Table Of Contents

What is Dotcom?

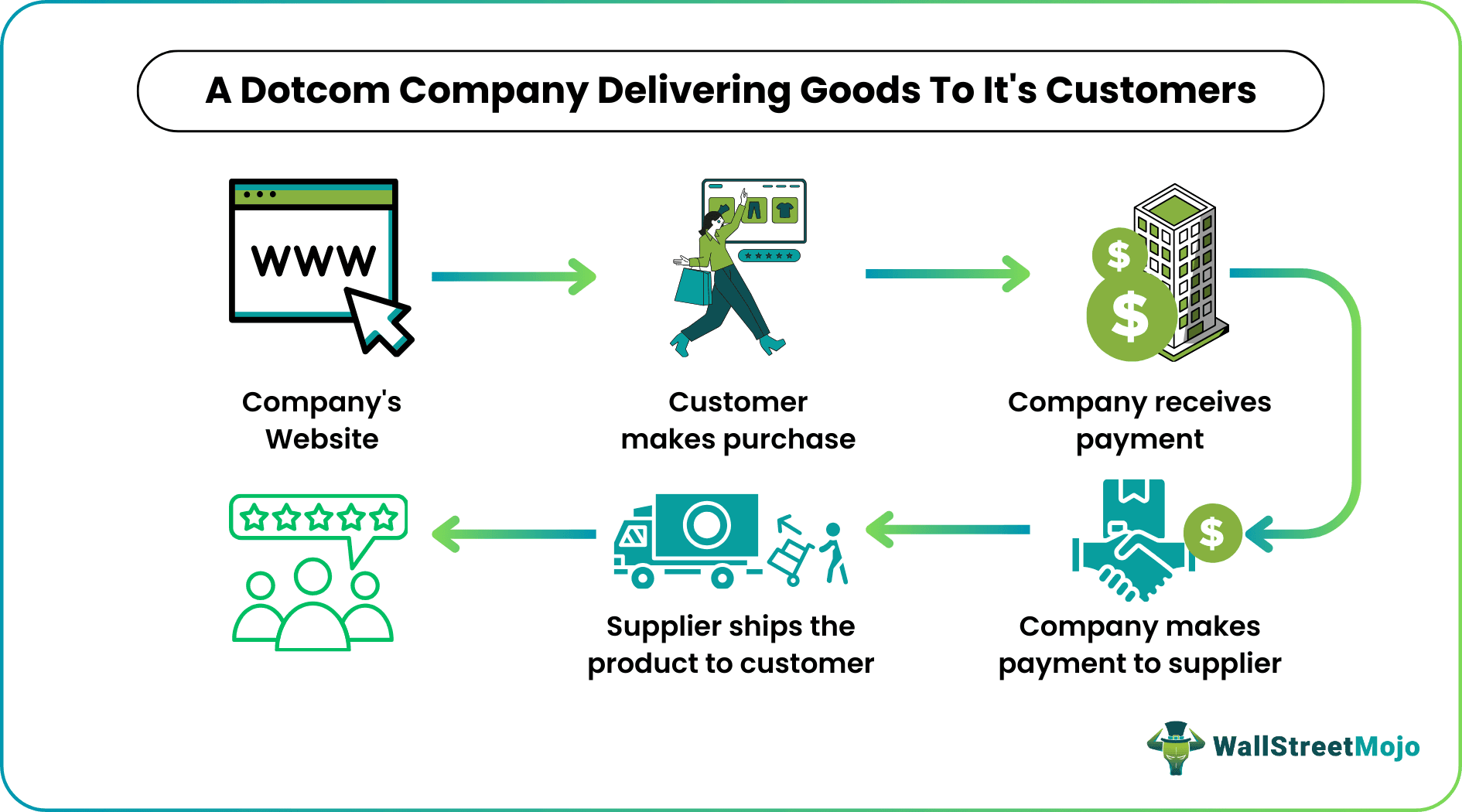

Dotcom refers to a domain on the internet with "com" signifying commerce occurring primarily on the internet. For example, Amazon is a top-rated dotcom company that made it big by offering products online. It allowed customers to buy goods on the web without setting a foot outside their homes and delivering it to their doorstep.

In the 1990s, many companies started using websites to do their business online. This was a big step as many website-based companies were not made of brick and mortar. However, it made the valuation of online businesses harder.

Key Takeaways

- A dotcom is a company that has an online presence and runs its business through a website.

- These companies have a domain address for their e-store. This is known as a URL usually ending with domain suffixes like .com, .in, .net, .org, .edu, .gov, etc.

- The dotcom bubble refers to the period from 1995 to 2000. During this period, the stock prices of online companies were highly inflated due hyping and frenzy trading. In March 2000, when the online business bubble burst, Nasdaq started plummeting rapidly.

Dotcom Explained

In the context of business, dotcom reflects e-commerce companies that operate with the help of the internet. There are multiple similar renditions or spellings, namely, dot.com, dot com, or .com. However, they all mean the same.

In the 1990s, traditional business firms showed immense interest in creating an internet presence. Soon, they became dotcom companies, offering products or services predominantly over the internet. Web-based companies like Amazon.com and Ebay.com took the world by storm.

