaction rate, and the revenue seasonality cycle.

#9 - Competitive Landscape/Industry

The prospective buyer should review the company’s list of known current and potential competitors. They should have an idea about the competitors’ advantages and disadvantages. Additionally, they must also review the company’s current marketing strategies and any agreements or contracts in place for marketing.

#10 - Strategic Fit as the Buyer

Arguably, the most important part of due diligence in understanding how a merger or acquisition with this company will best suit the prospective buyer and their strategic vision. The prospective buyer should review what synergies or savings will occur with this acquisition and how it will benefit both companies.

Frequently Ask Questions (FAQs)

A due diligence checklist is a set of information or documents every prospective buyer should go through before finalizing an investment or acquisition decision. The checklist lists out the documentation proving the most important compliance aspects of the seller. It is the company’s responsibility to present this information in a detailed form for consideration and review from the buyer.

Reviewing and examining the basic financial records before a purchase is called financial due diligence checklist. The seller has to present the prospective buyer with a detailed description of the financial statements, accounting data, audit reports, growth charts, details of revenue streams, etc.

One can generate a due diligence checklist by identifying the goals of the sales or merger and analyzing the business model in question. Next, the buyer can list out their due diligence compliance set by assessing the risk and profits associated with the deal. The buyer can then send their checklist to the seller, who is responsible for setting up an online data room where all the necessary information is supplied for buyer evaluation.

Recommended Articles

This has been a Guide to Due diligence checklist for business and its definition. Check out the top 10 most important items for a due diligence checklist in an M&A. For eg: Intellectual Property, Company-Owned Property, Corporate Documents and Records and Legal, Tax, and Environmental Liabilities, etc. You may also have a look at the following articles to learn more –