Table Of Contents

Doji Candle Meaning

Doji candle or star refers to a special candlestick pattern with a short-term trading range in which the closing and opening prices of security get equal. It indicates the traders that the market is at indecision, which means that both the sellers and buyers fail to gain from trading.

Traders often take the Doji candle as a sign of security price reversal, but it may not always be true. It usually occurs when traders cannot control the security prices. This candle has no standing of its own regarding security trading. It can be used only when combined with previous price action for deciphering the market sense.

Table of contents

- Doji Candle Meaning

- Doji candlestick is a unique cross-shaped pattern formed during an uptrend or downtrend of security prices when the opening and closing prices become equal.

- It signals market neutrality and a reversal trend but cannot be used to trade for profits alone without using other market analysis tools.

- There are four types of these patterns: long-legged, dragonfly, gravestone, and common Doji.

- A Doji and a spinning top differ as Doji means indecision, and a spinning top means decisiveness of the market trends.

Doji Candlestick Pattern Explained

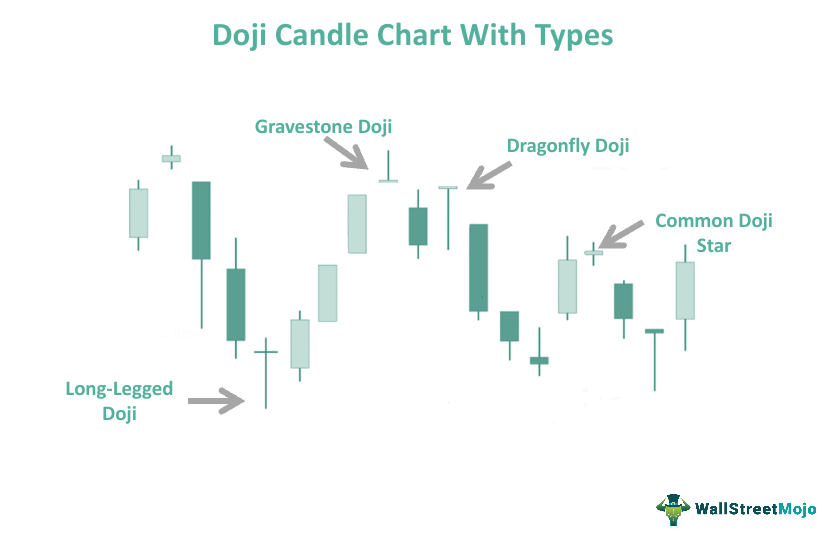

The Doji candle is the point on a candlestick chart where the opening and closing security prices become equal, temporarily keeping the market in equilibrium. The candlestick chart can form different Doji patterns depending on the price trends. The four main types of Doji patterns commonly seen are - common, gravestone, long-legged, and dragonfly Doji.

Doji looks like a plus sign, with each end denoting market positions. The left arm of the cross represents the opening price of a security. The right arm of the cross denotes the closing price of the security. The cross's top end shows the highest security price during the day trading. And the lower end of the Doji cross refers to the lowest security price during the day's trading.

Suppose one spots the market uptrend with a Doji. It means that the security market has reached its equilibrium phase. Furthermore, the market could move towards a higher trend if it gets rested for too long. It happens because an uptrend means a path of least resistance.

Types

There are four different patterns of a Doji candle, namely:

#1 - Common Or Neutral

It is the most common type of Doji candlestick pattern. Neutral Doji occurs when a security's buying and selling values are almost equal. It indicates a directionless future.

#2 - Gravestone

This pattern is formed when the uptrend ends, where the demand and supply factors become equal. The gravestone Doji closes and opens when the day gets low. Moreover, the earlier trend regulates the future direction trend.

#3 - Dragonfly

As soon as demand and supply factors reach equilibrium, dragonfly Doji shows itself when the downtrend ends.

#4 - Long-Legged

It is formed when the demand and supply factors get to equilibrium. Then, the previous trend and long-legged Doji determine the possible future of the existing trend.

Chart

Let us have a look at a Doji chart shown below:

As evident from above, one can say that Doji candle patterns get easily spotted on a security chart. It happens because they have:

- Quite small bodies

- An either upper or lower longer shadow

- Or two distinct longer shadows

One must be ready for security price trend reversal when the Doji develops on the chart. Hence, the appearance of Doji is significant for traders as it can tell a lot about future price trends when used with other security analysis tools.

Here is a chart taken from TradingView that clearly demonstrates the doji candles. The various types of the same are marked in the chart along with their names. However, for all of them, the open and the closed levels of prices are very close to each other, which is why it is called an indecision candle. The bulls and the bears act strongly against each other, and it is difficult for the trader to decide on a trade confidently. In such a case, the only way is to wait for the next price movement in the next trading session, which may give some insight into the market trend in the near future.

Example

Let us go through a Doji star and follow the security price of Microsoft for this example. Microsoft's security price opens at $105 for the day. As the securities market resumes trading for the day, sellers and buyers start trading Microsoft's security. As a result, price movement starts for the security of Microsoft. It touches the bottom of the chart at $104 and reaches the peak of the chart at $108. However, the closing price of Microsoft security again becomes $105 for the day.

Therefore, the price movement, closing plus opening price, forms a long-legged Doji candlestick, as shown below.

Doji vs Spinning Top Candlestick Pattern

Both Doji and spinning top candlestick patterns are common while trading securities. Let us check the major differences between them:

| Doji | Spinning Top Candlestick |

|---|---|

| The opening and closing price of security becomes equal. | It contains log legs on either side of the body, indicating huge differences between the opening and the closing price of a security. |

| It denotes the indecisiveness of the market. | Its long body represents the decisiveness of the market. |

| Its appearance in the chart implies that the balance between sellers and buyers is achieved. | The spinning top's appearance means the trade imbalance changed to a competitive fight between sellers and buyers. |

| A candle after the spinning top means markets would reverse or continue their trends. | It represents the ensuing battle between sellers and buyers of security. |

| Sometimes it may be seen as a signal of a market trend reversal. | It can get seen as a symbol of the weakening of the current market trend. |

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A Doji star means the status at which security closing and opening prices become equal during the observation period. Their cross-shaped or plus-shaped structure can easily identify them with zero bodies. By trading securities using this star, traders know that the markets are in undecisive mode. As a result, they can trade at a reasonable time when the price trends favor selling or buying for profit gains.

Experts say this star remains a bearish candlestick pattern at a special time when open, closing, and low prices get near each other, having a long upper shadow.

Doji stars indicate the reversal of the ongoing trend of security prices. It also indicates a time for pause & reflection for traders before making investment decision-making by the traders.

Recommended Articles

This has been a guide to Doji and its meaning. We explain its types, examples, comparison with spinning top candlestick pattern, and chart. You can learn more about it from the following articles –