Table Of Contents

What Are Dual Currency Bonds?

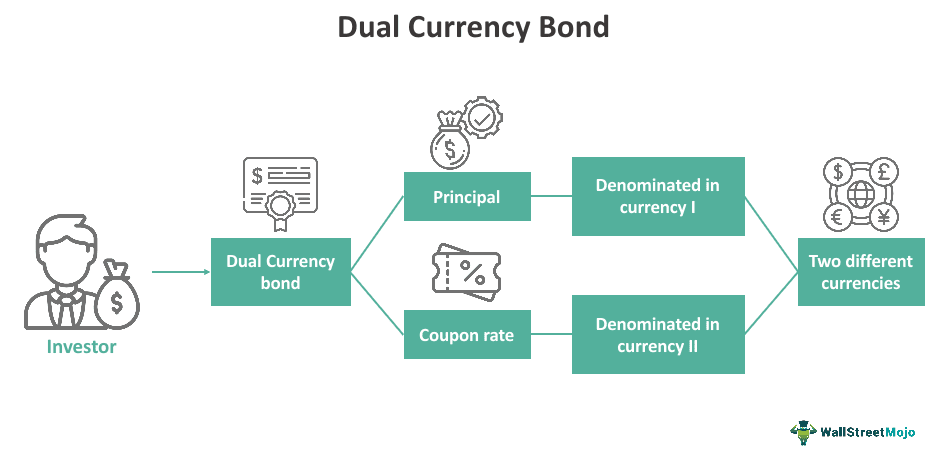

Dual currency bonds are debt instruments where coupon payments are made in one currency, while principal payment is in another. The purpose of this dual currency arrangement is to cater to the preferences of both issuers and investors.

Dual currency bonds can attract a broader range of investors because they offer the option to receive stable coupon payments in one currency while providing exposure to another currency. This flexibility can make these bonds more appealing to diverse investors. However, necessitates a keen eye on exchange rate movements to manage potential risks.

Key Takeaways

- A dual currency bond is a type of bond that combines two different currencies in its structure, distinguishing between coupon currency and principal currency.

- This arrangement is designed to accommodate the preferences of both bond issuers and investors, allowing for greater flexibility in choosing the currency for interest payments and principal repayment.

- It comes in various types, with the primary categories being traditional and reverse dual currency bonds. Each type has its unique characteristics.

- It offers flexibility and customization to issuers and investors. However, they also come with the trade-off of exchange rate risk, which should be carefully considered.

Dual Currency Bond Explained

A dual currency bond is a financial instrument designed with a unique twist. In this scenario, the bond's principal, or face value, is paid back in one currency, while the interest payments, also known as coupon payments, are delivered in another currency. This innovative structure serves both issuers and investors in distinctive ways.

This type of bond provides issuers with a powerful tool to entice foreign investors who have a preference for receiving returns in the coupon currency. What sets it apart is their flexibility. Both issuers and investors can tailor the bond's currencies to suit their specific requirements and preferences. This adaptability opens the door to customized financing solutions, fostering financial creativity.

Investors must be mindful of exchange rate risk when considering dual currency bonds. Fluctuations in exchange rates between the base currency and the coupon currency can influence the overall return on the investment. Investors may enjoy higher returns when the coupon currency strengthens relative to the base currency. Conversely, if it weakens, they could face reduced returns.

Types

Two common types are traditional and reverse dual currency bonds. These distinctions are based on which currency is used for interest payments and which one is used for the principal amount:

#1 - Traditional Dual Currency Bonds

- Interest Currency: In traditional dual currency arrangements, interest payments are made in the investor's domestic currency.

- Principal Currency: The principal amount, which is the face value of the bond, is denominated in the issuer's domestic currency.

#2 - Reverse Dual Currency Bonds

- Interest Currency: In reverse dual currency arrangement, interest payments are made in the issuer's domestic currency.

- Principal Currency: The principal amount is denominated in the investor's domestic currency.

Examples

Let us look at some examples to understand the concept better:

Example #1 - Traditional Dual Currency Bond

Imagine a U.S.-based multinational corporation, XYZ Inc., looking to raise funds in both the domestic market (USD) and the Japanese market (JPY). To achieve this, XYZ issues a traditional dual currency bond with the following terms:

- Principal Currency: The face value of the bond is in U.S. Dollars (USD).

- Interest Currency: Coupon payments to investors are in Japanese Yen (JPY).

- Purpose: This allows XYZ to access Japanese investors who prefer receiving returns in JPY while securing capital in USD, aligning with their global business operations.

Example #2 - Reverse Dual Currency Bond

Now, consider a Japanese multinational company, ABC Corporation, that seeks to raise capital in its home market (JPY) and the U.S. market (USD). ABC issues a reverse dual currency method with the following terms:

- Principal Currency: The face value of the bond is in Japanese Yen (JPY).

- Interest Currency: Coupon payments to investors are in U.S. Dollars (USD).

- Purpose: This structure allows ABC to tap into the U.S. market while ensuring that its investors receive returns in USD, which might be more appealing to certain international investors seeking dollar-denominated income.

Pros And Cons

The pros and cons are the following:

Pros

- Diversification: Dual currency arrangement allow issuers to diversify their investor base and tap into multiple currency markets, reducing dependence on a single currency source for funding.

- Investor Attraction: They can attract a broader range of investors, including those who prefer returns in specific currencies, enhancing the bond's marketability.

- Currency Matching: Dual currency arrangement enable issuers to align debt obligations with specific currency revenue streams, reducing currency risk and exposure.

- Customization: Both issuers and investors can choose coupon and principal currencies, tailoring the bond to their specific needs and preferences.

- Higher Coupon Rates: These bonds often offer higher coupon rates than standard bonds, potentially providing investors with increased income.

Cons

- Exchange Rate Risk: Investors may face fluctuations in exchange rates, which can impact the value of coupon payments and the principal amount upon maturity.

- Complexity: They are more intricate than standard bonds, requiring a deeper understanding of currency dynamics and potential risks.

- Liquidity: These bonds may have lower liquidity than major currency bonds, making them less suitable for certain investors seeking easy tradability.

- Credit Risk: Like any bond, investors face credit risk related to the issuer's ability to meet its obligations, independent of the bond's currency structure.

- Transaction Costs: Converting coupon payments or principal at unfavorable exchange rates can result in transaction costs for investors, potentially reducing returns.