All dotcom websites and businesses need to purchase a domain name. To understand this, let us use an analogy. Brick and mortar businesses have a physical office which has an address. In the same way, on the internet, every business needs a domain name to build a website. Businesses select a suitable domain name and create a URL, i.e., the online store's domain address.

So, the domain contains the company name along with the suffixes, .com, .org, .net, .in, or .edu. Companies also upload a catalogue of all their products or services on their website. Customers browsing the internet can purchase by visiting specific websites. This involves online payment, customer support and feedback assemblage.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Video Explanation Of Dotcom

Bubble

The term dotcom bubble refers to the overvaluation of dotcom stocks. From the mid-1990s, there was a frenzy to invest in .com companies. Emerging preference for the web coupled with hyping of these stocks as the next big thing led investors to pour their finances into tech stocks.

It was a different era as people were also investing in loss-making companies under the impression that it would earn them huge gains due to bullish reports. Startups with a little history of profitability were also getting listed with a mind-boggling response.

For example, the 1995 IPO of Netscape made history as it got itself listed at the issue price of $28, which rose to $75 on the first day itself. The company had gotten public a few months after its inception. Experts were surprised by the attention received by the debuting stock.

Investors hit it big by buying at a low valuation and selling at the higher end, contributing to an era of overvaluation and excessive trading. With large scale investments, tech stock prices shot up erratically. On March 10, 2000, Nasdaq peaked at 5,132.52.

Dotcom Crash in 2000

Investment in emerging tech stocks came with practical difficulties. Encouraged by the hypes and bullish reports, investors put money in anything even remotely related to the internet. Erratic investments hyped up everything in their way, including stocks that had no business plan, growth or profitability. The website traffic misled investors. They looked past crucial metrics of profitability and valuation.

Parameters like the business model and revenue-generating potential were also ignored. When investors realised their mistake, it sparked one of the biggest stock markets crashes, often referred to as the dotcom bubble burst.

Nasdaq that was at 5,132 in March 2000 slipped to 1,100 by October 2002. The Bloomberg US Internet Index fell to $1.193 trillion from $2.948 trillion, registering a loss of $1.7555 trillion between March and September 2000. Companies like Pet.com and Internet Capital Group laid off so many employees in the wake of mounting losses. As a result, many companies went out of business, with only a few surviving the crash.

Recently, the stock market rebounded after bottoming out due to the pandemic. Then there was the pumping up of GameStop and OTC stocks instigated by the social media. It made many draw parallels with the stock market crash of the 2000s, with experts advising caution.

Examples of Dotcom

Between 1990 and 2000, Dot companies fluctuated like a seesaw. Finally, only a few online businesses survived the dotcom crash that wiped out many names from the market.

Successful Internet Enterprises:

- Amazon.com: The company established an online bookstore in 1995. Scaling up, Amazon started offering a wide range of consumer products to its e-customers. From music and electronics to computer software. In 1997, the company released its IPO at $18. By 2000, Amazon stocks crossed $100. With the bubble burst, the stock price fell abruptly, losing over 90% of their value.

Profits went down; many investors lost money. Still, the company survived due to their efficient business strategy. As a result, today, it is one of the strongest players in online business, trading at over $3000 in 2021.

- Priceline.com: Travel-based website Priceline, that started out by offering airline tickets, trades at over $2000 in 2021. It was another survivor. Priceline offered travel services at a discount price. Customers could book hotels, vacation packages, car rental services and air tickets.

Trading at double digits, Priceline had an impressive market capitalization which was swept by the burst. The value fell below $10. However, the company continued to work hard and focused more on hotel bookings, European footprint and worldwide expansion.

Failed Internet Enterprises:

- Webvan.com: This company had come up with the idea of an online grocery store and delivery service. It released the IPO in the year 1999, with the shares trading at $30 on the first day. Post IPO the company’s market capitalization was $1.2 billion. The company planned ambitious expansions. But it landed nowhere, falling remarkably short on achievements. In 2001, its share value deteriorated to $0.06, and the business ultimately got shut down.

- theGlobe.com: Their business model allowed sharing of user-generated content as well mutual discussions. In 1998, the company went public at $9 soon reaching $87. However, much happened later on that worked against the company leading to its removal from the Nasdaq listing in 2001.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

FAQs

Coincidentally, at the time of the crash, Amazon did not need new investments. The crash did affect Amazon; it dried up many investors. But Amazon had received sufficient funding before the crash and remained afloat.

Dotcom company stocks were in high demand, and with bullish forecasts, there was overinvestment even in loss-making companies as long as they were related to the internet. It led to a dotcom bubble in the 1990s which finally burst in the early 2000. As per CNN, the Bloomberg US Internet Index fell to $1.193 trillion from $2.948 trillion, registering a loss of $1.7555 trillion between March and September 2000.

There were practical difficulties in the valuation of dotcom companies. They lacked tangible aspects that helped in the valuation of the traditional brick and mortar establishments. Investors were misled by website traffic and excessive hyping of the brands. In all the hype, the revenue generation model got overlooked that hollowed out the companies, leaving only those with strong fundamentals to survive the horrific stock market crash.