Table Of Contents

What Is Dow 30?

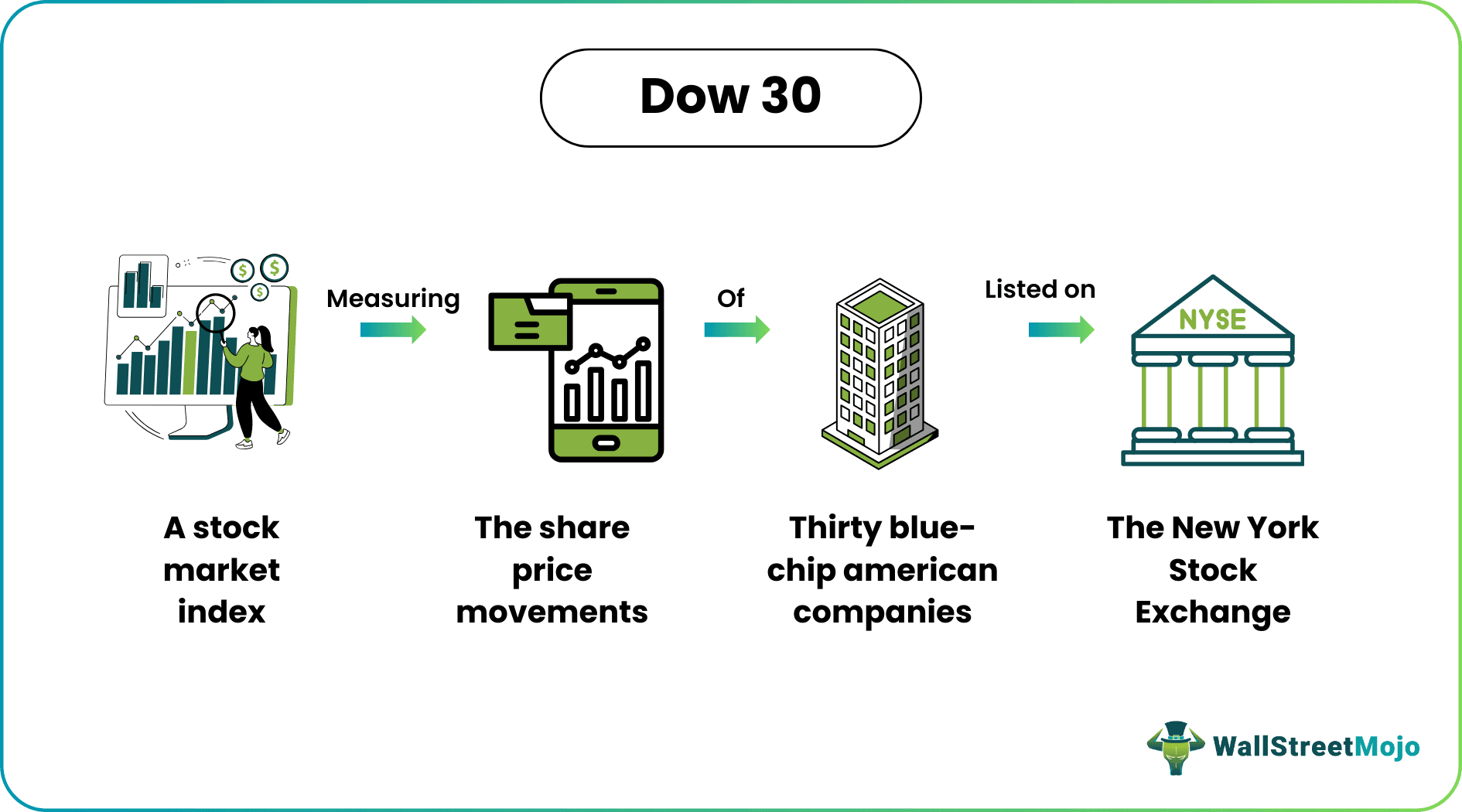

The Dow 30 or the Dow Jones Industrial Average (DJIA) refers to a stock market index tracking 30 blue-chip American stocks trading on the NYSE (New York Stock Exchange). It serves as a general indicator of market trends, helping an investor determine stock prices’ overall direction.

The Dow 30 companies are some of the most crucial names on the NYSE. However, the list of companies does not include utility and transportation organizations. A financial analytics and information company named S&P Dow Jones Indices operates this price-weighted index. Contrary to other important indices, a certain committee chooses the Dow 30 constituents.

Key Takeaways

- Dow 30 refers to one of the oldest stock market indices in the world, comprising 30 of the most important companies in the United States. The Dow 30 ticker symbol is DJI.

- It offers an easy way to get an idea of the U.S. stock market’s performance and general health.

- This index has some limitations. For example, it focuses on the industrial sector more and ignores the real estate and utilities sectors.

- Individuals need to calculate the sum of all stock prices in the DJIA and divide it by the Dow divisor to determine the points on the index.

Dow 30 Explained

Dow 30 refers to an extremely popular stock market index that tracks the performance of 30 publicly owned, large companies in the U.S. This index gauges the mood of the investment markets in the United States. As such, many experts consider it a very useful barometer of the U.S. economy and stock market. In particular, this index acts as a benchmark for the blue-chip stocks in the country.

If this index ends a trading day higher, traders view it as an indication that the overall market has gone up. On the other hand, if the index ends a trading day lower, market participants take it to mean that the market is down.

