Table Of Contents

Documents Against Acceptance (D/A) Meaning

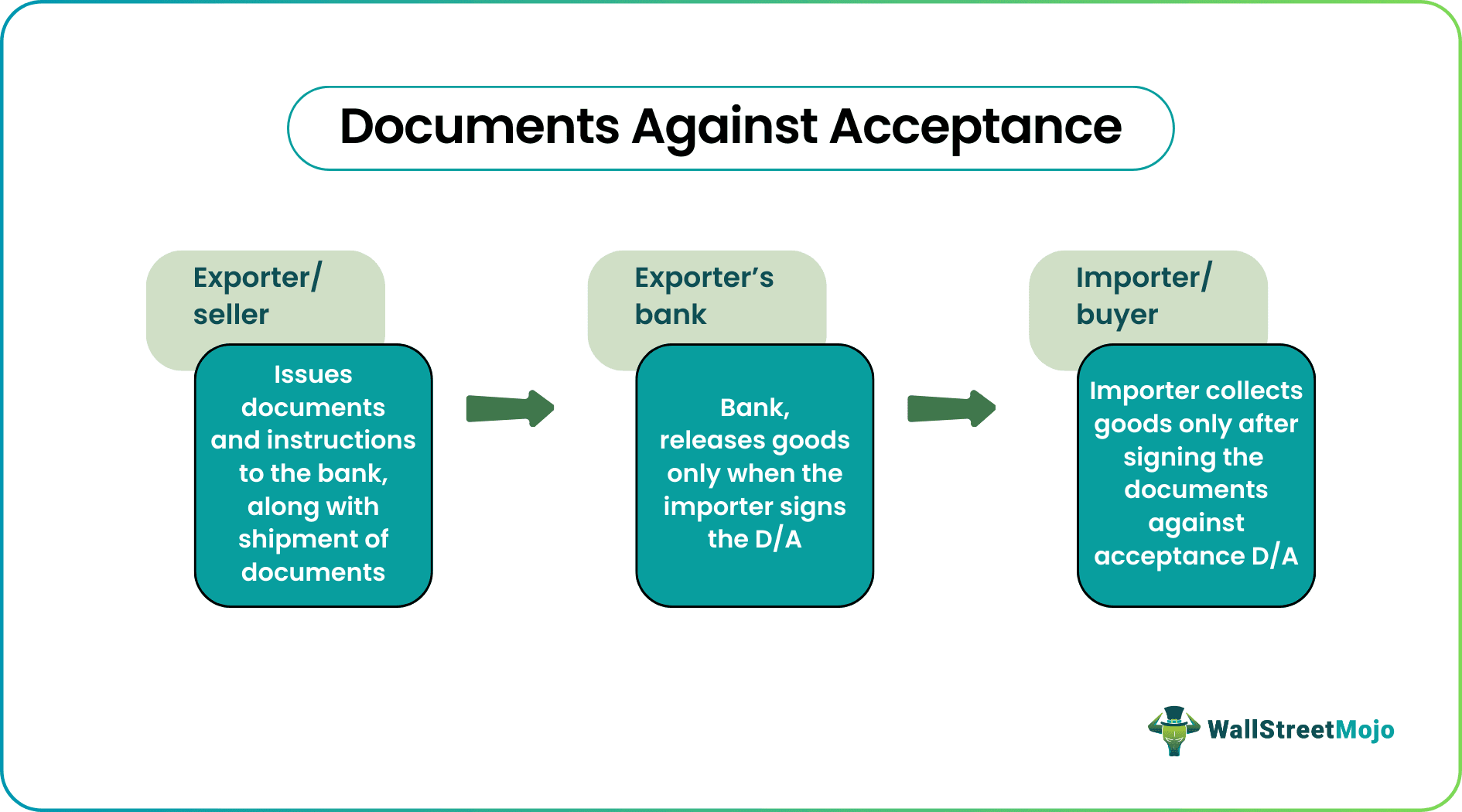

A document against acceptance (D/A) is an international trade agreement between an exporter and an importer. Exporters send this document to banks. The document instructs banks to release goods only when the importer signs the D/A.

