Table Of Contents

What Are Dogs of the Dow?

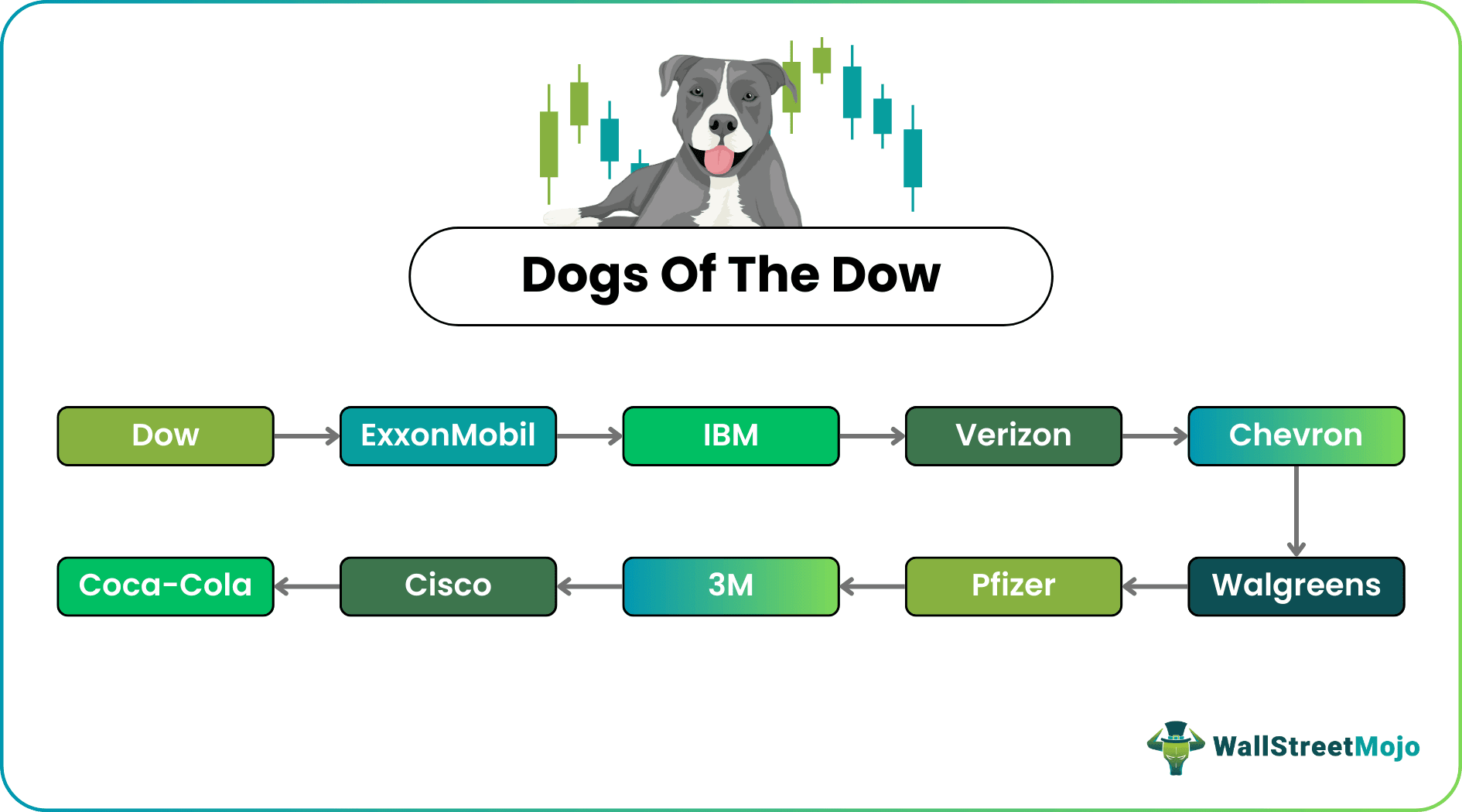

The Dogs of the Dow is an investment strategy in which an investor aims to select ten Dow stocks (known as Dogs) that have the highest dividend yields. The process aims to generate the highest profits for the investors by choosing those stocks that provide high dividend yields. The strategy is straightforward in its application and does not need any assumptions.

Even though investment comes with its risks, the digs of the dow strategy aim to beat the index and deliver high returns in the long run. The ten highest dividend-paying stocks are chosen to form this elite group that pays out the highest dividends to their investors. This list is revamped every year to accommodate the highest-paying stocks for the year.

