Table Of Contents

What Is The Dow Divisor?

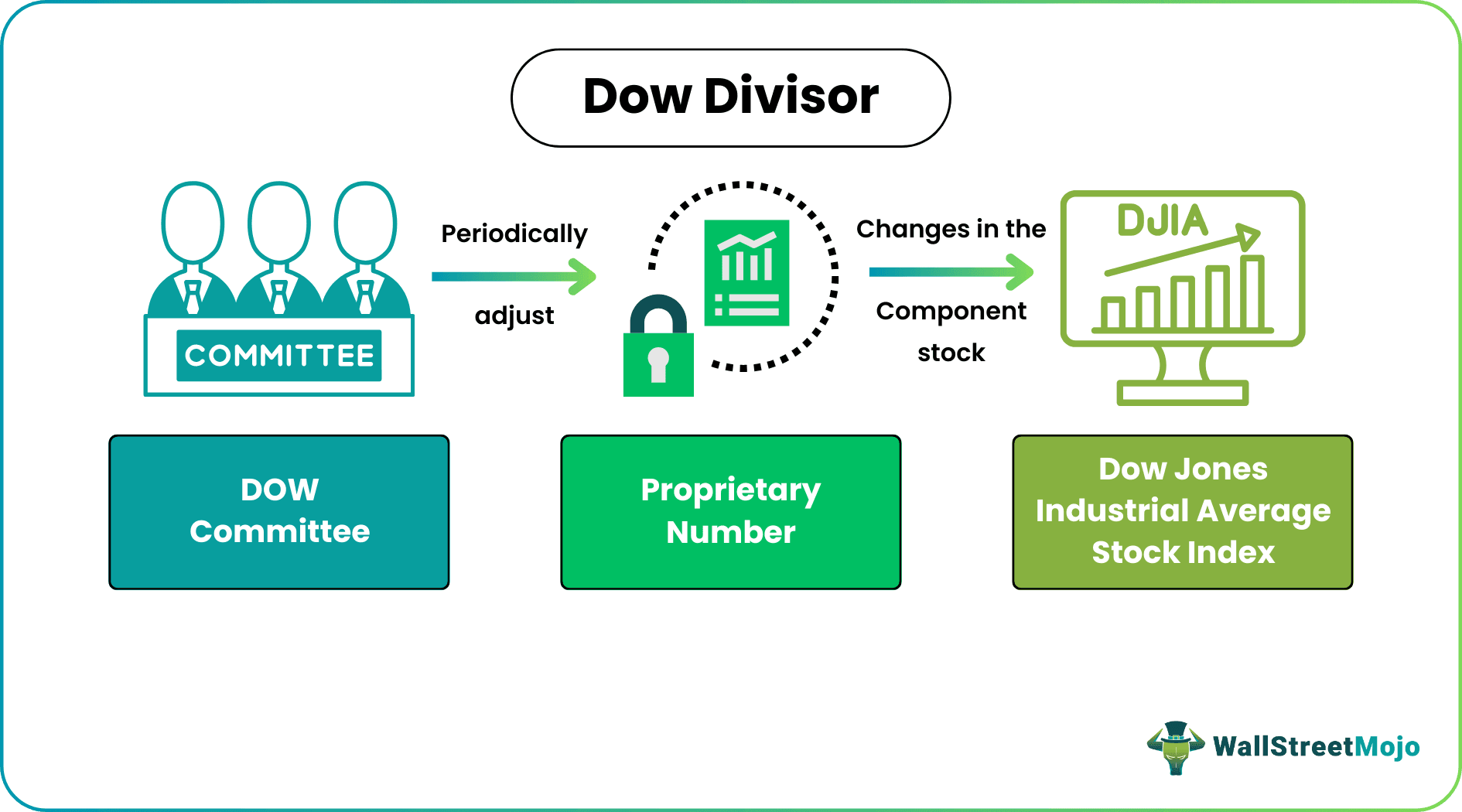

The Dow Divisor, also known as the Dow Jones Industrial Average (DJIA) Divisor, is a constant used to calculate the value of the Dow Jones Industrial Average. It is adjusted periodically to account for changes in the component stocks, such as stock splits or changes in the index composition.

The divisor's adjustment ensures that changes in the individual stock prices do not disproportionately affect the overall index value. By dividing the sum of the stock prices by the Dow Divisor, the index provides a representative measure of the overall performance of the 30 component stocks.

Key Takeaways

- The Dow Divisor is a constant helpful in calculating the Dow Jones Industrial Average (DJIA), a widely followed stock market index.

- The Dow Divisor's periodic adjustments account for changes in the component stocks, such as stock splits, stock dividends, and other corporate actions. These adjustments ensure that changes in individual stock prices do not disproportionately impact the overall index value.

- To calculate the DJIA, the sum of the stock prices of the component stocks is divided by the Dow Divisor. The resulting value represents the level of the index.

How Does Dow Divisor Work?

The Dow Divisor is a critical constant in calculating the Dow Jones Industrial Average (DJIA) value. It adjusts for factors affecting the index, such as stock splits, dividends, and corporate actions.

For example, when a stock split occurs, the number of outstanding shares increases, potentially distorting the index value. To account for this, the Dow Divisor's adjustment offset the impact of the stock split. This adjustment ensures the index value remains consistent before and after the break.

Here's a simplified example to illustrate how the Dow Divisor works:

- Let's say the Dow Jones Industrial Average consists of three stocks with the following prices and shares outstanding:

- Stock A: Price $100, Shares Outstanding 1,000

- Stock B: Price $200, Shares Outstanding 2,000

- Stock C: Price $300, Shares Outstanding 3,000

- To calculate the index's initial value, sum up the stock prices: $100 + $200 + $300 = $600.