The Dow 30 ticker symbol is ‘DJI.’ That said, one must remember that it is not a stock; one cannot purchase or sell units of this index. Individuals can only trade stocks that are part of DJIA. Also, one can allocate funds to it via an ETF or exchange-traded fund like the SPDR (Standard & Poor's depository receipt) DJIA ETF. A committee consisting of the Wall Street Journal’s editors chooses the constituents of this index.

As noted above, the DJIA is a price-weighted index. It means that all component companies are weighted per their share prices. Thus, the weight of the higher-priced stocks is more than those with lower market prices. Since this index can have a maximum of 30 stocks, a company exits the index when another organization enters it.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

In 1896, a journalist named Charles Dow created this index along with Edward Jones, his business partner. This stock market index is the second-oldest in the United States. The two of them introduced it to track the performance of the nation’s stock market during a time when the flow of information was usually limited. This index’s main purpose was to let ordinary market participants find out in which direction the market was moving.

Originally, the Dow 30 constituents were as follows:

- American Gas

- Tennessee Coal and Iron

- American Sugar

- Laclede Gas

- American Cotton Oil

- Distilling And Cattle Feeding

- American Tobacco

- National Lead

- Chicago Gas

- U.S. Rubber

- North American Utility

- U.S. Leather pfd.

As one can observe, this was a very commodity-focused index at the time of launch. That said, several changes occurred in the index over the years. In 1916, the components of the DJIA increased to 20 stocks from 12. Then, in 1928, the figure jumped to 30.

In 1932, the replacement of 8 stocks took place. The new ones included Procter & Gamble Company and Coca-Cola. During the Great Recession and the Great Depression, significant alterations occurred in the DJIA owing to multiple companies merging or collapsing.

Companies

Let us look at the companies in the DJIA as of July 25, 2023.

- American Express Co

- Cisco Systems Inc.

- Caterpillar Inc.

- Amgen Inc.

- Chevron Corp

- Apple Inc.

- Home Depot Inc.

- Goldman Sachs Group Inc.

- International Business Machines Corp

- Honeywell International Inc.

- Intel Corp

- Coca-Cola Co

- Johnson & Johnson

- Microsoft Corp

- Merck & Co Inc.

- 3M Co

- Procter & Gamble Co

- Nike Inc

- Salesforce Inc.

- UnitedHealth Group Inc.

- Travelers Companies Inc.

- Visa Inc

- Verizon Communications Inc

- Walt Disney Co

- Walmart Inc.

- Dow Inc.

- Walgreens Boots Alliance Inc.

- McDonald’s Corp

- JPMorgan Chase & Co

- Boeing Co

How To Calculate?

One can compute the points on the index by dividing the sum of all 30 stock prices by the Dow divisor, which gets updated when a company in the index does a stock split. The update takes place because the stock split can have an effect on the company’s share price.

Dow 30 = The Sum Of Every Stock Price On Dow 30 ÷ Dow Divisor

The Dow divisor as of November 4, 2021, was 0.1517.

Examples

Let us look at a few Dow 30 examples to understand the concept better.

Example #1

Suppose Home Depot Inc. was the highest-priced stock, and it closed at $325.11 on July 25, 2023. On the other hand, Let us say that Walgreens Boots Alliance Inc. was the lowest-priced stock that closed at $30.64. Since Home Depot’s stock price was roughly 10.6 times more than Walgreens’s, the latter’s stock price would have to move by 10.6% to have an identical impact on the DJIA as a movement of 1% in the Walgreens Boots Alliance Inc. stock price.

Example #2

The Dow 30 jumped higher on July 25, 2023, building on its longest winning streak in over six years. On the trading day, the index surged 0.2% or 58 points as Wall Street continued digesting the latest earnings results. Close to 130 in the S&P 500 index have reported earnings for the second quarter thus far, and out of them, 79% of the stocks managed to surpass analysts’ expectations, per FactSet data. With Microsoft and Alphabet yet to announce their results, traders could have more opportunities to make financial gains in the market.

Difference Between Dow 30 And S&P 500

The differences between DJIA and the S&P 500 are as follows:

- Weightings: While the DJIA is a price-weighted index, the S&P 500 index is market-capitalization-weighted. This means that in the latter’s case, the largest company will have the highest weight. Whereas, in the case of the former, the company with the highest stock price will have the highest weight.

- Diversification: The DJIA consists of 30 stocks, while the S&P 500 has 500 stocks. As a result, the latter is a more diversified and broader measure of the United States stock market.

Problems

There are several issues associated with DJIA. A few of them are as follows:

- The company having the highest stock price can have an influence on the index’s point. This could be an incorrect measure when analyzing movements in the market.

- Since this index has only 30 stocks, many experts believe that it may not be able to accurately portray the state of an economy and the performance of the overall stock market.

- The index ignores the utilities and real estate sectors.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The last time the Dow went below 30,000 points was in September 2022. As of July 26, 2023, it is trading.

One must remember that all stocks constituting the Dow Jones Industrial Average are generally included in the S&P 500 index. The stocks generally account for between 25% and 30% of the market value.

Dow 30 futures are futures contracts that individuals or organizations can purchase, aiming to speculate or hedge against the future values of the constituents of the Dow Jones Industrial Average. Futures instruments are derived from the DJIA as E-mini Dow Futures.

On January 5, 2022, The DJIA recorded an all-time high during intraday trading, reaching 36,952.65 points. That said, the index recorded its highest close the previous day, i.e., January 4, 2022, when it closed at 36,799.65.