By signing a D/A, the importer agrees to pay on a specific date. The payment date is predetermined and mutually agreed upon between the importer and exporter. Usually, importers sign the document, only when the goods reach the importer’s ports. This mode of trade is risky for the exporter. If the importer refuses to accept the goods, the exporter cannot recover transportation costs.

Key Takeaways

- Exporters send documents against acceptance (D/A) to banks. It is an international trade arrangement between an exporter and an importer. Banks release goods only when the importer signs the document.

- The D/A mode of international trade is precarious; if the importer defaults on the payment, the exporter might incur heavy losses.

- D/As are used when the exporter knows the importer well. Alternatively, D/As are used when the importer is a reputed or large corporation (payment defaults are unlikely).

Documents Against Acceptance Collection Explained

Documents against acceptance (D/A) is a credit agreement between an importer and an exporter. An exporter sends a D/A to the importer; the importer can move the goods only after signing the document. By signing the D/A, the importer agrees to pay in the future—on a predetermined date.

D/As are also referred to as a bill of exchange. In international trade, this document is standard; it is for payments.

It is a very convenient arrangement. An exporter directs a bank to release title and shipping documents. The importer can collect the documents as soon they sign the bill of exchange (D/A). Thus D/As ensure safe shipping and transparency in dealings.

Further, to mitigate risks, importers employ credit agencies. This way, exporters do not have to worry whether the purchaser will repay. The credit agency is a third-party offering insurance coverage against buyers' default.

These credit agencies have a global network. Therefore, exporters can contact insurance companies in any country. Also, credit companies are authorized by the government. Therefore, they have access to confidential financial information (about buyers).

On their own, small exporters might not have enough information about a buyer. Thus, credit insurance makes D/As more convenient for both parties.

Example

Now, let us look at a document against acceptance example to understand the procedure better.

Let us assume that Joe runs a shirt brand in New York. Now, Joe wants a particular fabric from London. Joe knows an exporter called Frank. Frank asks around and identifies local manufacturers who produce the exact fabric.

Thus, a formal meeting is set up between Joe (importer) and Frank (exporter). Frank agrees to export ninety cartons of fabric from London to New York. Joe and Frank enter a D/A agreement; Frank extends credit to Joe and dispatches the goods.

The D/A is shipped along with the goods. The consignment contains ninety cartons of fabric. But Joe can collect it only when he signs the D/A. As soon as Joe signs the D/A, he is legally bound to pay for the shipment on a specific date (mentioned in the D/A). The date of payment is decided mutually and beforehand.

On the mentioned date. The collecting bank contacts Joe for payment; after receiving the payment receipts, the collecting bank transfers funds to the remitting bank (Frank’s bank). Frank receives the amount in his account.

Risk

Risks associated with a document against acceptance are as follows.

- Sometimes, importers refuse to accept the shipping order, and exporters incur losses. Of course, the goods can be shipped back, but the transport costs are wasted.

- Similarly, the importer may refuse to initiate the payment for the shipment. Selling on credit is always risky.

- Though convenient, a miscommunication between the exporter and importer or the banking network can delay the transaction.

- In case of any error, gap, or misconduct, the exporter has to deal with the legal system (about import laws).

- Due to credit risks, many exporters prefer the letter of the credit system.

- To facilitate extensive international trade, the political and economic conditions of the buyer’s country should be stable. If not, the risks do not justify the enterprise. As a result, exporters will start avoiding a particular port.

Documents Against Acceptance vs Letter of Credit

Now let us look at documents against acceptance vs letter of credit comparisons to distinguish between the two.

- D/A is a credit-based system, an agreement with predetermined terms. A buyer’s bank issues a letter of credit (LC) to ensure timely, full payment to the seller. If a buyer defaults on payments (LC arrangement), the bank pays the seller on their behalf.

- Compared to a D/A, an exporter's letter of credit is less risky.

- D/As are issued by the exporter, whereas an importer’s bank issues LCs.

- With D/As, the bank is not liable if the importer fails to pay. In contrast, banks pay the seller if the buyer defaults on an LC agreement.

- D/As are more convenient and less expensive. LCs mitigate risks, but banks charge a hefty fee for their service and are expensive.

- For long-distance shipping, high-value cargo, and politically unstable countries, exporters decline D/As; instead, they prefer a letter of credit.