- Let’s assume that Stock B undergoes a 2-for-1 stock split, meaning each existing share is split into two new shares. After the break, the shares outstanding for Stock B become 4,000.

- With adjusting the Dow Divisor, the index value would stay the same due to the stock split. The new sum of stock prices would be $100 + $100 + $300 = $500. However, this would only partially represent the overall market movement.

- To maintain continuity, the Dow Divisor is adjusted downward. In this case, the divisor would be adjusted to 0.5 (the original divisor divided by 2). The calculation would be ($100 + $100 + $300) / 0.5 = $1,000.

Adjusting the divisor keeps the index value consistent even after corporate actions like stock splits.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

The Dow Jones Industrial Average was created in 1896 by Charles Dow and Edward Jones, founders of Dow Jones & Company. The original index included 12 industrial companies and was designed to provide a snapshot of the overall performance of the U.S. stock market.

In the early years, the DJIA was calculated by simply summing up the stock prices of its component companies. However, as the index evolved and underwent changes, it became clear that adjustments were necessary to maintain continuity and accuracy.

Over time, adjustments were made to the Dow Divisor to account for stock splits, stock dividends, and other corporate actions that could impact the index value. The Dow Divisor ensures that changes in individual stock prices do not disproportionately affect the overall index value.

The specific values of the Dow Divisor have changed over the years due to various factors, such as stock splits, changes in the index composition, and adjustments made by the committee that manages the DJIA.

The Dow Divisor plays a crucial role in maintaining the continuity and accuracy of the DJIA. It allows the index to be a consistent and representative measure of the performance of the 30 component stocks, even as changes occur within those stocks.

The DJIA has undergone several methodological changes throughout its history. For example, it transitioned from price-weighted to price-weighted with a divisor in the early 1900s and later shifted to a modified divisor-based calculation. These changes have helped improve the accuracy and relevance of the index.

How To Calculate?

To calculate the Dow Jones Industrial Average (DJIA), one needs the following information:

- Identify the 30 component stocks: The DJIA comprises 30 large, publicly traded companies. One will need the stock prices of these companies.

- Obtain the stock prices: Get the current prices for each of the 30 component stocks. One can find this information from financial news websites, trading platforms, or financial data providers.

- Add up the stock prices: Sum up the stock prices of all 30 component stocks to get the total.

- Determine the Dow Divisor: The specific value of the Dow Divisor is not for public disclosure. Therefore, one will need access to the exact value. However, one can assume an approximate value based on the most recent information.

- Calculate the DJIA: Divide the total sum of the stock prices by the Dow Divisor.

The formula is:

Dow Jones Industrial Average = Sum of the stock prices of the 30 component stocks / Dow Divisor

Examples

Let us understand it better with the help of examples:

Example #1

Let's say we have an imaginary Dow Jones Industrial Average (DJIA) with three component stocks and the following information:

Stock A: Price $50

B: Price $100

C: Price $150

Assuming a hypothetical Dow Divisor of 0.25, we can calculate the DJIA as follows:

DJIA = (50 + 100 + 150) / 0.25 = 1200

So, in this example, the DJIA would be 1200.

Example #2

Another example involving the Dow Divisor was the adjustment made to account for the impact of Apple Inc.'s stock split in August 2020.

Apple announced a 4-for-1 stock split, meaning that for each existing share of Apple, shareholders received an additional three shares. This stock split effectively reduced the stock price by a factor of four while increasing the number of shares outstanding.

The Dow Divisor prevents the stock split from causing a significant distortion in the DJIA. The adjustment lowered the divisor to offset the impact of the stock split, maintaining the continuity and accuracy of the index.

Criticism

Some common criticisms:

- Price-weighted methodology: The DJIA is a price-weighted index, meaning that the stock prices of the component companies determine their influence on the index value. Critics argue that this methodology gives higher-priced stocks more weight, which can skew the index's representation of the broader market. It doesn't consider the component companies' market capitalization or relative importance.

- A limited number of component stocks: The DJIA consists of only 30 component stocks, a relatively small sample size compared to other major market indexes like the S&P 500. Critics argue that this limited number may only partially represent part of the U.S. stock market, leading to potential bias and less accurate market assessment.

- Exclusion of specific industries: The DJIA focuses on industrial sector and does not include companies from technology, healthcare, or utilities sector. Critics argue that this exclusion can result in a narrow representation of the economy and miss out on significant sectors crucial to the overall market performance.

- Lack of transparency: The specific value of the Dow Divisor makes it difficult for market participants to replicate or verify the index's calculations precisely. Critics argue that this lack of transparency can lead to speculation and questions about the accuracy and objectivity of the index.

- Insensitivity to stock splits and changes: The DJIA uses the Dow Divisor to adjust for corporate actions. However, critics argue that the adjustments may need to adequately account for these changes, leading to potential distortions in the index's value. They contend that the price adjustments made through the Dow Divisor may not fully reflect the impact of stock splits on shareholder wealth.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

No, the Dow Divisor is specific to the calculation of the DJIA, while the S&P 500 divisor analyzes the S&P 500 index. Each index has its methodology and divisor.

The Dow Divisor adjusts the DJIA for stock splits, dividends, and corporate actions. It ensures that changes in individual stock prices do not disproportionately impact the overall index value.

No, the Dow Divisor is a positive constant. It divides the sum of the stock prices of the component stocks to calculate the DJIA, so it cannot be negative.

The DJIA was initially designed as a price-weighted index by its creators, Charles Dow and Edward Jones, back in 1896. The methodology has been the same throughout its history, although it has faced criticism due to potential distortions caused by higher-priced stocks.