Table of Contents

Free Donation Tracking Template

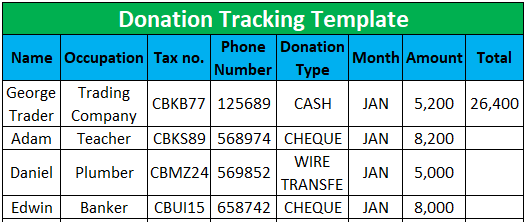

The donation tracking template is a straightforward template that will help organizations to keep track of donations received. All organizations which receive donations maintain it.

About the Template

- The template is straightforward. You need to keep track of the people giving the donations and the payment method. The total amount is also an indicator of the total donation received for the year.

- Many big organizations receive donations for the work they do. Therefore, it is vital to keep the pertinent details of the person donating and the person’s occupation. There have been several instances where illegal money routes to charities to make them look legal.

- Tax authorities and Government regulators closely watch the donations received by the organizations. As a result, all the money received is intensely scrutinized, and any suspicion can lead to severe investigation and even jail terms for the charity and the person donating.

- The template shown above maintains the correct details of the person donating. If the donation comes from a different country, the organization may add another column as the country.

- The organization should maintain each transaction record appropriately to save itself from severe charges. Here in this template, the name of the person donating is the first criterion. It is essential as, without a name, the organization shouldn’t accept the donation.

- The occupation of the person donating money is also significant. One needs to check the source of Income for the person thoroughly. If the person earns money from illegal sources, it will not accept that money as a donation.

- The organization should check whether the person donating money has got itself registered as a taxpayer. Most of the time, people donate to save themselves from higher taxes. Tax saving is an essential driver for donations, so the organization’s tax numbers should be recorded appropriately by the person donating.

- The contact number is also an essential medium of communication. An organization may also keep the address as a reference for the future. The organization must check if the address and phone numbers are correct.

- One can donate in several ways. A cash donation is very risky, and they should maintain proper records. The organization should properly maintain all types of payment. It should be available with appropriate references in case of an audit.

- The total donation for the month and year will help the organization to plan its expenses accordingly. Suppose the organization keeps the data of all donations for previous years. In that case, it will be easy for the organization to analyze the money they might predict to receive in the next year so that one can plan expenses accordingly.

How to Use This Donation Tracking Template?

This template is easy to use. The organization must fill in the name, address, tax no., and PH no. of the person donating. In the donation type, you will see a dropdown, and you need to select any of the below-mentioned options:

- Cash

- Cheque

- Wire Transfer

It is a crucial step as this will help the organization to keep track of the Inflow, which will get difficult to track once the year ends. The next column is the month. This column is also a dropdown. The organization will have to select any month from the options given below:

- JAN

- FEB

- MAR

- APR

- MAY

- JUN

- JUL

- AUG

- SEP

- OCT

- NOV

- DEC

One must fill in the amount individually. Once filled the amount, the last column will throw the entire donation received for the year. This template is straightforward to handle but is very important for auditing purposes. Therefore, an organization must pay the utmost attention while preparing this template. One must validate all the details before entering. Any wrong input will be challenging to handle during the audit.