Key Takeaways

- The Dogs of the Dow refers to an investment strategy in which an investor chooses ten Dow stocks (Dogs) with the highest dividend yields.

- The process objective is to create the highest profits for the investors by selecting stocks with high dividend yields.

- Michael B. O'Higgins brought the strategy in 1991. He published it in a book named "Beating the Dow." Also, he uploaded it to the official website of Dogs of the Dow.

- It is straightforward in its application and needs no assumptions. Therefore, an investor can efficiently utilize this investment strategy to gain higher returns on the Dogs.

Dogs of the Dow Explained

Dogs of the dow strategy is based on the argument that those companies of the Dow index, which issue blue-chip stocks, are better able to survive in difficult economic and market conditions and maintain their dividend payouts.

As a result, they tend to outperform the entire stock market. Accordingly, such stocks are said to be better indicators of the investments' worth. The stock prices do fluctuate based on the market and business conditions.

However, the prices are expected to increase faster for such stocks than those with low dividend yields in inadvertent business conditions. The dogs can perform better than the overall market when the year's results are combined.

In the strategy, an investor selects the top 10 stocks of the Dow index in terms of dividend yield at the end of the year-end.

The investor invests in those stocks on the first day of the next year. The investments are held for a whole year, and the same process is repeated each year to rebalance the positions taken to maintain the holding in fresh stocks that meet the criterion.

History

The strategy was brought into existence by Michael B. O'Higgins in 1991, and he published the same in a book named "Beating the Dow." He also uploaded the same later on over the official website of Dogs of the Dow. The strategy suggested that if ten such stocks are chosen that provide the highest dividend yields, the overall performance will beat even the Dow index.

Examples

Let us understand the concept of dogs of the dow ETF and direct investments in detail with the help of a couple of examples.

Example #1

Alison invests $20,000, using the Dogs of the Dow strategy as she wanted to create a passive source of income that did not have as much risk and dis not consume a lot of time as other options

Therefore, a decision to invest in stocks with the highest dividend yield is chosen, the investor's amount to invest in each stock comes to be $2,000 (i.e., 20,000/10).

It is known as equal price weightage as a similar investment is made in each stock irrespective of their prices.

Example #2

In 2022, the dogs of the dow ETF investors experienced a significantly better performance than the index. In fact, the alternative investment strategy had outperformed the index for the first time since 2018.

While the blue-chip index fell by 6.9% in 2022, the “dogs” as they are referred to rose 2.2%. Moreover, the dividend yields for the dogs was 2.7% which was significantly higher than the average yield of 2.1% and the S&P 500 average of 1.7%.

Criticism

Analysts and investors in the stock market follow different belief systems and therefore, different investment styles. As a result, there have been instances where dogs of the dow ETF have attracted its share of criticism. Let us understand them through the discussion below.

- It uses equal weightage for all stocks, and instead, price weighting shall be used in its place, and when price weighting is applied, the dogs give less return than the Dow index.

- The strategy does not account for many important factors such as dividend-payout ratio, price performance, etc.

Advantages

Let us understand the advantages of the dogs of the dow strategy through the explanation below.

The investment strategy offers the following advantages to its followers: -

- The strategy is straightforward, as there is no complexity in its application.

- The top-performing stocks are considered in the strategy regarding dividend yield, and they help an investor earn higher returns.

- The strategy does not involve any assumptions. Thus, it is based on actual and reliable data.

Disadvantages

Despite the convincing set of advantages, there are a couple of points that prove to be a hurdle or hassle for investors, analysts and experts. Let us understand them through the points below.

- Equal price weighing is used, which gives equal weightage to all the stocks instead of giving weightage to the prices of the stocks while making investments.

- Also, as mentioned earlier, the strategy is too simple and does not consider critical and complex factors.

Frequently Asked Questions (FAQs)

The Dogs of the Dow strategy has had a mixed track record throughout the years, but dividends were crucial in a year like 2022. The Dow Dogs' overall return in 2022 was positive at 2.2% compared to the Dow Jones Industrial Average's return of -7.0% and the S&P 500 Index's decline of -18.2%.

With two months remaining, the 2022 Dogs of the Dow continue to outperform the Dow Jones and S&P 500 indices. The 2022 Dogs of the Dow's year-to-date total return as of October 28, 2022, is shown in the table below to be

In 2021, Dogs of the Dow again outperformed, with 25.3% in total returns, compared to 21% for the index. As this illustrates, the Dogs of the Dow portfolio strategy can result in widely divergent results yearly.